Greetings from Lake Norman and Charlotte, North Carolina, where we are having a wet but overall terrific spring (pic is of our May Day celebration with neighbors – plenty of cheer… at a distance). This week, we will continue our earnings discussion with five key takeaways. Our focus will be on cable versus traditional telecom due to the earnings release schedule (read last week’s column if you would like a good AT&T and Verizon assessment). We will also touch on Microsoft’s Affirmed Networks acquisition and some interesting Q&A in the Apple earnings call.

Greetings from Lake Norman and Charlotte, North Carolina, where we are having a wet but overall terrific spring (pic is of our May Day celebration with neighbors – plenty of cheer… at a distance). This week, we will continue our earnings discussion with five key takeaways. Our focus will be on cable versus traditional telecom due to the earnings release schedule (read last week’s column if you would like a good AT&T and Verizon assessment). We will also touch on Microsoft’s Affirmed Networks acquisition and some interesting Q&A in the Apple earnings call.

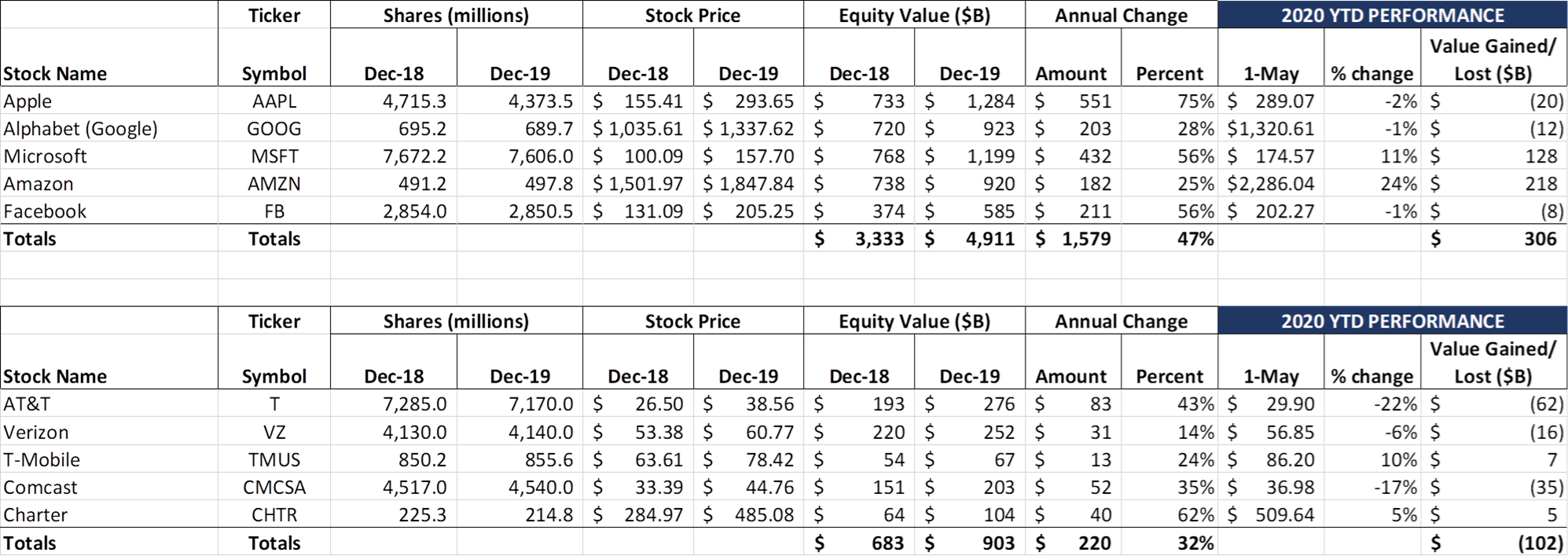

Even with a few earnings releases this week (and Friday’s broad-based market decline), the Telco Top 5 market capitalizations pretty much stayed put. Verizon and T-Mobile lost some value. Other than that, very quiet in Telcoland.

As the chart to the right shows, they have lost $102 billlion in market capitalization since the beginning of the year, with 58% of those losses occurring prior to March 1. In fact, the entire loss comes from Comcast and AT&T, the two Telco Top 5 stocks with the highest dependencies on content production and broadcasting.

