Q4 enterprise cloud infrastructure spend passes $50B

Enterprise spending on cloud infrastructure passed $50 billion. That’s up 36% year over year, according to a new report from Synergy Research Group. Synergy estimated total enterprise cloud spend for 2021 at $178 billion, up 37% from 2020.

The move continues the corporate trend away from data centers to the cloud, said John Dinsdale, Synergy research group chief analyst.

“Enterprises are now spending twice as much on cloud services as they spend on their own data centers,” he said.

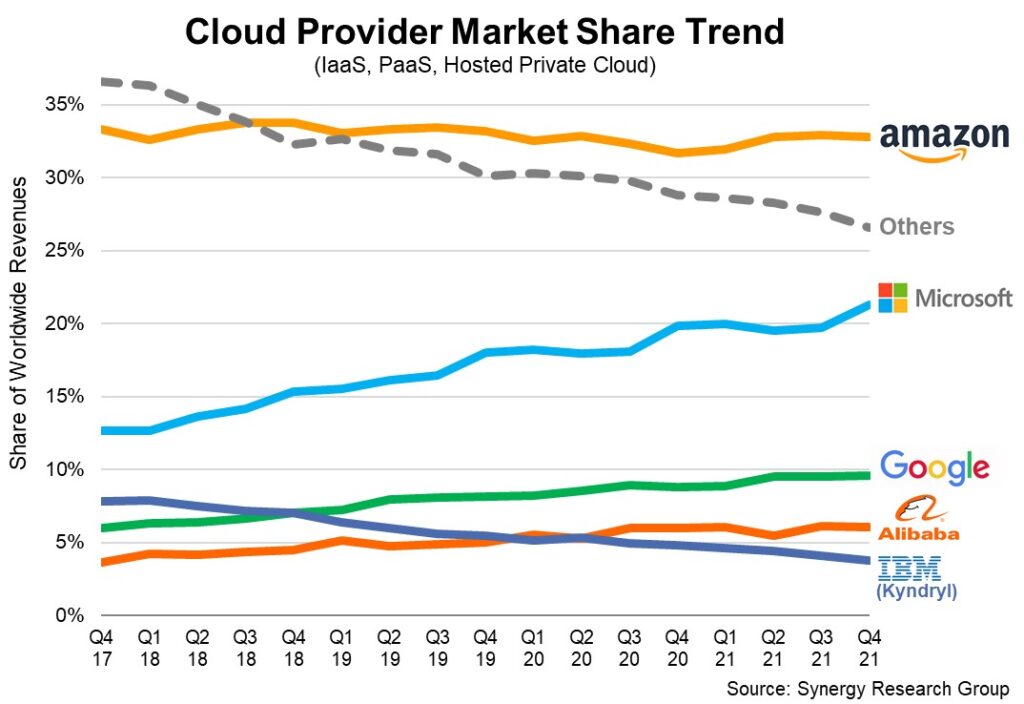

Dinsdale noted that Amazon leads the market by a wide margin. Microsoft, while perhaps not yet nipping at Amazon’s heels, is closing the gap, said Dinsdale.

“Microsoft’s market share is making impressive gains and is now just eleven percentage points behind Amazon. The rising tide continues to lift all boats, but some are being lifted more swiftly than other,” he said.

Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) accounts for the bulk of the market, according to Synergy. That sector grew 38% in Q4. No surprise, but the public cloud space is dominated by the big three hyperscalers — Amazon Web Services, Microsoft Azure and Google Cloud, according to Synergy.

“The dominance of the major cloud providers is even more pronounced in public cloud, where the top three controls 71% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world,” said Dinsdale.

Microsoft, Amazon lead 2021 IT vendor revenue also

In December, Synergy said Microsoft, IBM and Amazon dominated 2021 enterprise IT vendor revenue. It reported that they and 10 other firms generated over $25 billion in annual revenues, specifically from enterprise tech and service sales.

Synergy estimated associated enterprise IT revenues from the 13 businesses at $613 billion, up 10% year over year. Synergy estimated Microsoft was responsible for $120 billion of that, 24% year-over-year growth. Amazon led the list for year-over-year growth at 36%.

Huawei lost ground, while Ericsson and Nokia stayed flat on Synergy’s rankings. Synergy attributed Huawei’s weak results to geopolitical tensions and supply chain issues.

“While Huawei’s revenues dropped, business levels at both Ericson [sic] and Nokia were mostly flat, demonstrating the relative weakness of service provider sales compared with the enterprise sector,” said Synergy.

“Cloud and software-oriented markets were the standout performers, driving stellar growth for AWS, Microsoft and Salesforce. Vendors whose sales are focused primarily on more traditional on-premise products or infrastructure will continue to have a hard time generating exciting levels of growth,” said Dinsdale.