The battle over the size of spectrum licenses that the Federal Communications Commission will put up for bid in its highly anticipated 600 MHz incentive auction received another opinion as the Summit Ridge Group released a report touting the smaller, the better.

The report, “Right-sizing spectrum auction licenses: the case for smaller geographic license areas in the TV broadcast incentive auction,” states that “adopting appropriately small-sized geographic territories is necessary to promote competition and other important economic and social goals,” though it did add that providing small geographic licenses sized might not be enough to promote “competition and participation” in the planned auction.

The report’s general findings are similar to those being put forth by trade group the Competitive Carriers Association, which would make sense as CCA sponsored the report.

Summit Ridge Group noted in its findings that spectrum licenses sized to “cellular market areas” are “the correct license territory framework to use to ensure that licenses are right-sized in the forward auction.” Rural operators have been clamoring for the FCC to make available spectrum licenses sized to the CMA specification, noting that they are not interested in larger parcels of the “economic area” model that would in many cases require them to acquire licenses covering larger markets they have no interest in serving. The EA model splits the country up into 176 slices, with most of those slices including at least one mid- to large-sized market. The CMA model would see the number of licenses available swell to 734 in total.

The report noted that smaller license sizes will more closely match the coverage needs of carriers and thus result in a more efficient use of spectrum resources. The smaller sized licenses were also touted as being more beneficial in eliminating potential interference issues near national borders.

At the recent CCA Fall event, Cellcom CEO Pat Riordan explained that if the FCC goes with EA-sized licenses, it would be forced to bid on a license encompassing Green Bay, Wisc., which is a market that will garner intense interest from larger rivals and may not be a market it’s interested in entering with that spectrum.

A similar argument was put forth by Ron Smith, CEO of Kentucky-based Bluegrass Cellular, who noted EA-based license sizes would force the carrier to acquire spectrum in larger markets outside of its current rural footprint.

“The license sizes have to be at a level where I can at least participate,” Smith said. “I serve between large markets. If we go with EAs, I just can’t afford to buy or enter large markets. … We all want to participate and are just asking for auction rules that will allow that.”

Looking to back the claim that smaller license sizes will not diminish potential auction revenues, Smith noted that during the 700 MHz auction, CMA’s represented just 33% of the spectrum put up for bid, but accounted for 48% of the auction revenues.

Riordan stepped in and noted that he was not buying claims by larger rivals that the number of licenses put forth by CMA rules would be too complicated, explaining that if a small carrier could handle the process, he was pretty sure larger carriers would be able to manage.

“This is not too complicated for Verizon or the FCC,” Riordan said.

There did seem to be some suggestions that the FCC could go with a sort of hybrid scheme that would split the difference between EAs and CMAs, though there is no word on if that proposal could be ready in time for the planned 2014 auction.

Larger operators in attendance at the event were in favor of the EA model for licenses, claiming they made for a simpler auction process, which in light of the planned reverse auction model currently envisioned for the 600 MHz auction was touted as a significant benefit. Of a greater concern for some larger operators and CCA members were rules regarding the participation of Verizon Wireless and AT&T in the proceedings, with claims that the preponderance of spectrum below 1 GHz already controlled by those two operators should limit their ability to participate in the 600 MHz auction.

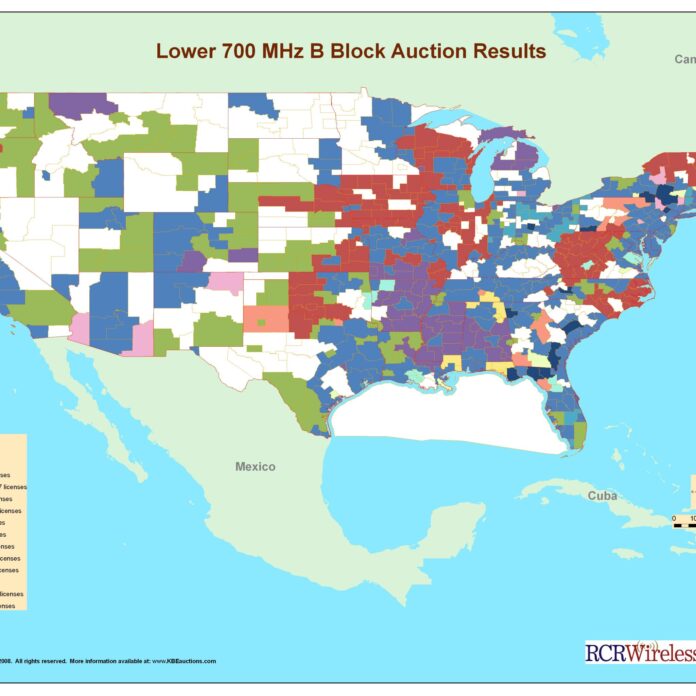

During the 700 MHz spectrum auction conducted in 2008, the FCC set aside licenses in a range of sizes, including CMA, EA and larger regional blocks. The FCC is working on putting out auction rules for a trio of planned auctions, including the H-Block, AWS-3 and 600 MHz auction.

Bored? Why not follow me on Twitter?