Not so quiet, however, for the Fab 5, where each component announced earnings this week. Amazon’s stark post COVID-19 assessment was accompanied by the following earnings release statement (emphasis added):

Providing for customers and protecting employees as this crisis continues for more months is going to take skill, humility, invention, and money. If you’re a shareowner in Amazon, you may want to take a seat, because we’re not thinking small. Under normal circumstances, in this coming Q2, we’d expect to make some $4 billion or more in operating profit. But these aren’t normal circumstances. Instead, we expect to spend the entirety of that $4 billion, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe.

As the schedule shows, the Seattle online giant has already gained $218 billion (or one AT&T) in market capitalization this year compared to $182 billion in all of 2019. While the $4 billion + will be spent ensuring the delivery of products and services, it’s important to note that Amazon will continue to heavily invest in their logistics network and local delivery. The expanded presence of Amazon (with ~$50 billion in cash and marketable securities and only $23 billion in long-term debt at the end of Q1) is a key factor when considering how we will recover from this recession (versus 2009-2010 when Amazon had a much smaller logistical infrastructure and no cloud business and 2001-2002 when Amazon was primarily a bookseller).

Apple, Google, and Facebook also gained on the heels of a brighter advertising outlook. We touch on one aspect of the Apple earnings conference call below, and take a look at the ever-changing supply chain for the newly launched iPhone SE. Overall, the Fab 5 have gained $306 billion of market capitalization in 2020 bringing the 2019-2020 total to $1.9 trillion. This is ~19x the market capitalization gained by Comcast+AT&T+Verizon+T-Mobile+

T-Mobile remains the only earnings announcement in the 10 (or 11 including the Q1 legacy Sprint sub stats release by T-Mobile on Friday) companies covered in the Fab 5 or Telco Top 5. They report next Wednesday (May 6).

