Greetings from Louisiana, Texas, Nebraska, Missouri, and Minneapolis, Minnesota, the home of this year’s Independent Show. Pictured are Sally Daniels from the National Content & Technology Cooperative (NCTC), Steve Leavitt from Connectbase, and Jim. The NCTC Connectivity Exchange creates a selling consortium of smaller broadband providers. Thanks again to NCTC and Connectbase for the opportunity to participate in this session. Additional details on the NCTC Connectivity Exchange can be found here.

This week’s Brief will focus on earnings announcements from some of the Telco Top Five. We will finish this analysis on August 20. Each of the five companies had bright spots, but it’s clear that some companies are struggling with industry-driven secular declines more than others.

Before diving into that analysis, Fastwyre is pleased to announce that we will be cutting yet another ribbon in Nevada, MO (more on the town here), on Wednesday, August 16, at Marmaduke Park. Stay tuned to the Fastwyre LinkedIn feed for additional details. Nevada represents our seventh new market launched in 2023.

The fortnight that was

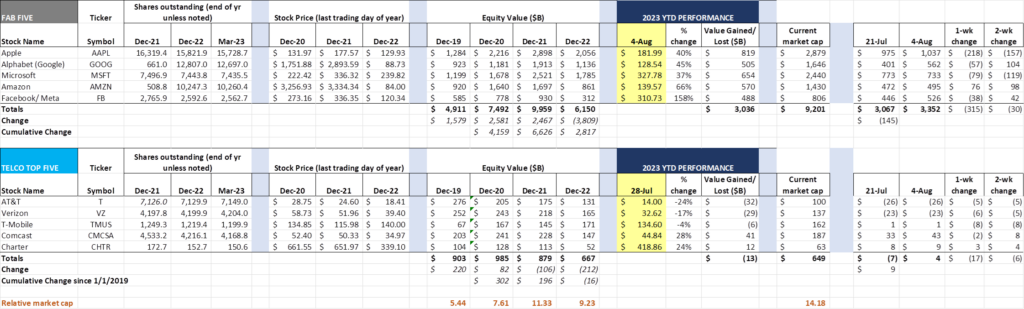

In the last Brief we made the following statement about Fab Five stock prices “With gains for the group already at $3 trillion, it would not be surprising to see more muted Fab Five gains in the second half of the year.” Strong earnings and cash flow outlooks from each of the Fab Five could not stop some of this week’s “sell on the news” profit taking. For the week, the Fab Five lost $315 billion, slightly more than 3% of their total value and 10% of their year-to-date gains.

Amazon, the Fab Five’s closest proxy to consumer spending, was the only stock higher for the week. As we have noted in previous comments, the Seattle-based powerhouse is a story of technology-driven post-pandemic consumer spending resilience. We will be doing a deeper dive into Amazon in the near future, but here’s a taste of what they are working on with their Amazon Clinic product.

Updated net debt and cash/ marketable securities changes as well as share count changes due to buybacks will be reflected in next week’s interim Brief. Long story short, the Fab Five as a group have more cash, fewer shares, and higher market capitalizations than they had at the end of March. How each company grows from here amidst an increasingly activist Federal Trade Commission (FTC) and Department of Justice (DOJ) is the challenge.

Meanwhile, the Telco Top Five also sold off after earnings, with the group losing $17 billion in the last week (2.5% of their market capitalization). After spending most of the year with market gains (and having fully recovered from a Memorial Day selloff), the Telco Top Five are now firmly down for 2023, having lost $13 billion year-to-date. As we will discuss below, the outlook is murky for telecom with increased competition, high debt levels, and 5G use cases that struggle to justify the tens of billions of investment made by each wireless carrier in spectrum and equipment.

