In just over 18 months, T-Mobile US has secured 2.6 million 5G FWA customers

At Mobile World Congress Barcelona, RCR Wireless News caught up with Neville Ray, president of technology at T-Mobile US, to discuss 5G progress and where the carrier is seeing the greatest monetization opportunities.

“One of the most compelling use cases out there is FWA,” Ray confirmed. “It sounds kind of crazy that in the U.S, where broadband is highly developed, that wireless can come along and start aggressively competing in the broadband space.” He explained, however, that fixed wireless fits nicely between “the haves and have nots,” enabling connectivity for those who live where building out fiber networks isn’t possible or isn’t financially appealing to providers. A 2021 CTIA report, for instance, estimated that 5G FWA broadband could serve nearly half of rural households in the U.S.

So there is a big market opportunity here. More than that, though, consumers want it. In just over 18 months, T-Mobile US has secured 2.6 million FWA customers, most of which were acquired within the past year. “This wasn’t a big, promoted use case, but it’s generating real revenue,” Ray said. He sees FWA taking off in other countries, too, and at MWC, noticed serious interest in this use case while touring vendor booths. “It’s 5G-driven, because you couldn’t do it on LTE. You didn’t have the spectrum or spectral efficiency of 5G, which allows you to offer a much richer experience and faster services,” he said.

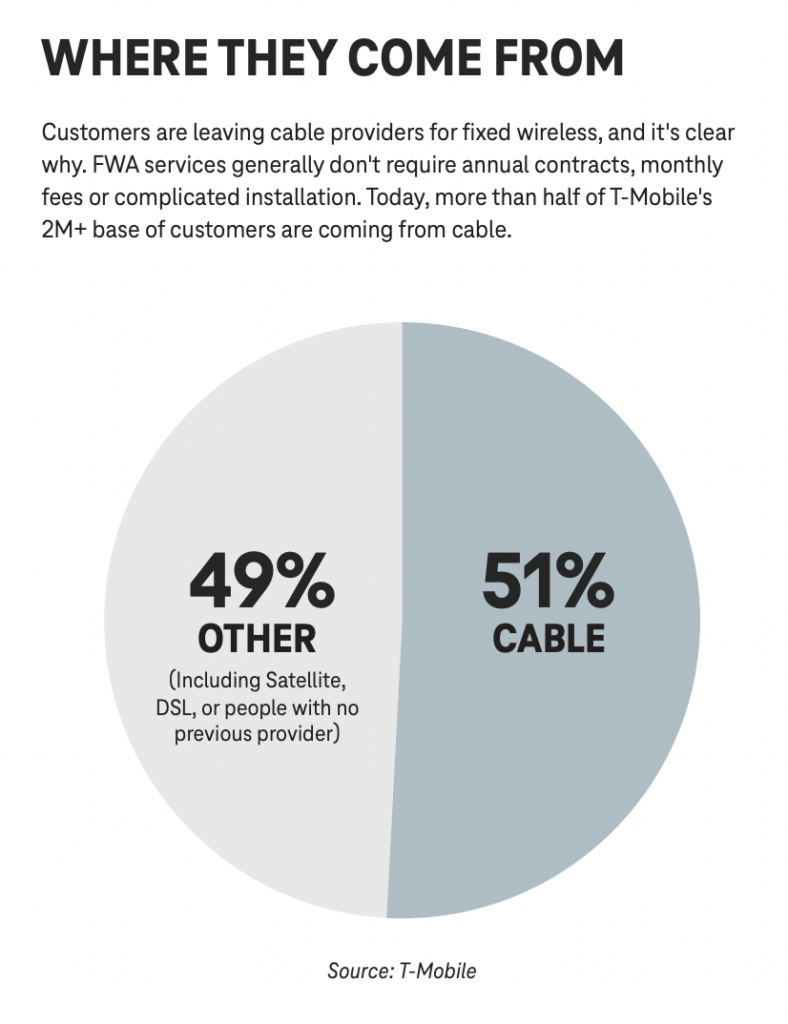

In a report published last year, T-Mobile US predicted that by 2025, T-Mobile and Verizon will have 11 to 13 million total FWA customers, many of which — as Ray hinted at previously — will be making the switch from a cable provider.

T-Mobile US’ FWA story involves its 2020 merger with Sprint, which left the carrier with an impressive spectrum portfolio, most notably consisting of 150 megahertz of Sprint’s 2.5 GHz spectrum. “When we combined T-Mobile and Sprint, Fixed Wireless Access was something we said we would do,” Ray explained, adding, however, that what the company expected to be a “slow burn” for subscription gains, ended up being a huge hit. “What surprised us was how receptive consumers were to a Fixed Wireless offering… We’ve seen FWA subscriptions accelerate and it has happened quicker than we thought.”

Beyond FWA, T-Mobile US has witnessed smartphone use skyrocket on its 5G networks. The carrier’s 5G subscribers are consuming 40 gig a month, almost 3 times the amount consumed on LTE. They are also gaming two to three times more and watching an average of more 40 of video a month. “Consumers are living more and more of their lives in these devices,” Ray summarized.

Ray also shared that he is excited about the eyewear wearable space, commenting that he is confident it will take off and once it does, it will materially heighten consumer engagement around 5G. “Finally, you have a new form factor for 5G that is not the smartphone or the tablet,” he said. “T-Mobile is investing at a rapid pace to make sure those network capabilities are in place … and the dialogue is heavy with partners to see how soon we can bring new engagement models to the market.”

When it comes to enterprise 5G, Ray said it’s moving, slowly. “But every CIO [chief information officer] you come across wants to talk about how 5G can help them. The problem is that the answer to that is 100 different things, depending on the business,” he said, adding that this fragmentation can make it difficult to point to a standout use case that is a big and as revenue generating as FWA for instance.

“Maybe the industry oversold 5G capabilities in the early days, but where now getting to a level of maturity in these networks where the 5G experience is differentiated,” said Ray. “For us, and for others, there is a lot of work being driven into the innovation space, trying to cultivate on the business and consumer side for new applications and services.”