Holiday greetings from Louisiana, Texas, Nebraska, Missouri (state capitol building in Jefferson City pictured), Kansas, Iowa and Colorado. Seven states and 2,300+ miles in two weeks as we are closing out the year with a bang at American Broadband. Looking forward to a couple weeks’ recharging at Patterson West in Fraser, Colorado, with family, then unpacking a few more boxes back in Missouri to properly celebrate the New Year. Happy (and safe) Holidays to each of you.

This week, after the normal market commentary and a brief peek into Apple iPhone 13 backlogs, we are going to succinctly define the five events that we thought had the biggest impact in 2021. It’s hard to limit our discussion to five and even harder to be brief, but we promise to do both. We will have a lengthier column on January 2 to preview the upcoming Consumer Electronics Show.

Many thanks to Fierce Telecom for putting together a robust virtual discussion on the future of rural broadband (part of their Digital Divide Summit). Our panel was chaired by Craig Moffett of MoffettNathanson, and included Claude Aiken of WISPA, Prasad Kodaypak of Radisys, and Richard Rommes of Harmonic. A full replay of our panel is here. Looking forward to future opportunities to discuss this transformational topic.

Speaking of Craig, kudos and congratulations are in order as they announced the sale of MoffettNathanson to SVB Financial Group, a division of Silicon Valley Bank (full announcement here). Their telecom team insights influence our thinking here at The Sunday Brief, and I am sure we are not alone. A terrific way to close out the year for the entire MoffettNathanson team.

The week that was

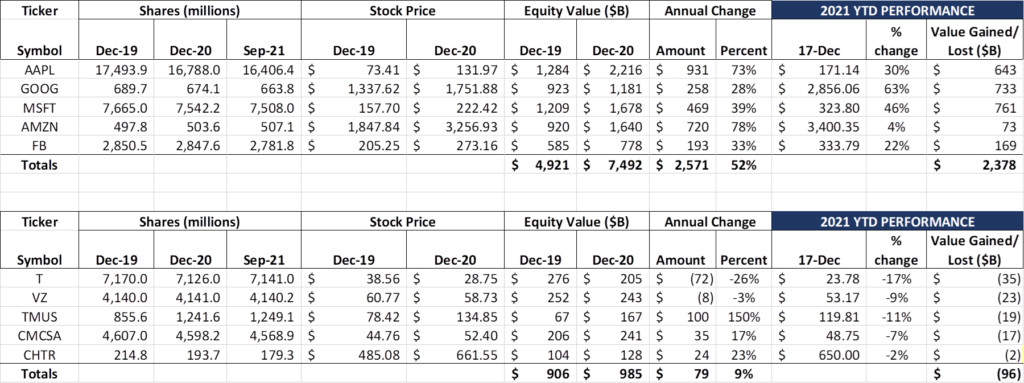

Another choppy fortnight of trading as the Fab Five continued to gain (+$228 billion over the last two weeks) and the Telco Top Five marked time ($-1 billion). Apple and Facebook accounted for all of the Fab Five change, with small gains at Google and Amazon netting against a modest loss for Microsoft. Whether a Santa Claus rally will propel 2021 gains above 2020’s $2.57 trillion level is anyone’s guess, but our beginning of year prediction that we would not see pandemic gains like 2020 in 2021 is likely to be dead wrong. The ramifications of market capitalization concentration have yet to be seen, but, as we have chronicled in many Briefs, wireless and wireline telecommunications are now features of the cloud, not separate standalone businesses.

What is still undecided is the level of broadband competition Comcast and Charter will be facing, and the entire telecom sector is being pummeled as a result. Shortly after our last Brief was published, Comcast Cable CEO & President Dave Watson presented at the UBS Global Telecommunications, Media, and Technology (TMT) Conference (transcript here). Two quotes stuck out to us:

On competition: “We’re staring at a pretty competitive environment will continue to be so. So our focus is how do we redefine the category. We’ve done that. We’ve kept up and then some with speed. We have ubiquitous plant capability. We deliver a ubiquitous 1.2 [gigabit] (corrected by company after the call) downstream. We have very solid upstream with a great road map that continue to increase speeds, both down and up.”

On fixed wireless: “The fixed wireless side, we’re looking at. It’s not a material issue still at all from our perspective… we anticipate things. Right now, we are at 40% of our footprint that’s been overbuilt from … the fiber overbuild between the major telcos. And when you read all of their announcements and everything that came out yesterday and then some, you look at another 15 points. So you get from the 40% goes to 55% over time. That still leaves 45% that’s not — that we have not addressed and that we’re still going at it hard. There’s still DSL that’s out there. There’s still non-fiber footprint that we will go at… we take it seriously. It’s a real issue, but we’re not having to make trade-offs between a core service, which I imagine is very important to them, their main wireless product. And they say things like, “Well, we haven’t had to yet make any trade-offs.” I think the yet is pretty important. So we’re going to continue. We’re not standing still.”

