LitePoint exec: ‘This is the first year we’ve ramped Wi-Fi 6E; it’s shipping in high volumes’

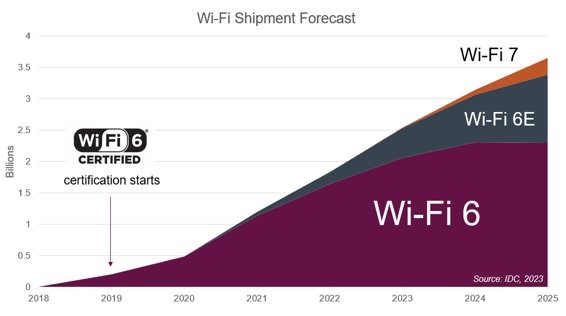

According to IDC Research, 3.8 billion Wi-Fi devices are forecast to ship in 2023 alone, and of those, 473 million are expected to be Wi-Fi 6E devices. The firm further expects more than 18% of all Wi-Fi 6 device shipments to be Wi-Fi 6E in 2023, a ratio that will grow to 32% in 2025. Below are four key drivers behind the growth that Wi-Fi 6E has experienced this year.

Post-COVID enterprise upgrade cycle

During the height of the COVID-19 pandemic, work and school took place largely from home, resulting in unprecedented traffic volume as usage shifted from enterprise and education networks to primarily consumer broadband networks. However, with pandemic precautions mostly behind us, this past year has been characterized by waves of workers and students returning to offices and schools. According to Adam Smith, LitePoint’s director of marketing, this has led to a “very weird” year for Wi-Fi, but has also contributed to a notable enterprise Wi-Fi upgrade cycle.

“Smartphones are down, PCs are way down, consumer APs have fallen off a cliff. Wi-Fi companies are struggling this year, but one of the bright spots we’ve seen is in enterprise,” he said.

Some AP companies are even claiming record shipments this year, he went on, adding, though, that these shipments are largely Wi-Fi 6E products. “I would say this is the first year we’ve ramped Wi-Fi 6E; it’s shipping in high volumes. Almost everything that we’re dealing with in production at this point is Wi-Fi 6E-based.”

Regulatory progress in the U.S.

Automated Frequency Coordination

In order for unlicensed Wi-Fi 7 devices to play nice in the 6 GHz band with the licensed users already occupying that band, such as fixed satellite providers, the FCC established Automated Frequency Coordination (AFC), a spectrum use coordination system designed specifically for 6 GHz operation.

To avoid potential interference with existing 6 GHz incumbents, the FCC defined two types of device classifications with different transmit power rules for Wi-Fi devices operating on the band: low power access points (APs) for indoor Wi-Fi and standard power APs that can be used indoors and outdoors. Standard power APs, particularly when used outdoors, are the most likely to interfere with existing 6 GHz users in the area, and therefore, AFC will prove most valuable in outdoor scenarios.

In November 2022, the FCC’s Office of Engineering and Technology announced the conditional approval of thirteen proposed AFC database systems in preparation for the testing phase of 6 GHz Wi-Fi operations, and according to Christopher Szymanski, director of product marketing for Broadcom’s Wireless Communications Division, the FCC is now finalizing these standard power rules. “They are currently going through approvals on geolocation solutions and companies are in the finishing stretch of getting AFC operator authorization. AFC-enabled Standard Power Wi-Fi 7 will turbo charge adoption in enterprises where they need flexibility that the low-power indoor rules do not provide,” he said.

It’s worth noting, however, that AFC is only relevant to the U.S. This means that for those other countries that have opened up the 6 GHz band for Wi-Fi operation — like many in Europe, for instance — there is currently no such mechanism, and these low-power problems can be expected to persist in the Wi-Fi 7 era.

As Jeorg Koepp, market segment and technology manager at Rohde & Schwarz, explained it, something like AFC isn’t “much of a topic” in regions like Europe and Asia yet as they are under the impression that low-power indoor Wi-Fi adequately addresses the majority of existing use cases. “In Europe and Asia, it might also be more difficult to establish a system that would work for all [of the region],” he added.

