Intel and Xilinx reportedly tried to acquire Mellanox

The confluence of several technology mega-trends–5G, artificial intelligence and big data analytics–require the support of cloud computing and data centers to efficiently run an increasingly diverse set of workloads. To keep pace with this type of demand, U.S. firm Nividia announced it will acquire Israel’s Mellanox for $6.9 billion, or $125 per share.

According to Nvidia, the two firms count among their clients every cloud provider and computer OEM. In a breakout, the companies listed customers as Cisco, Dell, HPE, IBM, Lenovo, Alibaba, AWS, Baidu, Google, Azure, Oracle and Tencent.

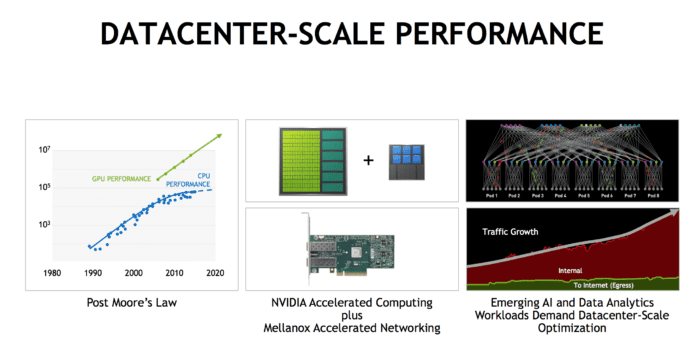

Nvidia CEO Jensen Huang said the acquisition will support “skyrocketing demand on the world’s datacenters. Addressing this demand will require holistic architectures that connect vast numbers of fast computing nodes over intelligent networking fabrics to form a giant datacenter-scale compute engine.

“The emergence of AI and data science, as well as billions of simultaneous computer users, is fueling skyrocketing demand on the world’s datacenters,” said Jensen Huang, founder and CEO of NVIDIA. “Addressing this demand will require holistic architectures that connect vast numbers of fast computing nodes over intelligent networking fabrics to form a giant datacenter-scale compute engine.”

According to multiple reports, Intel and Xilinx both participated in a competitive bidding process.

Looking to the 2023 timeframe, the companies see a total addressable market of more than $60 billion with around $50 billion from the computing segment and more than $10 billion from high-speed networking.

Mellanox specializes in Ethernet and InfiniBand interconnect for server and storage infrastructure with network and multicore processors, adapters, switches, cables, software and silicon. The company was founded in 1999 and splits its headquarters between Sunnyvale, California, and Yokneam, Israel.