Greetings from Missouri, where, as our multi-color weather radar picture clearly shows, we are experiencing the “summer-to-winter” weather change this weekend. And just on time, the last two weeks have been full of earnings news, some of which was received as frostily as November mornings in the Midwest.

This week, we will have a normal market commentary followed by a topic-focused earnings analysis. We have chosen the “build cycle” as the measuring rod for this Brief as we believe it explains a lot about earnings sensitivity and quickly summarizes where each of the Telco Top Five are in their attempts to grow coverage and capacity.

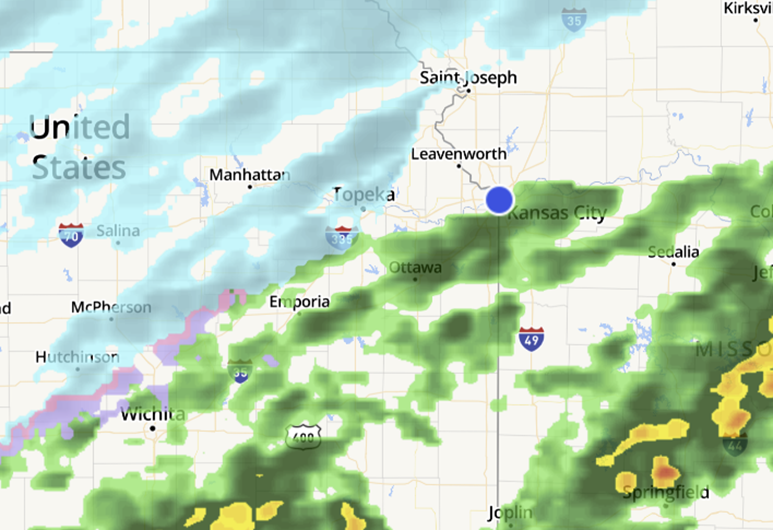

For those of you who are not aware, Apple is the only company of the ten we track that has not reported 3Q earnings. After all companies have reported, we will update share counts, net debt balances, etc. When we distribute next weekend’s interim Brief (available online at www.sundaybrief.com), each of those fields will be updated.

Also, there is still a lot of movement with the iPhone 15 Pro and Pro Max. We will likely run two more updates (later today and next weekend) as we believe that all of the backlog issues will be resolved by then. They are also available on the Sunday Brief website.

The fortnight that was

The catalyst for 3Q earnings stock appreciation was revenue growth. Beating analysts’ earnings estimates for the current quarter was not enough. And, as we saw in the case of Google Cloud, even 22% annual growth isn’t good news if another competitor (Microsoft) is growing their reveues by 29%. As a result of that one miss, Google lost nearly $168 billion since their earnings release (and Microsoft and Amazon increased their market capitalizations over the same period).

Meanwhile, 3Q US Gross Domestic Product growth was 4.9% (release here), with strong durable goods consumption (+7.6%) driving the way. This hotter than expected result drove the 10-year Treasury above 5% for part of last week before ending at 4.845% on Friday (see nearby chart from CNBC). The yield curve has certainly flattened as longer-term durations have risen to levels not seen in nearly two decades.

These higher yields present an alternative to many dividend-yielding stocks, putting pressure on increased revenue and earnings growth. Those companies (like Microsoft and Google) who have large internal cash balances can self-fund that growth, while those who need to go to the banking community face greater scrutiny. This is largely the case for the debt-loving telecommunications industry.

Overall, the Fab Five lost $222 billion and $410 billion over the last one and two weeks while the Telco Top Five lost $15 and $16 billion over the same one and two week periods. The worst performing stock in the Fab Five (Apple) is up 29% so far in 2023, while the worst performing stock in the Telco Top Five (AT&T) is down 20%.

On Friday, there was a key revelation (The Verge article here) in the DOJ v. Google trial – in 2021, Google paid $26.3 billion to various browser providers (including Apple, Mozilla, Samsung, and others) to be the default search engine. Viewed against a backdrop of 2021 revenues ($258 billion for 2021 – more here), it’s neither significant nor material (still a big line item, however). Even when just Google ad revenue for 2021 is considered ($209 billion), it’s still a relatively low 12.5% of revenues.