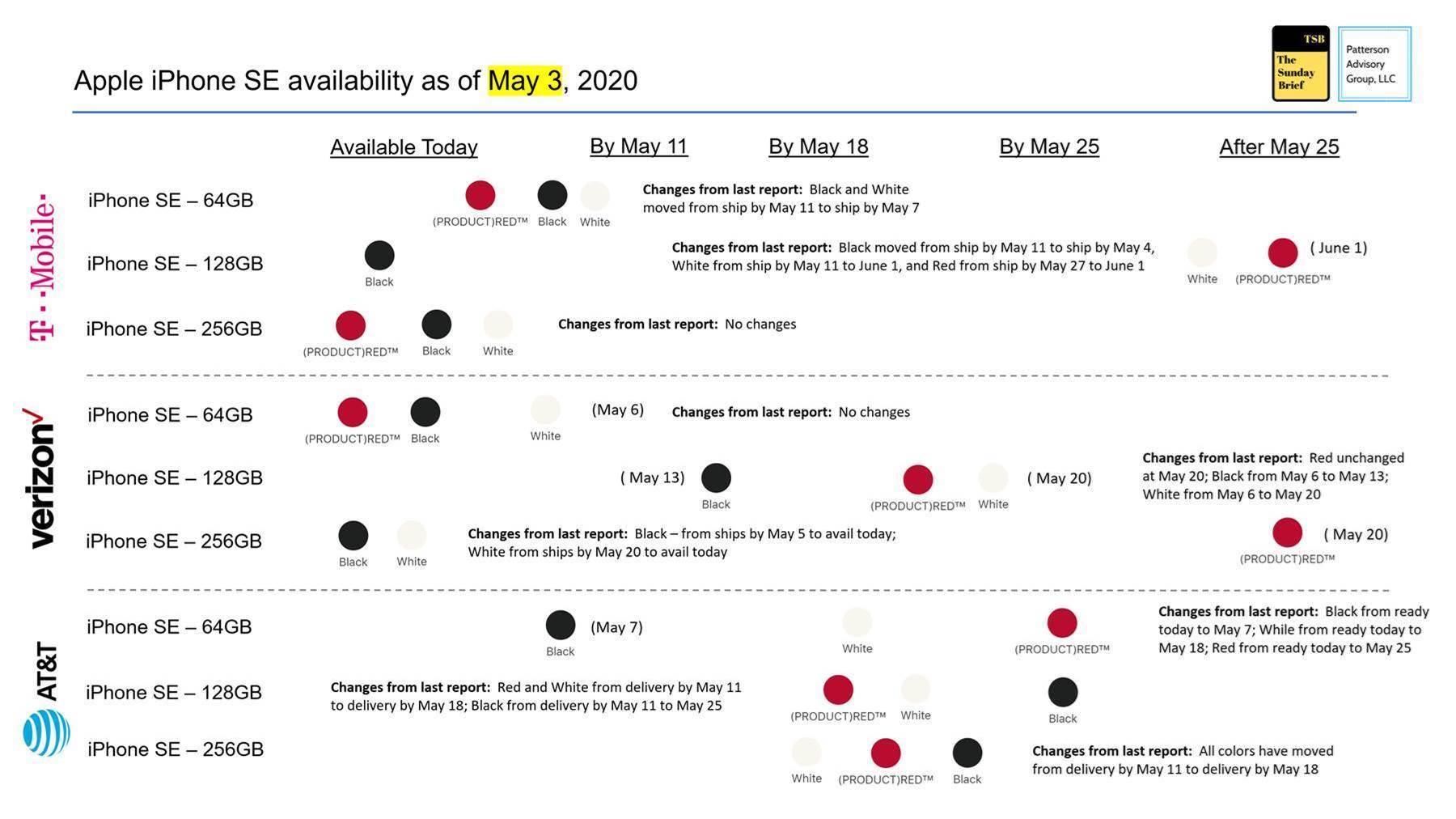

Before we dive into earnings, let’s look at the inventory state of the iPhone SE.

iPhone SE – supply shortages are likely related to form factor, not economics

The iPhone SE officially went on sale on April 24 and we established a baseline for availability observing that demand for 128GB exceeded supply. This likely indicates (and Apple seemed to back this up on the conference call) that there is a customer segment that would like a smaller form factor with premium smartphone power (see the ZDNet review here – one idea raised in the review is that as businesses come back to full force they might upgrade to the SE model and this could hurt iPhone 11 sales). ‘

This chart shows the availability of iPhone SE devices for AT&T, Verizon, and T-Mobile (we correctly assumed that the Sprint and T-Mobile supply chains are managing the iPhone SE availability “as one”). On top of these three online channel checks, we also looked at Apple.com and Bestbuy.com availability. The conclusion from the five channels is very clear for the 128GB storage tier (smaller screen with good performance leads to device shortages). In fact, if you want the 128GB in white, get prepared for at least a two-week wait.

Also, in keeping with what we saw with the iPhone 11 series launch last winter, the higher storage options tend to go on backorder earlier with Verizon and AT&T than with Sprint and T-Mobile. This is generally (but not always) the case in the chart above, with 256GB red devices in short supply but white more readily available. AT&T seems to have shifted the most in total volume, including the 64GB storage SKU – this is likely a result of more store openings and longer hours.

Apple appears to have shifted some inventory from their own online sales to the carriers as their site lists all storage options and color models as unavailable for shipment until May 28. This could also have something to do with store re-openings (which, according to this Bloomberg article, might not start in earnest in the US until the end of the month).

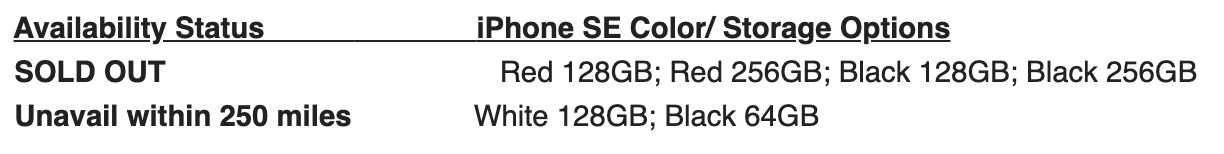

Best Buy rarely sells out, but the following models were sold out (or nearly so) as of Saturday noon ET:

We’ll keep a close eye on the Best Buy status, but the carriers seem to be the only place to get an iPhone SE with color and storage regularity. New this week (ZDNet got us thinking) is that this may have a slippover effect on business users who want a smaller form factor.

