IDC: ‘global smartphone shipments will not return to growth until the first quarter of 2021’

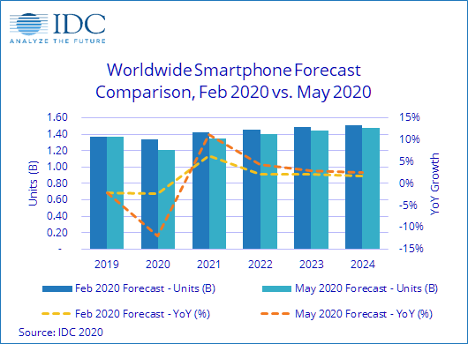

The International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker forecasts that the global smartphone market will experience an overall of decline 11.9% year over year in 2020, with shipments totaling 1.2 billion units. This expectation is informed by the impact of the COVID-19 pandemic, which caused the industry’s largest year-over-year decline in global smartphone shipments in history in the first quarter of 2020.

The first half of the year’s smartphone shipments are now expected to decline 18.2% in as consumers continue to face the pandemic’s effects on the global economy.

According to IDC, global smartphone shipments will likely not return to growth until the first quarter of 2021.

“What started as a supply-side crisis has evolved into a global demand-side problem. Nationwide lockdowns and rising unemployment have reduced consumer confidence and reprioritized spending towards essential goods, directly impacting the uptake of smartphones in the short term,” said Sangeetika Srivastava, senior research analyst with IDC’s Worldwide Mobile Device Tracker.

However, Srivastava went on to say that despite the dismal outlook, 5G is still being viewed as the catalyst throughout the forecast period, which she said “will play a vital role in worldwide smartphone market recovery in 2021.”

In fact, 5G devices, including handsets, have hit a milestone. According to a new report from the Global mobile Suppliers Association. Between the end of April and the end of May, the number of commercially available 5G devices jumped from 95 to at least 112, the GSA said.

There are now 119 5G phones available and/or announced, up 11 from the previous month. The number of commercially available 5G-capable phones grew by 13 in the past month, to at least 77.

IDC analysts pointed out that while the Chinese economy, specifically, will continue to be impacted by COVID-19, there have already been clear signs of improvement, with some factories resuming operations and the easing of some travel and logistical restrictions. Because of these milestones, IDC believes that the China domestic market will only see a single digit decline in 2020.

Parts of Europe, on the other hand, will experience a double-digit decline, as they were severely impacted, particularly in countries like Italy and Spain.

“China’s recovery has been impressive to say the least, especially given the initial impact of COVID-19 on the country,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Tracker. “There’s no question that challenges lie ahead for the smartphone industry and we believe the economic downturn is going to cause some fluctuation in the vendor and price-tier landscape. The surge in consumer spending around devices that are less mobile than smartphones (PCs, monitors, video game consoles, etc.) will undoubtedly take a share of the consumer wallet that would have been put towards smartphone upgrades and 5G. We believe this will result in even more aggressively priced 5G smartphones than expected prior to the pandemic. This could result in some share wins for the vendors that position their portfolios to capitalize on this change.”

Short-term impacts from the coronavirus pandemic are also hitting the internet-of-things (IoT) market, where a combination of manufacturing shut-downs, supply chain interruptions and changes in availability and demand of connected products is resulting in a forecasted 18% slump in new wide-area connections in 2020 compared with previous forecasts.