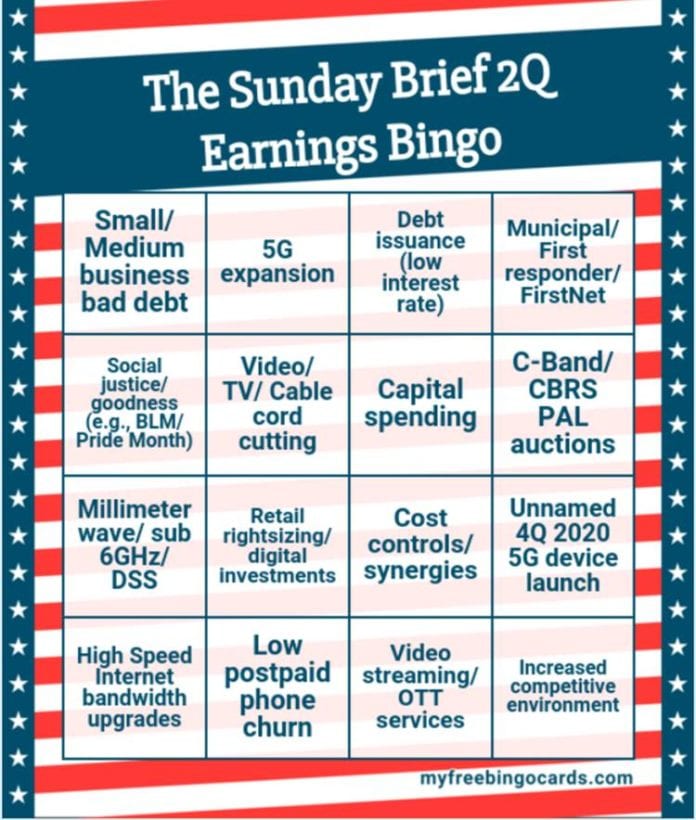

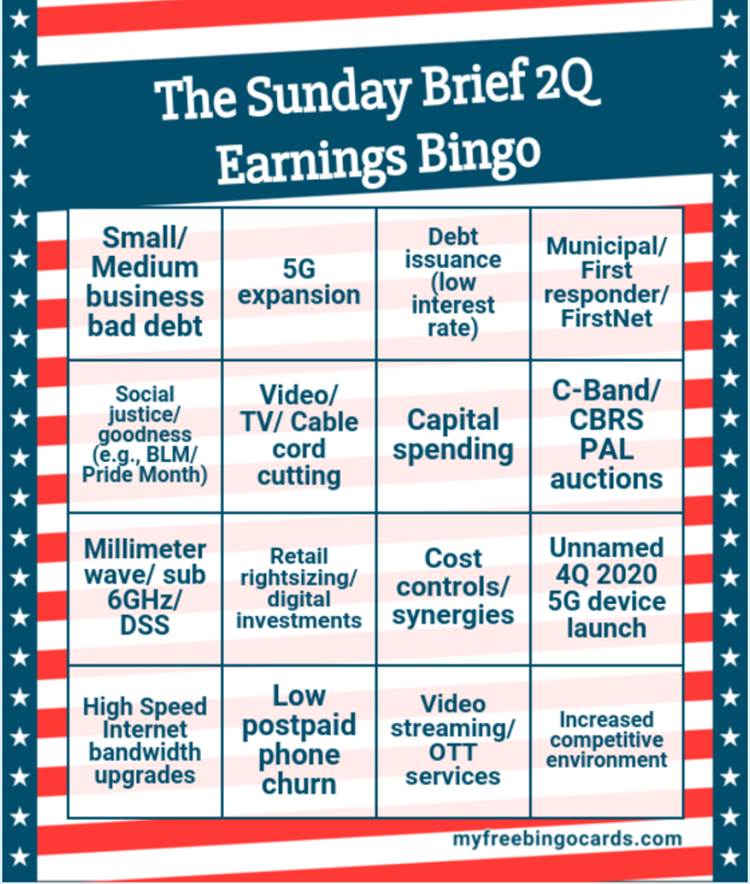

Summer greetings from Charlotte and Lake Norman, NC. This has been a news-filled week. In our Q1 2020 preview, we described a “bingo card” that a few Sunday Brief faithful use as more of a tongue-in-cheek way to manage through hours of earnings calls. While there are many company-specific items (e.g., FirstNet for AT&T, Disney+ for Verizon and Sprint synergies for T-Mobile), we think the card to the right is a pretty safe indicator of what each telecom/ cable/ wireless CEO will be talking about starting in just over a month. To get your own Bingo card, click here and play along online.