These two comments, combined with Verizon CEO Hans Vestberg’s predictions at the same conference about anticipated fixed wireless market share gains (transcript here) created anxiety concerning Comcast. From December 6 to 9, Comcast lost approximately $18 billion in market capitalization or 8% of it’s beginning of week market value. The stock price has only slightly recovered since then (up $1.04 or 2.2%). From their recent high on September 7, Comcast has lost more than 20% of its market capitalization. Investors are getting nervous.

We think this anxiety is unfounded for several reasons. First, Comcast has a lot of fiber deployed deep into their network in nearly every market. They are extremely disciplined and future-focused in their capital spending. Second, as we will discuss below with respect to YouTube TV and Hulu Live, streaming and linear cable costs are beginning to converge. The promise of materially lower costs for streaming companies is going to be lessened – it clearly is not in the best interests of content providers to disadvantage their largest purchaser (Comcast). Finally, Verizon’s fiber expansion in their 5G Home Internet markets is slowing (see map here and search on Richmond (VA), Little Rock (AR), Memphis (TN) or pretty much any other secondary market where Comcast is the incumbent cable provider). Bottom line: Comcast will face competiiton in some major markets – Atlanta, Chicago, Houston and Miami will become increasingly intense, but it’s hard to make the case, absent material fiber deployments that we aren’t sure Verizon’s balance sheet can accommodate, that Verizon is going to own 40+% share of Home Internet.

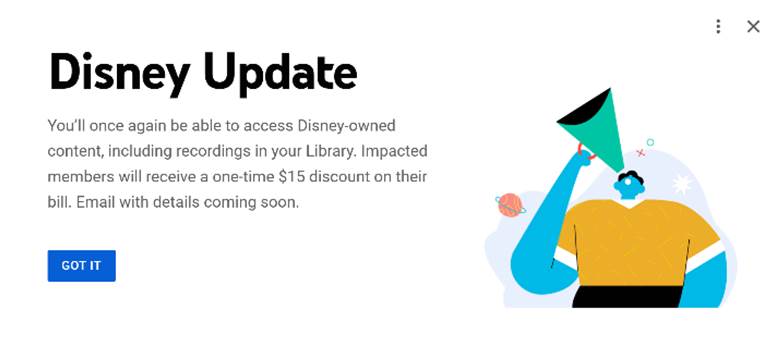

Speaking of content, Google’s cable replacement product, YouTube TV, failed to reach a deal with the Disney family of channels (which include ESPN, just two weeks prior to the College Football Playoff). While their announcement here says little about their negotiating strategy, their December 13 update a little lower on the page says a lot:

“Our ask of Disney, as with all of our partners, is to treat YouTube TV like any other TV provider – by offering us the same rates that services of a similar size pay, across Disney’s channels for as long as we carry them.”

Google’s position appears to be that they aren’t receiving a competitive rate relative to similarly sized partners. We think this is likely a comparison to linear providers (versus a comparison to Hulu Live, who is owned by Disney). To their credit, YouTube TV has already announced that they will be lowering the price of their service by $15/ mo. (to $49.99/ month) while the blackout is in effect. This allows many of their sports-hungry customers to add a very attractive sports pack tier ($10.99/ mo.) to make up for the lack of ESPN. All of this (plus Hulu Live’s already announced price increase to $70/ mo.) leads us to believe that YouTube TV rates are headed higher, and the retail gap between Xfinity, Spectrum, and other cable vs. streamers is going to narrow in 2022. For a deeper dive, have a look at the last Sunday Brief here where cable industry veteran John Malone discusses the death of “giant bundles” but leaves the door open for small/ medium packages.

NOTE: As we went to “press” Disney and YouTube TV announced they had reached a settlement. Sports will live on in the Patterson household on New Year’s Eve!

