5G will have a seismic impact on the network. At the end of 2021, there will be 507 million 5G subscriptions, showing a growth rate of 92% Year on Year (YoY). By the end of 2025, ABI Research forecasts that 5G subscriptions will surpass 1.78 billion, which is equivalent to 22% of the total worldwide cellular subscriptions. But it is not just about “person-centric” communications, as cellular-based Internet of Things (IoT) devices are expected to grow to 2.56 billion by 2025 from 1 billion in 2021.

Impact of mobile data traffic

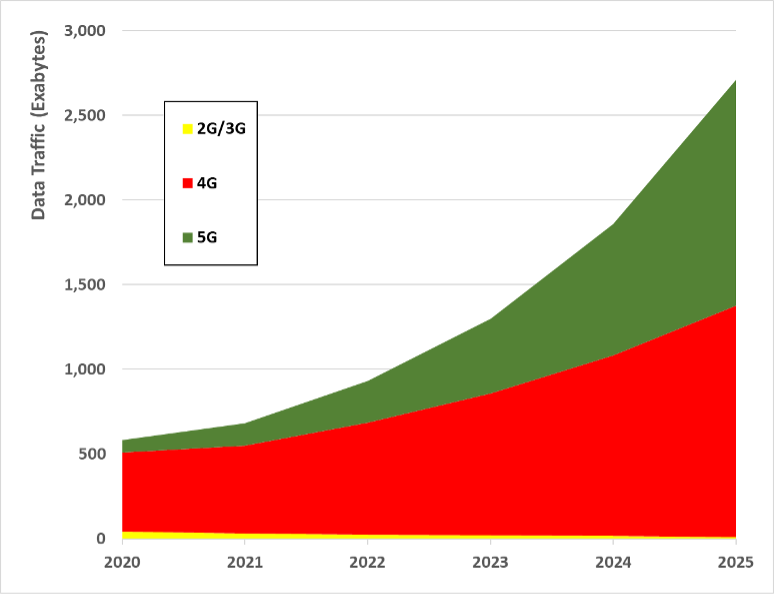

As mobile data subscribers continue to make greater and greater demands on operators’ networks, mobile data traffic is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 41% to surpass 2,708 exabytes on an annual basis in 2025. 5G subscribers may only represent 22% of total subscriptions in 2025, but they represent 49.1% of the total traffic generated in 2025.

Figure 1: Data Traffic Outlook by Technology, World Markets: 2020 to 2025

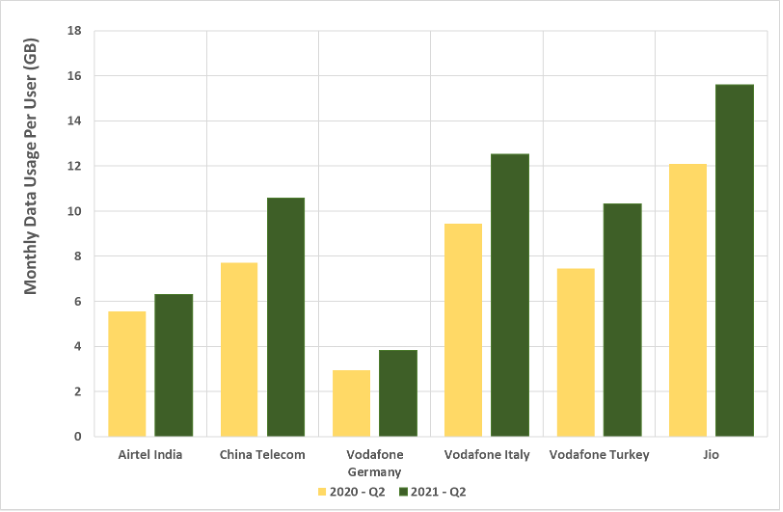

The type of data traffic has been shifting. In 2021, worldwide video downloads and streaming represented more than 80% of total data traffic. The impact of video traffic can be seen in the reported data traffic numbers from telcos (see Figure 2). The operator snapshot shows a YoY increase of 13.7% to 42.5% in range. In the case of Jio in India, data traffic per user per month now tops 15.6 Gigabytes (GB).

Figure 2: Monthly Data Usage per User, Sample Operators

Impact of Fixed Wireless Access (FWA)

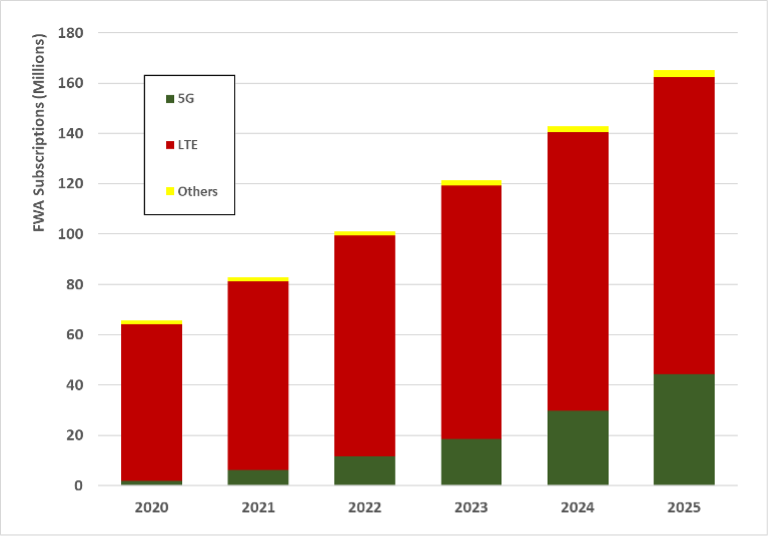

4G Long Term Evolution (LTE) has provided Fixed Wireless Access (FWA) with reasonable capacity and standardized equipment, but 5G will provide a substantial boost to FWA. Total FWA premises stood at 82.6 million at the end of 2021. 5G FWA subscriptions are expected to experience an expansion from 5.3 million premises in 2021 to 44.4 million premises in 2025, growing at a CAGR of 70.1% to help take the overall total FWA premises to 165.1 million. Crucially, 5G FWA Millimeter Wave (mmWave) subscriptions will be a key part of 5G FWA adoption.