Summer greetings from Charlotte and Lake Norman, NC. This has been a news-filled week. In our Q1 2020 preview, we described a “bingo card” that a few Sunday Brief faithful use as more of a tongue-in-cheek way to manage through hours of earnings calls. While there are many company-specific items (e.g., FirstNet for AT&T, Disney+ for Verizon and Sprint synergies for T-Mobile), we think the card to the right is a pretty safe indicator of what each telecom/ cable/ wireless CEO will be talking about starting in just over a month. To get your own Bingo card, click here and play along online.

Many companies hit the virtual conference circuit this week, so there is plenty of preview material to consume. We will touch on T-Mobile’s eventful week, and also on AT&T CFO John Stephens’ wide-ranging and insightful virtual discussion at the Credit Suisse event. But first, a look at market valuation changes.

The week that was

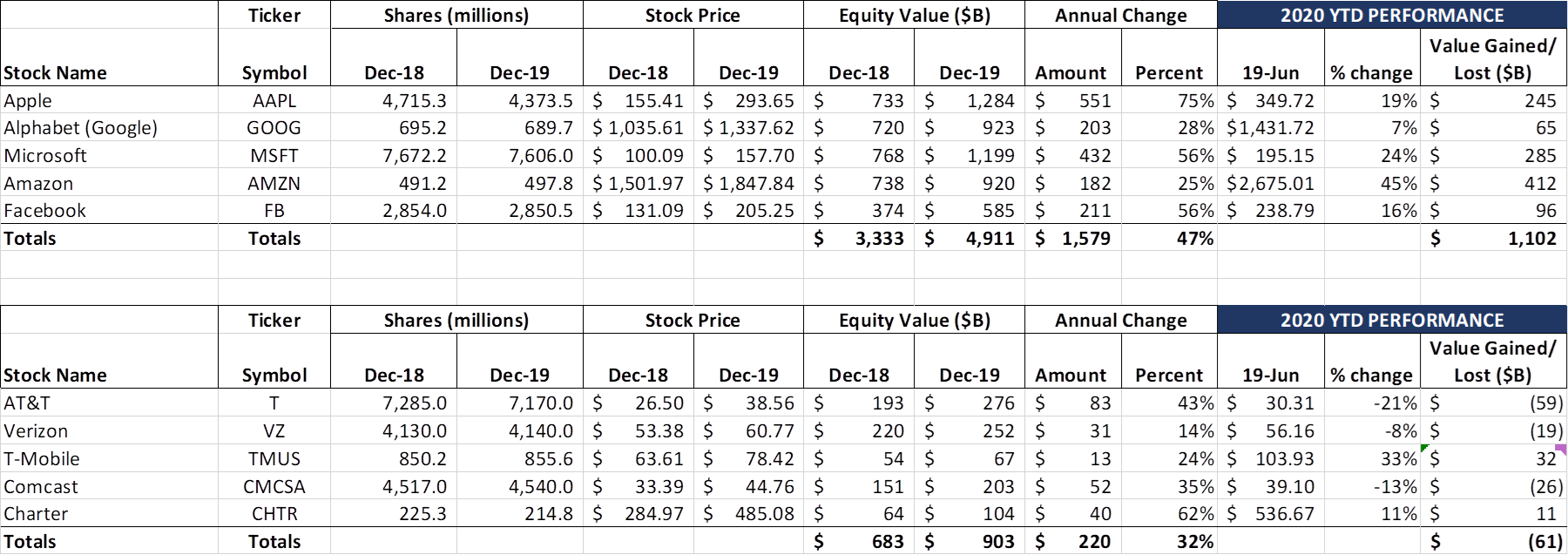

Overall, the S&P 500 was up 3.8% for the week, led in part by tech-heavy stocks (YTD, the S&P is down ~5% and the Russell 2000 is down ~15%). As we have seen in previous quarters, investors are looking for news on earnings drivers but, outside of a pre-announcement from T-Mobile (see SEC 8-K filing here starting on page 4), there has been very little new news or assumption changes. For example, there’s speculation from The New York Times that Apple may announce at their upcoming (virtual) Worldwide Developers Conference that they will be making their own chipsets for the Macintosh and end a 15-year relationship with Intel – no doubt that is news, but Apple needs to show something for the $16 billion they spent on R&D in 2019 (full 10-yr R&D trend from Statista here).

