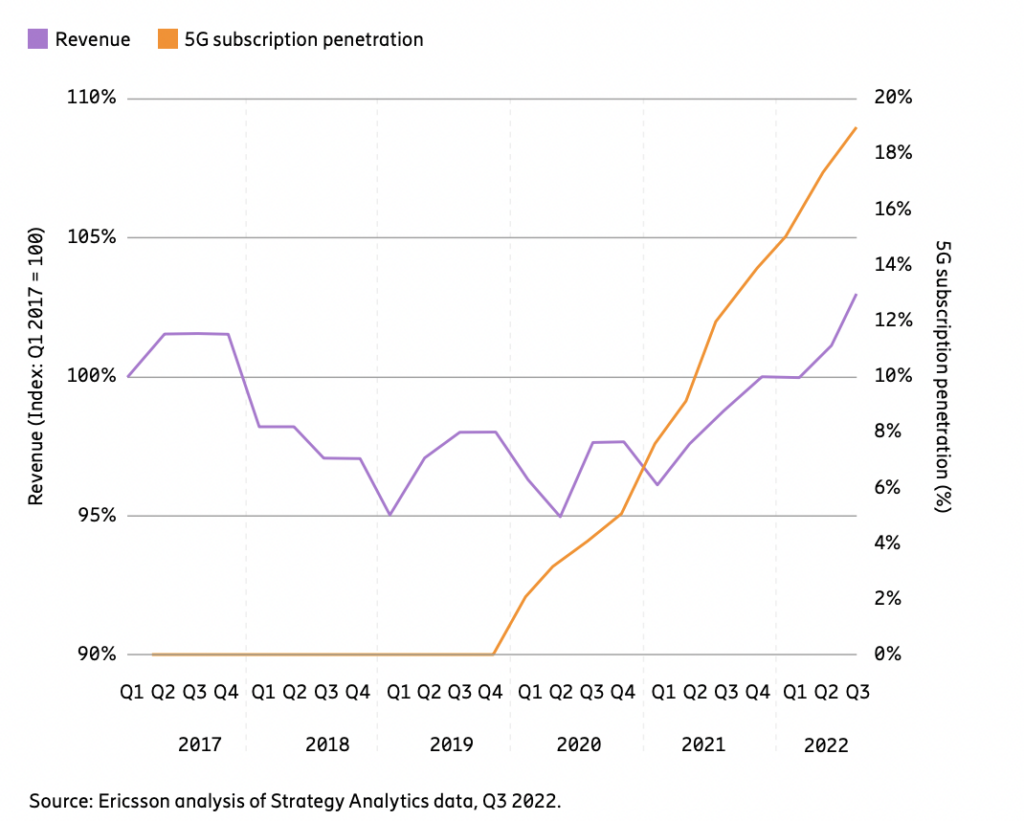

Ericsson has tracked a two-year revenue increase in the top 20 5G markets as measured by device penetration

New research from Ericsson finds that 5G monetization is picking up in the top 20 global markets as measured by device penetration. After years of stagnant ARPU, operators are seeing a service revenue lift from consumers using enhanced mobile broadband (eMBB) services; behind eMBB, the Swedish vendor identified fixed wireless access as another growth driver.

In the Ericsson Mobility Report Business Review edition, EVP and Head of Business Area Networks Fredrik Jejdling wrote that eMBB “offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Many service providers are updating their charging models and shifting customers to new, 5G-adapted subscriptions. The mobile broadband business will continue to comprise a significant part of service providers’ revenue in the foreseeable future, but it is not expected to drive long-term growth on its own.”

Before getting to what else is need for operators to fully realize 5G monetization, on the consumer eMBB front, Ericsson suggested a performance ladder providing “an incremental upgrade path for consumers, while also creating a gradual monetization model…Incremental pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.”

By the numbers, Ericsson researchers identified revenue growth in the top 20 5G markets beginning in the first quarter of 2020, with average revenue growth of 3.2% annually. This lift corresponds with the commercialization and scale-out of 5G networks in these leading markets.

