Greetings from Missouri, Texas, and Louisiana. Pictured is the state capitol building for the Bayou State (full history here). This week’s Brief will focus on a wide-ranging interview with Liberty Media’s John Malone. Rather than dive into earnings results, we thought that John’s insights (especially given the prescience of his 2021 thoughts) warranted a Brief.

Two weeks from today is Thanksgiving weekend which we hope you will be spending with friends and family. As a result, we will postpone our Brief to December 3rd and continue with our bi-weekly schedule then. We will publish our CES preview on Saturday, December 30th, and look forward to seeing many of you at our annual CES dinner (time and place TBD – please email us at sundaybrief@gmail.com if you are interested in attending).

One additional note – we will conclude our Apple iPhone 15 Pro and iPhone 15 Pro Max analysis later today (last Sunday’s post is here). If you are considering purchasing one of these models for the Holidays, supplies should be readily available. We view minimal backlogs as a positive catalyst for the wireless carriers (including Comcast and Charter) after three COVID-influenced years of choppy availability.

The fortnight that was

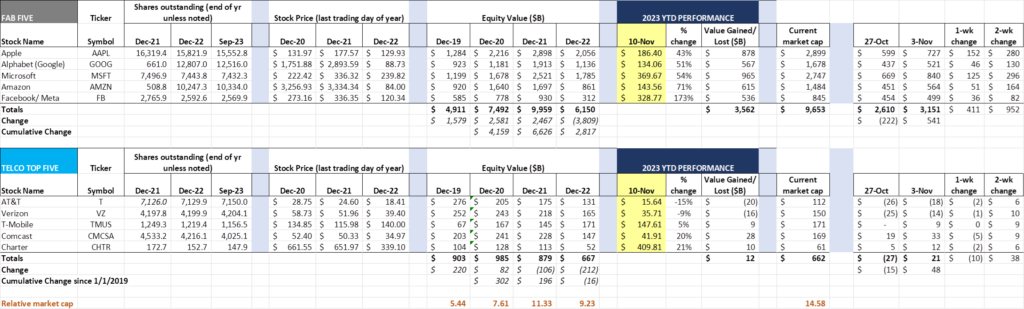

The bulls have been running the last two weeks and the Fab Five disproportionately benefited. Since our last Brief, they have gained a record-setting $952 billion in value. This exceeds any two-week COVID-related “pop back”, or any other period for that matter. As we frequently mention, the worst year-to-date performing stock among the Fab Five is Apple, up a mere 43% or $878 billion. The Cupertino giant is once again knocking on the door of a $3 trillion market cap.

Meanwhile, Microsoft has gained nearly $1 trillion in value this year, and Amazon a cool $615 billion. The group as a whole still has not recouped all of the 2022 losses (although Microsoft and Apple market capitalizations have individually). Since the beginning of 2019, however, they have added more than $6.3 trillion in total value. That’s a lot of wealth creation, even as interest rates are rising.

