The automotive industry is being revolutionized by continuous cloud connectivity, autonomous driving technologies, drive train electrification and shared mobility. These transformations are being facilitated in part by the standardized cellular technologies now commonly implemented in “connected vehicles” or “CVs”. The proportion of vehicles shipped worldwide with cellular connectivity embedded is forecast to rise from 46% in 2020 to 76% in 2026.1

The commercial ecosystem for CVs has significantly matured since I last wrote about it here nearly two years ago. The benefits, incremental revenues and costs now associated with the adoption of cellular technologies in vehicles are being reflected in major commercial actions by industry players and in financial markets. Incremental product revenues at a vehicle’s point of sale together with ongoing monetization opportunities in value-added services and cost savings will parallel what has been achieved in smartphones, where substantial profits are reaped beyond initial product sales and recurring network operator service fees in the app ecosystem. The value of automotive connectivity is created through improved safety features, enhanced navigation, driver assistance and automation, vehicle and driver monitoring (e.g., to adjust insurance premiums), reduced maintenance costs, in-vehicle entertainment services and over-the-air software updates for various systems.

Although the portion of new car selling prices and aftermarket service fees attributable to cellular connectivity was estimated to be $54 billion in 2020, total patent royalties paid by automotive OEMs to license the cellular standard-essential patents (SEPs) upon which those capabilities depend was and remains considerably less than 1% of that figure. And that low percentage royalty yield will reduce—despite increasing total royalties as more OEMs are licensed—because that CV market value is expected to grow faster to $166 billion or more by 2025.2

SEP licensing fees are modest in comparison to product costs and with thousands of dollars in revenues and cost savings anticipated from connectivity services over a car’s typical lifespan of 14 years.3 Indeed, SEP licensing fees are a small proportion of an estimated average cost of $700 per vehicle for OEMs on telematics and infotainment systems, which are marked-up significantly when sold to consumers as bundled features or optional extras in finished goods car prices.4 Examples of additional ongoing revenues to OEMs include £141 ($176) per year after an initial free period, excluding mobile operator service charges, to subscribe to the Audi Connect Infotainment package in the UK. “Remote Services” cost an additional £37. In the Eurozone, Volkswagen charges €75 ($80) per year to extend its We Connect basic subscription and €145 for its “Plus” service. OEMs can receive $30 or more per year from insurance companies for policy holders that opt-in to provide their driving behavior data.

The value that SEPs confer on a CV has been a topic of much discussion, but consensus on how much the automotive industry should pay to license the 4G, 3G and 2G SEPs that underpin connectivity-based solutions has recently emerged. A substantial majority of these SEPs are licensed by the Avanci patent platform for a one-time payment of $15 per 4G CV (or, from 1 September 2022, $20 per 4G CV). With more than 40 automotive brands under license including BMW, Ford, General Motors, Mercedes-Benz and Volkswagen, Avanci licenses around 45% of CV shipments. This is unsurprising given that the platform is providing the “one-stop shop” with transparent and predictable pricing that many implementers and government authorities have demanded.

Automotive is now the most significant segment in IoT SEP licensing, with licensing revenues in the low hundreds of millions of dollars—paid to SEP owners mostly multilaterally through Avanci, but also bilaterally to companies including Nokia and Qualcomm.

Cellular technology development is a huge, risky and costly endeavor including large numbers of R&D staff and many companies. For example, Ericsson, Nokia and Qualcomm each invest around $5bn apiece annually on R&D which is mostly in cellular. Other companies collectively invest billions more. Smartphones generate virtually all of the return on this R&D investment, which totals around $15 billion in SEP licensing revenues annually.

