Greetings from Georgia, Nebraska, Missouri and Louisiana. We look forward to cutting the ribbon and launching service in Warrensburg and Knob Noster (home of Whiteman AFB) this week. If you are in the area, please join us in celebrating competition and choice at 4 p.m. Wednesday, May 17. More details at the Warrensburg Chamber of Commerce website here.

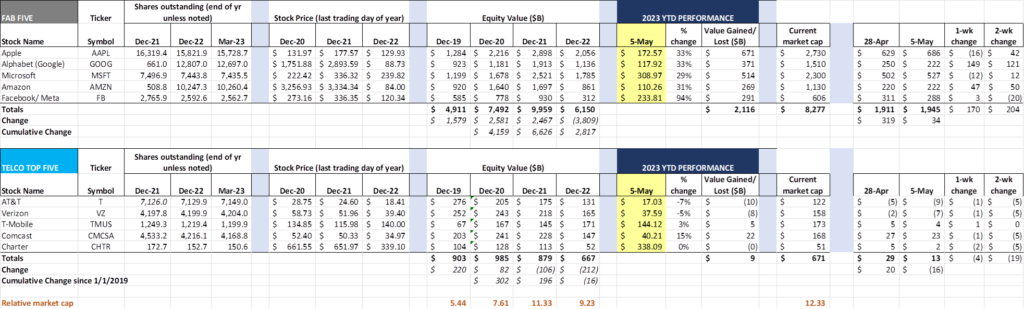

This week’s Brief continues the theme of concisely summarizing the first quarter situation assessment of the telecom industry. We covered three of the Telco Top Five (AT&T, T-Mobile, and Charter) in the previous Brief (here). This week, after a very full market commentary, we will round out the remainder with Verizon and Comcast.

We have deliberated about the content for the May 28th Brief given that it’s over the Memorial Day weekend. We will likely publish the Brief on Saturday the 27th and it will focus on the myriad of “letters” that now seem to be en vogue in the business world today. While we have not finalized our content, three have caught our attention: 1) The annual letter from Berkshire Hathaway (and the Buffet/ Munger Q&A); 2) Jamie Dimon’s 41-page summary of world economic conditions and projections (and, if you have not seen last week’s Bloomberg TV interview here, it’s worth some time); and 3) Amazon CEO Andy Jassey’s annual letter to shareholders. If nothing else, it will provide you bookmarks for additional summer reading.

The fortnight that was

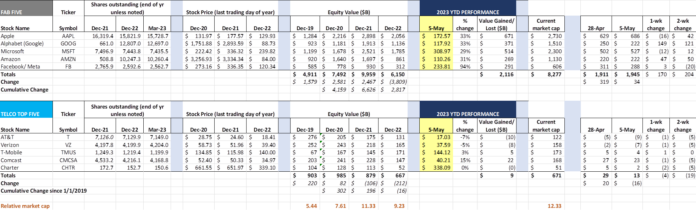

Editor’s note: Share counts have been updated to reflect the levels described in each 10-Q company filing.

The market capitalization train continued to roll on despite stubbornly high inflation readings and increased second half recession projections this past week. Since our last Brief, the Fab Five has gained slightly more than $200 billion, bringing their year-to-date gains above $2 trillion.

Unlike the bifurcation that’s occurring in the Telco Top Five, each stock in the Fab Five is bouncing back from 2022’s dismal $3.8 trillion loss. The worst performing stock in the Fab Five is Microsoft, up a mere 29%. Each of the Fab Five is still below their end of 2021 Covid-induced peak, but those gaps are narrowing quickly. While we are not in the business of predicting stock prices, it sure seems like these five will consume much of the market’s gains in 2023.

Most of this week’s $149 billion bounce in Google came after their I/O conference, as management reassured analysts, investors, and employees that they have an answer to Open AI’s GPT-4. They announced PaLM 2 (Pathways Language Model), a family of language libraries. For those of us who are active Gmail users, we have seen PaLM 1 in action through sentence completion assistance. PaLM 2 expands on those libraries considerably, increasing language support to 100+, and also delivers smaller-sized versions that can be powered on a mobile device. More on PaLM 2 here from Ars Technica and here from CNET.

