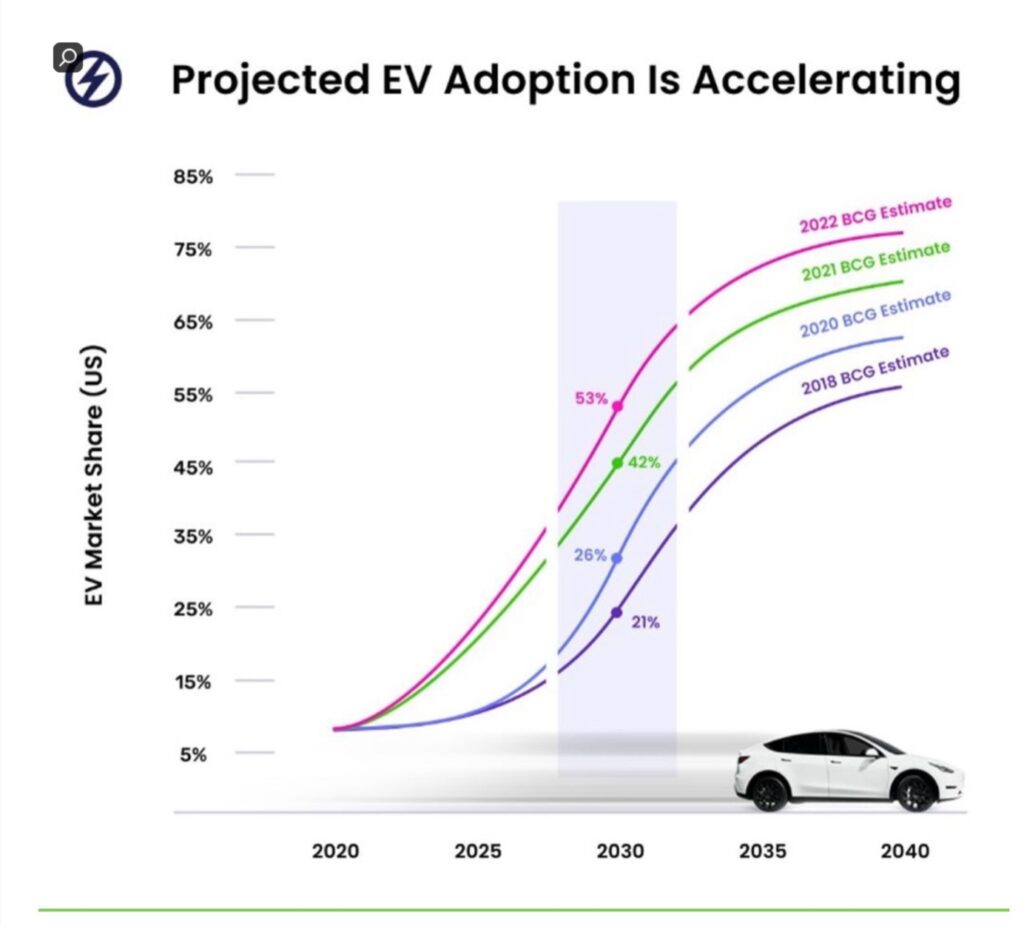

Electric vehicle (EV) adoption is outperforming all expectations, and is now expected to represent more than half of U.S. vehicle sales by 2030.

The ‘key link’ to mass adoption is now software, not hardware or vehicles. Fortunately, software innovations are already providing solutions to many of the scaling challenges and will play a crucial role in EV adoption. From $1bn in 2021, EV charging software is forecast to grow to $25bn by 2030, making it one of the fastest growing software sector in the market today and a huge opportunity for value creation for founders and VC’s.

Key challenges in EV adoption that software can help solve

Electric vehicles are set to revolutionize the industry. But a full transition to EVs requires overcoming several critical challenges.

The first relates to infrastructure and interoperability.

- While the number of charging points is growing, it is still far away from being able to meet the demands of many EV drivers. EV drivers still must plan their journeys (especially longer ones) as network of chargers are still inadequate, and ‘range anxiety’ remains a major stumbling block for many willing consumers.

