Greetings from Florida (pictured) and Missouri. The last two weeks were full of news, and we will have a larger than average market commentary as a result. Our Sunday Brief analysis will be focused on Verizon as we explore how they emerge from a multi-year rut.

For those of you who are following third quarter earnings releases, here’s a handy quick-reference guide:

(All listings Eastern Daylight Time.) As we indicated previously, we will be posting our initial insights for each Telco Top Five company on the day of their conference call. Per the October 1st Brief (here), we anticipate that cable will post strong wireless results, and that AT&T’s broadband gains will exceed expectations. We think that higher interest rates have suppressed moves and will dampen cable and telco broadband gross additions.

The iPhone 15 launch will be considered at or slightly above expectations, and the year-over-year benefit of this to AT&T and T-Mobile will be more noticeable in fourth quarter metrics. For more on the current iPhone sales/ backlog progress, please go to the availability posts on www.sundaybrief.com.

The fortnight that was

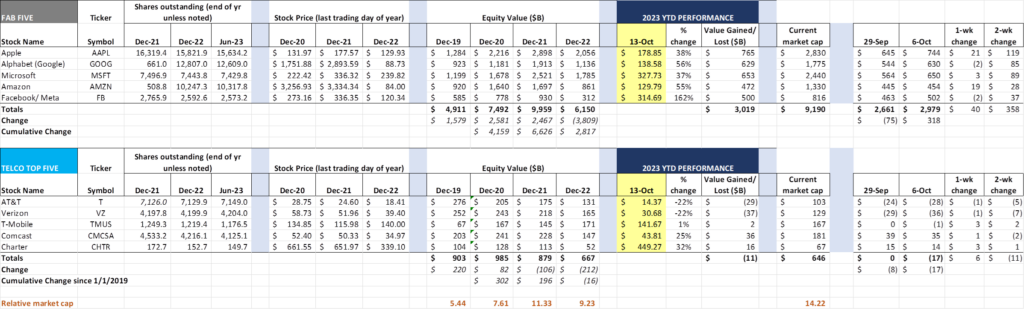

The quarter started strong for the Fab Five, with a total increase month-to-date of $358 billion. The gains are broad for the group with Apple leading the way (+$119 billion). The Telco Top Five has lost $11 billion over the same period. With losses in AT&T, Verizon, and Comcast offsetting marginal gains for T-Mobile and Charter.

The biggest news of the week broke on Friday when the Competition and Markets Authority of Great Britian gave their approval to Microsoft’s $69 billion acquisition of Activision Blizzard (see this New York Times summary for full details). The acquisition closed on Friday (New York Times coverage here). Per the Times, there were several concessions:

“Microsoft made a number of concessions to win approval. The company said it would not block Activision titles from being available for rival consoles such as Sony’s PlayStation. To assuage concerns from British authorities, the company agreed to transfer the cloud streaming licensing rights for all current and new Activision Blizzard games to Ubisoft Entertainment, a rival game publisher in France.”

The cloud streaming concession won over the British authorities because it represents a substantial amount of the video game ecosystem growth. Allowing games to be provided on rival consoles is a pretty significant concession as well. Was the deal worth it after all of the trials and negotiations?

The simple answer is “absolutely.” Microsoft needs to move beyond X-Box and Surface revenues, and the gaming industry provides a valuable platform into the home that few others have. It also is a development-intensive segment of the entertainment industry, leaving ever-higher barriers of entry as games become more intelligent and as Virtual Reality headsets take hold. We would not be surprised to see Microsoft’s next move be to acquire HTC’s virtual headset business (see more on the HTC Vive XR Elite from CNET here) to gain a further advantage against Meta and Apple (who lack the end-to-end interaction between hardware and software).

Meanwhile, the DOJ v. Google trial continued over the last two weeks. One particularly damning unredacted memo released on Friday features now-Google CEO Sundar Pachai expressing reservations over Apple’s plans to feature both Yahoo and Google search results (see first article here from the daily coverage by The Verge) . Pachai states in his email:

While Google’s current CEO might have had reservations in 2007 about insisting on default status, that’s what Google received. What’s interesting is that Apple was actually considering distributing two sets of browsers, but pulled back on this proposition, probably because the economic benefits of Google’s payments outweighed the costs of providing choice. As we stated in the last Brief, the mere thought of Apple being forced by the DOJ to redesign the user experience is bizarre, but the “multi-browser” remedy might work (although supporting several browsers could become unwieldy).

