October greetings from Lake Norman where we are enjoying an almost perfect fall. Pictured is Monday evening’s peaceful Lake picture from our dock. The view never gets old.

October greetings from Lake Norman where we are enjoying an almost perfect fall. Pictured is Monday evening’s peaceful Lake picture from our dock. The view never gets old.

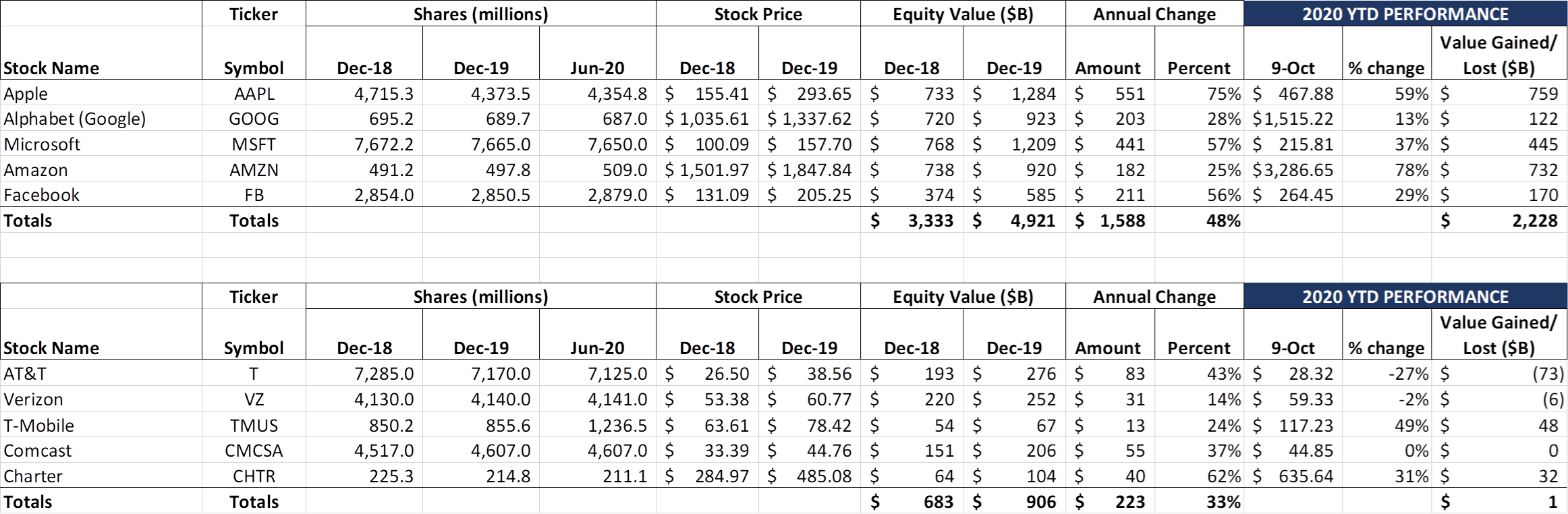

This week’s Brief is devoted to diagnosing AT&T’s sickness. We have highlighted their lost market value frequently this year (see latest chart below), and the company’s underperformance is evident. We will chronicle their recent strategic moves, and attempt to diagnose the “cocktail” required to heal the patient.

The week that was

The Fab 5 had a bit of a bounce back this week, adding more than $277 billion (a little over one Verizon) in market capitalization. There were broad gains across each stock, with notable strength in Amazon (+$82 billion wk/wk), Microsoft (+$74 billion) and Apple (+$69 billion). Next Tuesday, Apple will be holding an event where we should see the new 5G-equipped iPhones (more on what to expect from CNET here). We’ll cover that analysis in next week’s Brief.

The Telco Top 5 continued to hover around breakeven as a group, with increased pressure on AT&T (-$3 billion) and Comcast (-$2 billion). As we note below, Comcast’s recovery from April lows has been remarkable ($49 billion recovered since April 1). As a group, the Telco Top 5 have recovered over $162 billion since the April 1 low.

