German car giants Volkswagen and BMW have confirmed massive Industry 4.0 investments, and firmed up their interests in private industrial 5G as a means to factory automation and slicker production.

Volkswagen has announced “further” investment in digital technologies at its flagship plant in Wolfsburg. The company announced a €4 billion injection in digitalization last summer, geared towards “agile” production, with a target of “at least” 2,000 new digital jobs through 2023, just as it announced “up to” 4,000 non-production roles could go.

The budget for skills and training, to bring its workforce up to speed with new analytics and automation technologies, was raised by €60 million to €160 million. It said at the time tasks will be eliminated as a result of “digitalization, process optimization, and organizational streamlining”. It wants a five per cent jump in productivity in the period at the same time.

Volkswagen said it will invest in the “middle double-digit millions range” in 2020; whether the figure is part of or additional to the existing €4 billion five-year digitalization budget is not clear. But it said progress in 2019 has seen it introduce automatic ultrasound inspections of welds on car bodies and make forward-steps with human-robot collaboration.

The company is expected to be among the first German industrialists to capitalize on new spectrum liberalization in its local market. The company issued a tender to telecoms vendors to build private 5G networks last year. The company will start construction of its own private industrial 5G mobile networks in 122 factories in Germany this year, along with the likes of Siemens and Bosch, notably.

Country-mates Siemens and Bosch have already applied for spectrum licences in the 3.7-3.8 GHz band in Germany. Volkswagen is expected to do the same, and is already sitting on a tranche of test spectrum made available last year by the German telecoms regulator, for experimenting with cellular-connected manufacturing.

Volkswagen-owned Audi has been testing localised versions of LTE and 5G for vehicle production in lab conditions with Swedish vendor Ericsson since August 2018. Audi told Enterprise IoT Insights last year it was considering both privately owned and operated LTE and 5G networks for its manufacturing plants, and also hybrid ‘campus’ networks with local operators.

Rival firm BMW, which has itself confirmed €400 million to upgrade production at its Dingolfing vehicle plant (see below), is also looking at industrial 5G in Germany, and across its global production sites as well. The company’s joint venture in China, BMW Brilliance Automotive (BBA), claims to be the first automobile manufacturer to enable full 5G wireless coverage at all its plants.

BMW said: “The group is preparing to set up local, private 5G networks at its plants in Germany… The long-term aim is to establish 5G networks at all BMW Group plant locations worldwide.”

“5G provides the ideal conditions for numerous digital innovations and has the potential to further increase efficiency, quality and flexibility in production,” the group said.

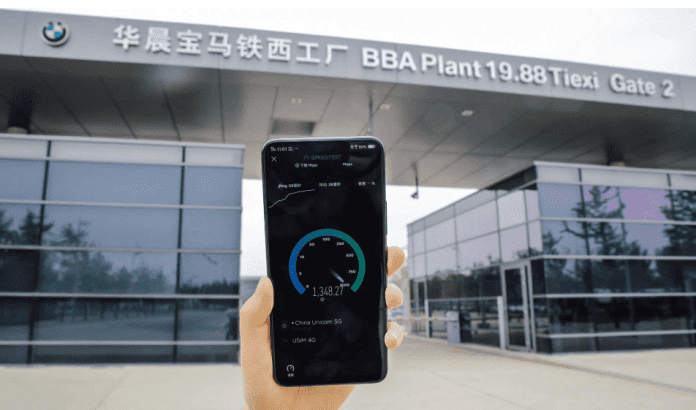

BBA’s 5G deployment is with China Unicom and China Mobile, and has grown out of a pilot at three plants in Shenyang, in China’s northeast Liaoning Province. Construction of 21 5G masts and 35 5G base stations was completed in April 2019, covering also plants in Tiexi and Dadong, plus a powertrain plant.

Johann Wieland, president at BBA, said: “5G… [has] the potential to revolutionise industrial production. BBA is taking a leading role in testing the use of 5G and developing new innovations and procedures to improve industrial productivity.”

BBA said data rates are running at one gigabit per second, having tweaked the system for three months, raising throughput from 600 megabytes per second initially. BBA has cited augmented reality, remote control of autonomous transport systems, and various human-machine and robot-to-robot communications as prime use cases.

BMW itself has cited “virtual and augmented reality, wide-scale networking of machines, and the use of autonomous logistics fleets” as 5G use cases. “The benefits of the new technology are not just in its high data rate and rapid response time, but also in the reliability and security of the network,” it said.

Back in Wolfsburg, Volkswagen’s new Industry 4.0 investment is already bearing fruit. Ultrasound inspections of door welds are no longer manual processes, it said; they are now automated, with data transferred to “an IT system” in real time. Volkswagen said the innovation is “unique in the global automotive industry”. The idea came from the production floor, and not the board room, the company noted.