We think that allowing Apple to provide their current remedy (see Macworld article here) actually provides a pro-competitive solution in the future. It would be difficult for us to contemplate a remedy here outside of a moderate financial penalty, but we aren’t exactly sure that the agreement between Google and Apple is illegal. It certainly is no more egregious than AT&T insisting on iPhone exclusivity for 3+ years (article here), or for Apple’s iPhone demands (which included relatively high minimum purchases over the life of the term) from Verizon, Sprint and T-Mobile. How this trial deters future bad behavior is a mystery, and we eagerly await the judge’s reasoning and ruling.

Since our last Brief, AT&T announced that they were exploring options for their DirecTV joint venture with TPG (Bloomberg article here). That the exploratory discussions began after the transfer of the NFL Sunday Ticket rights to YouTube TV is no surprise. Per the Bloomberg article, the Leichtman Research Group estimates that the DirecTV subscriber base was approximately 12.4 million subscribers as of the end of June. We think that figure decreased below 11 million after the NFL season began in September, and this drop is causing a lot of concern with AT&T. For more on the current joint venture structure, here’s AT&T’s original SEC filing. We anticipate that the company will not pursue a “fire sale”. but does have a sense of urgency to redeploy the potential proceeds into fiber and wireless.

In the last Brief, we discussed the new Xumo TV lineup that will begin to be distributed through Best Buy starting next month. In addition to embedding the Xumo operating system into televisions, both Comcast and Charter will be introducing a Xumo “puck” to selected customers. Charter recently announced the following promotion:

This extends and enhances the current Spectrum One promotion. We find the Spectrum TV/ Xumo bundle to be an intriguing offer (Spectrum TV is priced at $60/ mo. + $21-24/ mo. broadcast fee for the first 12 months, rising to $80/ mo. + the broadcast fee starting in month 13). Usually, any streaming box would be positioned to be an alternative to traditional video services (as Comcast positioned Flex prior to Xumo – a free service to all Xfinity Internet customers). This is not the case with this promotion – customers need to commit to an $80-85/ mo. rising to $100-105/ mo. to receive a free piece of equipment that Xumo competitors sell at the local Best Buy for a one-time fee of $30-50.

While this is the first test of Xumo positioning, we think that “free Xumo box with 1 Gbps upgrade” would have been more effective and certainly more in line with management’s comments during the Disney dispute about the relative unimportance of video going forward. Also, it would have kept the focus on mobile additions, which is a more critical long-term measure of Charter’s overall attractiveness. This inaugural Xumo offer is a real head scratcher, and, in our opinion, should be shelved in lieu of more emphasis on Spectrum One.

Keeping with the two themes described above, our final item for this Brief entails a head scratching and now failed merger. On Wednesday, telecom equipment maker Ericsson announced that they were writing down 50% of the goodwill value from their Vonage acquisition. This equates to about $3 billion.

We re-read the original November 2021 announcement (here) to discover clues concerning Ericsson’s reasoning behind the purchase price (which was a hefty 4.4x Vonage’s trailing 12-month sales). Here’s the statement from Ericsson’s CEO, Borge Ekholm:

“The core of our strategy is to build leading mobile networks through technology leadership. This provides the foundation to build an enterprise business. The acquisition of Vonage is the next step in delivering on that strategic priority. Vonage gives us a platform to help our customers monetize the investments in the network, benefitting developers and businesses. Imagine putting the power and capabilities of 5G, the biggest global innovation platform, at the fingertips of developers. Then back it with Vonage’s advanced capabilities, in a world of 8 billion connected devices. Today we are making that possible.”

We paraphrase above rationale as “The Vonage acquisition extends our wireless network expertise to enterprises.” This might be correct and acquiring Vonage might be necessary to create value for Ericsson’s shareholders, but why pay 4.4x sales to acquire a good but not “best in class” API developer? What dynamics are shaping the total addressable market size? Which mega-cap technology stocks also have their eyes on these interfaces (namely Microsoft, who purchased Metaswitch for $270 million and Affirmed Networks for slightly more than $1 billion)? There were a lot of clouded assumptions during COVID and we think Ericsson was poorly advised on this transaction. It will be interesting to see how they continue to grow their enterprise segment – using acquisitions might not be as palatable to their Board after the Vonage saga.