Bottom line: Apple has a big hit here with the iPhone SE, epecially given the launch conditions (stores closed, supply chain strains, etc.). We think that inventory issues could last well into June with Mother’s Day/ Graduation seasons creating additional demand. (Chart avail in PPT or PDF formats on request).

Earnings analysis: Broadband, business and mobile power cable

Comcast, Charter, and Altice all announced earnings this week. Altice represents the bookends of the current pandemic: Queens/ Long Island, as well as West Virginia, make up their territory. We’ll take a look at their earnings in three separate steps.

Broadband: Charter, Comcast, and Altice added a combined 990K residential and SMB broadband customers in the quarter. This nearly represents the last 4 quarters of U-Verse and FiOS net additions (+1.19 million) and does not consider AT&T or FiOS DSL disconnects due to upgrade. (The 990K also assumes none of the Internet Essentials or the Charter customers added from their Remote Education Offer remain after the free period has ended). This stat says it all: Telco was lapped nearly 4x in the latest quarter. Cable is the default, and (surprisingly) telco fiber is not taking away market share in fiber areas.

The best part is that cable is adding subscribers with lower capital intensity (cap ex as a % of total revenue). Line extension needs are low. Self-install (at least for Charter) is 90% (likely to settle in the 70s% which is still a massive improvement), and the operations are preparing for their next productivity investment based on experience (10,000 broadband customer additions per day), not conjecture.

When your most profitable product line grows at nearly 4x the rate of your competition, a lot of other less performing parts of the business (theme parks, broadcasting) can survive. Cable was prepared for the increased demands of a homebound pandemic – Verizon and AT&T were not as prepared.

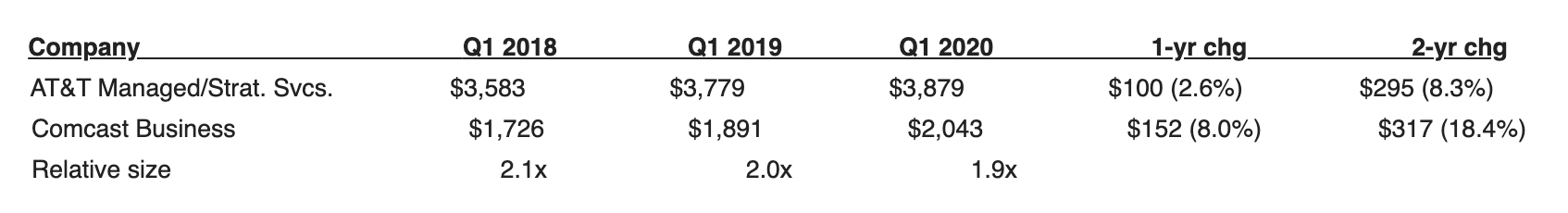

Business: While their SMB vs. enterprise revenue mixes are different, cable still appears to be doing quite well compared to AT&T and Verizon, and it’s increasingly coming through medium business and enterprise customers. Because of Verizon’s reporting restructuring (and also Charter’s Navisite sale and wholesale cell site backhaul changes), we’ll have to get an indication of how cable is performing vs. Telco using an AT&T vs. Comcast Business comparison (all amounts in $ millions):

What is being compared above is the performance of AT&T’s advanced services, including (per their footnote) (1) data services (VPN, dedicated internet ethernet and broadband), (2) voice service (VOIP and cloud-based voice solutions), (3) security and cloud solutions, and (4) managed, professional, and outsourcing services. None of the legacy voice services are included in the $3.9 billion – we are doing everything possible to give AT&T every benefit of the doubt and not saddling comparisons with legacy (cash-flowing) voice and wholesale businesses.

Comcast mostly operates in defined geographical areas, while the AT&T revenues shown above are global (there is no breakout in the release). Even with those constraints, Comcast outgrew AT&T by 1.5x on an absolute basis from Q1 2019 to Q1 2020 (more than 3x faster on a % basis). And that figure also is strong (1.1x) on a two-year basis.