Overall, the S&P 500 was up 3.8% for the week, led in part by tech-heavy stocks (YTD, the S&P is down ~5% and the Russell 2000 is down ~15%). As we have seen in previous quarters, investors are looking for news on earnings drivers but, outside of a pre-announcement from T-Mobile (see SEC 8-K filing here starting on page 4), there has been very little new news or assumption changes. For example, there’s speculation from The New York Times that Apple may announce at their upcoming (virtual) Worldwide Developers Conference that they will be making their own chipsets for the Macintosh and end a 15-year relationship with Intel – no doubt that is news, but Apple needs to show something for the $16 billion they spent on R&D in 2019 (full 10-yr R&D trend from Statista here).

The biggest news of the week is simply that the Fab 5 market capitalizations are on track to exceed 2019. Through June 19 (24+ weeks), these five stocks have added $1.1 trillion in equity market value. The worst performing stock, Google parent company Alphabet, is up a mere 7% YTD and 38% since the beginning of 2019 ($268 billion in equity market value added in just under 18 months – the smallest equity value appreciation of the five). While we have made similar points in the past, the Fab 5 will add more equity value in the first six months of 2019 than the Telco Top 5 have added in their entire existence (telecom management executives – let that sink in as you discuss whether Microsoft or Google are really serious about competing against Verizon and AT&T for private 5G network spending).

Then we have Apple stock which continues to defy gravity (nearly $800 billion in market capitalization created since the beginning of 2019), as analysts now realize that iPhone SE sales might come in stronger than expected (we suspected that from our iPhone SE back order tracking discussed for the six weeks following launch). There is also a lot of anticipation about the to be announced 5G device, muted on Friday by concerns that store re-closures might impact Apple product sales (fat chance as many of these locations are in malls where traffic has struggled since reopening).

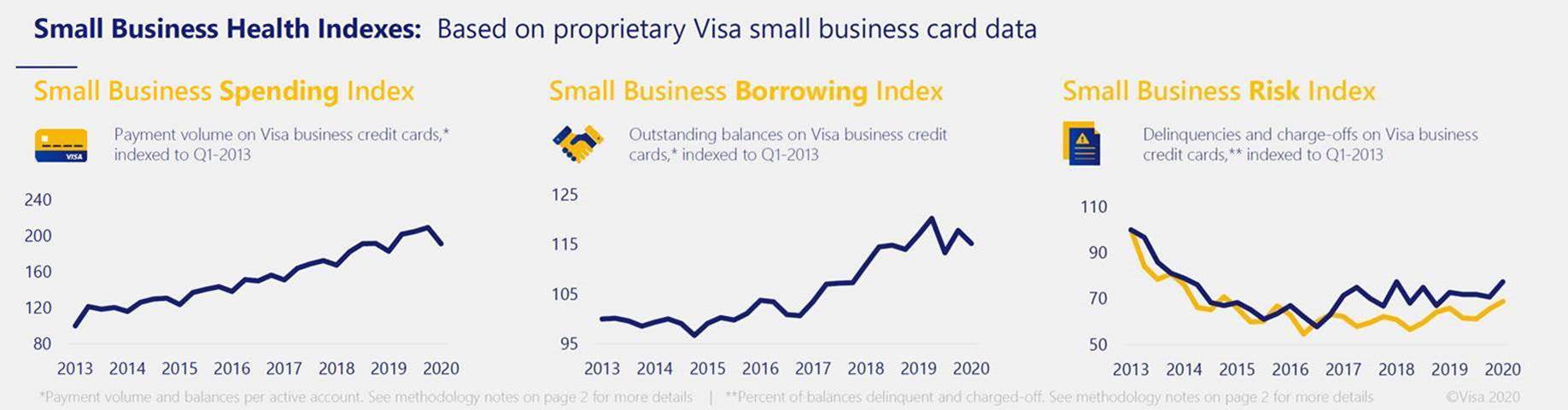

One of the more interesting economic health studies we saw this week was from Visa, who published a report on the state of small business spending on Monday. Here are their conclusions (emphasis added and link to report here):

- Outstanding balances on Visa business credit cards dropped 2.6 points but may increase as lost revenues kick in and borrowing becomes more necessary. Risk, on the other hand, ticked up with increases in both delinquencies (+3.3) and charge-offs (+6.6). Whether federal assistance programs and forbearance regulations can help stem the tide remains to be seen.

