The nationwide carriers spend millions telling us how affordable their data plans are, while behind the scenes they are working hard to make sure affordable data and the marketing that goes with it will not hurt profitability. That hard work is paying off.

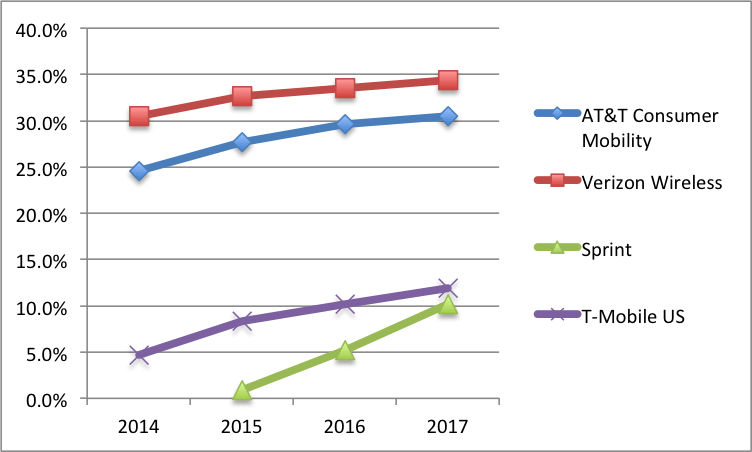

Carrier Operating Margins

Source: Company reports. 2017 numbers are through June.

“Our cost containment efforts are paying off, and it’s showing up in our margins and our earnings,” said AT&T CFO John Stephens on the company’s most recent earnings call. He noted that during the second quarter of 2017 legacy voice and data revenues were down by more than $500 million year-on-year, but earnings before interest, depreciation and taxes were up by more than $70 million.

All four nationwide carriers have seen operating margins increase during the last three years, as they work to control operating expenses. Analyst Kyung Mun of Mobile Experts said carrier operating expenses can be divided into three primary categories: network expenses, device costs, and sales, general and administrative expenses. Of these, network expenses are the smallest category, typically comprising around 20% of the overall operating budget, he said.

Network operating expenses are just part of the picture, but it’s a part carriers are controlling carefully. Mun said the two biggest components of network operating expenses are site leases and personnel costs, which together make up two-thirds of the network opex for a typical Tier 1 operator. Other network operating expenses include power and backhaul.

Mun said one of the primary ways carriers are controlling network opex is by adding new suppliers for sites and fiber leases, in order to maintain price competition. Much of the new site development is now around small cells, and Mun said this creates opportunities for new market entrants.

“As we think about small cells … the radio needs to be closer to the user. There will be … a broader scope of suppliers that operators can think about. They can think in terms of municipalities for site acquisition, putting their small cells on light poles, on street furniture,” Mun said. He added that operators may also have more choices for backhaul.

“On the backhaul side there are different types of metro fiber providers that operators can leverage in addition to the big ones out there,” he said. This is especially important now that the “big ones” are getting bigger. CenturyLink is merging with Level 3 and Windstream has acquired Earthlink. This consolidation may leave operators with fewer choices when it comes to traditional fiber providers.

“There is a lot of interest in looking at what are the alternatives beyond the traditional, major infrastructure providers, on both tower or site as well as on the backhaul,” said Mun.

AT&T and Verizon each own many miles of fiber, so in some cases they do not have to pay for fiber leases. And when fiber lease costs are high, these companies will evaluate the cost of building their own, trading in an operating cost for a capital expense.

For more on this topic, download our latest feature report and watch the accompanying webinar.

Follow me on Twitter.