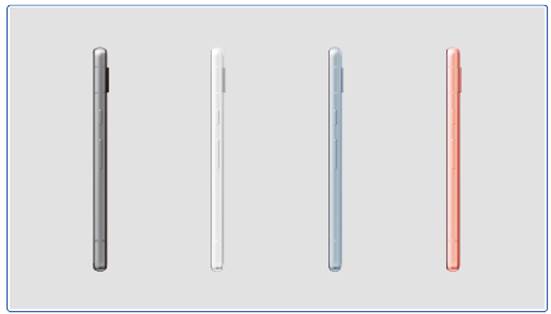

But that was not all the Mountain View company announced. Pixel now has a foldable device (blog announcement here), and the initial reviews are positive (despite a $1,799 retail price). Weighing a mere 10 oz., the 5.8 inch phone transforms into a 7.6 inch tablet. Coupled with integrated applications that can seamlessly transform with the screen change (Google Maps comes to mind), the Pixel Fold could eat away into Samsung’s large lead. We are also pleased that Google has put a 9.5 MP front-facing camera into this model, although we can’t help but think about what a higher-resolution version would do for its overall appeal (see Pixel 7a specs below).

As important as the Pixel Fold, Google addressed the other end of the spectrum with the $499 Pixel 7a (specs here). Eight GB of RAM and 128 GB of ROM, a 64 MP resolution rear camera and a 13 MP front-facing camera is a lot to pack into a mid-priced device, and certainly raises the bar for the upcoming Pixel 8 (and dwarfs the current iPhone SE). With both Verizon and AT&T moving to 36-month pricing, this sub-$15/ mo. equipment installment charge could help with family plan adoption.

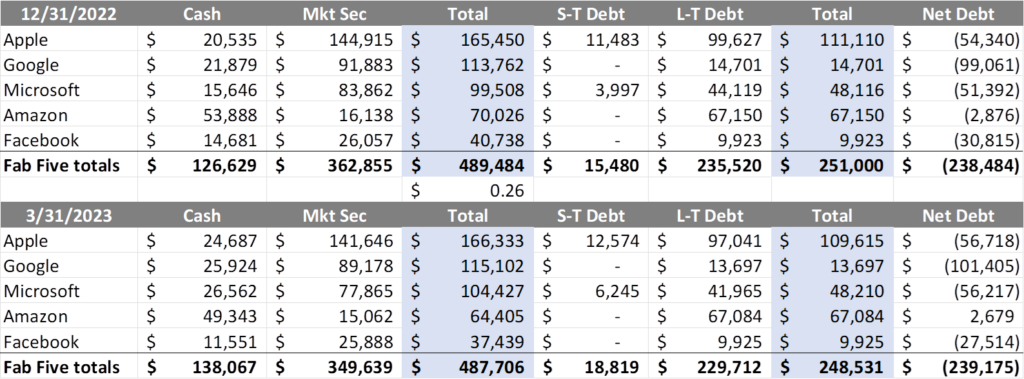

Google IO was not the only newsworthy item from the last two weeks. Apple announced earnings (package here), led by strong iPhone sales. Most impressive in the Apple release was their $63 billion in quarterly cash flow from operations (largely driven lower by diminished accounts payable). With the Apple release, we now have net debt levels for each of the Fab Five (shown is comparison to Q4 2022):

Included in Apple’s cash stability are $39 billion in stock repurchases for the quarter. Google also had slightly more than $13 billion in stock purchases, Meta had about $9 billion, and Microsoft had slightly less than $6 billion. Yet each company (except for Amazon) continues to have significant negative net debt balances. Even with new stock buybacks planned, there’s plenty of runway. Interest rate exposure (especially on a relative basis) is nonexistent, and while the California banking crisis is impacting many of their suppliers (and potential small company acquisitions), the Fab Five is impervious to any of those headlines – they are self-financing.

Speaking of financing, we did not miss the announcement that one of Apollo’s longtime investment partners, Mubadala Investment Company (Abu Dhabi’s sovereign fund), is investing $500 million into Brightspeed. The spinoff from Lumen has a long transformation ahead, and not a lot of time to complete it. Additional monies will help.

Finally, we got a peek at AT&T’s out-of-region plans with the completion of their Gigapower joint venture with BlackRock (announcement here). In what can only be viewed as another body blow for Lumen, the first markets are Yuma, Chandler, Gilbert (all in Arizona) and Las Vegas, Nevada. Interestingly, each of those markets is also served by Cox Communications. AT&T also announced that they would be launching Gigapower services in Scranton and Wilkes Barre, Pennsylvania (both Comcast markets, and a Verizon/ Frontier telco split), as well as a few edge-out areas in Alabama and Florida.

