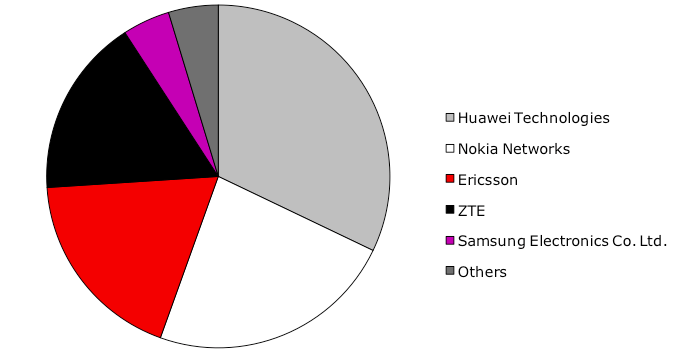

EJL Wireless Research estimates that macrocell digital baseband unit (BBU) shipments increased by 13% in 2016 as compared with shipment levels in 2015. While Huawei Technologies maintained its market leadership position in 2016, we note that Nokia outperformed the overall market and increased market share and jumped to second place globally in shipment volumes, surpassing Ericsson.

Exhibit 1: Global macrocell digital baseband unit shipments by vendor, 2016

Source: EJL Wireless Research LLC (August 2017)

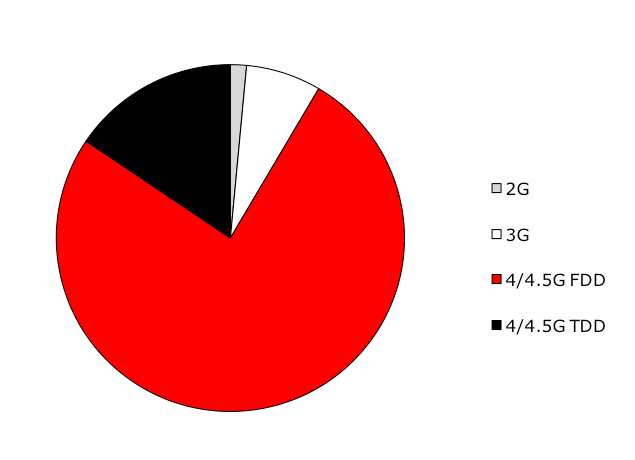

Due to the introduction of SingleRAN digital baseband solutions from all of the network equipment vendors, the market is predominantly 4G FDD LTE based with 76% share. These solutions are multi-radio access technology (Multi-RAT) capable, supporting FDD and TDD LTE as well as legacy W-CDMA/HSPA and GSM/EDGE air interfaces.

Exhibit 2: Global macrocell digital baseband unit shipments by air interface, 2016

Source: EJL Wireless Research LLC (August 2017)

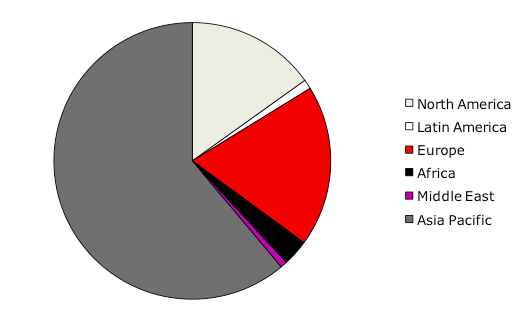

Asia Pacific remained the largest region for shipments in 2016 as China again remained the largest market with over 35% share globally. We note that India was also a major contributor to shipments due to network rollouts of LTE across the country, resulting in a 60% increase year-on-year.

Exhibit 3: Global macrocell digital baseband unit shipments by region, 2016

Source: EJL Wireless Research LLC (August 2017)

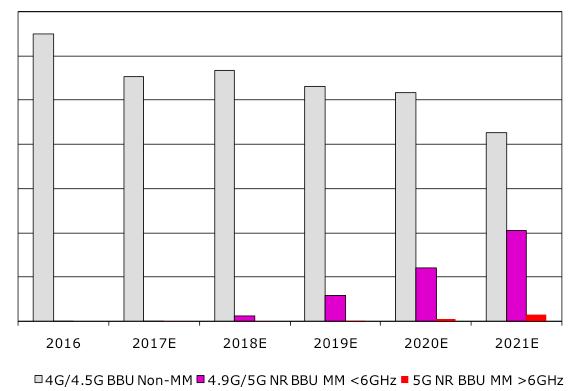

EJL Wireless Research forecasts that 4.9G and 5G NR BBU shipments supporting massive MIMO antenna technologies at spectrum frequencies below 6GHz will see commercial volume deployments in 2018 and continue to ramp through 2021. We also anticipate initial 5G NR BBU shipments supporting massive MIMO antenna technologies at spectrum frequencies above 6GHz (mostly 26/28GHz) will also see commercial deployments ramping in 2018 and 2019 but at a much lower level of volumes than the sub-6GHz products.

Exhibit 4: Global macrocell digital baseband unit forecast, 2017-2021

Source: EJL Wireless Research LLC (August 2017)