Former Microsoft CEO Steve Ballmer went on CNBC this week to comment on the House Committee’s report on Antitrust activities of Amazon, Apple, Google, and Facebook (a little over 3 minutes of that interview is here). Ballmer, who seems politically neutral, started the interview with the statement “When I read this report, it blew my hair back – that’s how crazy [the report was].” Ballmer went on to say that there continues to be a need for some government regulation of technology, and that these large firms should engage with regulators now.

In addition to Ballmer’s comments, WIRED columnist Steven Levy penned one of the most insightful columns on the report Friday. While lengthy, Levy describes the underlying issue as being much larger than tech:

“The questionable behavior the committee exposes in the thousands of pages of evidence here is less about the uniqueness of tech platforms than it is about how our system allows companies from any industry to conduct themselves. The huge, anticompetitive acquisitions listed in the report—like Facebook’s purchases of Instagram and WhatsApp—are much in the spirit of mergers we’ve seen in industries like banking, media, and airlines. If regulators look the other way when supermarket chains favor their house brands on display, why be surprised when Google pushes its services on search pages, and Amazon sends us its Basics line when we bark a request to Alexa? When a game company is disadvantaged by paying 30 percent of its revenue to Apple—while Apple’s competing product pays nothing—it sounds like the routine conflict of cable networks who favor content they own over those of companies who don’t have exclusive access to consumers. The report even takes the tech companies to task for using some of their fortunes to hire lobbyists to curry influence. Like, um, every other big industry in America? And, hey, Congress, whose fault is that?

In other words, Big Tech is doing business the American way. Exposing the sins of Amazon, Apple, Facebook, and Google is like pulling a curtain from a mirror.”

This is not the last we will hear from tech media on the Report. But the House Subcommittee’s position, that structural separation of market leaders is the best way to control anti-trust behavior, is definitely aggressive (and, as analysts suggested this week, tone deaf to the rapid changes that redefine markets and competition each month). This is not the last commentary we have heard from the tech community on this matter, and both Steven and Steve make some salient counterpoints to the report.

Curing AT&T’s Sickness – Telecom 3Q Earnings Preview (Part 3)

There’s something wrong with AT&T and shareholders know it. The stock’s inability to recover from pandemic lows earlier in the year (something Verizon and Comcast have done – see nearby chart) is noticeable. Over the past 12 months (excluding the yield impact of dividends), AT&T’s has underperformed Verizon by 22% and Comcast by 40%. Many questions are being raised by institutional holders, retirees, and potential partners about AT&T’s strategy and tactics. In short, AT&T is sick, but there is no consensus on the specific illness.

This week, AT&T CEO John Stankey gave a detailed interview this week to The Wall Street Journal (article here) where he called deals “the first step in a “wash-repeat cycle” that company leaders have used effectively for decades to build a constantly evolving cash generator.” Stankey went on to comment that AT&T’s high yield (resulting from its continued low stock price) “doesn’t make sense to me, and I can only conclude we must not have carried the day in people believing in that regard. But the decision to get to this place was a conscious one.”

We have studied AT&T’s history for a few decades now (see our Briefs here and here), and have come to the conclusion that AT&T a) has a poor track record executing most acquisitions (this goes as far back as 1991 and NCR), and b) frequently adjusts their strategy to rationalize specific acquisitions, a policy we find both disturbing and dangerous.

As discussed below, we see a higher hill for AT&T to climb as a broadband challenger to cable and potentially wireless alternatives (as one of the linked articles above indicates, they are no longer an incumbent), and also believe that they will deplete value through aggressive bundling tactics (starting with HBO Max). Bottom line: AT&T is not terminally ill – each issue we describe below can be fixed – but the timing and nature their path to full health remains uncertain.

The current picture: Broad-based broadband averageness

“What is AT&T really good at?” one of you asked me a few months ago. My first thought was “relationships.” Whether it’s record low postpaid phone wireless churn, or their long-standing relationships with federal (DoD this week), state, and municipal governments (or enterprises), AT&T has a long history of nurturing their relationships.