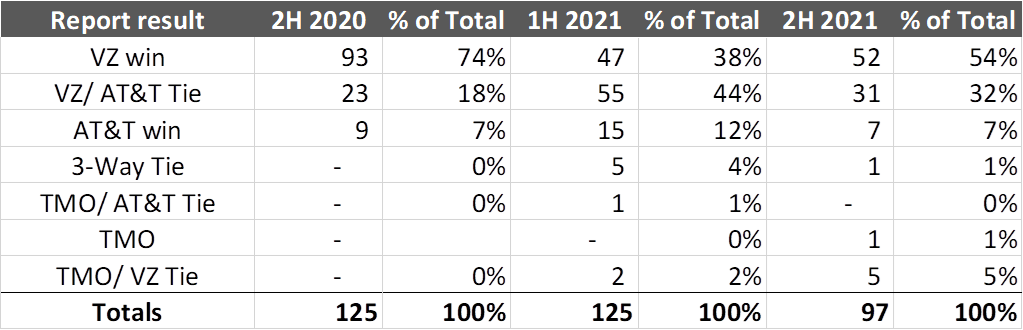

Finally, MoffettNathanson was not the only surprise telecom-related acquisition last week. Last Tuesday, Ookla announced that they would be acquiring the wireless measurement giant RootMetrics (Ookla blog lost here). The to-be-acquired company has been very busy finishing up their 2H 2021 measurement cycle, and our preliminary results (through Thursday, December 16) are nearby. Verizon has moved back into sole winner position in 52 markets or 54% of the total metros measured. Not where they were in 2H 2020, but headed in that direction. Of interest is the “T-Mobile/ Verizon Tie” line which has grown to five (four of these came since our last report). Not the magnitude we saw with AT&T’s FirstNet-related burst in 1H 2021, but if that category grows into double digits it might signal RootMetrics recognition of T-Mobile’s mid-band gains (Ookla already has T-Mobile on top of Verizon – more here).

Apple iPhone 13 availability – our latest check

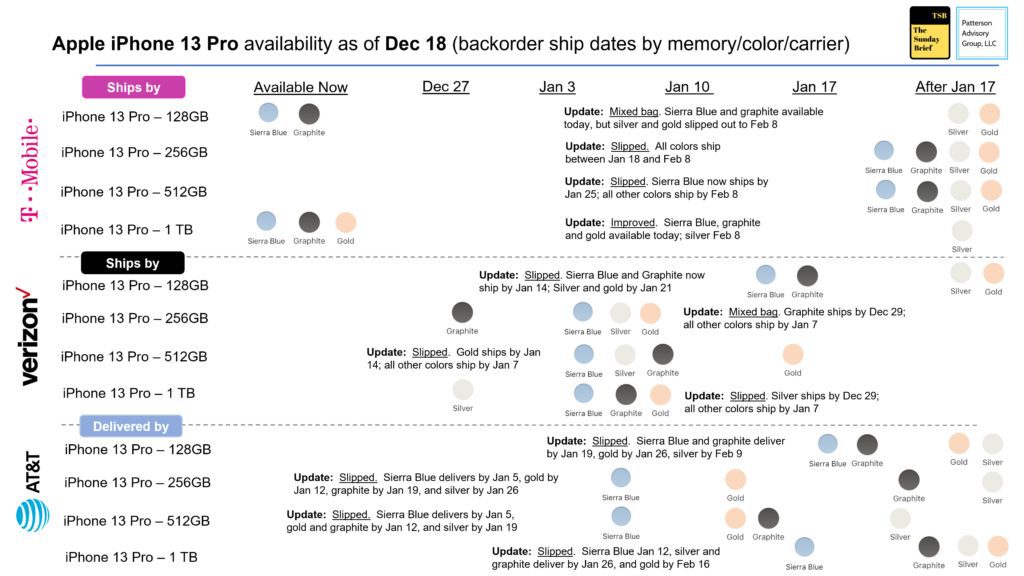

In what has become it’s own Sunday Brief attraction, we have continued to post weekly backlogs using Saturdays as our baseline day of the week. We are entering the 13th week since the iPhone 13 family was launched – said another way, we are only 36 weeks or so away from the next iPhone launch – yet we face constraints in the flagship iPhone 13 Pro model as the chart below shows:

The problem is most acute at T-Mobile, who is using the iPhone 13 Pro in their headline marketing offer. As of Decemebr 18, 11 of 16 possible storage/color combinations had shipping dates of January 18 or later, with many delayed into early February. That’s an indication of both the offer’s success (to switchers as well as legacy Sprint customers) but also highlights the fragile nature of the supply chain, even for Apple, in 2021.

The other interesting development can be seen with the iPhone 13 backlog. Clearly Verizon’s existing customer offer has had an impact on the availability of the 128 GB model. This presages higher upgrade costs but also lower churn at Big Red in 4Q 2021 results:

The contrast between AT&T and Verizon is striking. We fully expect the iPhone 13 backlog to clear up in the next two weeks, and will focus our attention on the iPhone 13 Pro availability in our next report.