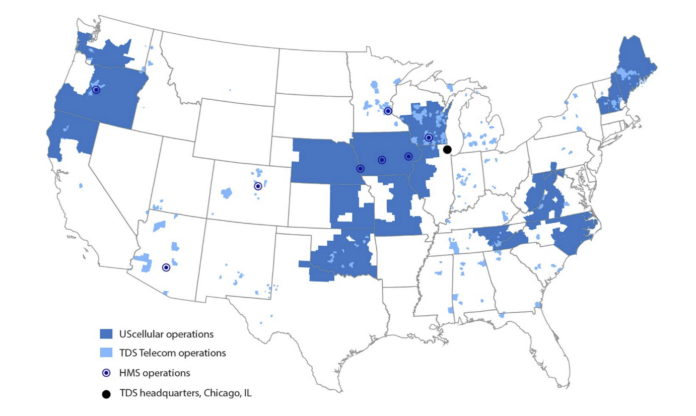

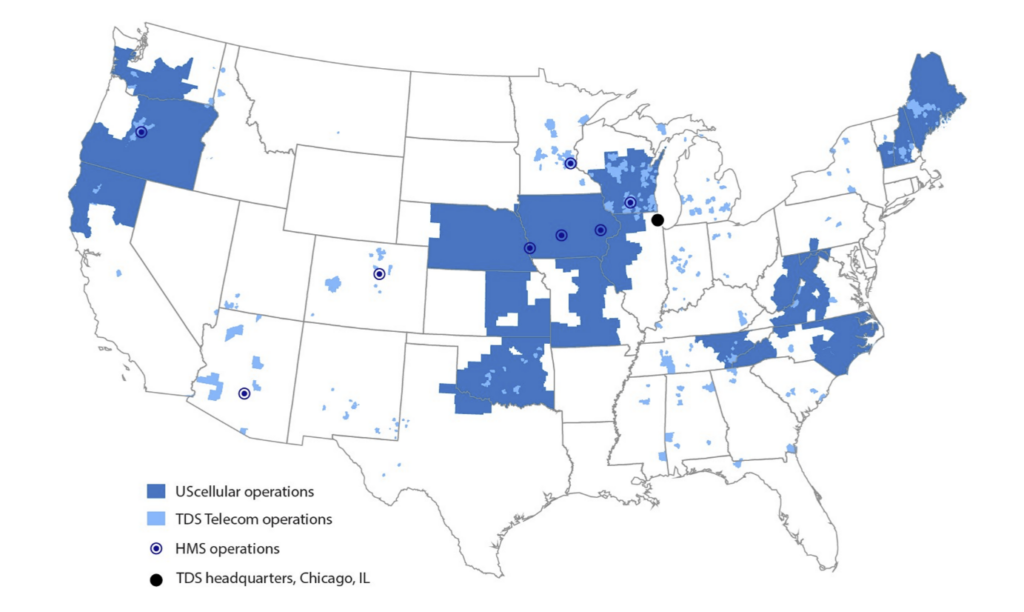

The culmination of the industry’s state was captured through Telephone and Data Systems’ (TDS) announcement on Friday that they were exploring strategic opportunities for their wireless arm, US Cellular (announcement here and Fierce Wireless article here). For those of you who need a primer on the US Cellular, below is a map of their operating territory and the TDS broadband footprint from the latest TDS annual report:

There is some overlap with the traditional telecom operations, but there are also plenty of other TDS Telecom operating territories where there is no overlap whatsoever.

The logical buyer of the US Cellular footprint is one of the Big 3 wireless companies. As we discussed in the last Brief, however, the FTC and DOJ recently jointly released Draft Merger Guidelines. Several would be crossed should the buyer be AT&T, T-Mobile or Verizon. As the Fierce Wireless article indicates, US Cellular still owns more than 4,300 cell towers across this region, giving the buyer of this asset options. Good wireless coverage, combined with a host of operational synergies if a larger carrier bid is victorious, explain the reason why the stock nearly doubled (+93%) on Friday’s news.

One thought that should not be ruled out is a possible bid from Charter. Of the cable companies who are most highly interested in wireless ownership, they would be the one we could see leading a consortium bid. Charter has significant operations in North Carolina, Wisconsin, and Maine and might have enough CBRS and other spectrum to fill in part/ most of the Kansas City Metropolitan Trading Area (MTA). And they have little interest in the TDS wireline asset. Mediacom (Iowa), Suddenlink (West Virginia), and Cox (Nebraska and Oklahoma) might also be interested in joining some sort of consortia.