Very-low-power unlicensed devices

In addition to AFC progress, the FCC commissioners also approved the use of very-low-power (VLP) unlicensed devices to operate in the 6 GHz band in October 2023, which Szymanski claimed means that Wi-Fi 6E chipsets can “do more than they could before,” which will drive adoption. “It will likely kick off an ecosystem of peripheral devices,” he stated.

Specifically, the FCC opened up 850 megahertz of the 6 GHz band to small mobile devices operating at very low power and established common-sense safeguards to protect incumbent uses. The FCC is further proposing opening up an additional 350 megahertz of the 6 GHz band for very-low-power devices. “That means we are expanding access to the 6 GHz band to help jumpstart the next generation of unlicensed wireless devices,” FCC Chairwoman Jessica Rosenworcel said in October. “We have now the unlicensed bandwidth, with a terrific mix of high capacity and low latency, that’s going to deliver new immersive, real-time applications. That means these are the airwaves where we can develop new wearable technologies and expand access to augmented and virtual reality.”

Increasing demand for IoT devices

The IDC foresses the growing demand for IoT devices resulting in an upward momentum for Wi-Fi in 2023. According to the firm’s latest reporting, Wi-Fi IoT device shipments totaled 37% in 2022 and are predicted to exceed 40% by 2027. Furthermore, Wi-Fi IoT devices surpassed smartphone shipments in 2021, and IoT is also expected to outpace primary client device shipments in 2027.

Wi-Fi’s role in IoT applications has evolved over the years as the technology has improved. Now, companies like Quectel — which specializes in IoT modules — view Wi-Fi as a core element in the growing IoT ecosystem. A Quectel spokesperson told RCR Wireless News that Wi-Fi’s role in IoT was historically limited due to concerns about power consumption, range and scalability, but that the introduction of Wi-Fi 6, 6E and now Wi-Fi 7, brought features like improved power efficiency, higher data rates, longer range and better handling of multiple devices. These advancements, continued the spokesperson, have made Wi-Fi more suitable for a wider range of IoT applications.

“Today, Wi-Fi supports a diverse range of IoT devices, from smart home appliances to industrial sensors. It offers a balance between range, bandwidth and power efficiency, which is critical for many IoT applications,” stated the spokesperson. “With the continuous evolution of Wi-Fi technology, it’s expected to play an even more significant role in IoT, particularly in areas requiring high data throughput and low latency, like smart cities, healthcare monitoring systems, advanced industrial automation, home and building automation, in-house energy management and healthcare.”

There is finally a Wi-Fi 6E iPhone

The list of Wi-Fi 6E-compatible handsets and other devices is not short; however, it’s no secret that Apple holds a great deal of influence within the telecom and connectivity sectors, and it wasn’t until 2023 that Apple came out with its lineup of Wi-Fi 6E products, which includes the 2023 Mac, 2023 MacBook Pro and perhaps most notably, the iPhone 15 and 15 Plus, released this past September.

“From a client device perspective, with Wi-Fi 6E now is in all major mobile and laptop platforms. This motivates enterprises because that 6 GHz radio in their Access Point isn’t going to be waiting in anticipation of traffic,” explained Szymanski. “They can reliably assume that there is a full Wi-Fi 6E ecosystem that can take advantage of the 6 GHz radio.”

Szymanski’s colleague at Broadcom, Mike Powell, who is the company’s director of product marketing for enterprise wireless communications and connectivity, agreed, more explicitly stating: “For all of my enterprise customers, the market moves as all major OS vendors move. There were other 6 GHz devices earlier; there were intel-based and android-based ones, but it seems like once all phone and computer ecosystems launched 6E, we were off to the races.”

Powell further articulated how this development will be a boon to Wi-Fi 7 enterprise adoption. “We saw [enterprises] do a whole portfolio of Wi-Fi 6, and a limited portfolio of Wi-Fi 6E because they knew it would be close in time to Wi-Fi 7,” he said. “Now with Wi-Fi 7, they are going to do a whole new portfolio top to bottom.”