Five events that shaped telecom’s 2021

Every major publication and analyst has a “Year in Review” column where they try to mention everyone and weave in some jello-esque predictions. We take a different tack at The Sunday Brief. Our view is not reader based – if it were, we would gush about Dish’s RAN achievements and their business development activities with Amazon AWS and Helium/FreedomFi. Or we would glow about the Tracfone acquisition by Verizon and how it’s going to shake up traditional prepaid services. Or we could talk about supply chip constraints and their inflationary impact on lower-end device pricing. All are really important, but not worthy of Top Five designation.

Our qualifier can best be summarized in one sentence: Did the action significantly change the vision and strategy of the company and/or the telecommunications industry? A reorganization of one large particular cable company is important, but the rollout of family plans to fuse a broadband + mobile bundle is completely different. We see five events as particularly impactful, and describe them here in chronological order:

- The completion of the C-Band Auction (February 24) – FCC announcement here. $81 billion in new auction purchases, with $69 billion of that by Verizon and AT&T. Add in equipment and other expenses, and these two companies will spend more than $125 billion through 2024 to deploy this large, fast, and denser network. It was an eye-popping number that would not have been possible except in a low interest rate environment. While T-Mobile bid $9.3 billion to “fill in” gaps in their current mid-band spectrum, they definitely came out ahead of their two wireless rivals with both time to market and cost basis advantages as a result of the Sprint purchase.

- AT&T’s DIRECTV (February 25) and WarnerMedia (May 17) announcements (here and here). No sooner had the ink dried on the C-Band announcement when AT&T announced that they would be forming a venture with private equity giant TPG to run their satellite and AT&T U-Verse businesses (AT&T remains a 70% shareholder of the new venture). Then, a few weeks following Investor Day, where they reemphasized the importance of video to AT&T’s communications business, the Board of Directors decided to spin off WarnerMedia into Discovery. It was an amazing turn of events for Ma Bell and represents a return to their communications roots (and a repudiation of the Randall Stephenson/ Ralph de la Vega “You can do it all” vision). Entire books will be written on what happened during the first year of AT&T CEO John Stankey’s tenure. So far, investors are not happy, with AT&T losing over $100 billion in market capitalization since the beginning of 2020.

- Lumen sells a large portion of their local telephone assets to Apollo for $7.5 billion (Aug 3) – announcement here. In what looks to some telecom historians as a reversion to the old US West footprint + the Sprint/ Embarq Las Vegas and Orlando properties, Lumen decided to sell 20 states to Apollo at a trailing EBITDA multiple of 5.5x. The sold company will be large with significant cash flow, but will also require tens of billions of dollars in fiber upgrades. Given the opportunities enabled by infrastructure spending, we aren’t sure that Lumen picked the right states, and that the better opportunity to create value might exist in lower density markets.

- Comcast/ Xfinity Mobile and Charter/ Spectrum Mobile deal with Verizon, and, as a result, announce aggressive MVNO family plans (Comcast’s announcement on April 15 is here and Spectrum’s announcement on October 11 is here). Both Xfinity and Spectrum are were already taking a meaningful minority of industry net additions, comprised largely of individual and two-line plans. Everything changed with these announcements, and many analysts expect that the duo’s net additions in fourth quarter could top 700,000. Not only has the mobile product had a positive impact on broadband churn (see earlier link for Dave Watson’s comments on the impact to Comcast), but they are reaching a scale point where EBITDA levels are positive.

- Bipartisan Infrastructure bill is signed into law on November 15, resulting in $40+ billion for unserved and underserved broadband deployment (New York Times article here and a more detailed provision-by-provision account here). This is a once in a generation program to push fiber and wireless throughout the country. States will administer the program with a $100 million minimum per state, great for Delaware and Vermont but not as good for California. This program will also create a permanent $30/ month subsidy for low-income households for broadband. More fiber deployments will enable more wireless (especially C-Band) in less densely populated locations. The combination of improved wireless coverage with the promise of fiber to the home (or nearest tower) will change the remote worker landscape for decades and reverse urbanization trends of the last 50 years.

We could go longer (and will post some “Deeper” content this week on the website on each topic), but these five events changed the trajectory of the communications industry in 2021, and leave a lot of questions about how each company will change their tactics to improve competitive position.

That’s it for this week’s Brief. In two weeks, we will go very deep looking at consumer trends in preparation for the Consumer Electronics Show in Las Vegas. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, Happy Holidays, Go Davidson Wildcats and Go Chiefs!