Those relationships are challenged, however, as new technologies emerge. Their bread and butter legacy (voice) services have been reduced to a mere 6.4% of revenues in 2Q 2020. That’s primarily a function of attractive substitutes such as desktop VoIP/ video/ conferencing, cable (VoIP) residential and SMB services, and wireless substitution.

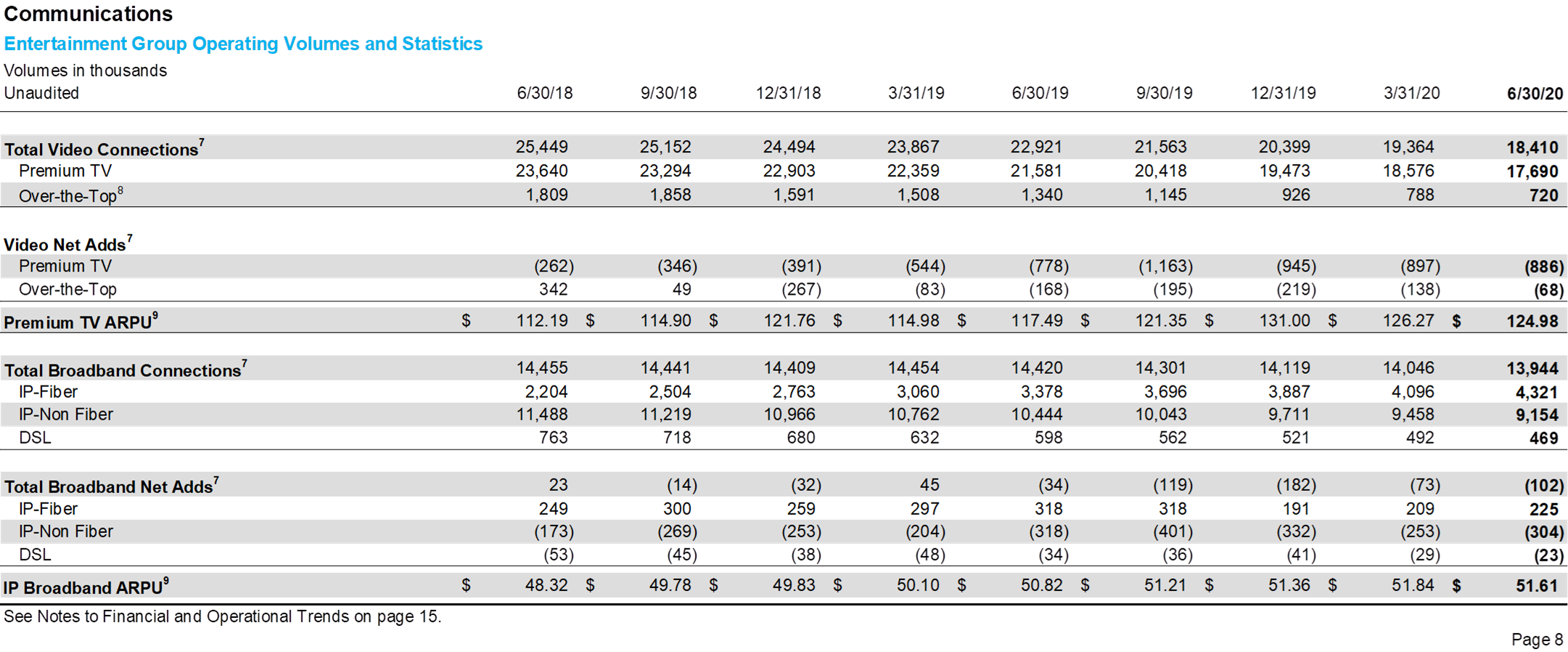

Nowhere has the technology impact been greater than in consumer and small business broadband. Cable DOCSIS standard has dominated DSL (regardless of flavor) for the last 12 years. The impact of data and voice losses has created a “Swiss cheese network” of penetration. AT&T has committed to deploying additional fiber (see AT&T Communications’ President Jeff McElfresh’s comments here), but, as shown below, the company has merely managed to stem the bleeding from IP-Non Fiber customers through fiber upgrades.

