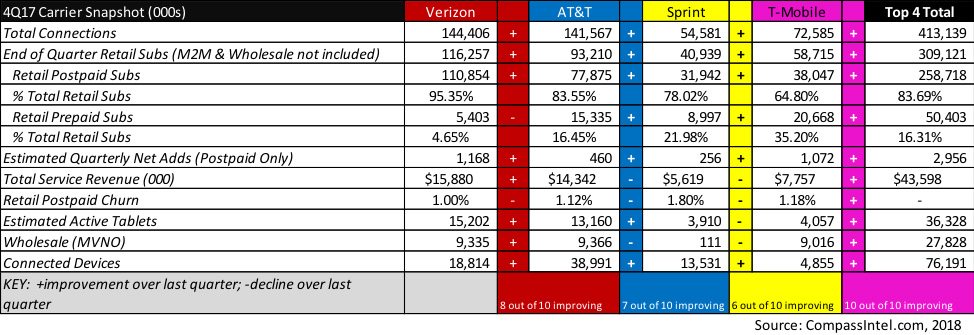

All four carriers have finished up their earnings calls, and Compass Intelligence just completed the final assessment of Q4 2017 and the entire 2017 analysis. In addition, Compass Intelligence evaluated the comparisons to previous quarters and year ending 2016 to 2017 in terms of improvements and declines. We do this each quarter to understand the subscriber and share changes, as well as evaluate the key trends taking place in the wireless industry for both consumer and B2B. We have been tracking the quarterly metrics since 2007. Some metrics are our own internal modeling and estimates, as the market does not report in all categories. A snapshot of Q4 2017 is below.

Compass Intelligence compared last quarter’s results to this quarter to show which metrics showed improvement over others (denoted by + or -).

Below are additional thoughts and insights based on the quarter and annual performance:

- Summary:

- Q4 2017 experienced the most additions of connections for 2017, while Q3 experienced the highest overall service revenues compared to other quarters

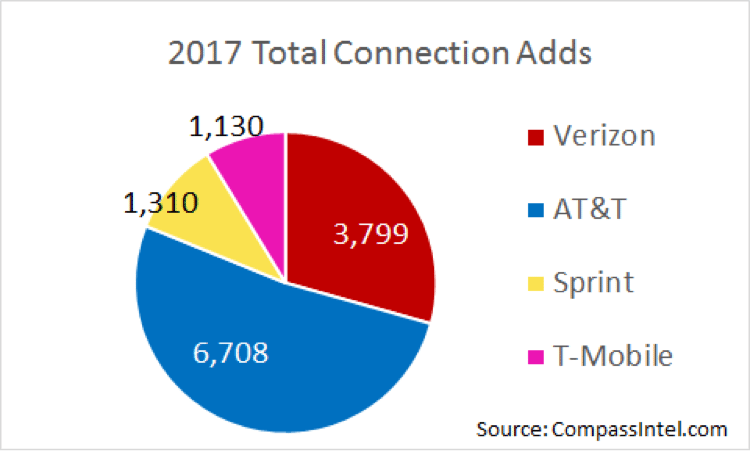

- The Q4 2017 quarter ended adding 6.6M new connections QoQ (includes IoT and mobile subscribers), which is 12.9M added for the entire year.

- Retail Subscribers for the Top 4 carriers reached 309M, or an addition of 6M added for the whole year

- While Verizon maintained the lowest churn for the year at an average of 1.02% in 2017 compared to .985% averaged in 2016, AT&T followed with an average churn for 2017 at 1.08% (same as in 2016)

- A total of 3.8M tablets were activated for the entire year (2017), which is a decline from 2016 as many rely on Wi-Fi for connectivity and even use their phones as hotspots

- Verizon ended the year with 35% market share, followed by AT&T with 34%, T-Mobile with 18%, and Sprint with remaining (market shared based on number of connections including subscribers and connected devices/IoT)

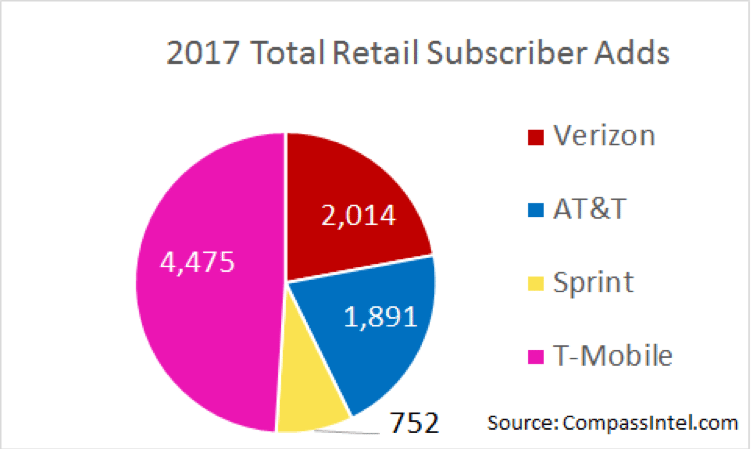

- AT&T leveraged its growth in IoT connections in 2017, while T-Mobile gained the most retail subscribers with roughly 4.5M added in 2017 (twice more than the next largest carrier additions, Verizon) (Note: T-Mobile made a decision to remove Lifeline subscribers from its wholesale connections in Q2 2017, which impacted overall Total Connections trends for T-Mobile)

Quarterly analysis

- REVENUE: Verizon and T-Mobile both experienced service revenue increases from Q3 2017 to Q4 2017

- T-Mobile increased revenue in Q4 2017 by $128M compared to Q3 2017.

- Combined the industry experienced a total of $546M in overall wireless service revenue in 2016

- Total Q4 2017 mobile service revenue reached $43.6M (compared to $44.3M in Q4 2016), which remained stable from Q3 2017

- POSTPAID ADDS:

- All 4 carriers ended the quarter with positive postpaid net adds, adding 3M retail subscribers for the quarter (.4M more adds than Q4 2016)

- T-Mobile dominated with postpaid adds, being the only carrier to add more than 1M (1.2M) postpaid adds this quarter, with Verizon adding 983K in Q4 (placing 2nd among the carriers in terms of adds)

- Verizon added 1.2M postpaid subscribers in Q4 2017, twice the adds in Q3 2017

- Sprint had a very nice turnaround compared to 2016, adding 1.3M total connections and 752K retail subscriber additions in 2017 (about 65% of the annual adds were added in Q4 2017 alone)

- CONNECTIONS:

- Total industry connections reached 413.1M at the end of Q4 2017 for the top 4 carriers

- Total industry subscriber base: 424.8M (Includes ALL MNOs and MVNOs)

- Total smartphone subscribers: 345M

- Total Connected Devices: 76.2M (IoT and Connected Devices)

As shown above, overall the industry added an estimated 12.9M connections in 2017 compared to 21.5M connections in 2016, which represents a 3.1% change from 2016. While Verizon ended the year with the most connections at 144.4M connections, T-Mobile lead overall retail subscriber adds for the year, adding over 4.4M subscribers in 2017. AT&T’s growth was primarily driven by IoT connections, adding an estimated 7.4M connected device connections in 2017 (2M more than adds in 2016). Sprint had its own success story returning to positive net adds for the year, adding 488K in Q4 alone.