- As the EV market grow, it will strain the grid. According to some estimates, we will need 1.1 EV chargers for every EV car. This could increase peak electricity demand on local grids by 15-50%, requiring expensive upgrades to accommodate the increased demand.

- The interoperability of different EV charging systems remains a major issue – currently it causes problem of overnight charging for EV owners who lack off-street parking and journey planning. Having varying protocols meant there were different standards/levels of device management, transaction handling, security, smart charging functionalities. New protocols like the Open Charge Point Protocol (OCPP) and communication standards such as ISO 15118 are now in place but will need continuous co-development by all stakeholders, to increase compatibility between different charging stations and management systems.

The second key challenge is equipment and maintenance cost:

- EV charging hardware remains expensive. The cost of a charging station varies significantly by type though generally, a Level 2 240-volt (the typical home charger – with capability for full charging around 6-8 hours) station costs up to $2,000 incl. installation costs, with level 3 charging stations intended for public and commercial networks costing typically between $10,000 and $40,000.

- In addition to hardware and installation costs, soft costs drive up operational costs. These soft costs include complex permitting processes, lagged communication between utilities and providers and high maintenance cost if not serviced well (especially for outdoor chargers).

The final challenge relates to the length of time and cost of e-fueling:

- Refueling a gasoline car is straightforward; charging an EV remains more complex. Some stations provide a full charge in as little as an hour (and an 80% charge in as little as 20 minutes), while others require several hours. Overnight charging is often available, but the length of time required can vary depending on the model and station type. The cost of charging also varies depending on vehicle type, location and the charging station, as well as associated fees. On the positive side, in the UK, recent figures show a driver exclusively using rapid or ultra-rapid public chargers pays 18p per mile for electricity, compared with 19p per mile for petrol and 21p per mile for diesel.

EV software companies provide essential solutions

The evolution of charging technologies is following a typical pattern of innovation that both improves performance and commoditises hardware, so the EV equipment cost and charging time will rapidly drop in coming years. Software innovation then becomes the real enabler of EV scaling by addressing the industry’s remaining key challenges.

On the issue of EV charging infrastructure availability and managing its impact on the power grid, there are already many companies solving the “pain points” here. This revolves around cities and EV charging companies planning placement of chargers, utilities monitoring strain on the grid resulting from EV charging, and EV drivers planning their trips.

- PredictEV, Volta Charging’s proprietary network planning software, uses machine learning to predict current and future EV charging needs, from infrastructure load requirements to site-level specifics. The software can forecast current and future demand with high levels of accuracy, allowing for precision network expansion. State governments in the US are now using PredictEV to identify optimal and equitable charging locations.

- For grid management, we have companies such as London-based Kaluza. The company’s advanced platform helps utilities manage the impact of EV charging on electricity grid demand by providing an intelligent, distributed system that can monitor, control and optimise charging. Kaluza uses an AI-driven approach to predict EV charging behaviour and reduce peak demand, while also optimising energy costs by intelligently scheduling charging to coincide with low energy demand and lower electricity rates. Similarly, WeaveGrid’s data-driven platform ensures the grid can accommodate electric vehicles safely by helping utilities in the US find EV drivers, analyze and gather insights on charging patterns, enroll them in managed charging programs and EV-specific rates and incentivize beneficial charging habits.

- For journey planning, there are a number of apps that help drivers optimise their trips both from a timing and cost perspective. For instance in the UK, Zap-Map has almost all public charge points mapped, showing live status data. Its paid version offers What3words navigation, charging network filters, charger ratings and display on car screen.

On the issue of improving the ROI of EV charging infrastructure and reducing the cost of charging session, a number of software companies are tackling the challenges here. Most use-cases revolve around real-time monitoring and improving demand flexibility to reduce charging costs:

- In Europe, The Mobility House developed the easy-to-use and hardware agnostic ChargePilot platform that provides B2C and B2B owners of EV charging stations with a management system for monitoring, maintenance, schedule-based load management and billing. All these capabilities that result in improved user experience and cost savings are provided across multiple geographies e.g. in Munich, Zurich, Paris or Belmont (CA).