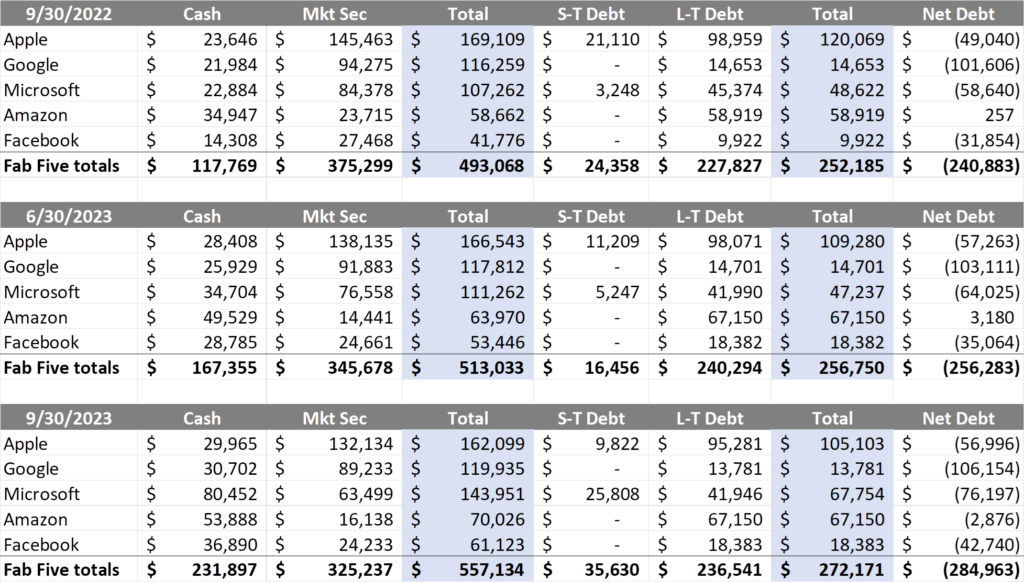

Because Apple had not posted their earnings as of the last Brief, we did not have everyone’s balance sheets to analyze net debt levels for each of the Fab Five. Here’s the updated table as compared to the previous quarter and the year-ago quarter:

As we discussed in last week’s interim Brief (here), the only anomaly in the current figures is Microsoft, who appears to have taken on some short-term debt in September to fund their Activision Blizzard acquisition (which closed mid-October). Normalizing for that increase in cash alone brings the total cash + marketable securities level in line with the previous and year-ago quarter levels.

The mix of cash to total liquid assets is also interesting and a reflection of 5+% short-term interest rates. Nearby is a 5-year yield chart from CNBC of the 2-year Treasury bill (our best proxy for changes in the short-term risk free rate). A year ago, short-term interest rates were yielding 3.0-3.5% (and rising quickly); now they are yielding 5.0-5.5%. The 5% threshold might have been the trigger for reevaluation of each company’s investment policy.

Removing the incremental $25 billion from Microsoft’s cash balance, total cash balances rose 24%, and on a year-over-year basis rose 75%. That represents a material change in each of the Fab Five’s cash management strategies and might explain some of the recent equity volatility (easier to take advantage of market dips like the one we had in late September/ early October).

Cash levels continue to build. Our hunch is that the Fab Five are waiting for an administration change that will be more friendly to M&A activity while many of them continue to buy back stock. Note: if the executive branch remains in Democrat hands, we would look for most of the Fab Five to be more aggressive in their dividend and share repurchase activity.

One exception to the dividend/ buyback prediction will be Amazon, who continues to expand their health care business unit. They announced an additional Prime benefit this week that capitalizes on their One Medical acquisition (which closed in Feb 2023). For $9/mo. (and $6/mo. for each additional subscriber), Prime members can get unlimited 24/7 on-demand virtual care as well as access to on-site care in many cities (see markets here). This service provides a less expensive and more convenient alternative to local clinics or “doc in a box” which are being increasingly used for lesser ailments that may require prescriptions (e.g., that bad case of poison ivy, or pinkeye, or the flu). Combined with the continued progress Amazon is making on their Pharmacy (and particularly their RxPass product – see nearby picture), they are beginning to provide a holistic solution for the entire health care system.

This service provides a less expensive and more convenient alternative to local clinics or “doc in a box” which are being increasingly used for lesser ailments that may require prescriptions (e.g., that bad case of poison ivy, or pinkeye, or the flu). Combined with the continued progress Amazon is making on their Pharmacy (and particularly their RxPass product – see nearby picture), they are beginning to provide a holistic solution for the entire health care system.

Amazon’s health care moves deserve particular attention because they are materially different from their Fab Five peers. Apple has made great strides with applications and the Apple Watch but lacks the care provider network that Amazon is building. The complementary nature of Apple’s and Amazon’s efforts reflect the attractiveness of this extremely large addressable market, yet also reflect the barriers to entry cemented by decades of insurance processes and subsidies.

In other news, The Wall Street Journal reported on Friday that Verizon is going to be offering a bundled Netflix + Max bundle for $10/ mo. as a part of their myPlan offering. For those of you who are not familiar with Verizon’s revamp, new and existing customers can customize their service plan to include many non-traditional telecom services. Currently, the myPlan non-telecom “adders” consist of:

- Hulu/ Disney+/ ESPN+ bundle ($10/mo.)

- Apple One: Music, TV+, Arcade, iCloud ($10/mo.)

- Walmart+ ($10/ mo.)

- Apple Music Family ($10/ mo.)

MyPlan customers can also purchase video streaming at a discount ($15/mo. credit for $10). The Netflix/ Max bundle should fit in nicely with Disney and Apple offerings.