Same As it Ever Was (3Q Earnings Preview – Part 3)?

We are ending our 3Q earnings preview with an assessment of Verizon. Specifically, we are challenging this conventional wisdom:

Same as it Ever Was #4: Verizon will be able to balance its consumer wireless postpaid phone acquisition strategy, growing both their retail and wholesale bases. This two-pronged strategy will create optimum financial results for the company. Verizon’s offers will lure AT&T and T-Mobile customers while not disturbing the ever-growing wholesale cable subscriber base.

Verizon is a large company facing challenges across many stakeholders. Equity investors continue to expect growth and increased dividends. Bondholders expect to be paid interest and principal on time. Customers expect a “best in USA” network. Employees expect management transperancy and leadership in an increasingly competitive environment.

To continue to fund a “best in USA” network (e.g., their $45+billion investment in C-Band spectrum) and increase dividend payments, Verizon needed a different type of investor. The cable companies leveraged Verizon’s network strength to create a profitable MVNO competitor. (Developments in bit prioritization also helped Verizon’s profitability and cable’s cost structure). Their long-term commitment created a cash flow stream that is funding the interest and principal payments for spectrum and coverage.

The cable MVNOs are now growing nicely with a broadening lineup of plans and pricing. Some of those plans are attractive to existing Verizon retail customers (particularly those with 1-2 lines in their household). Others (specifically the “by the Gig” offers) are going to be attractive to Verizon’s existing Tracfone base.

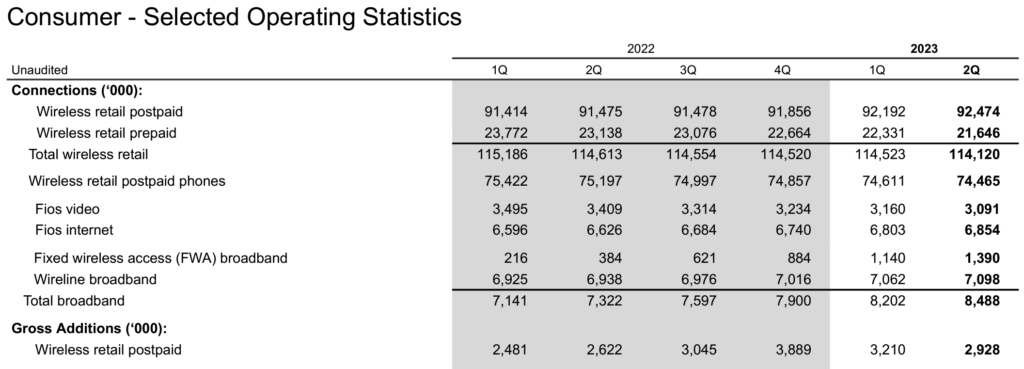

The following table from Verizon’s 2Q earnings release helps us understand how many retail consumers use the Verizon network today:

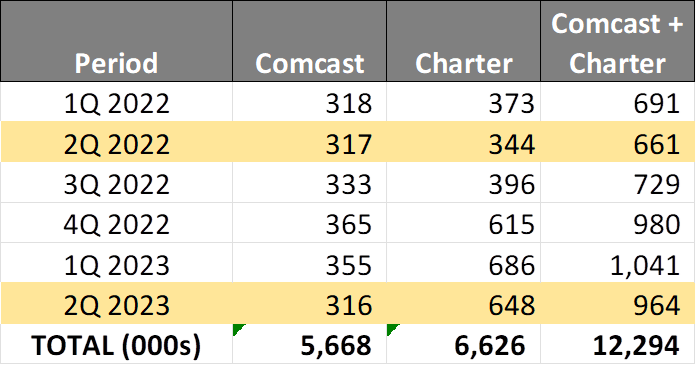

While the consumer retail unit has lost slightly more than 1 million retail connections since the beginning of 2022, cable has more than made up for the difference. Here is the growth of cable (Comcast and Charter only) since the beginning of 2022:

Cable net additions of 5+ million (sum of the last six quarters of growth) have more than offset the wireless retail losses at Verizon and leaves the company with more than 119 million retail and wholesale connections (note – while there are some small business customers at the cable MVNO, the vast majority are residential and all of the cable wholesale revenues are booked through Verizon’s consumer unit). Add a growing Verizon Business to this figure and the network overall now supports ~150 million connections. That’s a lot of radios, towers, and circuits.