Another value block that is unlocked is the standalone TDS Telecom asset. Our understanding of the reasoning behind the possible sale of US Cellular was to free up capital to overbuild each of the TDS markets and enable future edge-out activity. However, as a byproduct of conversations concerning the US Cellular asset, some parties might find a reinvigorated TDS asset to be either a terrific complement to an existing broadband provider or a compelling cash machine platform for a private equity-led fiber rollup. TDS still needs a lot of fixing, but likely has a lot of intrinsic value as a standalone company.

We expect this process to play out quickly given the small number of players. Due to synergy differences (roaming cost recapture, operating synergies, etc.), it’s likely that any Big 3 transaction will undergo material federal and state regulatory scrutiny and likely not close until late 2024 or even 2025.

He said, he said (Part 1)

We listened to each of the Telco Top Five earnings conference calls and largely came away with confirmation of the themes outlined in our May and June Briefs:

- AT&T’s preservation strategy is working. Churn levels remain low. Mobility service margin EBITDA improved to 55.5% but remains sluggishly low considering a 3.1% postpaid upgrade rate.

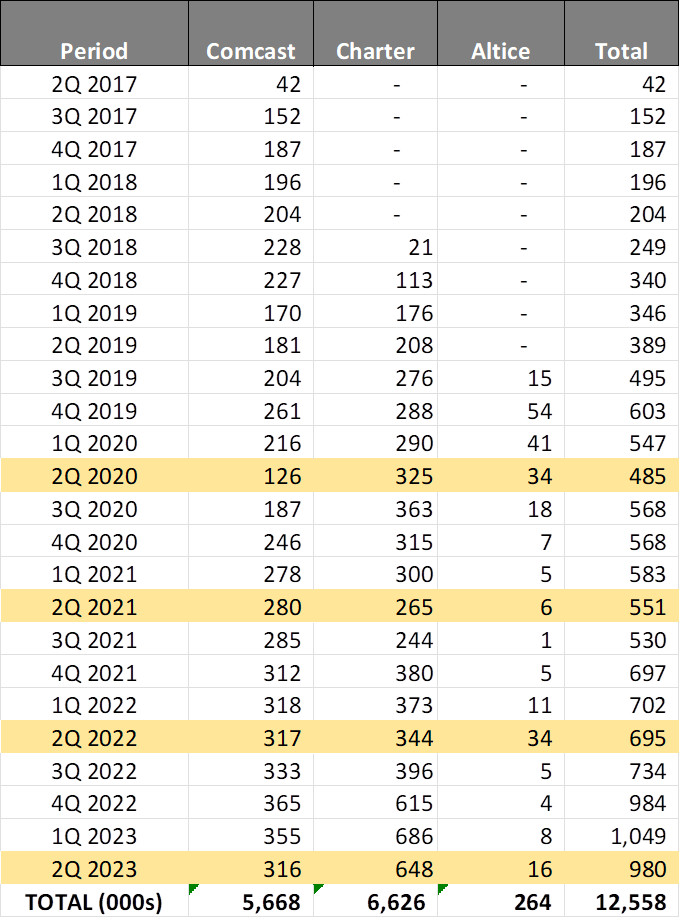

- Cable continues to chip away with improved wireless gains, adding 980K subscribers across Comcast (+316K), Charter (+648K), and Altice (+16K). See nearby chart for historical net additions by quarter. It’s clear from the results that Comcast is more measured in their wireless gross addition approach than Charter. Regardless, both companies have a long runway of addressable passings available (by our rudimentary calculation, their market share remains less than 5%).

- Verizon continues to struggle with Tracfone integration. Big Red lost 1.5 million prepaid retail wireless customers over the last year with 685K coming in 2Q. The situation at Tracfone will become even more tenuous with the re-entry of Dish and other MVNO launches in 2023.

We think that the contribution of cable MVNO revenues and profits to overall service revenue growth at Verizon Wireless (reported through the Consumer unit) has been widely under-reported. With 12.3 million MVNO subscribers generating at least $19/ month in operating income to Verizon, that’s roughly $700 million of quarterly Operating Income contribution. Excluding MVNO performance (or providing a “retail-only” view of the Consumer unit) would show that Verizon’s Consumer unit is slowly melting away.

One more comment on the Consumer Unit: Were it not for the low upgrade environment (which translates into lower equipment subsidies), Verizon would have shown lower EBITDA and Operating Income. EBITDA improved $216 million from 2Q 2022, but $317 million of that figure was from lower equipment subsidies.