Figure 3: Fixed Wireless Access Subscriptions, World Markets: 2020 to 2025

A holistic, three-dimensional radio access network strategy

5G cell sites will be markedly distinct from their 4G/LTE predecessors. Operators now have novel technological innovations that they can employ to reduce the costs of 5G network densification. They will need to take a holistic, Three-Dimensional (3D) macro cell, micro cell pole and indoor small cell strategy. Operators that offer a seamless 5G experience that address the needs of 5G to the enterprise sector, as well as 5G to prosumer end-user markets, will gain the most Return on Investment (ROI) from their 5G. Massive Multiple Input, Multiple Output (mMIMO) can be deployed on macro sites, poles and even indoor sites to provide a converged, high data throughput foundation.

mMIMO can boost ROI

mMIMO is a multi-antenna technique that evolves Multi-User MIMO (MU-MIMO) by scaling up the number of antennas at the basestation to obtain the benefits of increased spectral efficiency in the radio channel.

An mMIMO system significantly increases the number of basestation antennas so that they outnumber the end-user device antennas in the sector. This increases the degrees of freedom in the radio channel to improve spatial orthogonality between end-user devices, consequently reducing inter-user interference and offering a more stable, deterministic and robust spatial multiplexing gain than when using MU-MIMO.

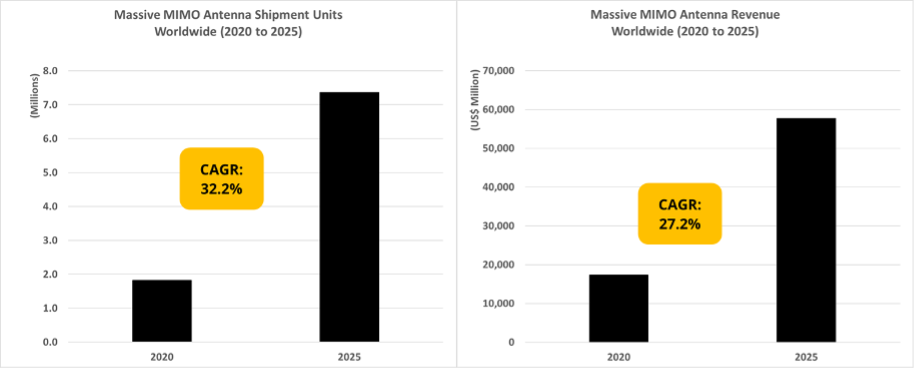

ABI Research expects annual mMIMO antenna shipments to reach more than 7.3 million by 2025, growing at a CAGR of about 32% from 2020 to 2025. In terms of revenue generation, this is forecast to reach US$56 billion in the same year, growing at a 5-year CAGR of 27.2%.

Figure 4: mMIMO Antenna Shipment Outlook, World Markets: 2020 and 2025

mMIMO requires innovation to maximize the ROI of macro sites

Large-bandwidth mid-band and mMIMO can effectively increase cell capacity, cope with traffic growth and reduce network bit costs. mMIMO deployments are increasingly becoming an industry requisite for large Time Division Duplex (TDD), contiguous bandwidth-type deployments.

The reality is that the coverage capability of mid-band spectrum is more limited than that of low band. To increase network coverage, the traditional solution is to increase the Radio Unit (RU) transmit power. However, this solution can only improve the downlink coverage, but does not address the limitations of uplink coverage (i.e., from the end-user device). Increasing the transmit power also increases the power consumption of the end-user module, which defeats the energy saving objectives. The novel innovations of mMIMO address these issues and maximize the ROI of macro sites.

Advances needed in mMIMO design

Increasing the number of passive antenna arrays is a new direction of mMIMO innovation. Vendors have been investing in Research and Development (R&D) in the mMIMO sector. Huawei’s MetaAAU solution, for example, improves network coverage and network energy efficiency. MetaAAU adopts ELAA technology to have 384 antenna dipoles in the unit compared to the typical 128 to 192 antenna dipoles that previous 64T64R antenna designs have offered in the industry. Furthermore, the implementation of novel algorithms, such as AHR Turbo, can enhance the user experience and capacity. This type of algorithm approach enables precise tracking of end-user devices to enable better adaptive beam optimization. Also, the software capability reduces system interference, thereby improving cell performance.

These innovationshold significant promise for mMIMO. First, the coverage gains will extend the life cycle of the existing macro grid and could potentially reduce the need for incremental site additions by 20%. Second, the innovations will reduce energy consumption and its associated Carbon Dioxide (CO2) footprint. Third, they improve network performance, including coverage and quality of experience.

Summary and conclusions

The use of mMIMO antennas can provide enhancements to Communications Service Providers’ (CSPs) operations through lower operational costs due to more efficient networks, while producing an optimal user experience. Apart from the operational and Total Cost of Ownership (TCO) reduction benefits (up to 15% to 25%), the following market factors can further drive their adoption:

- Increased access to spectrum asset bands, such as the 3.5 Gigahertz (GHz) band.

- Better handling of the data traffic growth that 5G stimulates.

- mMIMO’s technological advantage in delivering reduced latency and improved energy efficiency.

- Development of solutions to overcome physical cell site space limitations.

- The implementation of more cost-effective and power-efficient signal processing algorithms.