AT&T’s broadband connections have fallen 1.2% since the beginning of the year. The quarterly growth rate of their flagship AT&T fiber product is now 5-5.5% (4Q 2019 – 2Q 2020), down from double those levels in 2018. New housing starts are still strong, even if multi-family housing was down in August. Pending home sales are at record levels. Why is the fiber business growth stagnant?

Our only explanation for this is poor local market execution. This begins with a mentality that attempts to apply the same mass market “wash-rinse-repeat” formula that is used for Apple phone launches. Local wired connections are different – they require an understanding of every foot deployed to the pole (if aerial) and from the pole to the home/ apartment. Local knowledge, monitoring, and follow-up is required. AT&T appears to lack this capability, especially compared to their cable competitors.

T-Mobile took direct aim at AT&T’s IP-Non Fiber and DSL base this week with the launch of their Home Internet product in 450 communities ($50, taxes and fees included, no monthly commitments). From our channel checks, it appears to have been met with overwhelming response. Here are a few of the AT&T “towns” where T-Mobile is offering the service:

-

- Atlanta- Sandy Springs- Alpharetta, GA

- Birmingham, AL

- Charlotte- Concord- Gastonia, NC

- Chicago- Naperville- Elgin, IL

- Detroit- Warren- Dearborn, MI

- Jacksonville, FL

- Indianapolis- Carmel- Anderson, IN

- Kansas City, MO

- Louisville, KY

- Los Angeles- Long Beach- Anaheim, CA

- Miami- Ft. Lauderdale – Pompano Beach, FL

- Saint Louis, MO

- San Francisco-Oakland- Berkeley, CA

- San Jose- Sunnyvale- Santa Clara, CA

- San Diego-Chula Vista- Carlsbad, CA

Unlike wireless service, which involves telephone number porting (a clear sign that customers have switched carriers, usually triggering winback efforts), trying a service like T-Mobile Home Internet triggers nothing except a disconnect. Customers merely connect the T-Mobile provided router to their Wi-Fi access point, see a speed change (should be a positive comparison to DSL and some IP Non-Fiber services), and either continue or return the equipment.

Things are about to get a lot worse for AT&T’s non-fiber residential broadband prospects, thanks to their Bellevue competitor. They need to respond as a challenger locally – network accountability, fast resolution times, chronic issue elimination, and perhaps a bold move like a fully integrated relationship with Best Buy Total Tech Support.