- Half of small businesses were either at risk of closing (45 percent) or anticipated they would need to close (5 percent) because of the COVID-19 pandemic, according to a Q1 survey conducted by Kelton Global on behalf of Visa.

- Most small businesses are looking for assistance to stay afloat, either through flexible payment options (81 percent), relief from debt payments (78 percent), or access to loans (73 percent).

The 45% figure, while very hard to stomach, is in line with what is historically seen in a local community following a major hurricane or earthquake (CNBC article here). The impact on consumer spending will likely be more muted until July (2019 taxes due) and August ($600/ week extra unemployment compensation ends August 1). From this Wall Street Journal article, it appears that many consumers are paying down debts and increasing savings with only selective spending increases.

Bottom line: The week was great for the Fab 5 ($210 billion in equity market capitalization increase) and flat for the Telco Top 5. There are several very disturbing trends emerging for small businesses, which could send a bad debt ripple through the economy.

2Q Earnings Preview – Buzzword Bingo

T-Mobile’s Crazy Week. As mentioned earlier, there were three investor conferences this week with nearly every one of the Telco Top 5 represented at every conference. We will touch on some key trends below.

T-Mobile’s Crazy Week. As mentioned earlier, there were three investor conferences this week with nearly every one of the Telco Top 5 represented at every conference. We will touch on some key trends below.

The biggest newsmaker this week, however, was T-Mobile. The Bellevue telecom giant announced a new CFO (Peter Osvaldik – previously T-Mobile’s CAO – 43 years old –promoted from within – pic nearby), and finalized the Boost divestiture date with Dish (July 1). Further, all legacy Sprint postpaid subscribers will be receiving the full benefits of T-Mobile Tuesdays (great for bringing down churn). But the biggest surprise was from section 7.01 in the SEC 8-K link above where they disclosed:

- Retail postpaid net additions would be 800,000–900,000, primarily due to growth in Postpaid – Other (meaning non-phone Postpaid sales). Whether this was one T-Mobile for Business customer (e.g., a state or federal government agency) or multiple closed sales is unknown. We definitely saw demand for the iPhone SE in the weekly back order assessments which served as a barometer for increased activity, but this is a very surprising number;

- Merger related costs were substantially increased from $500-600 million to $800-900 million. Fewer stores will be brought back online (similar to what AT&T said this week), and more opportunities to reduce the workforce earlier than expected (including elimination of the entire former Sprint Business inside sales division);

- COVID-19 costs for 2Q are now expected to be $100 million less than previously communicated (from $450-550 million to $350-450 million);

- Non-cash impairment charges of $418 million before taxes. These relate to two items: 1) $200 million for the write down of a new billing system that was under development (codenamed U2), and 2) $218 million for a partial write down of the Layer 3 (now T-Vision) acquisition as the company moves away from the legacy standalone product to one bundled with fixed wireless access (FWA) service.

All of this news was released in less than 48 hours. And there was a newsworthy outage (mostly Voice over LTE or VoLTE) that was caused by a fiber cut in the Southeast (more on that here). And then the announcement that they had raised $4 billion in senior secured notes at ridiculously low rates ($1 billion of 6-yr notes at 1.5% coupon, $1.25 billion of 8-yr notes at 2.05% coupon, and $1.75 billion of 11-yr notes at 2.55%). The company did not specify which notes they were going to redeem (other than the fact that the targeted bonds did not contain a “make whole” provision), but, assuming that they save 500 basis points on $4 billion in debt – every $200 million in annual interest savings helps (who says Treasury can’t carry a synergy target?).

Bottom line: T-Mobile could fill a row on the 2Q Earnings Bingo card just by itself based on this week’s events. It will be way too early to say that Sprint’s postpaid phone churn rate will match T-Mobile’s, but we are predicting that legacy Sprint churn (if reported) will be a lot closer to 1.5% than 2.0% (both are still the highest in postpaid). This week’s actions clearly show that T-Mobile is very serious about reducing costs.