Arizona and the Florida/ Alabama edge-outs make a lot of sense. AT&T is following the growth in the Grand Canyon State (some of it from their current exchanges in California). We aren’t sure how this announcement will impact Google Fiber’s plans in Chandler and Mesa (analysis here) but a Cox-Allo-Lumen-AT&T battle royale would certainly be interesting to watch (Allo announcement here). We wouldn’t rule out Google Fiber and others participating in the Gigapower venture for certain routes in the future (the venture needs participation from others to ultimately succeed).

First quarter earnings in five words or less (Part 2)

In our last Brief (here), we summarized the earnings calls for AT&T, T-Mobile, and Charter as follows:

| AT&T | Durable customers |

| T-Mobile US | Durable cash flow |

| Charter | Mobile and rural subsidies |

In this Brief, we round out the telco top five with Comcast and Verizon and follows:

| Verizon | Wireless and business turnaround |

| Comcast | Commercial services and mobile |

Verizon: Wireless and business turnaround

In wireless, our greatest concern remains AT&T. As we discussed in last week’s Brief, they have no bundle partner (that may change with the launch of WarnerMedia Max this month) and stagnant operating margins. FirstNet continues to prop up business wireless performance, but T-Mobile is proving to be more of a competitor than many thought. It’s possible but unlikely that either AT&T or Verizon will have the ability to meaningfully raise prices, and postpaid churn is slowly rising.

Verizon’s story is a bit different. They continue to maintain their dominance in the RootMetrics RootScore Reports across 125 metro areas. We think, based on our look at the first half of 2023’s results, that Big Red will outright win 70% or more of the markets and tie with AT&T or T-Mobile in another 20+%, a level not seen since the end of 2020. Their C-Band deployments are yielding fruit.

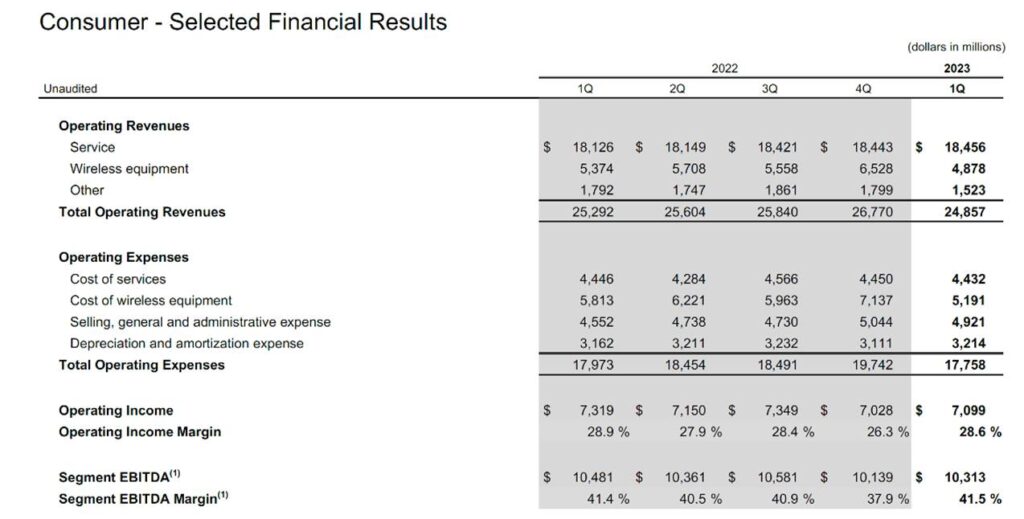

Verizon also has significant relationships with Apple and Disney for content and streaming (see consumer plans here). But, as we saw with Disney’s results last week, even content from one of the greatest in the business can get stale. The consumer wireless results shown nearby aren’t as compelling a growth story as their larger Seattle-based peer. After the wireless equipment subsidy is removed, the total operating picture is dismal ($7.41 billion in adjusted operating income for Q1 2023 vs. $7.76 billion in Q1 2022, a 5% decline). And these figures include the growth from the cable MVNO relationships (see next section). Verizon’s “sans MVNO” EBITDA margins are likely in the mid-to upper 30s%. Bottom line: Postpaid consumer needs a makeover beyond the $30/ mo. cable match price point Verizon enacted in December.