Business services relationship story is not much better

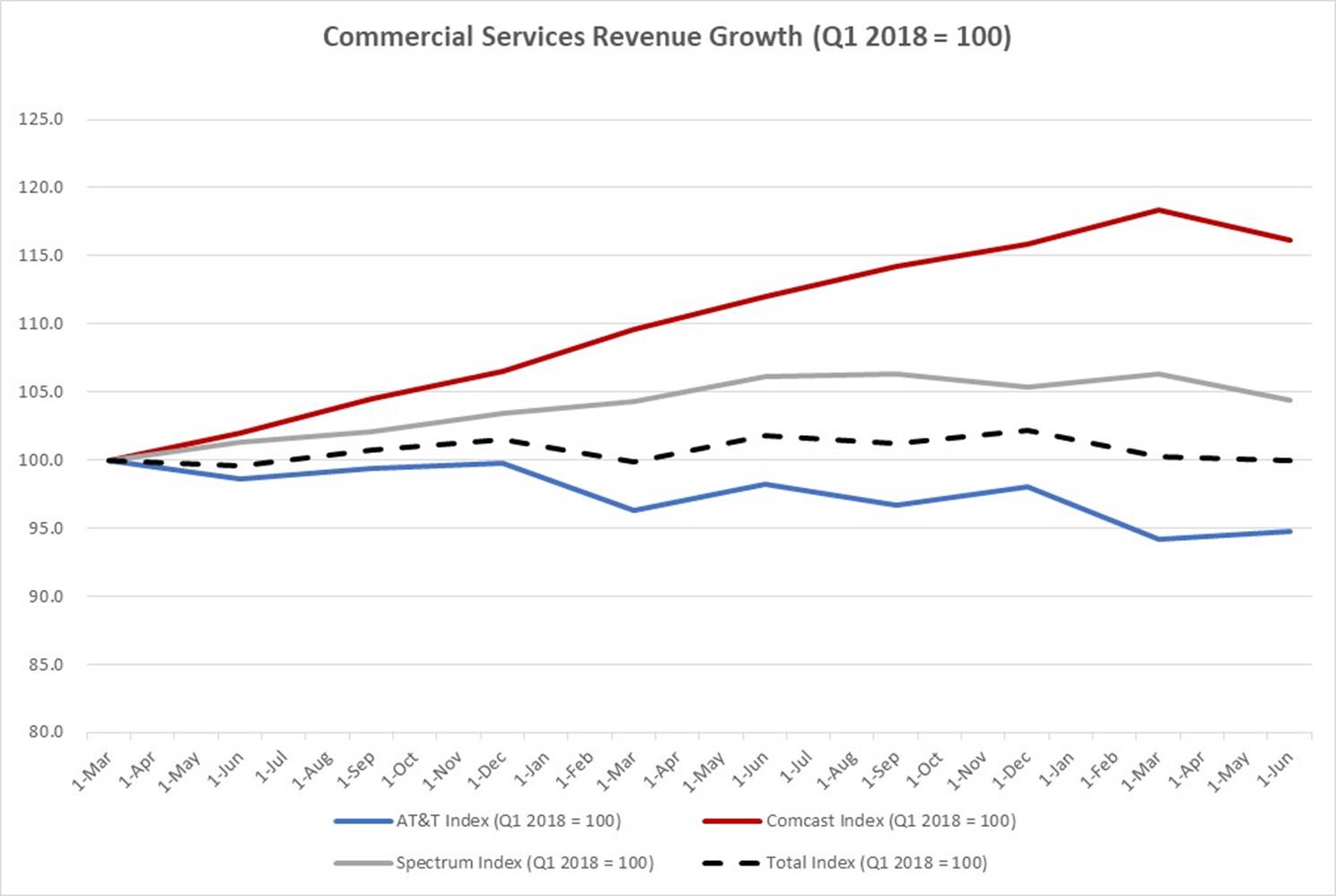

AT&T has long held strong relationships with business customers, including SMB. As the nearby chart shows, however, their lead on wireline services appears to be moving to cable. Using Q1 2018 business wireline revenues as a baseline, AT&T has seen quarterly revenue deterioration of about 5.2%. Comcast has seen strong growth of 16% and Charter (Spectrum Business), even with changes to their policy on wholesale transport sales to other carriers, has grown 4.4%, Neither Comcast nor Spectrum Business are newcomers to the space – their market gains are not a surprise to AT&T (or Verizon or CenturyLink). But they indicate that AT&T is not the leader it once was in business wireline. Not so bad a story as residential broadband, but, with business wireless services sure to come from Spectrum Business and Comcast as CBRS providers (along with Dish as a bandwidth wholesaler), AT&T’s market advantage just got smaller – it’s another front to defend.

AT&T has long held strong relationships with business customers, including SMB. As the nearby chart shows, however, their lead on wireline services appears to be moving to cable. Using Q1 2018 business wireline revenues as a baseline, AT&T has seen quarterly revenue deterioration of about 5.2%. Comcast has seen strong growth of 16% and Charter (Spectrum Business), even with changes to their policy on wholesale transport sales to other carriers, has grown 4.4%, Neither Comcast nor Spectrum Business are newcomers to the space – their market gains are not a surprise to AT&T (or Verizon or CenturyLink). But they indicate that AT&T is not the leader it once was in business wireline. Not so bad a story as residential broadband, but, with business wireless services sure to come from Spectrum Business and Comcast as CBRS providers (along with Dish as a bandwidth wholesaler), AT&T’s market advantage just got smaller – it’s another front to defend.

Dealing with the effects of a COVID-induced recession are going to impact both AT&T and cable. They will both experience potential issues, especially with high-margin commercial video services (bars, restaurants, etc.). Out of their local footprint (and especially after the NFL season ends in early 2021), AT&T is going to struggle to keep these small businesses from moving to less expensive, higher-bandwidth options. And for those businesses that close, the propensity to sign up with AT&T at a new location depends on bandwidth performance, not brand. Cable tends to win this share of new decisions, and “shaking it up” likely plays to cable’s favor.

No doubt, AT&T continues to dominate with federal, state, and local government business, especially in states where they are the incumbent communications provider (FirstNet was a huge win). And, unlike in the residential space, T-Mobile does not have the wireless scale (yet) to firmly position itself as the SD-WAN/ small business connection of the future. That day is coming, however, and a swift TMO fixed wireless response driven by 2.5 GHz + 600 MHz stand-alone 5G deployments could produce a headache for AT&T.

Then there’s WarnerMedia

In our previous conversations on AT&T, we have overlooked WarnerMedia as a production house (putting it the same context as when petroleum giant Gulf+Western owned theater giant Paramount in the 1960s and 1970s). But then we are reminded of former AT&T CEO Randall Stephenson’s two unassailable truths:

- Consumers will continue to spend more time viewing premium content where they want, when they want, and how they want, and;

- Businesses and consumers alike will continue to want more connectivity, more bandwidth, and more mobility.

From these principles come additional strategies and tactics (our interpretation of AT&T’s statements justifying the Time Warner acquisition):

-

- Profits/ cash flows from content will fund deeper expansion of wireless and wireline connectivity

- More connectivity bundles will create a highly competitive product versus Verizon (Disney+, Apple Music) and T-Mobile (Quibi, Netflix)

- Producing highly desired, AT&T-sourced content will provide extra leverage when renegotiating retransmission agreements with companies like Comcast (NBC Universal)

- Advertising opportunities will abound from the integration of highly personalized/ valued content