The point made by the prosecution, however, is that Google is the only one earning $209 billion in ad revenues and that increasing default fees paid to Apple and others created an insurmountable barrier to entry. Now that Google is starting its defense, expect to see additional competitive information emerge. In Google’s mind (see The Verge article here), Google is fighting for relevance against TikTok, ChatGPT and other social media platforms. Kudos to The Verge for their daily coverage of the trial – if the prosecution is successful, the remedy could alter the structure of the US technology industry.

Separately, M&A and shareholder activism has picked up over the last two weeks in the broadband world:

- Monday, October 16: Searchlight Capital and the British Columbia Investment Management Corporation announce that they will be teaming up to purchase Consolidated Communications for $4.70 per share (announcement here);

- Tuesday, October 17: Jana Partners disclosed a large and growing stake in Frontier Communications and called for the company to be sold to a strategic buyer or private equity (Reuters article here). The hedge fund indicated that they had the support of a “large” telecommunications company, which many suspected was T-Mobile. Mike Sievert, T-Mobile’s CEO, slayed that rumor in their conference call the next day. More on his comments about fiber below;

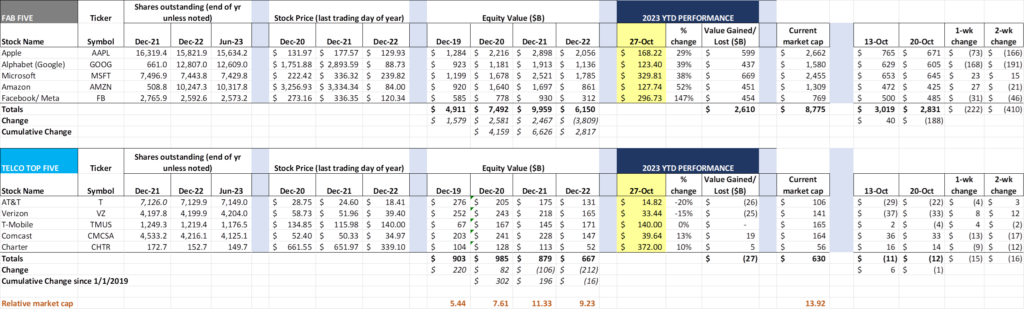

- Tuesday, October 24: ShenTel announced that they plan to acquire Horizon Telecom for $305 million in cash and $80 million of Shentel common stock (news release here – map of the two networks from the Shentel management presentation is nearby). The purchase price represents ~ 6x Horizon’s 2022 revenues.

Even with rising interest rates, transactions are beginning to emerge and FOMO is taking hold. This is likely to be the beginning of a steady stream of rumors, with some culminating in announcements.

Finally, last week, Nokia announced that they would be laying off 16% of their global workforce, expecting about 72,000 remaining after the action. As capital budgets are trimmed, profits at both Ericsson and Nokia are falling quickly. More about Nokia’s woes in this CNBC analysis.

Third quarter earnings review (part 1)—the build cycle

This is the first time since early 2021 that we have had the opportunity to really dig into each word spoken in quarterly earnings. As many of you know, we posted our initial thoughts from each of the Telco Top Five earnings to the website (except Charter’s Friday earnings call – we will discuss that in some detail below). If you did not catch those posts, they are here and here and here and here.

