IDC predicts that the global smartphone market will fully recover by 2022

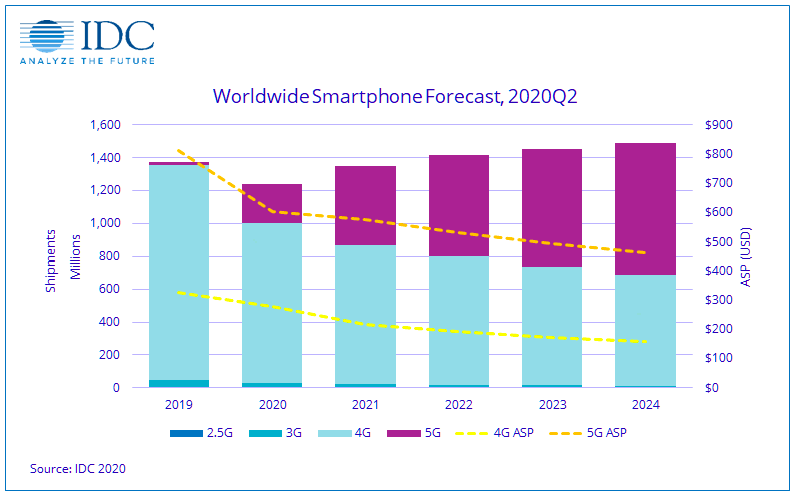

According to International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, the global smartphone market is forecast to decline 9.5% year over year in 2020 with shipments totaling 1.2 billion units, following a tough year.

The report indicates that the second quarter of 2020 saw slightly better-than-expected numbers, but that wasn’t enough to fully salvage the market, which was still down 17% year over year with “visible signs of economic concerns.”

“Although we expect year-over-year growth of 9% in 2021, that is only due to the large drop in 2020. The real recovery won’t happen until 2022 when smartphone volumes return to pre-COVID levels,” said Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “Other elements beyond 5G will play a role in the market recovery, most notably the continued opportunity in developing markets. There continues to be a strong shift towards low- to mid-end 4G devices in developing regions, which make up over 80% of smartphone volumes in these regions.”

Despite the negative outlook for the immediate future, IDC does expect the smartphone market to rebound, returning to a full recovery by 2022, and achieve a compound annual growth rate (CAGR) of 1.7% over the five-year forecast. The growth prediction, according to IDC, is driven by the assumption that most people worldwide will still consider smartphones to be the computing platform of choice.

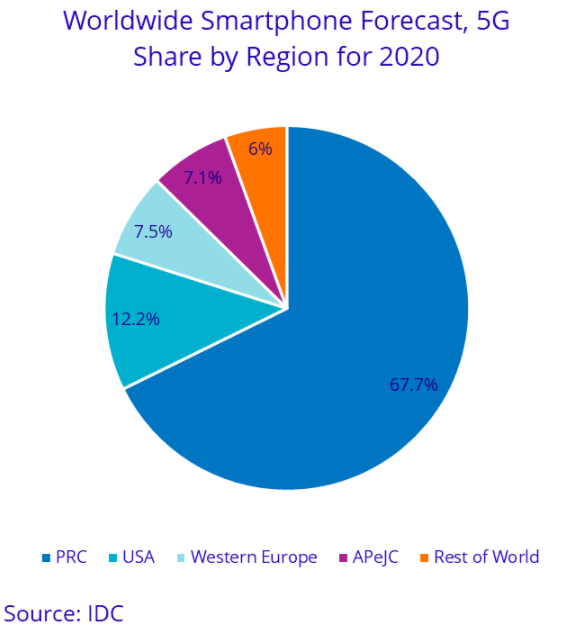

Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers, expressed confidence that 5G is still top-of-mind for all smartphone OEMs “despite the challenges with the COVID-19 pandemic and lack of consumer demand.”

“While many of the top vendors have reduced their 2020 production plans to align with the market decline, we’ve seen most of the cuts focused on their 4G portfolios. Most channels in developed markets have set the expectation that the portfolios they carry will be dominated by 5G units by the end of 2020 leaving less shelf space for 4G,” he continued.

However, he added that consumer demand for 5G is very low and when combined with the market’s economic challenges, “the pressure to drive down hardware and service fees associated with 5G will become increasingly important.”

Some of this hardship might work in the favor of consumers, as the average selling prices (ASPs) of 5G devices are expected to drop in 2020 and beyond. For instance, in the past quarter, China saw 43% of 5G devices priced under $400 and IDC expects global 5G smartphone ASPs to hit $495 by 2023.

IDC expects 5G smartphones to capture 50% of the global market by 2023.