The business segment is not in great shape either. Postpaid phone growth is half of Q1 2022, and phone churn is up 10 basis points over the same period (overall postpaid business churn is up 16 basis points). Operating margins are lower, and business wholesale (remember One Fiber’s wholesale potential? Minimal contribution) is plumbing new lows.

Verizon will inevitably cut capital and jobs to right the ship. There are other measures that can help, however:

- Implementation of a rotating content program (versus Disney + only)

- Faster execution of the Tracfone conversion (which is its own mini transformation)

- Accelerated use of 5G as last mile access for business customers

- Restructuring the cable MVNO relationship

- Increased use of excess data and spectrum capacity to address specific segments (e.g., Multi-Dwelling)

Big Red can do a lot better. They have a strong fiber network, terrific spectrum capacity, and some of the best wireless engineers in the industry. While this may be difficult to admit, the company needs to confess that their products aren’t competitively positioned to win and that course corrections are needed.

Comcast: Commercial services and mobile

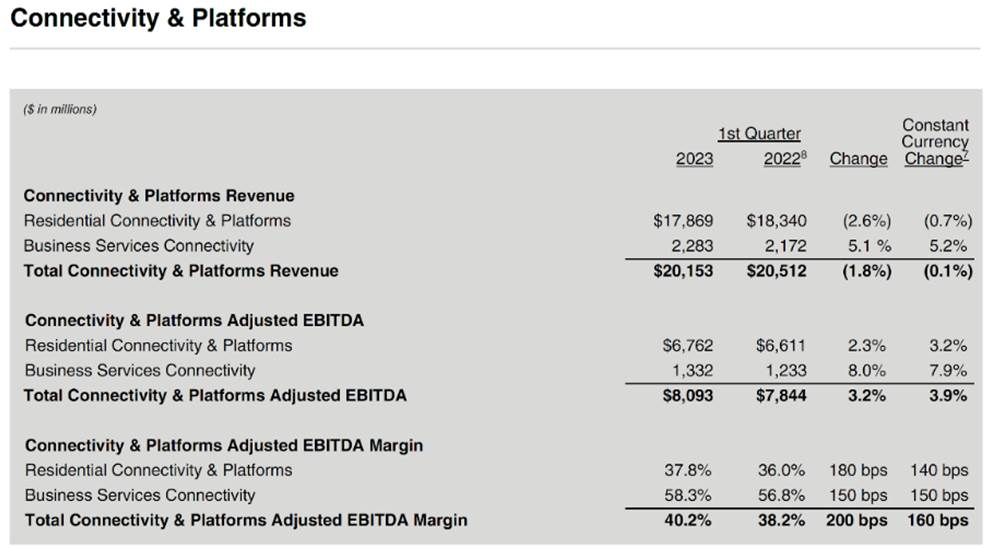

Comcast has the most levers to pull of any of the Telco Top Five – international diversification, vertical business units, significant relative market share advantages with residential and small business segments, and an advantageous MVNO relationship with Verizon. On top of this, the company recently purchased Masergy, which is clearly driving business growth (see nearby chart).

While many analysts are focusing on Comcast’s over the top Peacock streaming service (which will have its occasional setbacks but is generally on the right track), we are most interested in business and mobile (and perhaps the intersection of those units).

The nearby chart clearly shows the quarterly performance differences: Business services is much smaller than residential (11% of revenues) but highly profitable (16% of EBITDA and meaningful higher margins). Forty percent of Comcast’s Connectivity & Platforms segment Q1 EBITDA growth came from business services. Best of all, business customers spend a lot less on video services, a product in secular decline.

In his opening comments, Comcast President Mike Cavanaugh said the following about this segment (transcript here):

“We move fast and are more capable of reliably and cost effectively meeting our customers’ needs. We already have over 2.5 million domestic business customers, more than any other competitor and are targeting a $50 billion market opportunity within our footprint and a $70 to $100 billion total market opportunity that we can now go after by leveraging our technology and partners outside of our footprint.”

There are concerns about a possible recession on overall connectivity growth, particularly for small and medium businesses (cited as a major source of Comcast’s recent growth). And we like both Charter’s and Comcast’s opportunities to grow as Florida (mostly Comcast) and Texas (mostly Charter) expand.

Bottom line: While relatively smaller by revenues, Comcast Business represents a better business opportunity than residential. The company clearly underplayed this opportunity in their announcement. However, with a carrier-grade global network in the portfolio, Comcast can own customer relationships and strengthen cable’s overall position.