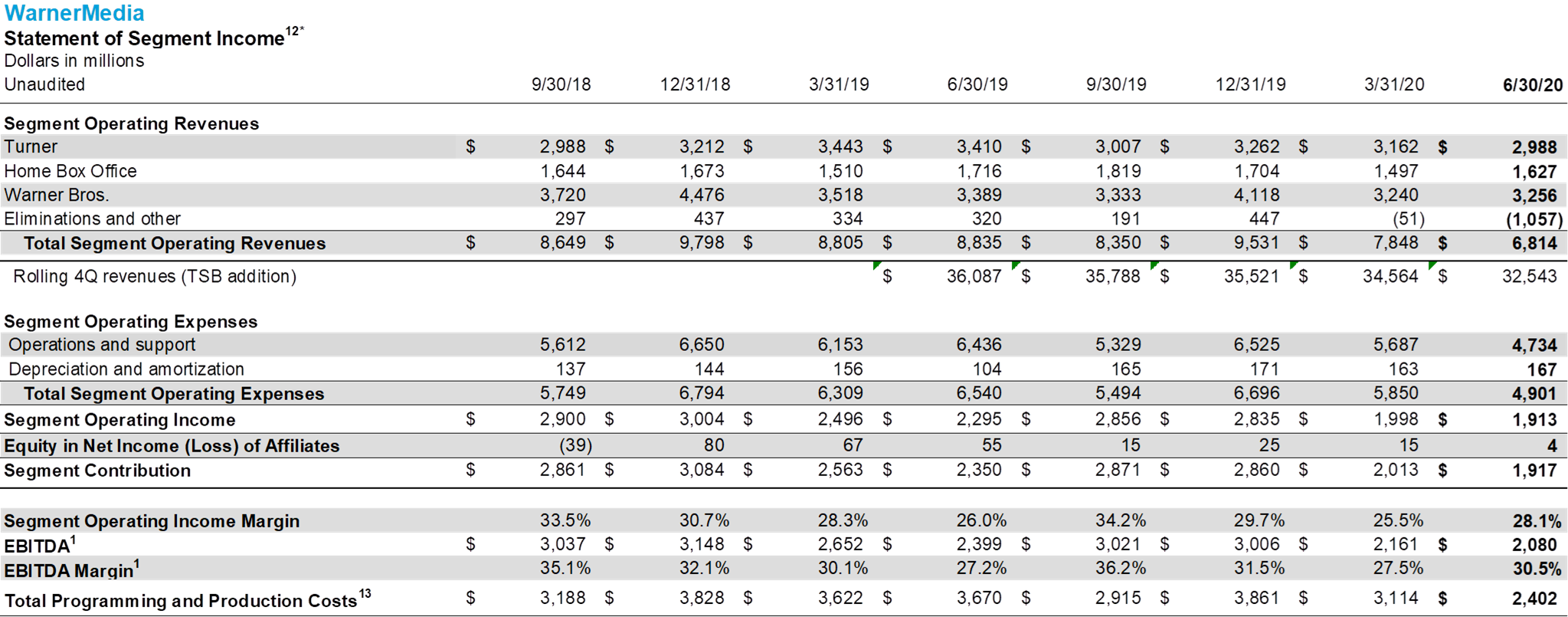

The jury is out on whether it was worth $85 billion in cash and stock (and another $20 billion in debt assumption) to fulfill this vision. John Stankey responded to this in the Wall Street Journal interview mentioned earlier, imploring current shareholders to give the company more time (presumably post-COVID) to prove out the investment. Here’s the 8-quarter performance for Warner Media through 2Q 2020:

Note the rolling four-quarter revenues line we added which shows that revenue growth was beginning to stall prior to COVID-19 (down 1.6% from four quarters ending in June vs. December) but nosedived (down 8.4%) in the first half of 2020. Around 10% of the quarterly pre-tax segment contribution would be consumed by the interest on the $20 billion of debt brought into the acquisition. Cost pressures are rising, and reports of significant layoffs at the WarnerMedia unit are leaking with The Wall Street Journal reporting that the latest round will cut total costs at the unit by 20%. Conservatively, this would bring total layoffs at the unit to ~ 5,000 employees or about 17% of the division.

If no blockbuster emerges in 2021, what does this mean for AT&T? What incremental revenue stream is needed to declare HBO Max a success? At what point is the $85 billion purchase price written down (same question for the $49 billion ($67 billion with debt) purchase of DirecTV)?

The array of possible outcomes with WarnerMedia is large, but the justification of an $85 billion purchase is going to be highly dependent on building blockbuster franchises. What’s easier to predict with certainty is that neither Verizon (now aggressively seeking buyers for The Huffington Post per the New York Post) nor T-Mobile are going to follow on with their own content purchases.

While we do not dispute Mr. Stephenson’s two unassailable facts, the “therefore we should spend over $100 billion including debt on WarnerMedia” has always been more perplexing to us. When a company moves from content relationship management (e.g., Verizon’s relationship with Apple and Disney+) into ownership (or production management), a lot changes. We see the outcome here as binary – either a legacy franchise is created that catapults mobility and broadband into exclusive/ preferred providers of content, or internal miscues and execution failures muck up AT&T in a corporate quagmire just as competitive pressures are beginning to accelerate.

Bottom line: AT&T faces the future as a broad-based telecommunications provider in a world where champions are crowned for their agility, focus, competitive paranoia and leadership. AT&T needs to exit 2021 with a more route miles of fiber, more SMB and broadband customers, higher wireless and broadband ARPU and blockbuster content franchises. To win, they need to act locally, act competitively, and think creatively. The jury is out, writedowns are looming, and time is not on their side.

We could write a lot more on AT&T (especially their recent store closures – see here for Jeff Moore @ Wave7’s take), but that’s it for this week’s Brief. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website).

Stay safe, keep your social distance, and Go Chiefs!