The growing use of advanced networks for LTE and the upcoming introduction of 5G reflect an important growth in mobile data traffic. In this context, in order to be able to meet the needs of operators, including for wireless backhaul, the industry faces an increasing demand for more spectrum.

However, country regulators are not moving at the same speed when it comes to freeing up spectrum. While, in more mature markets of North America and Europe, there are regulations and allocations for Super High Frequency (SHF) bands (3-30 GHz), this is generally not the case in other regions. Table 1 provides detail on the frequency bands covered in the 5G PMP, mmWave and Backhaul Regulatory Database.

Table 1. Frequency ranges researched

|

Frequency band |

Frequency range |

|

10.5 GHz |

10.15 – 10.65 GHz (ITU-R F.1568) |

|

12.5 GHz MVDDS |

12.20 – 12.35 GHz / 12.55 – 12.70 GHz |

|

26 GHz |

24.5 – 26.5 GHz (ITU-R F.748-4) |

|

28 GHz |

27.5 – 29.5 GHz (ITU-R F.748-4) |

|

31 GHz |

31.0 – 31.3 GHz |

|

39 GHz |

38.6 – 40.0 GHz |

|

42 GHz |

40.5 – 43.5 GHz (with a 1.5 GHz T-R spacing: ITU-R F.2005) |

|

60 GHz |

Usually part of the V-Band: 57 – 64 GHz |

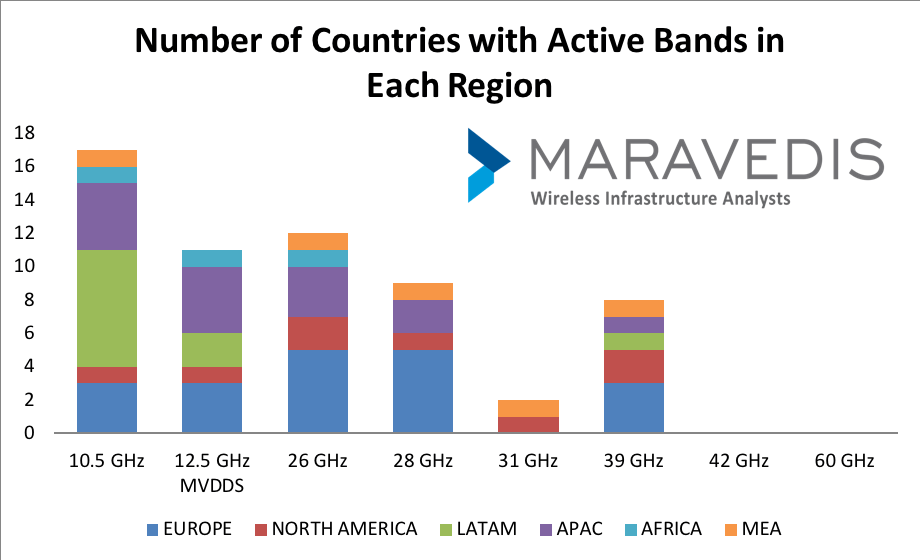

As shown in Figure 1 below, Europe and North America are also the regions where there are more markets with active bands in the millimeter wave bands (mmWave) or Extremely High Frequency (EHF) range (30-300 GHz). In this range, 39 GHz is the most used band.

Source: 5G PMP and mmWave Regulatory Database 2018

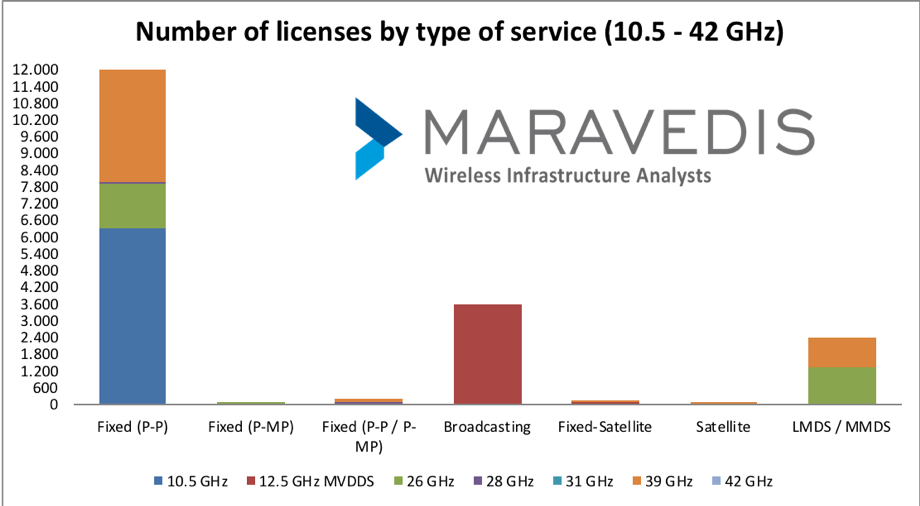

Among the 8 bands analyzed in this report, only the 12.5 GHz band is mostly used for broadcasting and satellite services, while the studied other bands are largely employed for fixed wireless services, particularly for Point-to-Point (PTP) microwave links, either for network access or for backhaul. Our analysis also reveals that only 5 countries use Point-to-Multipoint (PMP) applications, and this so only in the 26 – 39 GHz range.

Figure 2 shows the overall number of licenses by type of service in each band. As can be seen in Figure 2, fixed PTP links are the service with the highest number of licenses. Furthermore, both the PTP and PMP links are used for network access — including last mile fixed wireless access– in some countries and to backhaul mobile networks in others. Of note, in some countries, a single license can refer to a bundle of frequencies, rather than to a single one. Accordingly, the number of licenses does not necessarily equal the number of frequencies.

