Preliminary estimates suggest 1Q20 CBRS RAN revenues were in line with expectations, accounting for 1% to 3% of the overall 1Q20 North American RAN market. Even if the regulatory process has taken significantly longer than expected, the results are encouraging given that the ICDs started in late 3Q19 – it took around five years for small cells to approach the same revenue share for the worldwide RAN market in the macro to small cell transition. The results in the quarter also validates the message that we have communiated for some time, namely that various delays have not impacted the underlying demand for new bands that ultimately improves spectrum utilization, lowers the barrier to entry, and provide opportunities for a wide range of non-traditional participants to operate a public or private LTE, or eventually 5G NR, network at a lower cost of operating a typical network.

Within the mix, preliminary readings indicate deployments to support Fixed Wireless Access (FWA) and capacity augmentation for mobile broadband (MBB) applications comprised the lion share of the 1Q20 CBRS RAN market, underpinning projections that the spectral efficiency upside with LTE, the flexibility of the GAA layer, and recent technology advancements in combination with a thriving CPE ecosystem provides a compelling business case for LTE FWA addressing both suburban and rural locations with suboptimal fixed broadband solutions, poor fixed penetration, or highly concentrated landscapes. At the same time, some suppliers are reporting a reasonable uptake with private wireless type applications for both indoor and outdoor use cases.

Within the mix, preliminary readings indicate deployments to support Fixed Wireless Access (FWA) and capacity augmentation for mobile broadband (MBB) applications comprised the lion share of the 1Q20 CBRS RAN market, underpinning projections that the spectral efficiency upside with LTE, the flexibility of the GAA layer, and recent technology advancements in combination with a thriving CPE ecosystem provides a compelling business case for LTE FWA addressing both suburban and rural locations with suboptimal fixed broadband solutions, poor fixed penetration, or highly concentrated landscapes. At the same time, some suppliers are reporting a reasonable uptake with private wireless type applications for both indoor and outdoor use cases.

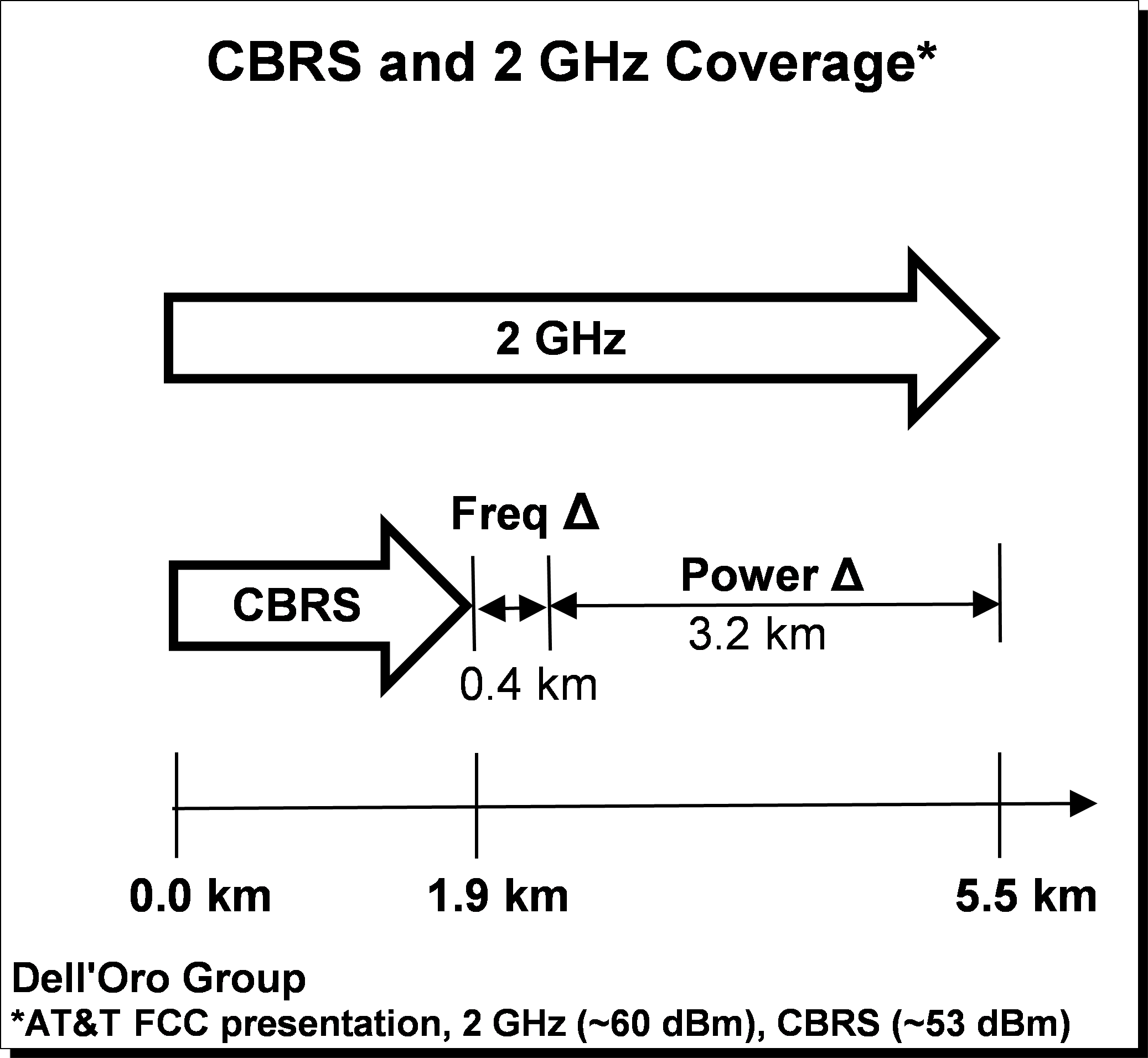

More importantly, suppliers are reporting impressive performance with data speeds in the hundreds of Mbps over greater distances surpassing half a mile in numerous cases, alleviating some, though far from all, concerns that the proposed EIRP levels and the implied cost per bit challenges in locations with greater inter-site distances will impact the business case viability of broader coverage areas for service provider relying on the spectrum as a primary band.

More importantly, suppliers are reporting impressive performance with data speeds in the hundreds of Mbps over greater distances surpassing half a mile in numerous cases, alleviating some, though far from all, concerns that the proposed EIRP levels and the implied cost per bit challenges in locations with greater inter-site distances will impact the business case viability of broader coverage areas for service provider relying on the spectrum as a primary band.

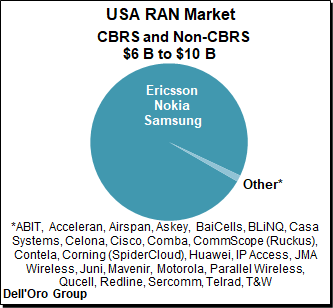

While initial estimates suggest the leading North American RAN suppliers including Ericsson, Nokia, and Samsung are also well positioned with the CBRS band, one of the more interesting aspects of this spectrum is that the CBSD or CBRS RAN landscape continues to evolve – according to the CBRS Alliance, there are now 25 to 30 suppliers with OnGo certified CBSD solutions on the market. And since the top three US RAN suppliers accounted for more than 98% of the 2019 RAN (CBRS and non-CBRS) market, the growing field of smaller CBRS RAN suppliers remain optimistic the “Other” bucket will comprise a larger share of the CBRS RAN market relative to the overall US RAN market.

It is still early days for CBRS and the list of caveats that could derail the uptake beyond the innovators and early adopters remains long, however initial developments suggest some of the risk assumptions that have been adopted can be modified while at the same time adding confidence to the forecast, with the overall CBRS market – LTE plus 5G NR – projected to grow at a rapid pace between 2019 and 2024 with cumulative RAN investments projected to surpass $1.5 Billion. In other words, it is now justified to be cautiously optimistic about the CBRS opportunity.