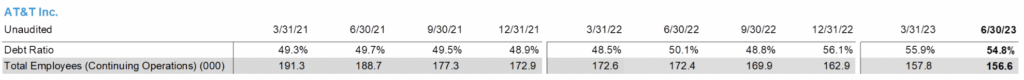

- Speaking of EBITDA, here’s the latest headcount trendline at AT&T:

Nearly 35K fewer employees since the end of March 2021. That’s a run-rate savings to the company of nearly $4 billion, assuming they can right-size office space and get out of certain long-term leases. Adjusted EBITDA, however, has not improved by this amount (only about $1 billion over the last five quarters). Without the headcount reduction savings being reinvested into customer preservation, AT&T might have been in worse condition.

As we have stated in previous Briefs, one might have expected greater job cuts because of Sprint’s merger with T-Mobile. That is not the case, however. T-Mobile had approximately 71,500 employees as of the end of 2Q, down from 78,000 at the time of the merger in 2Q 2020. Since the beginning of 2021, AT&T has shed more than five employees for every one lost at T-Mobile.

- T-Mobile had a stellar quarter, with postpaid monthly phone churn of 0.77% leading the way (likely correlated to an unusually low 2.6% upgrade rate). We thought that T-Mobile subscribers would have had a higher rate based on their 24-month Equipment Installment Plans or EIP (Verizon and AT&T heavily promote 36-month EIP), but that was not the case, and T-Mobile directly benefitted from this trend.

Even with $3.6 billion in stock repurchases over the period, T-Mobile managed to generate an additional $2.1 billion in cash (ending balance of $6.8 billion). And, to everyone’s surprise, Wholesale and other revenues did not collapse in 2Q (down 3% over Q1 and 13% over 2Q 2022). T-Mobile had the strongest performance and is best positioned for market share gains in 2H 2023. Our only question centers around T-Mobile’s capital spending – we think they should be spending more and improving overall coverage and footprint. They appear to be wasting a precious opportunity to erase any doubt about their network quality along highways and in rural regions.

- Charter Communications got the biggest post-earnings bump of any carrier with their stock surging last week (+5.6%). We thought their earnings picture was particularly bright for mobile, where they are on track to grow 2.5-2.8 million customers on an annualized basis for the foreseeable future. One thing mentioned on the earnings call that warrants review is Charter’s exposure to the Affordable Connectivity Plan. Given the high probability that the subsidy will be lowered (probably from $30/ mo. to $20 or $15) as the legislative process unfolds, this might expose the company to lower profitability and/or higher churn. Our view is that Charter is more uniquely exposed to those changes than Comcast or legacy telecom carriers.

Overall, there was something for everyone in this quarter’s earnings reports, with AT&T and Verizon “mixed bags” and Charter, Comcast, and T-Mobile outperforming. We will have more discussion on T-Mobile vs. Comcast in next week’s Brief.

As to the title of this week’s Brief, we were intrigued by the messaging around the nature of Verizon’s MVNO agreement with the cable companies. Here is the question and (Verizon CEO) Hans Vestberg’s response from the Verizon earning call held on Tuesday, July 25:

This implies that Verizon controlled the outcome of any changes to the cable MVNO relationship, and that if cable were to slow down (or even have negative subscriber growth), then Verizon could change the terms. We have some understanding of the current arrangement and can say with confidence that the cable industry has more control than Hans’ statement indicates. This sentiment was reflected by Dave Watson, President and CEO of Comcast Cable:

Based on other comments in the Comcast transcript, it was clear that Comcast also scrutinized Vestberg’s statements. The bottom line is that there is no doubt that cable companies are benefitting from a terrific MVNO deal, and it’s likely that some parts of the deal can be changed as cable continues to grow. But it’s also likely that Comcast (and especially Charter) will use their ability to independently offload traffic as a cudgel should Verizon attempt to exercise any leverage.

In two weeks, we’ll focus on Comcast vs. T-Mobile and see who the strongest provider is headed into the end of 2023. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Go Royals, Sporting Kansas City, and our U.S. Women’s Soccer Team!

Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.