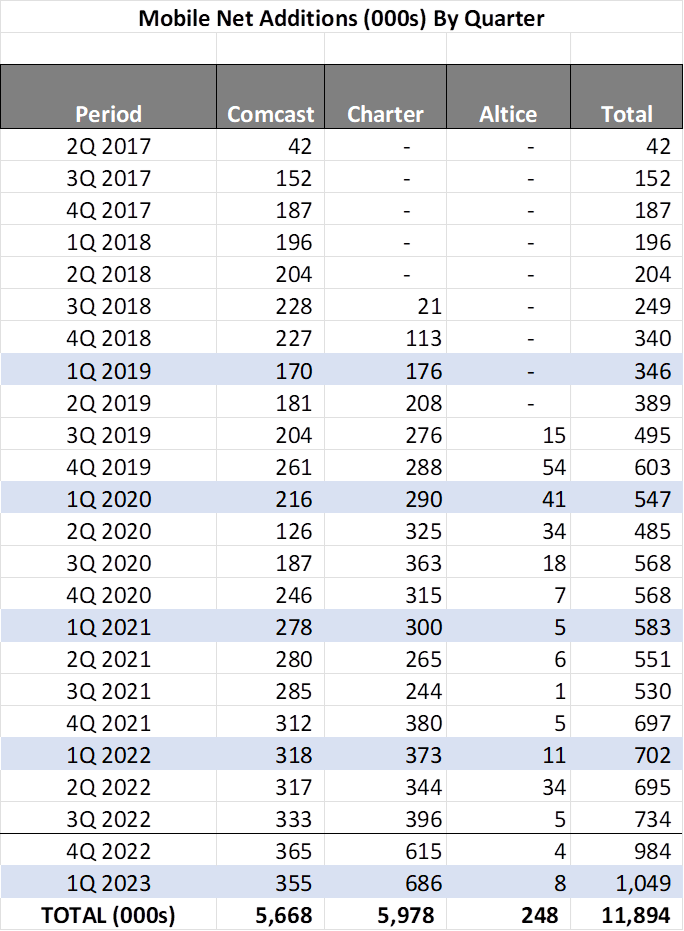

Then there’s mobile. As shown by the nearby chart, Comcast did not have the mobile “pop” that Spectrum One brought to Charter. This was largely due to the mid-February announcement of their bundle terms. We anticipate a larger net addition figure in 2Q.

When asked about mobile on the conference call, Comcast Cable CEO Dave Watson gave an interesting “all of the above” answer:

“Our strategy is to focus very much on our core service offerings of By-the- Gig, which we still have and use, and unlimited tiers. And it gives us a … real strong value proposition to all segments that we serve. So it’s important to note that we leverage mobile in all aspects of how we go to market, in acquisition, base management and retention. So mobile does very well in all 3. But as connects are a little bit softer through the cycle, base management has been very strong as we go to existing customers and provide a great upgrade opportunity for them. So our pricing focus is our core services, but we do go in and out in terms of promotions, with gift cards, some device subsidies that we’ve historically done, really no different there. But we also had a $50 combined broadband, mobile offering that all helped. There was a little bit of a lift there and a great value message to the existing base… And so you look at it, there’s upside in residential and commercial. There’s a domestic and international upside with mobile. There’s an opportunity for us to consider long-term cost side with offloading traffic.”

While lengthy, this reveals several key points. First, Comcast is not focused solely on acquisition but on selling the current products to increase broadband retention. We view this as a critical point of distinction versus Charter, who is leveraging Spectrum One across their base.

Second, Comcast will use the $50, 2-year broadband bundle when it’s appropriate. We view their offer as generally superior to the 12-month Spectrum One, largely because of the tapered pullback on the promotion after the second year. Cable has generally found that two-year promotions work better than one for a variety of reasons.

Finally, mobile for business customers is going to be more important because of the Masergy acquisition. How this unfolds is likely the topic of a future Brief (hint: we think it’s more than just wireless backup services).

Overall, because of their regional residential connectivity focus, we like Comcast’s prospects slightly less than T-Mobile’s. That the two of them are battling for “most valuable global telecommunications company” is not a surprise, however. Both have less execution and “defend” risk and have debt profiles that allow them to take advantage of options as they come available.

That’s it for this week. In our Memorial Day Brief, we will analyze the three letters described above. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific end to the quarter and Go Royals, Sporting Kansas City, and Davidson Wildcat Baseball!

*Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband