This is a rehash of a social media exchange last week, somewhere in a far-off echo chamber on LinkedIn, following a post by Enterprise IoT Insights about unsuccessful IoT deployments – which riffed on a slide from Canada-based LoRaWAN solution provider TEKTELIC, shared during a keynote presentation at The Things Conference in Amsterdam, and which appeared subsequently to get the whole IoT market talking, sometimes turning the air blue.

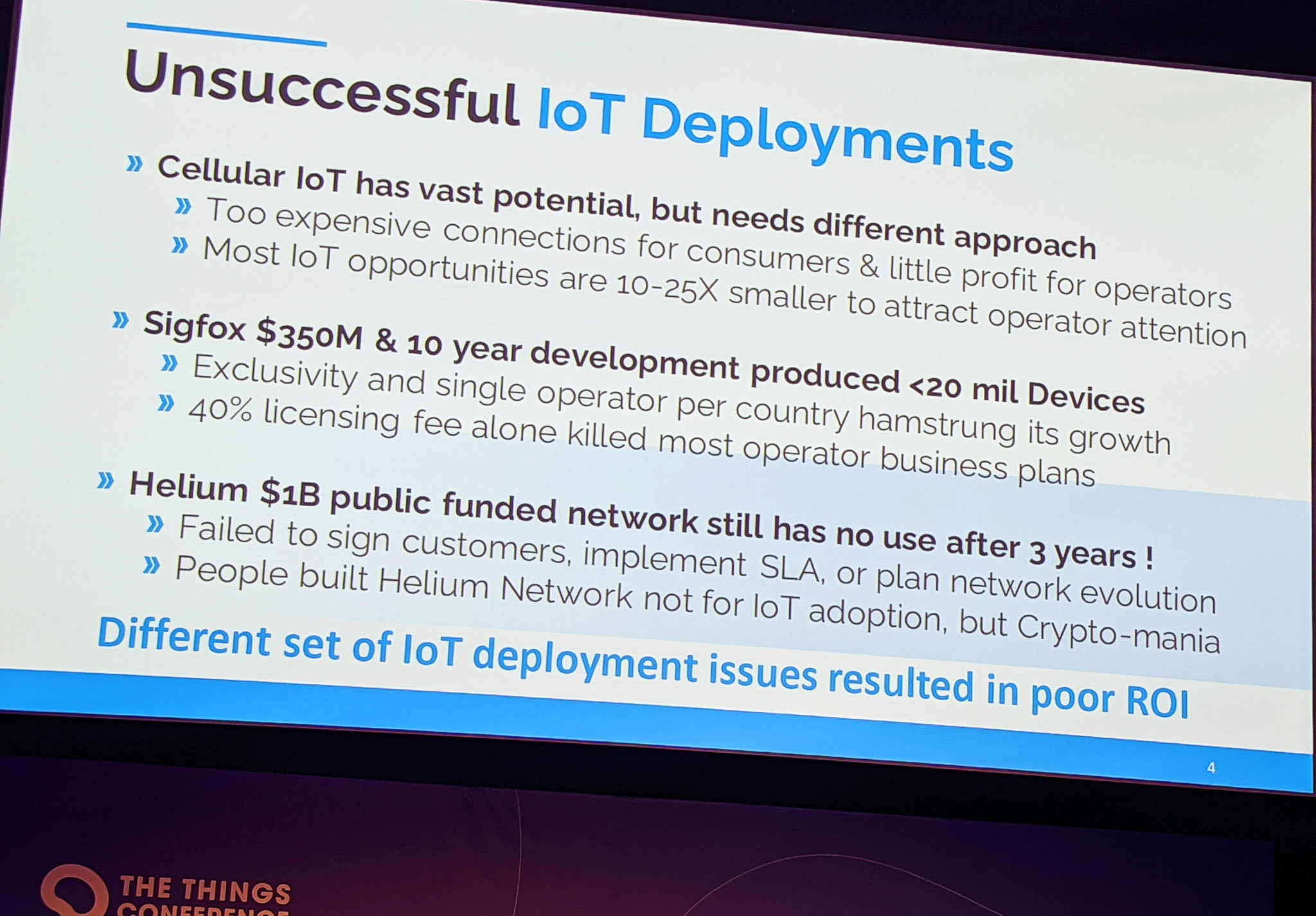

Suffice to say, revisiting it is more interesting than most of what has crossed the newsdesk lately – including the latest dispatches from MWC in Las Vegas this week, and unopened ones from Hannover Messe USA a week ago. So, instead: a recap, and a replay, about the merits of different IoT networking models – and enough pedantry and debate (and point scoring about what constitutes IoT) to get your knickers in a twist. The slide in question is shown below.

The post by Enterprise IoT Insights in response said: “A good summary slide from Roman Nemish from TEKTELIC at The Things Conference today in Amsterdam. This is the LoRaWAN world-view of the state of ‘things’ in the IoT market, with the point that LoRaWAN has avoided these scrapes. But it is hard to argue with, as well – that NB-IoT is decent tech that does not make business sense for MNOs, that Sigfox is good tech with a bad business model, and that Helium is a good idea with no business at all.”

It went on: “And that everything else is too late by now, anyway. Feels like IoT has grown up, and is old enough to reflect on what works and what doesn’t. And that LoRaWAN has survived this reckoning, by accident or design, based largely on its private networks and not, actually, its stop-start public infrastructure play – that it has learned, by necessity, to make the ROI work.” Cue some kind of mass hysteria, in a small corner of the tech universe.

It is worth reflecting, again, on the slide’s contents. Nemish, president at TEKTELIC, argued that new-wave cellular IoT – in the form of NB-IoT and LTE-M, primarily – is “too expensive” for consumers and too small-margin for mobile operators; that “most IoT opportunities are 10-25 times smaller [than the kinds of deals that would] attract operator attention”. Cellular IoT has “vast potential”, he concluded, but requires a “different approach”.