Annual cost savings will be around €3 million euros, once fully implemented. The solution will transfer to other production sites “progressively”, it said. Stefan Loth, plant manager at Wolfsburg, said: “This represents a huge step for plant efficiency, and it is an excellent idea from the team.”

Robots have been checking and adjusting the alignment of vehicle headlamps at the Wolfsburg site since the start of 2019. Factory workers only need to turn on the lamps and no longer need to exit the vehicle to align the lamps themselves. Volkswagen is pursuing closer human-robot collaboration, it said, for installation of doors and boot lids on vehicles.

During 2020, robots will, again, take the lead, with data about such detail as gap dimensions automatically transferred and processed by algorithms in the cloud, somewhere (detail of connectivity and edge/cloud setups is unavailable). Millions of euros will be saved, said Volkswagen.

“We will continue to consistently follow the path to the digital factory with our entire team in 2020,” said Loth.

Meanwhile, Audi has just announced an in-house maintenance app for 150 staff at its plant in Ingolstadt to carry out maintenance work faster and more efficiently. The app gathers sensor readings and analytics insights about machinery on production lines across the plant, and pushes notifications to engineers in ‘real time’.

From it, they know which equipment (in which hall) is affected, where (in the warehouse) replacement parts can be found, which maintenance staff are required, and whether they are on the case already. Defects and work steps are recorded in the app, on site, by staff.

The point is faults are detected quickly, downtime is reduced, and production goes more smoothly. It saves on paper, too.

“Maintenance staff need a lot of information that was not previously available to them in full and at a glance. The maintenance app changes this. It informs them instantaneously and automatically about defects in a system,” says Audi.

The app is out of trial, and in usage on the assembly line at Ingolstadt. It will be introduced in the paint shop at Audi’s Neckarsulm plant shortly, and rolled out to other sites from there.

Separately, the Volkswagen group has a €25 million annual ‘carbon fund’ for innovation projects that directly and indirectly cut the group’s carbon footprint. The fund, launched a year ago, has so far bankrolled the introduction of smart LED lighting in nine production sites and so-called “separation circuit refrigeration systems” at its Kassel plant to cool the machines and spindles.

The first is projected to save 116,000 metric tons of CO2 annually; the second will save 1,350 metric tons annually, reckons Volkswagen. Other initiatives, deployed variously, include new energy efficient pumps, “industrial washing machines”, temperature regulation technology, and a “load-dependent volume flow control system” at its Hannover paint-shop.

Over 100 new projects are scheduled for funding from the 2020 budget.

Ninety per cent of external power to Volkswagen’s plants will be from green energy sources in 2020, from around 70 per cent today, the company said. It is focused on natural gas for its own power generation; its Wolfsburg power plants will switch from coal to gas (combined cycle gas turbines) by 2022, it said.

Volkswagen and Microsoft have announced a deal to collaborate on projects around sustainability, and digital education and training. Microsoft will offer digital training for Volkswagen staff at Volkswagen’s Faculty 73, the car maker’s developer facility. School opens in the spring. Training at the Wolfsburg plant, in topics such as coding and artificial intelligence, is also on the cards.

Ralf Pfitzner, head of sustainability at Volkswagen, said: “Climate protection and digital transformation are the key issues for the future of business and society. The challenges are immense – so it is important the transformation takes place on a broad social basis and that we take people with us. For this we need cooperation. ”

Sabine Bendiek, managing director of Microsoft Germany, said: “The time of solo efforts is over. The new decade requires common answers to major challenges. That is why we are bundling our commitment with Volkswagen and want to promote the use of digital technologies and artificial intelligence for the benefit of the environment, society and the economy.”

Volkswagen said it will invest €19 billion in “future technologies” for future vehicles through 2024, with €11 billion going on electric mobility in its various forms.

BMW’s €400 million upgrade of its production facility at Dingolfing in Germany, the company’s largest production site in Europe – and, in reality, a network of plants in with a total area of around 280 hectares – is geared for production of its forthcoming BMW iNEXT electric crossover vehicle, which puts 5G in the driving seat, scheduled for launch in 2021.

Milan Nedeljkovic, member of the board at BMW, commented: “Thanks to our flexible production structures, our plants are ideally equipped to meet the most diverse market needs.” The site is also being readied for production of “highly-automated” vehicles.

Nedeljkovic said: “As the technology in our cars grows more and more complex, system integration capabilities will become a decisive competitive advantage. With the BMW iNEXT, our Dingolfing location is demonstrating that we are capable of implementing growing product demands in efficient large-scale industrial production.”

New Dingolfing Plant Director Christoph Schröder: “The BMW iNEXT is… a pioneer for many key automotive innovations, especially autonomous driving. It is also paving the way for further rollout of these technologies over the coming years. The current structural measures for the iNEXT will also benefit other models built in Dingolfing in the future.”