SMBs feel that enterprise providers are just trying to “sell them stuff and move on” and as a result, “overpromise and underdeliver”

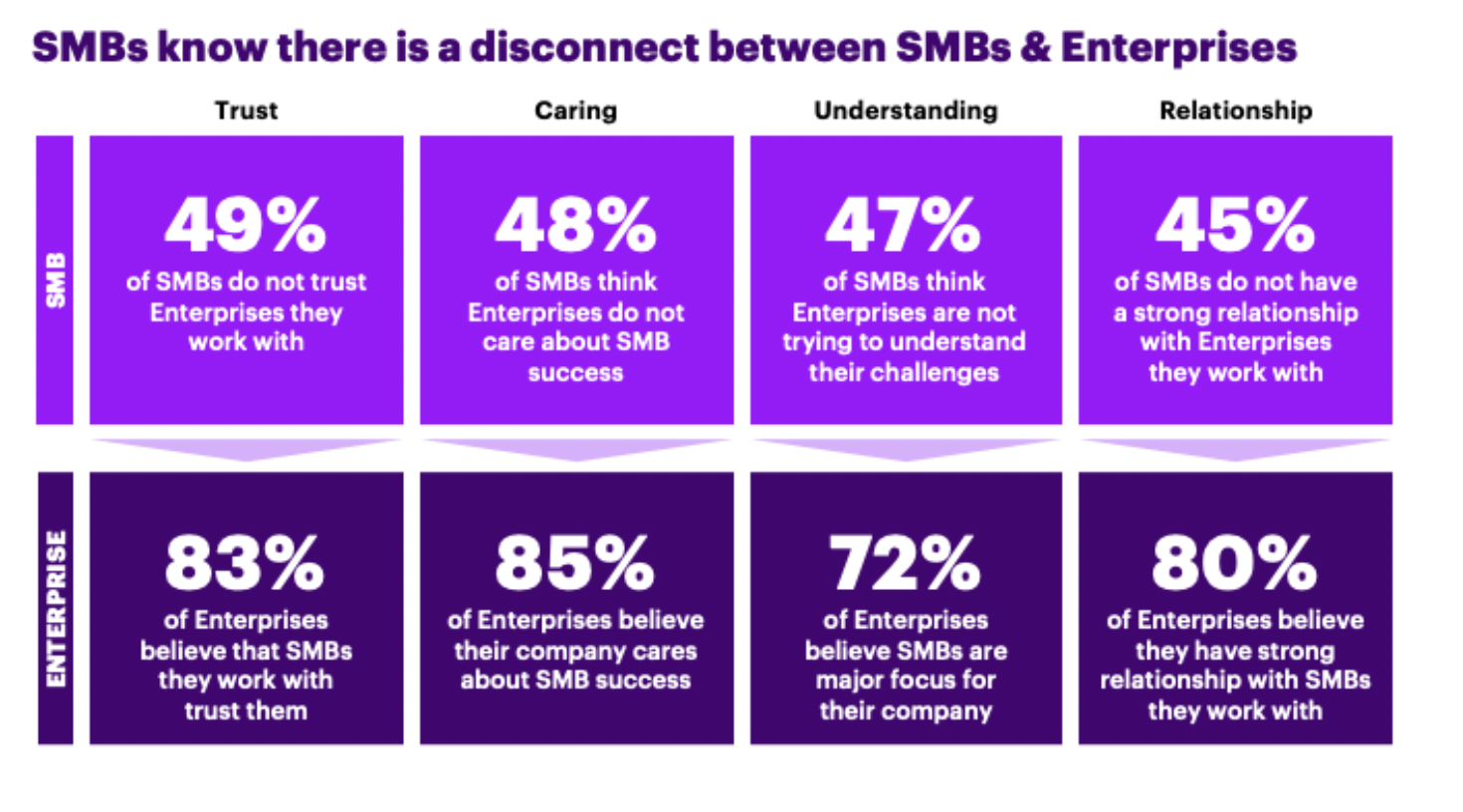

In a recent report, conducted by Accenture, 49% of small and medium-sized business (SMB) respondents indicated that they do not trust enterprise companies when it comes to helping them along on their digitalization journey. However, SMB are, in fact, eager to implement digital capabilities. This combination of distrust of large enterprises and desire for advanced tech, according to Accenture’s North American Comms & Media Industry Lead Andrew Walker, creates a critical opportunity for communication service providers (CSPs) to swoop in and take their offerings beyond simple connectivity by providing additional digital and IT services.

Using a dentist’s office as an example, Walker described how an SMB needs connectivity, office software and IT security, but almost certainly lacks advanced IT and connectivity expertise. “This is an area where a CSP can step in and not only provide basic connectivity, but also software and a secure platform that holds customer records all as a single package,” he said. “This seems like a no brainer.”

If you extrapolate this across all the different types of SMBs in the market, he continued, a massive growth opportunity for legacy communication companies emerges.

“There is money being left on the table for them,” explained Walker, adding that because connectivity is an expensive business and CSPs have invested heavily in infrastructure and spectrum, they need to uncover more revenue.

“However, because of market competition, the ability [for CSPs] to raise consumer prices is really low and if you can’t raise prices, where is the money?” he offered. “It has to be SMB and enterprise, but because there is fierce competition in that market as well, you can’t raise prices there either.”

The solution, he argued, is to “sell more things.”

The lack of trust that SMBs feel for enterprise IT providers creates the ideal opportunity for CSPs, who, as a result of their applauded response to COVID-19, are currently being looked at quite favorably.

Walker explained further: “CSPs have done really well coming out of the pandemic in terms of trust. Connectivity models had to transform because everyone was home, and communications companies kept the lights on, provided more broadband and upgraded speed tiers. They did exactly what they were supposed to do during scary time. They enabled us to work from home and allowed SMBs to continue connecting to their customers.”

On the other hand, many SMBs feel that enterprise providers are just trying to “sell them stuff and move on” and as a result, “overpromise and underdeliver.” Additionally, enterprise companies often treat the entire SMB marketplace as a mass-market offshoot, offering the same package to different types of businesses, despite their disparate needs. “Almost like they’re a consumer,” added Walker.

Currently, CSPs only control around 5% of the expanding SMB technology and services market. Accenture believes that if CSPs can seize the SMB opportunity, they could see be as much as 10% growth in the market in the next five years.