Azure for Operators built on three principles: partnerships, ecosystem development and infrastructure monetization

Microsoft, given its established position in distributed cloud computing, enterprise relationships, and massive developer community, sees the confluences of 5G, edge computing and an operator focus on new services for specific vertical industries as a big opportunity. With its acquisitions earlier this year of Affirmed Networks and Metaswitch, along with establishing Azure Edge Zones and Azure Private Edge Zones, there was speculation Microsoft was positioning itself to grab market share from traditional network equipment providers and perhaps even service providers. But with the recent launch of Azure for Operators, Microsoft made clear its goal is to use partnerships and ecosystem development to help operators deliver value-added 5G services.

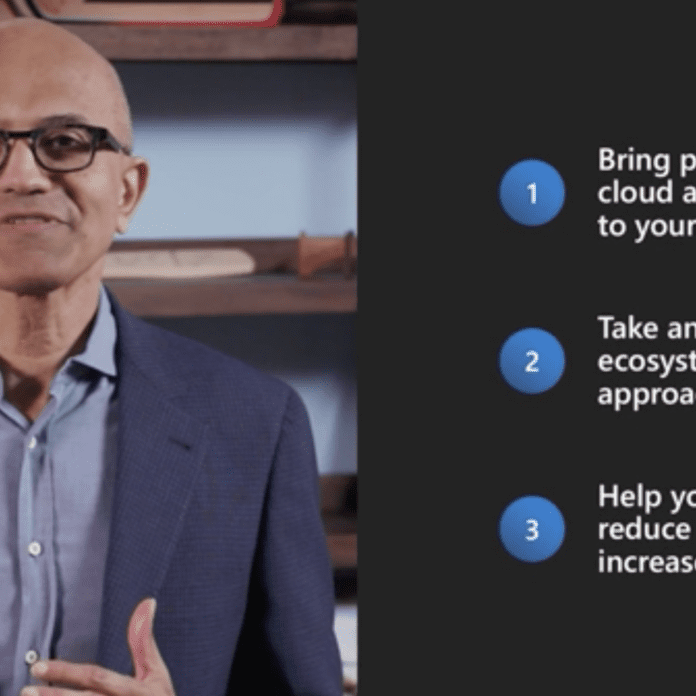

In launching Azure for Operators last month, Microsoft CEO Satya Nadella laid out the three principles coloring the company’s approach to working with service providers as they work to build out and monetize 5G.

“We want to partner with you to bring the power of the cloud and edge to your network,” using Azure’s real-time operating system to continue to support IoT device connectivity and management while extending automation out of the core to the nascent network edge,” Nadella said. “Second, we want to take an ecosystem-wide approach bringing the scale of our developer and partner ecosystem to you.” Combining enhanced mobile broadband with ultra reliable, low latency communications and massive IoT “will unlock new use cases that increase in value as they’re incorporated into developer applications…Third, we want to help you create additional value by helping you reduce cost and increase revenue.” Given the approximately $1 trillion that will go into upgrading networks to 5G, “There is a critical need to reduce total cost of ownership and monetize these investments. We will enable you to deliver these existing services…as well as value-added services with greater cost efficiency [and] lower capital investment than ever. These three principles guide our work together.”

The relevant products here are wide ranging and include cloud-native core network functions from Affirmed, Azure artificial intelligence and machine learning tools, the aforementioned Azure Edge Zones, Azure Sphere which is an IoT security that covers hardware, cloud and operating system, Azure IoT for Operators, Azure cloud-to-edge, AI-backed security, and unified communications and other capabilities that came with the Metaswitch acquisition.

In an interview with RCR Wireless News, Shawn Hakl, partner for Azure Networking and a veteran of Verizon’s enterprise group, said the company views “carriers as natural partners in our vision of becoming the world’s computer.” In delivering wide-ranging enterprise services that draw on the full feature set of 5G—eMBB, URLLC and mMTC—he said the relationship is becoming less transactional and more conversational. “It’s much more solution-oriented. In the end, anything you can do to simplify the experience from mobile to cloud, to make it simpler, more secure, more resilient, is going to be a positive thing. I think a conversation is a great way to describe it. Not, ‘Hey, here’s some technology.’ We can grow the pie together. We’d like to see edge and IoT come to life with some of these new technologies. We see [operators] as natural partners to do this together…It’s a lot about listening and learning.”

To the telco acquisitions, the goal, Hakl said, was to “bring in telco DNA…We’re not trying to recreate a vertically-integrated stack. Microsoft is a platform company. We want to move workloads onto the cloud. We believe strongly that the Ericssons and Nokias will continue to be in the telco ecosystem. This isn’t a carrier bypass strategy.”

Commenting on analyst Jim Patterson posing the question, “Is Microsoft the new Ericsson?” and acknowledging analysis in the Financial Times aound a booming tech sector, shrinking telecoms sector, and Microsoft potentially taking a stake in Nokia, Hakl pointed out that Microsoft hasn’t pushed into access networks or licensed spectrum holdings. Microsoft is also a member of the O-RAN Alliance, an operator-led vendor consortium focused on swapping out proprietary RAN equipment for general-purpose compute hardware running virtualized and cloud-native network functions. Hakl said the company “philosophically” believes open, interoperable networking is good but, “We’re in a listening and learning mode. We want to learn through participation with our partners. We’re excited about where this goes.”