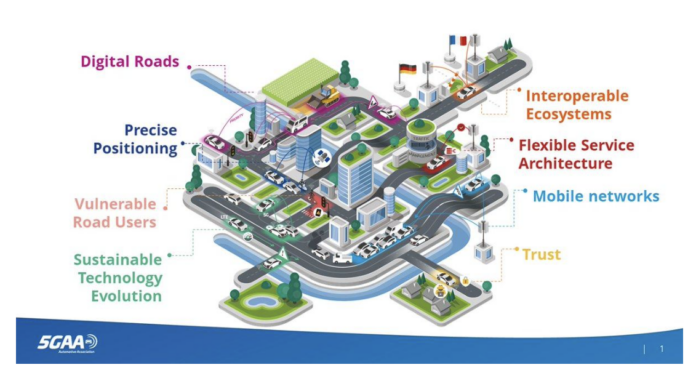

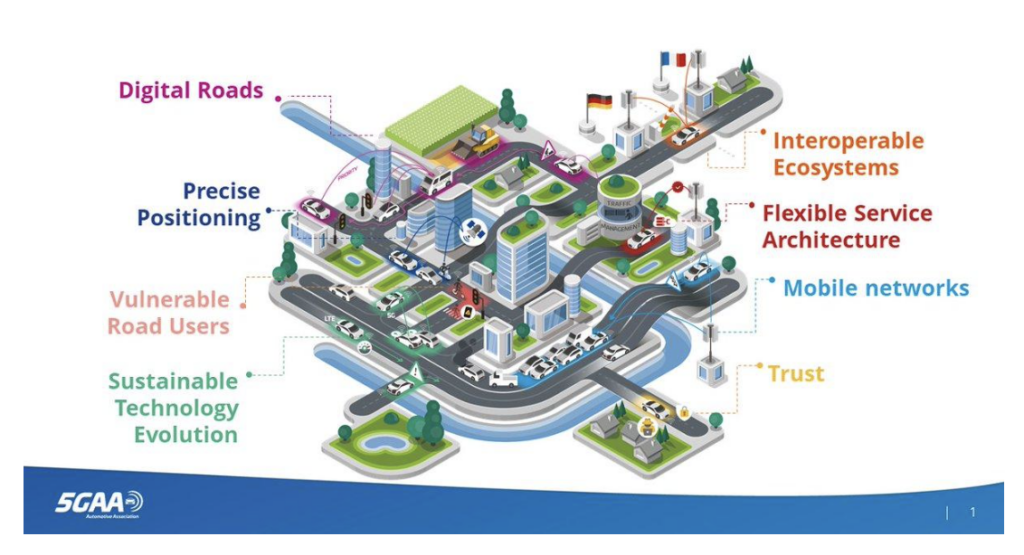

While CVs valuably exploit various cellular technologies, including prime 4G LTE capabilities such as eMBB for streaming video, cellular technologies developed specifically for vehicles are also a major focus for standards setting organization 3GPP and the many companies that contribute patented technologies to its standards. Cellular Vehicle-to-Everything (C-V2X) technologies include many features that can improve safety on the road and help enable or enhance Advanced Driver-Assistance Systems (ADAS) and Automated Driving Systems (ADS). WiseHarbor analysis of 3GPP Radio Access Network Working Group contributions reveals that a significant 5% of these are for C-V2X among many innovations.

Consumers often pay more than $1,000 for a new smartphone, plus more per month in network operator service fees, because of the value they obtain from the many free and other services these devices also enable them to obtain including search, navigation, and social media. CV pricing likewise reflects value downstream—regardless of whether all that value is captured by the OEM itself. Yet CVs generate less than one fiftieth of the cellular SEP licensing fees from mobile phones. This is despite OEMs already collecting substantially more than half of their total annual revenues of $2.7 trillion in 2021 from CV sales. In comparison, total mobile phone sales revenues are around $500 million annually. Even if every CV produced over the next five years is licensed—including those expected to include 5G— the proportion of licensing revenues from cars is still unlikely to exceed one tenth that from smartphones.

With increasing adoption and value of connectivity in vehicles, there is consensus with acceptance now that the modest SEP royalty charges being widely paid are fair and reasonable. Manufacturers and users of CVs are deriving enormous value from cellular technologies including those developed specifically for automotive use.

1 WiseHarbor estimates based on various industry sources.

2 Markets and Markets estimated the global connected car services market to be worth $54 billion in 2020 with growth to reach $166 billion by 2025. Other industry analyst firms forecast a larger market (e.g. see endnote 3). “Less than 1%” is based on WiseHarbor’s estimate for cellular SEP licensing revenues on CV sales. Total annual car sales revenues were forecast by Statista to be in the range of $2.7-3.0 trillion.

3 Other CV market value estimates also include ongoing services revenues and operational cost savings. Allied Market Research valued the global connected car market —”offering comfort, convenience, performance, safety, and security along with powerful network technology”—at $63.03 billion in 2019, and projected it to grow at a CAGR of 17.1% to reach $225.16 billion by 2027. McKinsey & Company estimates connectivity could deliver up to $310 in revenue and $180 in cost savings per car per year, on average, in 2030. There are around 1.4 billion cars on the road worldwide.

4 WiseHarbor estimates this figure using various sources focusing on component and manufacturing costs with car sales volumes rising from 73 million in 2020 to 95 million in 2026 and with the proportion of vehicles connected expected to rise from 46% to 76% in that period.