We find that Max addition particularly interesting as HBO, a key content contributor to Max, was previously owned by AT&T (and now a separate company, Warner Bros Discovery). Netflix is a current component of the T-Mobile Go5G Next, Go5G Plus, and Go5G plans.

We don’t think that the new bundle will significantly impact the fourth quarter selling season (trade-in and other promotions are already in full force), but Verizon’s myPlan additions are blurring the lines with their competitors while keeping the Disney+ bundle exclusively on Big Red (at least for now).

Our hunch is that AT&T will not follow suit, but instead focus on their wireless/ fiber bundle discounts to maximize returns. We think that the rift between Verizon and Amazon (see the June 3rd Brief here for more) is not healed and that T-Mobile is missing out on a cross-town partnership to compete against Big Red.

Finally, the biggest telecom news over the last fortnight not directly related to the Telco Top Five was the FCC announcement of the Enhanced ACAM recipients (announcement here). The Alternative Connect America Model is an FCC-administered plan that rewards rate-of-return (mostly very rural) telecommunications carriers who agree to certain broadband buildouts for a series of annual payments (more on the evolution of this program from USAC here). In the link above there is a schedule of the anticipated payments by carrier as well as buildout requirements expected over the next four years.

Enhanced ACAM approvals are significant for several reasons:

- They bypass the bidding process that BEAD would have enabled

- The payments are intended to cover 100% of the cost to build 100/20 to each home in the exchange territory

- Building can start in January when payments begin (engineering can start now). BEAD builds will not begin until 3Q 2024 at the earliest (AT&T CEO John Stankey indicated on their most recent conference call that they are not planning any BEAD construction until 2025)

- Per the NITA BEAD guidelines, there can be no “double dipping” – BEAD funds cannot be used in Enhanced ACAM areas. Note: Enhanced ACAM funds cannot be used for areas already covered under CAF II or RDOF build programs

- Because this is a nationally administered plan, it avoids the potential of state-specific labor, letter of credit or other requirements (and, for companies like TDS who operate in many states, it keeps state-specific compliance differences to a minimum)

- Due to the obligation to provide services to 100% of the exchange area, fiber will be pushed further into the countryside. This should position the Enhanced ACAM recipient to serve the (likely rural) areas adjacent to the exchange boundary, allowing state-specific BEAD funds to be stretched even further.

The net of this is that $18 billion in additional funding will be provided by the FCC to build an additional 703,000 homes with 100 Mbps/ 20 Mbps service. That equates to slightly more than $25,000 per connection. The question now becomes “Will states need to give back some of their BEAD money for overlapping areas?” We think that answer is “no” and, as a result, the $42 billion for BEAD with a 30% private company match + $18 billion for Enhanced ACAM now blooms into a $70-80 billion initiative. That’s one heck of a grant pool that should have a meaningful impact on things like Amazon Prime’s remote health care efforts discussed earlier.

We also think that this additional funding (and others, such as the upcoming USDA ReConnect round) makes it harder for traditional fixed wireless providers to make the case for less fiber. Under the “no one ever got voted out of office for deploying longer-lasting roads” mantra, it would be difficult for us to see the states, many of whom are flush with funds, recommending a higher percentage of fixed wireless deployments.

Like the ever-shifting NTIA guidelines, the Enhanced ACAM rules are going to go through some changes over the next few quarters. But 90+% of the territories and rules are firm, and this announcement is going to alter the BEAD process,

The CNBC John Malone interview – explained and deciphered (2023 edition)

Over a 2021 Thanksgiving weekend Brief, we analyzed David Faber’s interview of cable pioneer and Liberty Global Chairman John Malone (Brief is here; full interview still out on CNBC for free here). Few individuals have the broad, historical perspective of John, and we think that a 60-minute interview warrants special attention.

Excerpts of the current recent interview are here, here and here. The full interview is now a part of a CNBC series called “Leaders” which you can record through your favorite streaming or linear cable service, or it’s also available in its entirety through CNBC’s premium PRO service.

For those of you who are not familiar with Liberty Media and their holdings, a good summary can be found here. From the company’s 26% holding in Charter Communications to their investments in Formula 1 Racing, TripAdvisor and the Atlanta Braves, their holdings span the spectrum of the telecommunications industry. In addition to that, the Malone family is currently the second largest land owner in the United States (see The Land Report 2022 winter edition here).