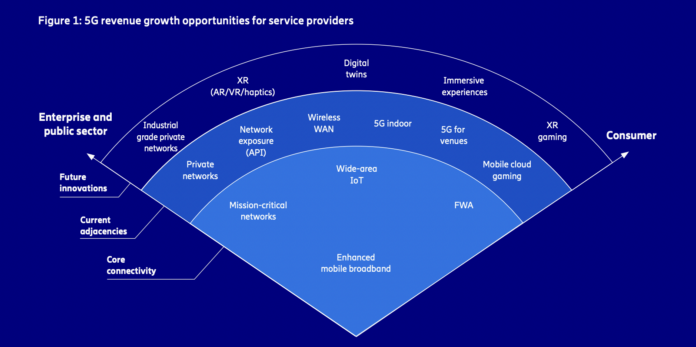

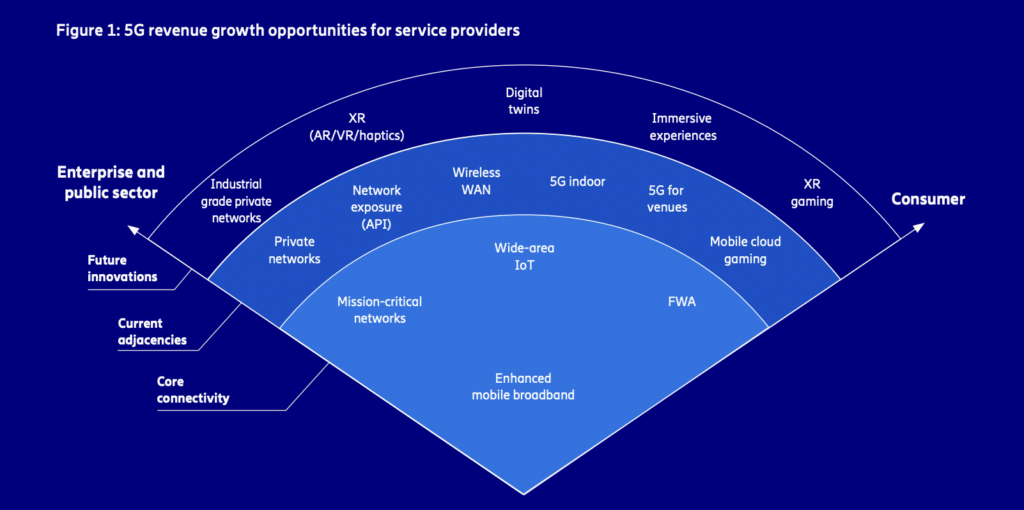

In terms of the big picture on 5G monetization, Ericsson sees three bands: core connectivity which includes eMBB, FWA, mission critical networks, and wide-area IoT; “current adjacencies” includes mobile, cloud-based gaining, private networks, the positioning of 5G as a primary network rather than a fallback, CPaaS models, and in-building/venue coverage; and the broad “future innovations” band which includes Extended Reality, digital twins and “industrial grade private networks.”

5G-enabled FWA has emerged globally as an attractive revenue source given its fast time to market, ability to re-use infrastructure, familiar subscription/billing model, and commercial bundling options for growing existing ARPA along with new customer acquisition.

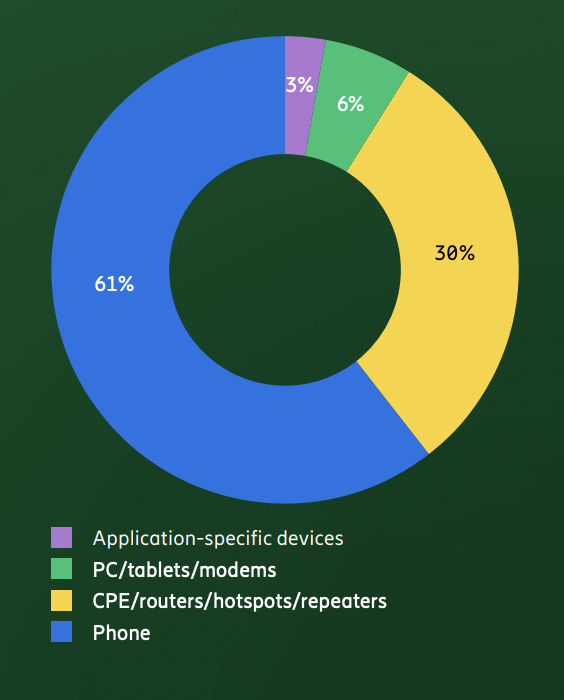

Application-specific devices needed for private 5G to make waves

As operators around the world are learning, the more durable 5G monetization strategies involving advanced enterprise-facing solutions aren’t yet making a meaningful impact on balance sheets. Ericsson called out “growing 5G opportunities in enterprise and public sector applications across the world,” but also cautioned that, “It is as yet early days for 5G…”

As it relates to private 5G networks as an enabler of enterprise digital transformation, one problem identified in these pages and elsewhere is a lack of vertically-focused devices with the necessary capabilities. Examining the 5G device landscape, Ericsson tallied announced products and found that 61% were phones, 30% were CPEs, 6% were PCs or tables, and just 3% were “application-specific devices.”

That said, the report authors wrote, “There are already clear signs of a coming uptake of 5G services in several industries…Industrial ruggedized 5G handsets have been launched…Mobile devices such as autonomous mobile robots (AMRs), drones and XR devices are already being connected by modules to a gateway. This is expected to accelerate in the coming years. As innovation in 5G…picks up the pace, not only on the consumer side but also for enterprises, new application-specific devices will increase in number, possibly also in areas not yet considered.”