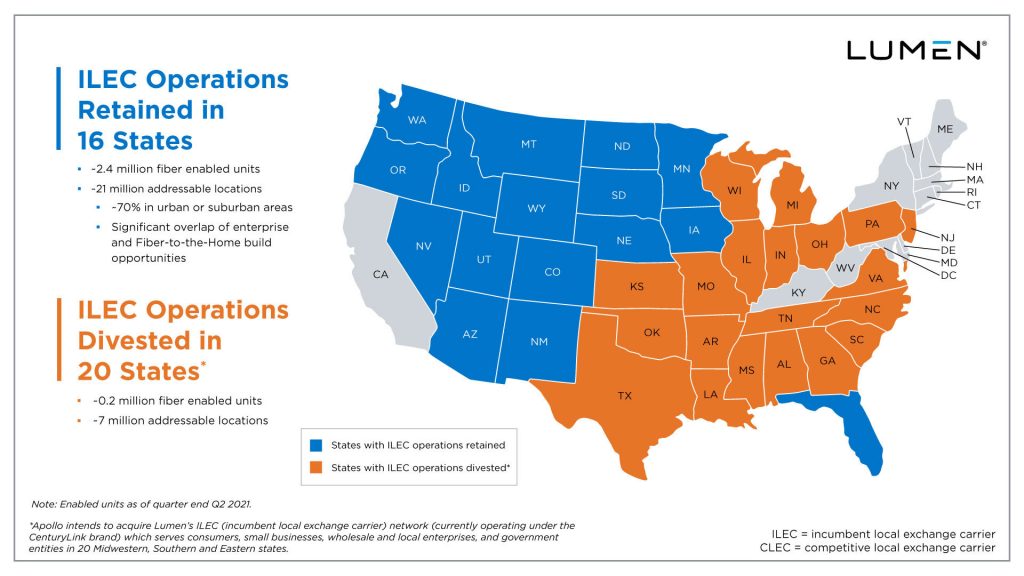

Lumen will sell CenturyLink-branded assets to Apollo across 20 states and retain those in 16 states

Lumen Technologies has agreed to sell a portion of its incumbent local exchange carrier (ILEC) operations to Apollo Global Management for $7.5 billion. Lumen will retain the CenturyLink-branded assets in 16 states and 687,000 fiber subscribers, while Apollo will obtain assets in 20 states, mostly in the U.S. Midwest and Southeast, and 59,000 fiber subscribers.

The transaction will aid Lumen’s growth, with a renewed focus on its large business clients that generate most of its revenue, as well as its home-broadband subscribers.

“This transaction is an important step in our continued efforts to transform Lumen and drive future growth for our company,” said Jeff Storey, Lumen president and CEO. “We are pleased with the attractive valuation we received for these assets, which highlights the overall value of Lumen’s extensive asset portfolio. Apollo Funds will receive a great business with a strong customer base, dedicated employees, and a platform for future growth.”

For Apollo, who will gain fiber and copper networks, tower site connectivity and central offices from the deal, the transaction is part of its larger plan to get more involved in the telecommunications industry. In October 2020, the private equity firm acquired a telecommunications platform owned by Lendlease, then in May 2021, it purchased Verizon’s media assets for $5 billion and just last week, invested $200 million in FirstDigital Telecom, a Utah-based carrier.

“The team at Lumen has built a great business and we see an incredible opportunity to provide leading edge, fiber-to-the-home broadband technology to millions of its business and residential customers,” said Aaron Sobel, private equity partner at Apollo. “As more of our economy, educational systems and entertainment choices move online, it reinforces the urgency and importance of providing faster, more reliable internet connectivity to bridge the digital divide, particularly in rural and suburban America. Through this investment, we will address this divide by expanding the latest fiber infrastructure to more local communities while delivering exceptional customer service.”

The transaction is expected to close in the second half of 2022, subject to customary closing conditions including required regulatory approvals.