- Based in Denmark, Monta’s EV charging management software serving drivers, companies, cities and the electricity grid with one integrated software solution. It makes it easy for businesses to maximise the charging efficiency of their EV charging infrastructure. It offers detailed analytics, real-time monitoring, dynamic pricing capabilities and automatic billing and payment. For drivers, Monta, which is present in 9 European countries, helps consumers control their home charge point, identify public charging locations and schedule charging session when electricity is cheapest and cleanest.

- Energy goes one step further in “solving” energy management and cost of charging sessions by pivoting from monitoring to optimisation through predictive suggestions. Its software platform automatically schedules charging session depending on electricity prices and leverages home solar panels to obtain free green energy.

Lastly, as more commercial vehicles and fleets are “electrified”, software is more crucial than ever to manage fleets, since companies have to plan deliveries based on charging status of each vehicle.

- Vulog and Autofleet are leaders in EV fleet management. Vulog’s integrated software and data solutions power shared mobility services such as car-sharing, ride-sharing and bike-sharing. Autofleet’s cloud-based software platform helps businesses manage fleet vehicle maintenance, driver safety, fuel monitoring and route optimisation.

- With the ownership of vehicles increasingly becoming “shared” and “electrified” the ability to merge EV charging infrastructure management with vehicle sharing becomes very important and determines both the adoption of the shared ownership model of vehicles and electrification of commercial fleets

EV software will become the key enabler of EV scaling and ultimately a key enabler of the energy transition

As the EV adoption scales, systematic maintenance of EV infrastructure will become crucial. Whilst EV charger monitoring exists today, the concept of smart, “self-healing” EV chargers are not yet widely adopted. We believe this capability will be software-led, as evidenced by the smartphone market (where your smartphone learns from your daily charging habits to improve the lifespan of your battery). Today, companies such as Driivz claim they can already address up to 80% of operational problems related to EV chargers remotely, by leveraging automated self-healing algorithms. As a result, issues with EV infrastructure can be automatically diagnosed and proactively fixed (even remotely) which maximizes network availability and stability.

From a user point of view, EVs need to be charged much more frequently than gasoline vehicles. Instead of the typical 40 annual fueling sessions for a gasoline car, an EV may need 500 or more yearly charging sessions. The nature of these sessions is different i.e. not just one-way, full charge every time. This presents opportunities for software to play a role in the optimisation of the charging sessions and to take advantage of those daily interactions to upsell users various services. In the long run we anticipate the emergence of super-apps from the EV charging software sector, which will fuel significant additional growth.

Finally, EV charging software will be instrumental to the transition towards renewable energies. According to Virta Global, there will be 140-240 million electric vehicles globally by 2030, which means there will be at least 140 million batteries with an aggregated storage capacity of 7TWh, or 7,000GWh. In 2021, only 2.4GW of storage was developed in Europe, but various studies predict we’ll need around 200 GW of energy storage by 2030. EVs will provide crucial power storage to support the generation of renewable energy, using vehicle-to-grid (V2G) technology. As more V2G protocols continue to be developed (currently mostly dominated by CHAdeMO-type chargers), we see software playing a larger role to harmonise the different standards/protocols.

A white paper from Kaluza shows a typical EV sits parked 90% of the time with a battery capable of storing 40kWh of energy – enough to power an average modern home for two days. Unlocking bi-directional charging will enable more affordable, highly resilient energy transition. Companies such as ev.energy and Kaluza are already exploring and developing, trialing and deploying software in this space. This is done by engaging the automotive OEM early and forming close collaboration with regulators to implement frameworks that enable scale. These companies are now set to play a critical role in providing solutions to help take the strain off the grid and accelerate the transition toward renewable energies.

Overall, we see EV charging software as one of the fastest growing, and potentially one of the largest, new software sectors in the market today. As the complexity and scale of EV charging networks increases, EV charging software looks set to eventually become a $50bn+ market, helping drive the global economy even faster toward net zero.