AT&T CFO John Stephens delivered a wide-ranging talk on Wednesday at the (Virtual) Credit Suisse Communications Conference (transcript here). This followed an equally thought-provoking discussion with AT&T Communications CEO Jeff McElfresh and Tuesday’s Bank of America Merrill Lynch TMT conference (transcript here). Rather than an analysis of the entire call, let’s look at three important quotes (of many) that Mr. Stephens made:

On store closures (vs. digital):

“…our customers have wanted to go to a more online and more digital experience, [and] we’ve been building up those resources, building up that muscle with COVID. And quite frankly, we closed close to 1,000 stores during COVID. But we had to rely on that and really lean on that and pressure test it even more than we had in the past. That’s worked really well. So when you go through that and then you look at the — where are the malls going to be when they open up, where — what is retail going to look like, before you go back and open all your stores, you’re going to go through that evaluation and you’re going to look to streamline and be more efficient. And certainly, we’ll go through that process. COVID might have given a timing to that, but this was a process that we would have expected to go on for some time.”

This is John’s nice way of saying 1) AT&T will likely not reopen a lot of mall stores and 2) it’s going to take a lot of associated foot traffic and financial incentives to lure them back. Earlier in the conversation, John refers to their COVID minimum store deployment of one store for every 30-mile radius in a metro area. We doubt that will be the new standard, but it’s highly likely that AT&T will cut back more than needed and then bring new locations online as demand dictates.

On small business TV losses:

“Video continues to be a challenge, particularly in the first quarter. And in April, we saw a lot of small businesses shut down. A lot of those bars, restaurants, hotels, they suspended their accounts with us. When their businesses are closed down, they’re not going to be utilizing the television under the — through the sports bar or utilizing for entertainment in the hotels when they don’t have any customers. So we’re going through that process, and that is a challenge. We’re working with all of those customers. We have permissions in place to deal with that and try to work with them on it to suspend the accounts, and then when they reopen have them come right back on. But it’s been a challenging time. We’ll continue to face that.”

This ties in very well with the Visa commentary in the previous section, and it will be very interesting to see how AT&T is reserving for bad debts with respect to small business TV. Likely a very small portion of overall profitability, but, while many are focused on small business data and wireless voice growth, there’s a highly profitable offset here, and one that cable could be very interested in acquiring for either the current customer or the replacement sports bar.

On Business Wireline cash generation:

“Business Wireline is — doesn’t get the respect it deserves because it keeps putting up good solid numbers and generate a lot of cash. The broadband business with the fiber growth actually grew revenue in the first quarter. And remember, the initial investments, we’re building out the fiber broadband that we ran over the last 5 years. So every dollar revenue really helps with cash flows because the money in the investments are already made. And then in wireless, as I mentioned, we have about a $500 million improvement in EBITDA, so that goes with it a strong cash flow. So when you think of those 3, it’s about 75% of our free cash flow

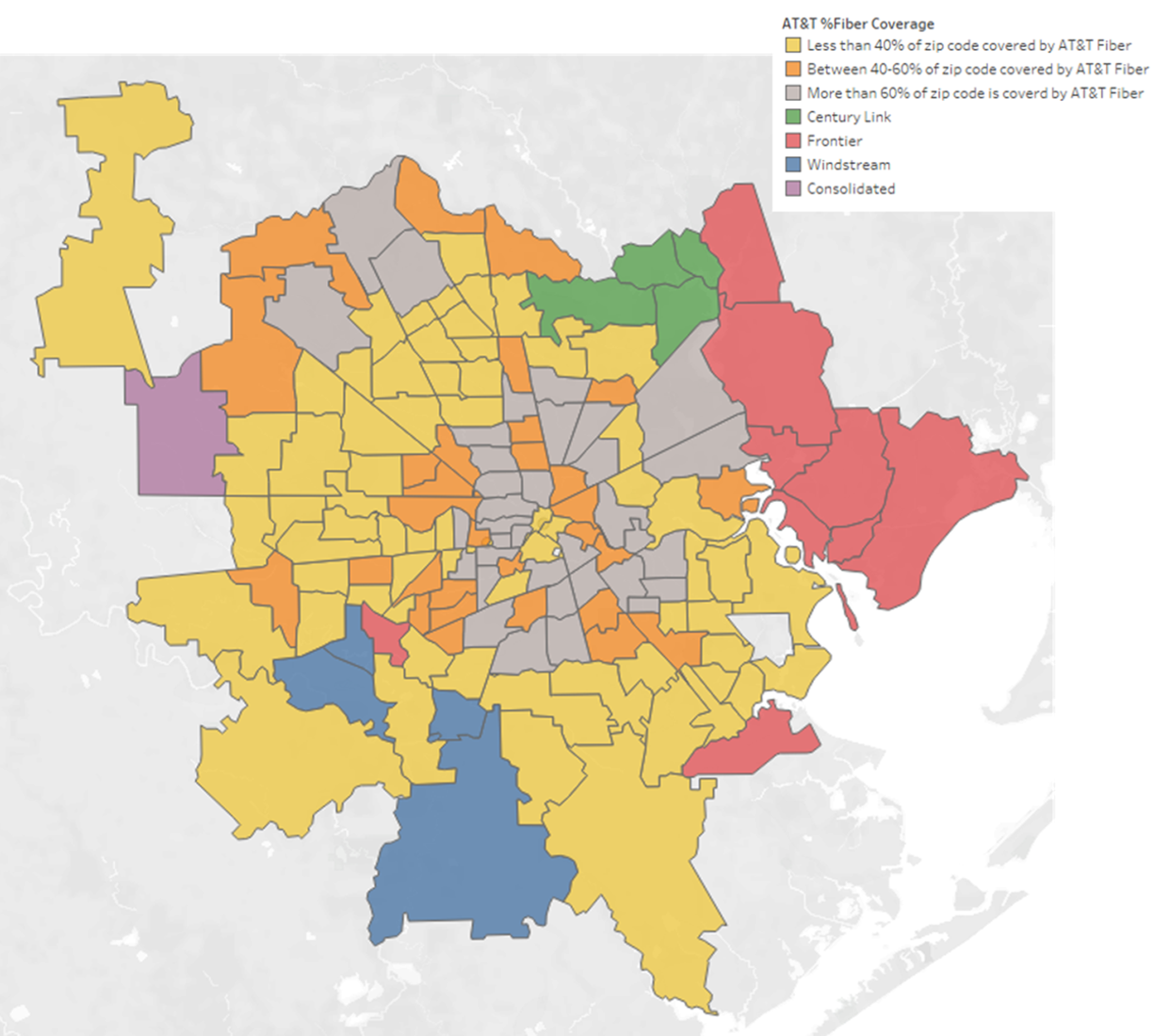

From the CFO’s lips to [former head of AT&T Business] John Stankey’s ears. There’s one small problem: Spectrum and Comcast (and to a lesser extent Cox and other cable companies) who want the same high-speed customer. One of the great marketing battles that will occur in the next 12 months will center around AT&T’s fiber value proposition versus cable. In most metros, AT&T has narrow, business-focused deployments (we highlighted some in the June 7 Deloitte Sunday Brief), and minimal single family home coverage (see nearby chart of the Houston MSA provided by Broadband Now – all of the mustard colored shadings represent tip codes where AT&T’s fiber deployment to residential customers is less than 40% of homes).

In most of the commercial office business locations Stephens mentions, there is competition. AT&T has to win over commercial customers either using aggressive promotional pricing (as they are doing with AT&T fiber – see exploding rate description here) or they need to bundle wireless (promotional discounts by another name). And time is not on their side as Verizon is going to have some fiber for sale in many of their markets quite soon.

Bottom line: John Stephens is one of the best CFOs in telecom if not corporate America. He’s making profitability-impacting decisions every day and AT&T’s 2019 asset divestitures were amazing. But Ma Bell has been knocked down by the economic effects of COVID-19 – small business closures, store closures (staying closed), sports programming, movie production delays, broadcast channel advertising headwinds, and lack of a fiber monetization strategy are all fires that need to be put out quickly before they join together in a contiguous blaze. Mr. Stephens’ firefighting skills will definitely be put to the test.

Next week, we will conclude our “Second Quarter Earnings Preview – Buzzword Bingo” series with a focus on cable (particularly Comcast and Charter) as well as Verizon. Please keep the comments and suggestions coming, and, if you have time, check out the new and improved website here.

Also, If you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe and keep your social distance!