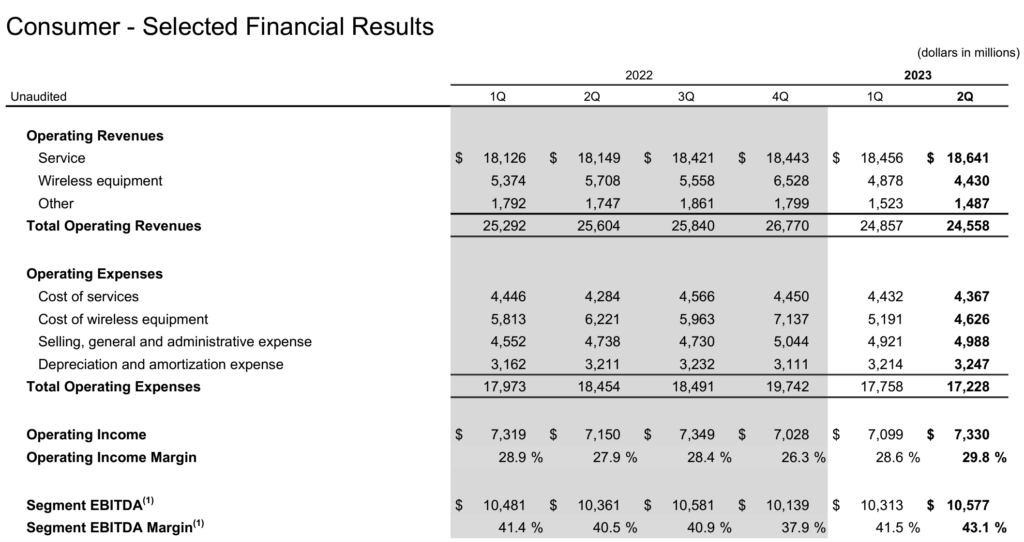

Despite all of the subscriber growth, revenues have not kept pace. Wireless service revenues (which include wholesale) have grown a mere $545 million over the last six quarters and EBITDA is flat for the consumer unit over the period. The details below are from Verizon’s 2Q earnings release:

The Consumer unit’s operating income has barely budged (a generous comment considering the remarkable turnaround from Q1 to Q2 2023) and EBITDA is up less than 1%, yet cable’s wholesale customer base over the same period has grown by more than 5 million users. This profitability malaise cannot be attribured to FiOS video or phone losses. Was the cable MVNO worthwhile to Verizon’s shareholders? Did the cable “hedge” mask retail mistakes in 2022 and early 2023? What is the true postpaid retail wireless profitability? Many questions about Verizon CEO Hans Vestberg’s management need to be asked by disgruntled shareholders.

Verizon’s two-pronged retail approach to acquire wireless phone share is as follows:

Prong #1: Use new C-Band capacity to launch a price war at the low end (as we are currently seeing with the Visible brand – see YouTube ad here). Target Metro by T-Mobile but understand that there will be some movement back to Verizon from some Comcast and Spectrum price-sensitive users.

Prong #2: Use the iPhone launch and Holiday season to run phone-centric offers (perhaps with generous trade-in allowances) and lure away T-Mobile and AT&T families where Verizon’s network is significantly superior. Verizon has described at several investor conferences how they are decentralizing marketing and promotion. The impact of that process change has not been felt yet, but there are still nine weeks remaining in the Holiday selling season.

It’s hard to imagine Verizon will be successful on either front. Prepaid requires a level of customer attention (especially with respect to older devices and billing/ collections) not seen in the wireless postpaid phone business. And iPhone promotions are usually quickly matched by competitors even if their network in that market is subpar.

Meanwhile, each of these activities reduces cable’s addressable gross additions market and drives up their customer acquisition costs. Bottom line: Our guess is that we end up with a bleak Q4 and Q1 readout and Verizon changes their investment strategy to “less retail, more wholesale.” This helps profitability but shines a brighter spotlight on the growth and long-term sustainability of the cable relationship And murmurs concerning management’s tactics turn into full-throttled calls for heads. The picture is bleak unless performance is remarkably improved by the end of 2023.

That’s it for this week’s Brief. Starting this Thursday, look for “short takes” on the Sunday Brief website. Also, we will have the normal interim Brief and the Apple iPhone 15 Pro and Pro Max updates next weekend. And in two weeks, we will have a lot of earnings to digest. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).