In other words, there is not enough profit in (low-power) cellular IoT for mobile operators to give it proper focus – and the deals are not big enough to make them really care. The IoT game – based on finely-calculated returns on volume-deals not going much higher than 100,000 units at a time – is better served by smaller-sized providers, without regional spectrum licences, offering broadly-equivalent technologies in unlicensed bands, he implied.

But experiences with Sigfox and LoRaWAN (in some formats) – the French-born IoT twin-tech that started the whole low-power wide-area (LPWA) movement, and forced the cellular community to come up with their own alternatives – have not been much better, necessarily, the story goes. Sigfox pumped $350 million over 10 years into its technology and network, only to go into receivership at the start of 2022 with fewer than 20 million devices under management.

The problem, said Nemish, is with the business model, and not the tech. (As an aside, a takeaway from The Things Conference last week, as from the LoRaWAN World Expo in Paris in the summer, and from any number of private discussions in between, is the IoT market is mature enough to let go of its closely-held tech differences, and acknowledge that customers don’t really care so long as it works – and so the blame switches to the business model, instead.)

Nemish blamed Sigfox’s ‘failure’ on exclusive single-market contracts and cripping licensing fees; these “killed most operator business plans”, he suggested. Of course, Sigfox lives to see another day – and, it might be noted, Taiwan-based IoT house Unabiz, its new owners, have just hosted the 0GUN Alliance of Sigfox operators in France to bash-out a new operator model, and a collaborative approach to a “unified LPWAN world”.

And LoRaWAN is not exempt in the analysis, either. In Amsterdam, Nemish held up the madly-hyped Helium model for crypto-led community network building as another failed IoT business model. Again – and of course, with a critical appraisal of a LoRaWAN network by a LoRaWAN provider – the tech is not the problem, just the way it is being offered. Because Helium, he said, with $1 billion of public community funding, has “no use” after three years.

