Time for an update on the state of play in the industrial IoT platform market; there are numerous studies and rankings of the principle platforms in the space, but Gartner’s annual Magic Quadrant review remains the gold standard, and the one Enterprise IoT Insights follows. The analyst house has just released its latest annual ranking, and there is some jockeying for position, it seems, compared with last time out.

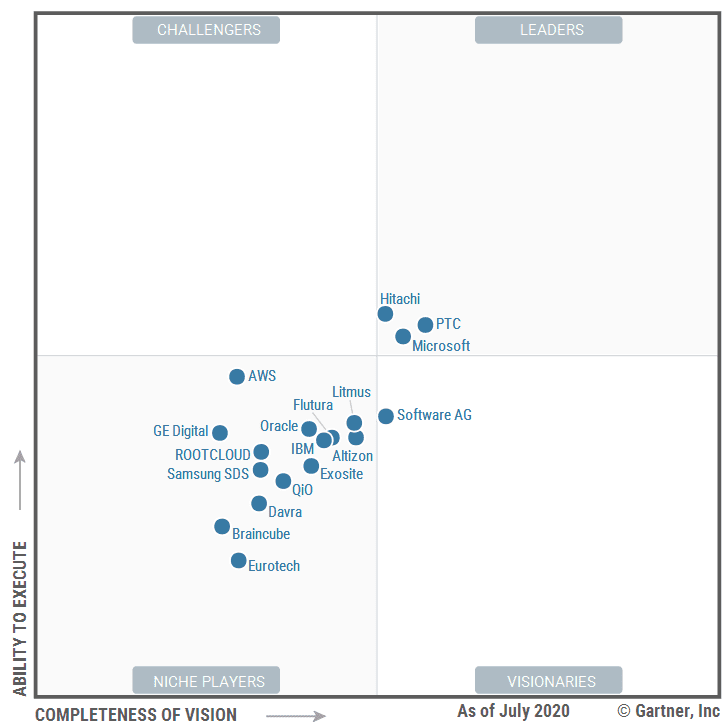

While the old familiars – PTC, Hitachi, and Software AG – remain near the summit, they have been split and joined by a pair of new entrants, in the shape of the twin ‘hyper-scaler’ cloud platforms from Microsoft and AWS. The ranking shows PTC (Thingworx) and Hitachi (Lumada) have firmed-up their positions at the top of the table, driving northwards of the ‘execution’ line (see image) to establish themselves in Gartner’s eyes as ‘leaders’.

By contrast, Software AG (Cumulocity IoT) remains in ‘visionary’ mode, stalled beneath the line, with a slower uptake among industrialists and a “disconnect” between the sales and implementation. The German outfit has been knocked into fourth, ostensibly, by Hitachi and also Microsoft, which did not feature at all in Gartner’s review of industrial IoT platforms a year ago.

By contrast, Software AG (Cumulocity IoT) remains in ‘visionary’ mode, stalled beneath the line, with a slower uptake among industrialists and a “disconnect” between the sales and implementation. The German outfit has been knocked into fourth, ostensibly, by Hitachi and also Microsoft, which did not feature at all in Gartner’s review of industrial IoT platforms a year ago.

But Software AG rides high still, on the tails of the leading pack, and is commended for its wide support for third-party devices and industrial protocols, and positive customer feedback, particularly from manufacturing clients. Meanwhile, Microsoft (Azure IoT) has soared into third, as ‘leader’, just below PTC and Hitachi in the ranking, with a “large, diverse partner ecosystem” and “broad visibility in the market”.

AWS (AWS IoT) comes in fifth on first entry to the Magic Quadrant, jumping ahead (or neck-and-neck, depending on how one prioritises vision and execution) of industrial IoT platforms from the likes of Altizon, Flutura, GE Digital, IBM, Litmus, and Oracle. Gartner noted its “ease of implementation” and cloud leadership on the one hand, and “potential gaps” and its portfolio on the other.

Industrial IoT platforms from Braincube and Samsung SDS have also featured for the first time, both as ‘niche players’. Accenture, notably, was dropped on the grounds the company is merging its Connected Platforms as a Service (CPaaS) IoT platform with its artificial intelligence for IT operations (AIOps) platform, leaving its stand-alone industrial IoT platform offer as “not saleable” and without customers.

Interestingly, Gartner has provided some forecasts on take-up of industrial IoT platforms, predicting 50 percent of industrial enterprises will use them to improve factory operations by 2025, up from 10 percent in 2020. Through 2025, 25 percent of large global industrial enterprises will acquire or invest in an industrial IoT platform company, it said; up from five percent in 2020.

Gartner focuses on three asset-intensive industries for its assessment: manufacturing and natural resources, which include the sub-sectors of automotive, consumer products, energy resources, heavy industry, life sciences, and healthcare products, and natural resources and materials; transportation, which includes air transport, motor freight, pipelines, rail and water, warehousing, and couriering; and utilities, which include electrical, gas and, water.

The company said: “The industrial IoT platform, in concert with the IoT edge and through enterprise IT/OT integration, prepares asset-intensive industries to become digital businesses. Digital capabilities are achieved by enhancing and connecting their core business with customers, suppliers and business partners.”

It added: “Complex IT/OT integration is accelerating as first-generation solutions evolve and trust develops in operations. CIOs must focus on the long-term potential of IIoT platforms in addition to near-term impact.”

A full description of the top five industrial IoT (IIoT) platforms is included below, quoted verbatim; access to the Magic Quadrant report is available through signup via PTC’s press statement on its own ‘leader’ ranking (and probably via other sources, too).

1 | PTC – Thingworx (‘leader’)

ThingWorx’s strength lies in its experience with assets across vertical markets. PTC has developed a global ecosystem of IIoT-focused technology partners, solution providers and global system integrators. PTC maintains a global sales force and an indirect channel of resellers worldwide. Observed and verifiable industrial use cases include asset monitoring and predictive maintenance of multiple in-field assets.

Strengths

- PTC’s go-to-market and R&D efforts with Rockwell Automation’s FactoryTalk received positive user feedback and accelerated adoption since the strategic partnership was formed.

- PTC continues to invest more effectively in its market visibility and its community of users, partners and developers. Initiatives such as its LiveWorx event, its marketplace of software, and its developer portal make PTC a safer choice in many SI portfolios and on a majority of user shortlists reviewed by Gartner.

- PTC offers very high-quality service and support.

- ThingWorx has a strong proven ability to support customers for a full, on-premises deployment of an IIoT platform able to operate in a disconnected scenario.

Cautions

- Some customers using PTC’s analytics expressed frustration relating to implementation and usability.

- PTC’s digital twin offers limited support to industrial owner-operators of industrial assets.

- PTC still lacks a competitive installed base and related experience in the utilities, and transportation and logistics sectors.

- Based on customer feedback and customers in Gartner inquiries, PTC’s pricing for its ThingWorx Enterprise Edition is often more expensive than competitors for both cloud-based and full on-premises deployments.

2 | Hitachi – Lumada (‘leader’)

Hitachi’s Lumada platform satisfies requirements for asset-intensive industries like manufacturing, transportation, energy and utilities. Recent developments in Lumada include the repackaging of various applications that Hitachi had developed across implementations in its operating companies and non-Hitachi customers.

Strengths

- Hitachi Vantara can offer a complete Lumada platform and a curated solution from various OEM providers to different asset-intensive industries like manufacturing, transportation, oil and gas, utilities, and smart cities. Lumada can be fully deployed in on-premises, hybrid and cloud-centric patterns, giving customers a compelling range of options.

- Lumada exhibits strong capabilities, validated by numerous reference customers, in integration functionality and application development/composition. The platform’s composable nature helps Hitachi Vantara in “co-creation” activities for the personalization of the platform for specific solution requirements.

- The vendor has a breadth of industrial use cases, reflected in numerous customers observed by Gartner that span many different industrial sectors.

- Hitachi Vantara has rearchitected a range of industrial application components into a focused application catalog, including Lumada Manufacturing Insights, Lumada Maintenance Insights and Lumada Video Insights.

Cautions

- Device management capabilities are weak compared to other competitors and are not considered competitive.

- Reference customers cite support for digital twins as among the weakest areas of Lumada functionality, rating this capability substantially below market average across all vendors.

- Hitachi’s repositioning of Lumada as a more domain-agnostic (rather than IoT-specific) platform may lead to slower adoption of the platform, slow the growth of the developer community, and reduce the enrollment of partners into ecosystems explicitly focused on IIoT.

- Hitachi Vantara maintains a limited set of resellers for sales and services for Lumada, limiting the availability of resources in the market. Hitachi Vantara’s recent reorganization to combine with Hitachi Consulting may cause this challenge to persist. Companies looking for third-party, independent services should address this issue with Hitachi.

