Counterpoint Research: ‘In some markets, operators have adopted a wait-and-see approach to 5G SA’

According to a new report issued by Counterpoint Research, the majority of 2023 network rollouts will be in emerging and secondary markets, driving the global transition from 5G Non-standalone (NSA) to 5G Standalone (SA).

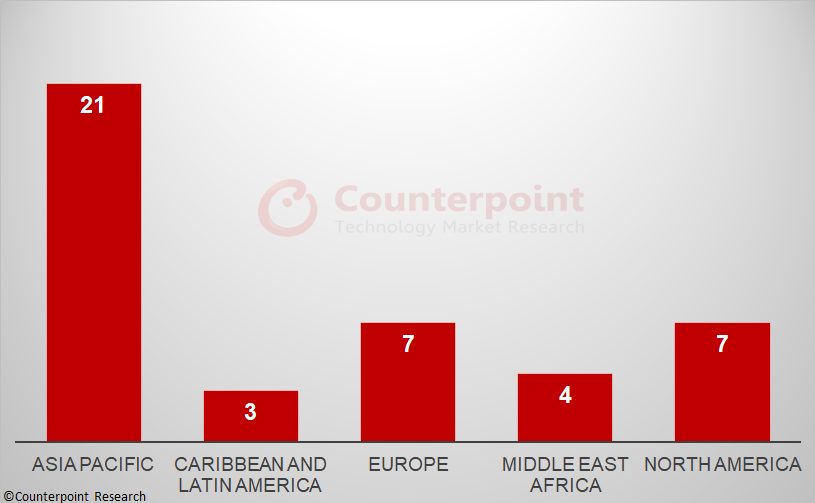

The research firm published a 5G SA tracker to better detail the progress of this transition. So far, the tracker has indicated that 42 operators around the world have deployed 5G SA commercially. Many others, said the firm, are testing SA or are in active trials.

The tracker shows that at the end of 2022, the Asia-Pacific region led the world at the end of 2022, followed by North America and Europe. The Middle East and Africa and Latin America lagged behind.

When it comes vendors, Ericsson and Nokia lead the 5G SA core market globally, according to Counterpoint, which stated that these players are “benefiting from the geopolitical sanctions on Chinese vendors Huawei and ZTE in some markets.” Other vendors in Asian, like vendors Samsung and NEC, have been focused on their respective domestic markets, but are expected to expand their SA reached this year. Counterpoint also said that U.S. vendor Mavenir has shown to be active across all regions, and has multiple deployments scheduled for 2023.

Additionally, the firm looked at spectrum use, finding that most operators are deploying 5G in mid-band frequencies, while just a small number are also launching in the sub-1GHz and millimeter wave (mmWave) bands.

“Most of the deployments are in the developed economies of the world with those in emerging economies lagging. In some markets, operators have adopted a “wait-and-see” approach and are looking for evidence of successful use cases before switching from 5G NSA to SA,” said Counterpoint. “The ongoing economic headwinds might also delay commercial deployment of SA particularly during the first half of 2023.”