As per the slide, parent Nova Labs has “failed to sign customers, implement SLA(s), or plan network evolution”, he suggested. The community behind it, originally bedsit enthusiasts on to a good thing, are not motivated by “IoT adoption but [by] crypto-mania”, said Nemish. Just look on eBay, where 10,000 secondhand Helium miners (gateways) are being flogged, to see how its star has fallen, he said – along with its stock, with HNT trading up 12 percent at around $5 at writing, on the back of a deal for decentralised 5G with T-Mobile in the US, but down from a high of nearly $30 a few months ago.

The post/share on LinkedIn drew quite a response. “Good stuff; not enough people tell it like it is,” said one commentator. “Awesome content,” said another. “Wow, brutal slide,” said Rob Tiffany, one-time IoT chief at Ericsson, also former tech chief for Hitachi’s seminal Lumada IoT platform, now a roving consultant on the IoT circuit. Tiffany was, perhaps, more taken with the cellular and community IoT analysis; the old Sigfox model is, now, widely discredited (and being changed).

Nemish responded directly. “The goal was not [to be] brutal, but [to] identify fundamental issues for the delays and failures with today’s most common IoT deployments – compared to their own targets from two-to-five ago. LoRaWAN did better because, after a few large early [public] deployments, most have been small-scale private networks, addressing clearer issues, and requiring smaller investments and shorter deployments – meaning better ROI… and others [will] follow this model,” he said (edited for style/language).

Samir Djendoubi, once with PTC’s ThingWorx, once with Accenture, now offering freelance IoT consultancy, protested: “Reducing unsuccessful IoT deployment to a network analysis is like looking to the milky way through a loop. The right title should be: bad telco analysis of IoT.” The rejoinder, from Enterprise IoT Insights, was just: why not consider the merits of LoRaWAN-related IoT network models, even if only because it fits neatly on a single slide?

But Rick Bullotta, also once with ThingWorx, and now “advisor/investor/mentor” (and self-proclaimed “de-influencer”), responded: “The title of the slide should be ‘unsuccessful LoRAWAN IoT deployments’. There have been countless successful IoT deployments on other technologies. And those who live mostly in the wireless sector seem to forget that roughly 97-98 percent of all connected devices aren’t on cellular, satellite, or LoRAWAN.”

Ouch. Except NB-IoT, LTE-M, and Sigfox are not the same as LoRaWAN – and whether or not you want to include Wi-Fi, BLE, Zigbee, and sundry proprietary 802.15.4 tech in a discussion about new-wave LPWA networks, the fact remains the likes of LoRaWAN, Sigfox, NB-IoT, plus a few others, promise to open up new IoT use cases. They also occupy a certain elevated (hyped) position among IoT believers, in attendance at The Things Conference.

Which is not an explanation at all, reckoned some others. Steve Jennis, another consultant, formerly with ADLink and Texas Instruments, responded: “Paraphrasing Tolstoy; all happy IoT deployments are alike, but every unhappy IoT deployment is unhappy in its own way. Simplification is good, over-simplification is not.” Others said the internet of things is just finding its feet, same as the internet of phones and laptops had to before.

“Keep building and moving forward. We are where we are now with the internet because this was happening day after day in the 1990s and early 2000s,” said Russell Blakemore, operations director at Pillinger Controls, a UK-based firm producing energy management controls for buildings. There was some joshing about 5G, as well. “Haven’t you heard? 5G changes everything,” quipped one wag.

Nemish responded to the goading about 5G, too. “It is actually funny how many operators say 5G solves all IoT problems, [and to] just wait a bit longer. But we are not interested in IoT problems, but in real-life business problems. If you ask how 5G addresses these, most [operators] cannot answer.” But cellular IoT is cropping up, he said, just not as king-tech to rule them all, as mobile operators have already crowned it.

Of course, the cellular IoT market is alive with experimentation and innovation, as well. MVNO-style providers like 1NCE, Arkessa, and BICS would each argue they have solved the business case for NB-IoT / LTE-M in terms of global availability, rock-bottom pricing, and all-round profitability – and want the five- and six-figures volume deals that operators shrug at. And one might regard 1NCE, even, as the default cellular IoT channel for Deutsche Telekom and Softbank.