3 | Microsoft – Azure IoT (‘leader’)

Microsoft delivers IIoT platform capabilities via Azure IoT services. Microsoft benefits from its history working with industrial enterprises and their use of Microsoft operating systems and OPC within embedded systems. Industrials build and deploy IoT solutions composed of Azure IoT services and other Microsoft software services. Customers also have access to a marketplace for third-party software.

Strengths

- Microsoft has customers with production deployments that span core operations, supply chain and industrial field deployments for manufacturing, transportation and logistics, and utilities.

- Customers are very positive relating to Microsoft’s approach to security for IIoT. Azure Sphere enhances device security to protect from cybersecurity and device encryption.

- Microsoft has a large, diverse partner ecosystem for both technology platforms and indirect sell-through partners.

- Microsoft has broad visibility in the market based on the frequency with which the company appears in buyers’ evaluations for IIoT platforms.

Cautions

- Emerging Azure IoT Edge modules may be challenging to manage as both first party and third party mature through the development life cycle.

- While Microsoft’s horizontal IoT technology can functionally support most customers’ IoT requirements, most customers need or prefer to have Microsoft partners to act as intermediaries for solution planning and feature engineering. Customers feel this helps them leverage Microsoft technologies into end-to-end IoT solutions.

- To extract data from some OT systems, industrial equipment may need third-party protocol software or Edge modules to integrate into Azure IoT.

- The Azure portal has a highly customizable UI, but plug-ins or third-party modules may need to be leveraged to track service performance, utilization and health all in one page.

4 | Software AG – Cumulocity IoT (visionary)

Software AG is a Visionary in this Magic Quadrant. Software AG’s Cumulocity IoT consists of Cumulocity IoT Cloud and Cumulocity IoT Edge. Software AG emphasizes the strength of its integration and device management and application enablement capabilities as key differentiators for Cumulocity IoT. Cumulocity IoT is strongly focused on manufacturing and transportation and logistics projects.

Strengths

- Software AG supports over 150 third-party devices spanning more than 350 protocols to enable the connection of a broad range of industrial devices.

- Customers in manufacturing are typically satisfied with the overall experience with Cumulocity IoT.

- Cumulocity’s device management software offers users a trusted and mature set of software capabilities.

- Software AG’s strength in integration and use and management of APIs is a key differentiator.

Cautions

- Cumulocity IoT is not yet widely used by industrial enterprises to augment OT functions for improved asset management life cycle strategies and processes.

- There is a disconnect between the sales cycle and the implementation projects in Software AG’s customer management organizations, which leads to customer dissatisfaction.

- Software AG’s partners lack sufficient experience and knowledge to resell and implement Cumulocity IoT.

- The technical service and support at Software AG is sometimes a point of dissatisfaction for some channel partners and platform customers.

5 | AWS – AWS IoT (niche player)

Amazon Web Services (AWS) is a Niche Player in this Magic Quadrant. AWS bases its IIoT platform on the AWS IoT services, which address all major functional components expected in this market. AWS’s first approach to the market is from a general IoT perspective rather than a primary focus on industrial sectors. The services can include various types of AWS data persistence, integration, artificial intelligence (AI), analytical models and management.

Strengths

- Customers cite ease of implementation as a strength of AWS IoT, noting great flexibility in combining IoT capabilities with various other AWS services outside of AWS IoT.

- AWS’s broad range of capabilities enables industrial customers to create very diverse and verticalized solutions.

- Customers identify their partnership with AWS, specifically the vendor’s willingness and ability to quickly innovate enhancements to existing services, as a significant reason for their successful deployments.

- As a market share leader in cloud infrastructure and platform as a service (PaaS) capabilities, as well as being part of one of the largest and best-resourced companies in the world, AWS can accelerate its impact in this market.

Cautions

- The cloud-centric nature of AWS’s offering creates potential gaps for customers desiring all components of the platform to operate in a completely disconnected, on-premises model, particularly for device management.

- The abilities to integrate easily in brownfield industrial settings and deliver OT-like replacement functionality remain areas of emerging capabilities for AWS IoT as it looks to grow its IIoT catalog.

- Given the broad range of AWS services required to comprise a complete IIoT solution, customers are faced with development challenges, which few are capable of handling with organic resources.

- Unlike many of its competitors in this market, AWS does not offer a catalog of applications that leverage the capabilities of AWS IoT, creating a challenge for the vendor in presenting a “full solution” value proposition to the market.