Source: 5G PMP and mmWave Regulatory Database 2018

By contrast, except for the 39 GHz and 60GHz (unlicensed), the bands in the mmWave range have seen little activity. For instance, the 31 GHz, 42 GHz, and 60 GHz have not been regulated in all markets (except for Egypt where Telecom operators use the 31 GHz band). This applies even to the developed markets of Europe and North America where relevant regulations are not in place, or the bands are open, but remain mostly inactive. Therefore, despite the increasing pressure on operators to acquire more backhaul spectrum, in most countries, there is still a clear trend in usage towards the lower bands in the SHF range. In many markets bands in the 10.5 – 28 GHz range, a great number of licenses have been allocated. The 39 GHz is the exception, and the concentration of licenses in this band is limited only to three countries: Netherlands in Europe, the U.S. in North America, and Brazil in LATAM (see Table 2).

Table 2. Number of licenses by band (10.5 – 42 GHz range)*

|

Frequency bands |

EUROPE |

NORTH AMERICA |

LATAM |

APAC |

AFRICA |

|

10.5 GHz |

32 |

6256 |

115 |

7 |

2 |

|

12.5 GHz MVDDS |

104 |

3506 |

63 |

7 |

1 |

|

26 GHz |

1611 |

1318 |

9 |

4 |

1 |

|

28 GHz |

86 |

48 |

7 |

2 |

0 |

|

31 GHz |

1 |

44 |

2 |

0 |

0 |

|

39 GHz |

11771 |

813 |

379 |

4 |

1 |

|

42 GHz |

1 |

0 |

0 |

0 |

0 |

*This table does not include MEA and the Russian Federation (data are not public)

Another factor that influences the spectrum availability in those bands is licensing arrangements. For instance, in the U.S., the FCC auctioned spectrum in the 26 – 39 GHz range, which explains to a great extent the pressuring scenario for spectrum availability.

The downside of mmWave’ promise for future 5G networks is that licensed mmWave spectrum has come to be unfairly dominated by large ISPs, such as Verizon and AT&T in the U.S., which own 55% and 66% of the popular 28 and 39 GHz bands, respectively. In total, these two companies own 58% of licensed mmWave spectrum in the U.S.

However, unlicensed and lightly-licensed mmWave spectrum, such as the 60 GHz V-Band and 70/80 GHz E-Band, can provide the benefits of mmWave without the prohibitive costs of the licensed spectrum. This allows smaller ISPs to stay competitive amidst the monopolistic practices of larger providers.

For instance, San Francisco-based Webpass, a gigabit ISP acquired by Google Fiber in 2016, is using the commercially available mmWave technology to provide broadband service. Webpass uses a combination of fiber networks and PtP mmWave radios to deliver gigabit broadband to residential and business customers. These radios operate in the inexpensive, lightly licensed 70/80 GHz E-Band, avoiding thus the licensed mmWave spectrum owned by Verizon and AT&T. Another service provider using mmWave wireless solutions is UK-based Metronet, which also uses the 70/80 GHz E-Band for last mile broadband infrastructure. Like Webpass in the U.S., Metronet can deliver gigabit fiber-like wireless to U.K. customers using mmWave radios. In addition to the relatively lower cost of fiber-like wireless infrastructure (as compared to FTTH), a further advantage of mmWave fixed gigabit wireless networks is the ease of deployment and scaling. The use of the lightly licensed 70/80 GHz E-band or unlicensed 60 GHz V-Band for last mile wireless broadband makes these networks an affordable and thus appealing option for many wireline and cable service providers.

The same auction mechanism has been used in 7 of 10 Latin American countries under study, as well as in 2 of the studied 3 African countries, although the demand in those countries is lower due to these countries’ less dynamic markets. In other regions, such as Europe and APAC, spectrum has been given on the link-by-link basis. This same auction mechanism also applies in Canada. In all these regions, there are variations, such as First Come First Serve (FCFS) and administrative procedures accompanied by the payment of fees.

“The discourse is shifting from ‘spectrum-based’ to ‘link by link-based’”, said Luis Reyes, author and senior regulatory analyst at Maravedis. “The results of this research confirm a trend observed in the last years: the trend is towards giving licenses on the link-by-link basis, rather than on the spectrum-basis, because the former is more efficient than the latter. So, it is more about thinking in numbers of licenses/links, rather than in terms of spectrum. This is not a mobile market and, according to what I have researched, it behaves differently”.

Beyond the domain of fixed wireless, the timescales to make mainstream commercial devices supporting millimeter wave (mmWave) spectrum are still uncertain. Even in countries like the USA, where there are plans to auction these high-frequency airwaves soon, the radios are likely to be confined to broadband CPE rather than handsets for some time. But that is not deterring the more blue-sky element of the wireless industry from looking even higher up the spectrum, as far as terahertz frequencies, for their next source of airwaves to support massive capacity and new applications

Maravedis “5G PMP and mmWave Regulatory Database 2018” provides a number of insights into in the 10.5 – 60GHz range spectrum regulation and ownership. The detailed analysis of 34 countries worldwide shows that Europe and North America are the regions where bands in the 10.5 to 28 GHz range have been allocated the most and are being most actively used by operators.

If you are interested in learning more about the current usage of frequency bands in the 10.5 – 60 GHz range and the applicable regulations, please download the brochure.

[1] Active frequency band means actively used by the license holder