California-based Nimbelink and Georgia-based Simplex Wireless, both responding to the post, said they had similar conclusions about the viability of cellular IoT, and similar-sounding solutions to promote it. And a couple of IoT solution providers, in the form of environmental monitoring firm Ayyeka and crop monitoring firm Semios said in the comments they had gone with cellular IoT as “by far the best solution” and a “gamechanger… for simple connected sensors”, respectively.

But the most forthright response to the TEKTELIC slide at The Things Conference came from Paul Pinault, vice president of product strategy at France-based industrial IoT provider Braincube, and a presenter himself on stage in Amsterdam. Writing in a blog post, on his own blog site Disk91, he said: “[It was] an active bashing session from TEKTELIC on stage… [which] displayed sh*tty things [about] competition [in the market].”

Pinault, whose Amsterdam presentation made the case for an every-tech industrial IoT environment (where Sigfox plays alongside LoRaWAN and Wirepas, and adjacent to NB-IoT and Wi-Fi, and a step removed from LTE, 5G, and wired Ethernet), defended the achievements (if not the models, directly) of Sigfox and Helium. (Note: the quotes below, from his Disk91 review, are reworded for purposes of language and clarity.)

On Sigfox, he wrote: “When The Things Industries (TTI) has just announced its first million devices with a network construction [that] started just about a year after Sigfox, [then] 20 million connections is not so bad.” It might be argued The Things Network (TTN) – actually; another community based network roaming model – has been de-prioritised by The Things People (TTN/TTI) as its flagship concern in favour of the TTI project.

But Pinault continued: “If you missed the [Helium] wave that made your competitors super rich two years ago, how can you go on stage and pretend to talk about the next wave? The argument is [that Helium is the] biggest network without any connections. [Which is] 50 percent true [because] it is the biggest network. But if you talk about 10,000 devices which may or may not be for sale on eBay, it is still only one percent [of all the gateways on the network].

“But it is 50 percent wrong, as well, because there is active usage and an active ecosystem on Helium. The network is just a year old and the crypto-boost network [model] frightens people – [compared with the kind of] open-source network TTN launched. But TTN/TTI is one of the largest and fastest growing networks, [and has] convinced a lot of service providers. So solution providers would do better to look at new market opportunities than to bitch.”

But Nemish followed up with his own LinkedIn post about the furore – noting that his keynote had “caused a few heated discussions even though I stated nothing new” – to make the case again that cellular IoT has potential, and might just be the primary driver for ‘massive IoT’, even to surpass the old forecasts about 20 billion IoT devices. In it, he ran a back-of-the-envelope calculation to say that the cellular market, today, is, well, massive, worth $3.6 trillion-odd.

The maths says there are 7.1 billion smartphones, worth about $600 each, on $30 airtime contracts, on average; and that there are a bunch of other bits and pieces with home connectivity, security, M2M, insurance, asset tracking, services, and the like. “In short, the global cellular market is worth a cool $3.620 trillion,” he writes. If only the smartphone model – killer devices, endless apps, easy access – could transfer to cellular IoT, then scale would be easy enough.

On the IoT side, LoRaWAN is doing great, he writes; the best of the bunch. “With 350 million LoRaWAN devices today, one could estimate connectivity revenue around $1 billion and device revenue of $800 million. [So] it is already a great business… But it is less than 0.1 percent of the cellular business. It is also an apples-and-oranges comparison, as one is aimed at high data rates and the other at low data rates.”

But the cellular market has the global infrastructure to make IoT work, in a way the LoRaWAN market does not – if only it could fix its issues, in the way the LoRaWAN market has. “If operators addressed the IoT connectivity costs, developed IoT solutions and made them available for consumers to use different IoT devices, like what Apple did with the iPhone and apps, then 20 billion is not such a large number… If the cellular IoT business grew to just present two-to-three percent of its total business, it would translate into a $100 billion IoT business.”

Anyway, no real conclusions, just food for thought.