This interview is wide-ranging and thorough – the two discussion points below capture a small portion of David Faber’s interview. Malone packs no punches when is comes to his thoughts on the role of net neutrality, big tech, and his cable investments (full text from CNBC here):

“So whether the economics of sports, continuing to drive broadcast, the anomaly is that that network neutrality, the government policy creates this, this crazy world in which Amazon can go buy Thursday Night Football for multiples of what the industry has been paying and for the distributors like Charter or Comcast instead of being one linear channel which consumes, you know, which is everywhere and consumes perhaps 1,000th of the 1% of the capacity of the network, suddenly it becomes 30 million streams, okay, on Thursday night, essentially choking the networks with and forcing the distribution companies to spend a lot of money on expanding capacity rapidly. And yet, it costs Amazon nothing for the transport. So what we’ve created here is an open path for big tech to essentially decimate [the traditional broadcast model].”

To paraphrase this lengthy quote, more capacity is needed for a small fraction of the week’s bandwidth usage because of an individualized streaming experience that Charter and other companies are footing the bill for. This sounds like the “American Idol” calling moments for both the local telephone and long-distance voice networks twenty years ago (in the early/ pre-app years of the show, the audience could call an IVR and vote). In that instance, however, the company hosting the 800 number had to pay for the termination of that call to their systems. As John indicates, outside of increasing AWS server capacity at carrier hotel and other Amazon Outpost sites that already exist for Prime Video needs, there really aren’t any variable costs for Amazon.

Since Malone does not see an end to big tech’s acquisition of national sports rights, he suggests that there will need to be some sort of “regulatory relief.” We think that is wishful thinking.

On the role of fiber and wireless in the broadband space, Malone is equally direct:

“MALONE: There’s going to be an enormous appetite for capacity on the network. And that’s us. Wireless can’t do that. So this fixed wireless thing that has a caused a little—

FABER: It’s caused a hiccup in broadband sub additions—

MALONE: And valuations.

FABER: And valuations.

MALONE: That’s just not going to be able to handle. They don’t have enough spectrum. They’re not gonna have the capacity to handle this massive growth in streaming. And therefore, the broadband companies will at worst be a duopoly with the incumbents who are trying to overbuild. Now the overbuilders, in my opinion will mostly go broke because they can’t get a return at today’s interest rates capital costs. They’re just not attractive so—

FABER: Do you include AT&T as an overbuilder?

MALONE: Yes, yeah. They made a commitment in order to get some deals done that they were going to build, overbuild themselves with fiber, and they’ve done some of that. And so I think all the business models that Brian has, that Rutledge had, were all based upon expectation of a fiber competitor on some portion of the footprint. I think that has all slowed down even with the incumbents because of their other financial pressures. So, you know for Verizon or AT&T, they’re paying horrendous dividend ratios right now to support their stocks.”

This exchange is a little more concerning and echoes sentiments from Charter’s CEO Chris Winfrey on recent earnings calls. There is no doubt that the cost of capital is going up (see our earlier comment on the 2-year note). But AT&T’s 3Q results (see our previous interim Brief comments here) showed us that they can grow fiber ARPUs by 8.9% while they are growing fiber units by 16%. And they are doing it during one of the slowest moving seasons in real estate history.

We are not huge fans of AT&T but know a (nearly) bankrupt company when we see it (see our comments on the telecom “undercard” in previous Briefs). AT&T has issues (including growing a dividend when there are needs for any free cash flow to improve the company’s wireless and wired holdings), but they are not on the verge of going bankrupt. Our view is that they are likely earning a pre-tax cash flow yield (period FTTH EBITDA/ total FTTH capital deployed) on their current fiber footprint in the high teens. That is likely multi-hundreds of basis points higher than their cost of capital.

The big factor Malone misses is the BEAD, Enhanced ACAM, ReConnect, and other monies that will be flooding the market over the next several years. In a world where the only financial sources are commercial banks, his logic is probably correct, but this is not that world. In fact, unless a vast amount of government grants are won by the cable broadband providers, it will likely be one in which the borrowed (versus granted) capital costs per home passed will likely be less than those experienced in privately-funded cable edge-outs.

There is so much more to discuss here (e.g., Malone’s plan for Disney – sell to Apple, and spin off ESPN to private equity), but we have reached our word limit. On December 3, we will start our “Biggest events of 2023” edition. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Go Chiefs, Davidson College Men’s Basketball, and Sporting KC!