Company execs say they are still confident, enthused about Sprint merger

T-Mobile US continues to outstrip the rest of the industry on customer gains while delivering strong financial performance. T-Mo added 1.7 million total net additions during the quarter, up 15% from the same period last year; 1 million of those were branded postpaid net adds, including 656,000 postpaid phone net additions. The company’s net income was $908 million for the quarter, up 36% year-over-year.

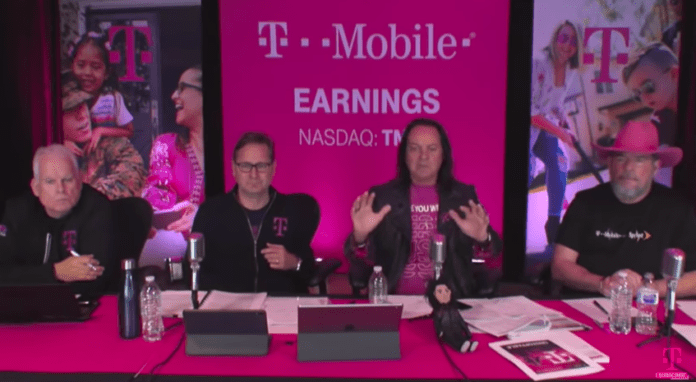

Company executives said on the quarterly call with investors that they are both confident and enthused about the proposed merger with Sprint and expect it to go through. But the fate of the merger is still in question and as Bloomberg noted, investors continue to be most interested in whether the proposed tie-up will win regulatory approval. The Wall Street Journal reported earlier this month that approval was unlikely as the deal is currently structured; both T-Mobile US CEO John Legere and former Sprint CEO Marcelo Claure, current COO of SoftBank, disputed the story.

Legere, speaking on the T-Mo quarterly call, said that the regulatory review process is in the “final innings” and said that he continues to expect the merger to close later this year. He cited a number of merger milestones, including having gained 16 of the 19 state-level approvals that it needs in order to move forward. T-Mobile US recorded $93 million in merger-related costs during the first quarter of 2019.

Among the numbers and highlights from the company’s first quarter earnings and call:

-Service revenues of $8.3 billion, up 6% from the first quarter of 2019; postpaid service revenues were up 8% year-over-year.

-T-Mobile US had its lowest-ever branded postpaid phone churn rate of 0.88% during the first quarter of 2019.

-T-Mobile US’ capital expenditures for the year are still expected to come in between $5.4 and $5.7 billion for the year, with most of that front-loaded; expenditures during the second quarter will step down from those in the first quarter, the company said.

-The company continues to expand its portfolio of offerings, from the home internet service pilot that it started last quarter to its “T-Vision” video service to a mobile-first checking account service. Asked about the company’s strategy on bundling wireless and its various other services, Mike Sievert responded that it depends on how you define bundling.

“If what you mean by bundling is that we’ll give you a decent deal on the core product only if you buy a bunch of other stuff you don’t really want — no, we’re not going to do bundling, that’s the game plan that AT&T pursues,” he said, going on to describe T-Mo’s plan as putting out “disruptive” offers that are augmented by its various services.

-T-Mo said that it has 326 million people covered with LTE and is doing an “aggressive build-out” of its 600 MHz spectrum holdings, which now cover more than 3,500 cities and towns.

-Speaking about the company’s plans for 5G, CTO Neville Ray said that T-Mobile US “[intends] to put down a very large, three to four-lane highway across the U.S. with 600 MHz, and I think it’s going to be in stark contrast to the pockets of 5G that are out there today — very, very limited — from AT&T and Verizon.” The carrier plans to do this as 5G devices become available in the second half of this year, he said. While Verizon may have more 5G cities on its list, Ray said, “it seems to be a handful of sites” in very urban areas with “very limited range.” T-Mobile US, he added, is working with the same equipment and software ecosystem as Verizon and “the software is not mature,” Ray said. (Sprint CTO John Saw, speaking at a 5G conference this week, also mentioned waiting on stable commercial 5G network software).