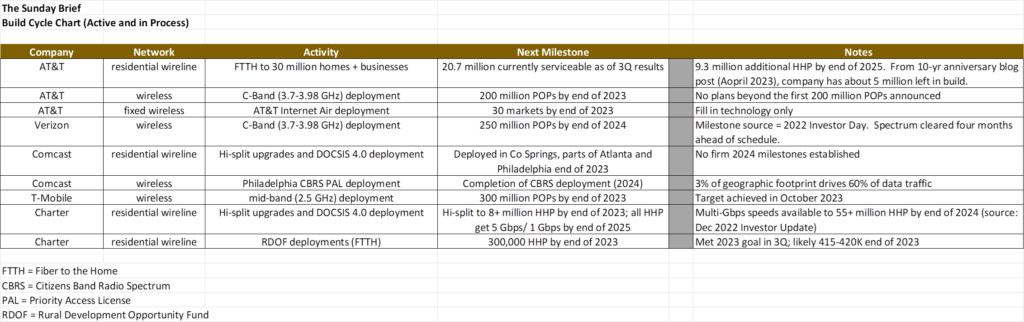

The telecommunications industry is in the midst of two build cycles. Wireless companies are continuing to expand their spectrum reach (C-Band being the most popular) and wireline companies are extending fiber closer to the customer (and, in the case of AT&T, Brightspeed, Lumen, Verizon and dozens of smaller providers, to the home). There are other projects, such as AT&T’s Internet Air and Comcast’s CBRS deployments, which are company specific, but wireless mid-band coverage and increased local fiber deployment are the two largest build cycles in the telecom industry today.

Not surprisingly, each company is at a different point in that build cycle. And as a result, some companies are deep in the capital spending trench. AT&T (and, to a lesser extent, Verizon) has both C-Band deployments and local fiber upgrades deepening that trench. Everyone is spending capital, but each company is at a different place in the cycle.

The following table outlines some of the key builds each company has announced and discussed:

This is not an all-inclusive project chart, but gives an indication of who has the most “build cycle” left. For example, Verizon has stated that they will build an additional 500,000 Fios passings this year, but that represents a mere 3-4% growth in the base (per the company, they covered around 15.2 million passings with fiber at the end of September).

Clearly AT&T is going to be busy as their total marketable footprint for fiber will increase by ~50% in the next nine quarters. Today that represents a cash flow drain, but 9 million additional homes can yield a lot of free cash flow, and AT&T’s ARPU for fiber rose by 9% year-over-year (it appears to be a very attractive and valuable product).

Cable also has very big upgrades to their plant coming over the next 2-3 years with hi-split and DOCSIS 4.0 upgrades. Today, they are in the early innings of that upgrade cycle, but, as both Comcast and Charter have indicated, it still leverages the existing HFC plant going into each home (we look forward to seeing the results on a broad scale vs. traditional FTTH XGPS-PON architectures).

Many analysts were concerned that Charter was prioritizing their RDOF acceleration over their plant upgrades. It’s important to note that a lot of the equipment needed to fully deploy hi-split is going through the same supply chain constraints seen in the post-COVID era. While it might shift the equation to (main competitor) AT&T in some of the Texas markets (assuming Ma Bell can meet a 30 million end of 2025 target), Charter is making a good decision to advance their rural fiber build just as states are deciding which company is best capable of meeting aggressive BEAD deployment goals. We will have more to say about Charter and Comcast’s earnings announcements in the next Brief, but suffice it to say, we thought the selloffs in each stock were unwarranted.

“Ulf and team now that they’ve reached 300 million people with mid-band Ultra Capacity 5G are now setting about the task of deploying all of our spectrum resources to that base. And we’re only just beginning. We have the bulk of our 2.5 gigahertz now rolling out, but our target is to be at 200 megahertz around the end of this year deployed against the 300 million people. And then more room to run next year because, as I said, we have Auction 108 proceeds still pending, we have C-band that we haven’t deployed, 3.45 as well as re-farming potential from spectrum being used for LTE right now like AWS.… We, right now, at a broad scale, are not looking at alternatives to that from a wireless standpoint…. We remain open-minded to whether there are techniques that would allow us to deploy capital specifically for 5G broadband and make a great return for you. But so far, we haven’t drawn any conclusions that, that’s a scalable opportunity for us.”

T-Mobile is now in capacity augment mode. That’s a great place to be as a share taker, and one of the many reasons why they recently reignited their “four new lines for $100” promotion with the opportunity to get four iPhone 15 devices for free (with eligible trade-in).

Bottom line: Different build cycle positions drive new product and marketing developments. Cable has to touch every customer over the next 2-3 years – no small task. Verizon and AT&T will need to continue to deploy mid-band spectrum to match T-Mobile – no small task. T-Mobile needs to augment capacity in the right places to take profitable market share from Verizon (including wholesale) and AT&T. Everyone is at a different point, but capacity augments tend to be easier than adding new high bandwidth capacity.

There are plenty of additional topics for future Briefs. T-Mobile had some provacative comments about fiber, and both Comcast and Charter had plenty to say about DTC, Xumo, and Disney. We will begin to unpack these comments in upcoming Briefs. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).