While this is not a perfect comparison by any means, it does project that Comcast will likely eclipse AT&T’s most important wireline business unit in several years. This is perplexing in so many ways: AT&T’s deep legacy and reputation in business (particularly global), AT&T’s global network, and AT&T’s wireless network/ IoT bundles should provide significant headwinds to Comcast Business (and Charter and Altice as well). Yet Comcast and Charter are growing at mid-single digits overall.

Bottom Line: There are many concerns about smaller businesses and the effects of bankruptcy on all of the carriers. As Charter indicated, there’s a lot of stress testing going on, and, even in the most dire scenarios, growth is still positive for the year (or at least not negative). Verizon and AT&T’s dour assessment of business wireline stands in contrast to cable’s “I smell an opportunity” messaging.

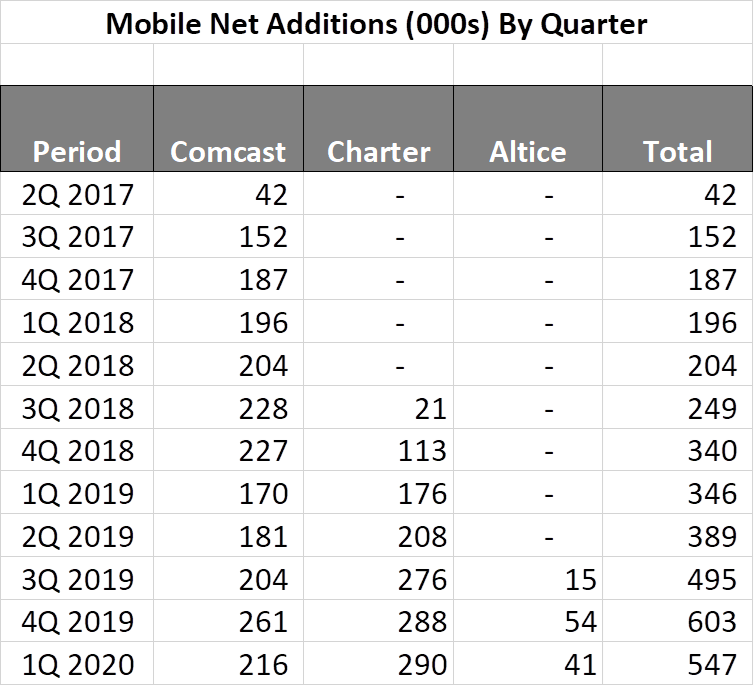

Mobile: We have updated the charts on the right, and cable probably missed their internal estimates but came out of the quarter with decent net additions. The vast majority of these net additions are what the Big 3 wireless carriers would call “postpaid phone net additions.” For Q1 2020, AT&T had 163K net additions, Verizon had 68K net losses, and Sprint had 348K net losses (253K postpaid phone net losses for three of the top four carriers).

Mobile: We have updated the charts on the right, and cable probably missed their internal estimates but came out of the quarter with decent net additions. The vast majority of these net additions are what the Big 3 wireless carriers would call “postpaid phone net additions.” For Q1 2020, AT&T had 163K net additions, Verizon had 68K net losses, and Sprint had 348K net losses (253K postpaid phone net losses for three of the top four carriers).

Against the backdrop of free phones, military/ senior discounts or low handset lease costs are the cable selling machines who added 547K customers with none of these promotional plans in place. In the case of Charter (branded as Spectrum Mobile), a $45/ month taxes and fees included unlimited phone service operating over Verizon’s network is very attractive to folks who are doing everything possible to economize.

Unlike the Business section above, the cable companies’ ability to grow has its limitations even with 5G and equipment installment plans. Cable still breaks apart (or at least starts to get awkwardly complex) after two lines. That’s not much of a multi-line play (and, frankly, just the way AT&T and Verizon like it). And multi-line plays are a given in the business world.

The question the analyst community should ask is “How will Comcast and Spectrum address the wireless customers above two lines?” There’s no clear answer, and the network operators don’t want to make it an easy problem for MVNOs to solve. That’s why Comcast and Charter will aggressively bid on CBRS (3.5 GHz) spectrum, and, as Charter CEO Tom Rutledge suggested, use it for aggressive macro offload through small cells. And, once that problem is resolved, Comcast and Spectrum need to be able to address using CBRS (and perhaps C-Band) as a private LTE network solution for larger customers. Unlike the previous “scortched earth” strategy where Comcast solely focused on 1-5 line opportunities for their first couple of years, this time the opportunity starts at 25-50 wireless lines. Mobile/ wireline integration opportunities abound, and additional offload planning is needed – now.

Where is Apple headed with the Apple Card? An interesting earnings call Q&A

While listening to Tim Cook handle a wide array of questions on Apple’s earnings call, we were surprised at his response to Wamsi Mohan’s (Bank of America) question. Here is the exchange:

Wamsi Mohan (Bank of America): … I know you’re doing a lot with both the Apple Card and financing plan for iPhones to get your products in the hands of customers. But, I was wondering, would you consider using the strength of your balance sheet maybe a little differently, structure maybe deferred payments or things like that, or do you think that there could be other steps like bundling that you will consider versus what you already currently do?

Tim Cook: Well, as you know, we launched the payment plan earlier on Apple Card for iPhone. We’re working on doing that for other products as well. And you’ll see something on that shortly. So, we’re very focused on the affordability point. The trade-in programs also are fairly wide across the board and act as both something great for the environment, also something great from a way to get that entry price down. In terms of deferred payments, nothing to announce today. But, as you know, having access to the card, at least in the United States, gives us more degrees of freedom. And that is not using our balance sheet. But we play a key role in deciding what kind of programs go with the card.

Could Apple defer payments (kind of a “Sign and Drive” Volkswagen event) to drive premium phone and 5G adoption? Will the Cupertino giant go the way of Samsung and offer 36-month financing instead, at least on more expensive models? While this may be tough for Apple to swallow, a 36-month option may be needed for the top-tier products. Unlike the auto industry, we don’t think that Apple will mix payment deferrals and long-term financing. If the iPhone SE trend holds, however, and there’s some iPhone 11/ iPhone Pro inventory left in August, it would not be surprising to see some Apple Card related offer. We really like rewarding more credit card purchasing a a means to get a reduced payment as an alternative (double Apple’s Daily Cash until the monthly payment has been fulfilled). Stay tuned.

Earnings analysis – is Microsoft the new Ericsson?

Microsoft also had their earnings announcement this week. As we have noted several times in the last two months, the Redmond-based software powerhouse has added over $560 billion in equity market capitalization to MSFT shareholders in the last 16 months (more than AT&T and Verizon have added in their histories – combined). The government is not pleased with Huawei’s ascendency to telecom infrastructure power, and, as the Wall Street Journal reported in February, Microsoft has been involved with AT&T, Dell and others in developing a replacement wireless switching architecture to Huawei.

At the end of March (prior to the earnings announcement), Microsoft Azure (cloud product) announced that they would be introducing Azure Edge Zones, a product that enabled wireless (5G) control and administration functions to extend to the edge. There’s a great deal of complexity with this as that server needs to inter-operate and coordinate with 5G networks globally. In their announcement, Microsoft trumpeted wide-scale participation:

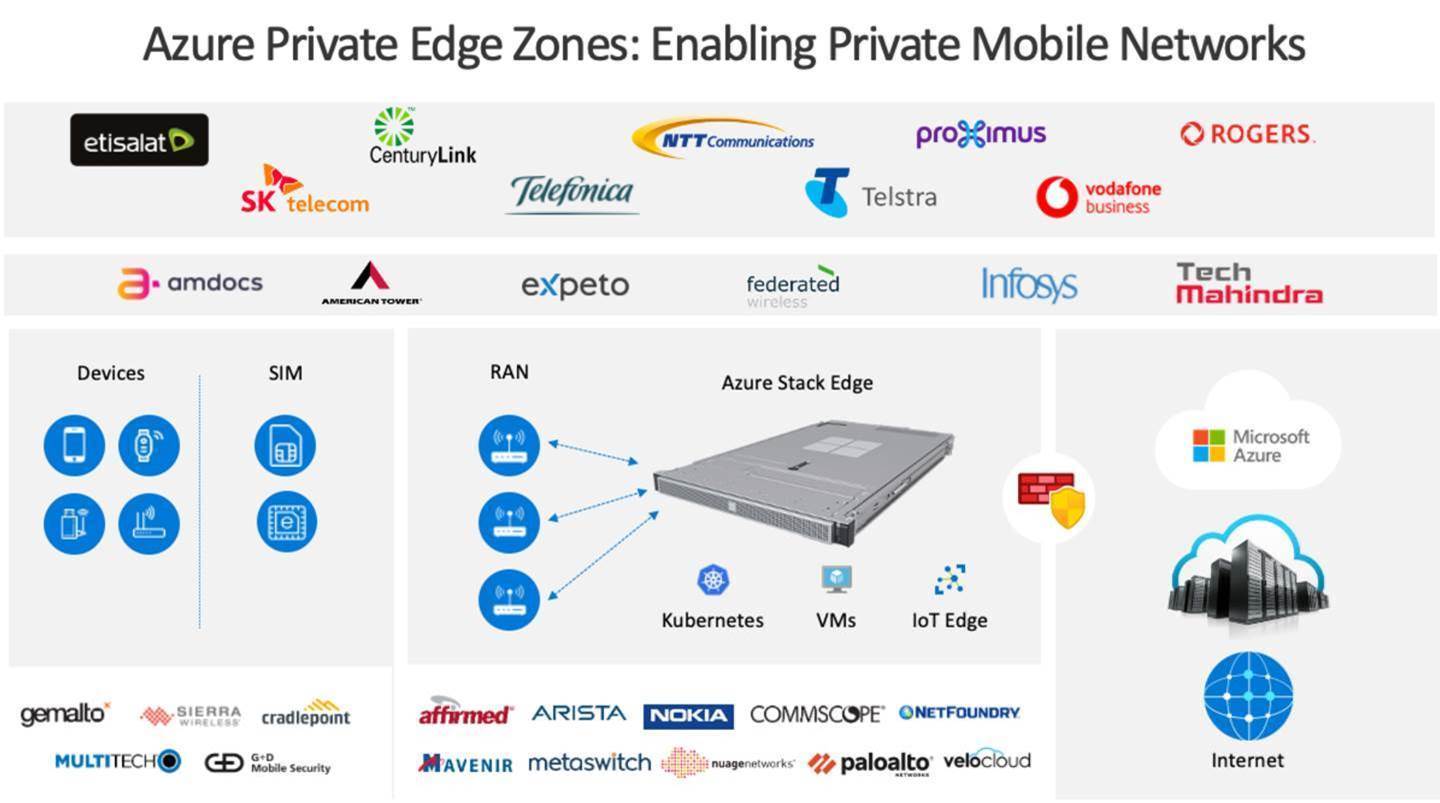

Microsoft did not stop there, however. They also introduced a Private version of the Edge Zone product. This version probably makes the CIO excited, but not the wireless enterprise salesperson. Here’s the ecosystem partnership for the Azure Private Edge Zone (as of March 31):

This carrier section of this ecosystem slide looks an awful lot like the previous slide except for one missing member: AT&T (and curiously, the inclusion of CenturyLink who operates a lot of backbone but not a lot of wireless infrastructure today). Satya Nadella, Microsoft’s CEO, also made a point of discussing the importance of the Edge Zone product in his introductory comments of this quarter’s busy earnings call (and highlighted the importance of the Affirmed Networks acquisition).

There’s a lot more to do to compete with Ericsson, and it’s unlikely that Microsoft would focus its energies on integrating LTE into 5G (they might start with private networks that only interoperate at the 5G level using the 5G Standalone or SA standard). But Microsoft is definitely taking steps to replace traditional telecom infrastructure providers and firmly detach operating systems from hardware. And they have $137 billion in cash and marketable securities on their balance sheet, a global presence, and the ear of every Fortune 1000 Global CIO.

Internal business communication is quickly moving to Teams – could business wireless be next?

That’s it for this week. Thanks again for your readership. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here. If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!