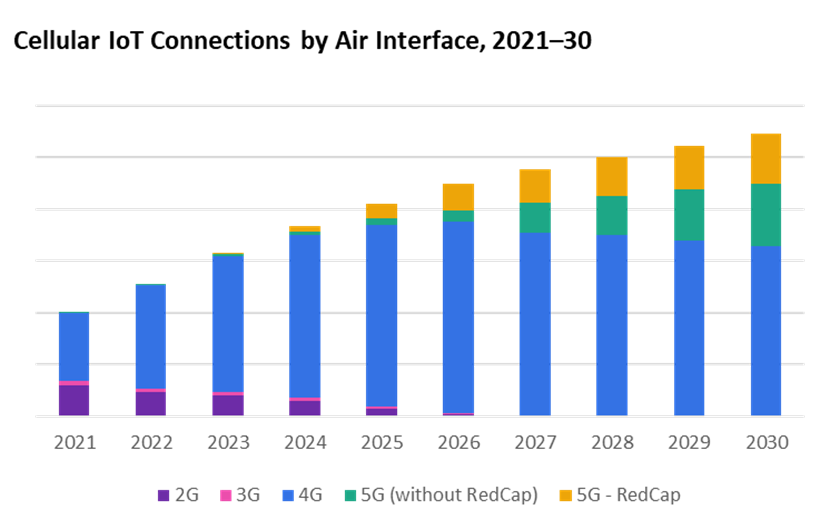

Mass adoption of reduced-capability 5G (5G RedCap) for mid-tier cellular IoT applications will start from next year (2024), commencing in China, reckons analyst house Omdia. The arrival of RedCap, it said, will help to drive overall cellular IoT connections to 5.4 billion in 2030, representing a (rough) rise of around 70 percent compared to 2023. 2G- and 3G-based IoT connections will vanish, effectively, by 2027, new research by the firm suggests.

Meanwhile, 4G/LTE-based IoT connections will continue to dominate, going from around 2.6 billion in 2023 to 3.2 billion in 2030, constituting around 82 percent and 60 percent of the total cellular IoT market at either end of the period. 5G-based IoT connections will reach about 1.2 billion in 2030, comprising around 22 percent of the cellular IoT market, from virtually nothing in 2023. (Note, these are estimates based on a reading of the Omdia graph below.)

Omdia said 5G-based non-RedCap ‘massive IoT’ and LTE-based Cat-1 bis modules will also drive overall volumes. The ‘massive IoT’ category is a curious one, it might be suggested, and Omdia’s classification of a 5G-based ‘massive IoT’ portfolio is not entirely clear. The original 3GPP technologies specified in this class are the twin LTE-based technologies NB-IoT and LTE-M, pitched squarely at the mass-scale low-power end of IoT.

There is no 5G-based massive IoT technology, as such – unless NB-IoT and LTE-M are to be qualified instead as 5G technologies based on their forward-compatibility with 5G NR networks. But they remain LTE solutions. Which possibly skews Omdia’s category-numbers towards 5G (based on a press note, and not the full report). Otherwise, LTE-based Cat-1 bis – a single-antenna version of LTE Cat-1, which does not require an LTE upgrade like NB-IoT and LTE-M – will continue to gain more traction and drive cellular IoT volumes, alongside RedCap, says Omdia.

For its part, hype around RedCap is impacting the IoT vendor community in the way that its parent technology, 5G, has impacted most of the mobile market – to the point expectations among customers are unrealistic, and LTE-based cellular IoT solutions have become a harder sell. That is the word on the street, anyway. But Omdia says RedCap will, starting next year, find its groove as a mid-tier 5G-IoT solution to slot below critical-grade ultra-reliable low-latency comms (uRLLC) and fully-fledged enhanced mobile broadband (eMBB) comms.

“It will also enable futureproofing of devices as the industry anticipates the eventual phase-out of 4G beyond the year 2030,” it writes. Its forecast also finds that over 60 percent of cellular IoT module shipments will come from the Asian and Oceania region, making up approximately 80 percent of cellular IoT connections in 2023. Which is, in itself, an astonishing statistic; the market knows very well that China dominates in cellular IoT, but four-fifths of the total market (in Asia Pacific) is a veritable lion’s share.

Most of the growth, it turns out, will come in the automotive sector, which is pegged for the largest number of module shipments due to the “growing demand for smart vehicles integrating 5G connectivity”. Which, to editorialize further, does not on the face of it seem to add up to massive IoT, either – based just on global sales, even after-sales, of IoT gadgetry for connected cars and trucks. Surely deployments of low-cost and low-power cellular IoT in cities and factories and homes is where the promise of massive IoT will be made real?

Or maybe this is just how the cellular market sees massive scale, and this is just mid-range RedCap modules play? But Omdia makes the point that China, where most of the growth will come, will likely subsidise RedCap costs to drive sales. Alexander Thompson, senior analyst for IoT at Omdia, says: “2024 will be a pivotal year for 5G RedCap growth. This will begin in China, where most volume is expected and in due course subsidies will bring the average selling price of modules down to similar pricing as LTE Cat-1”.

A final note in the Omdia statement says most of the money in cellular IoT will come from application enablement platforms (AEPs), and that the market will remain fragmented enough from an industrial perspective to hinder all-out monopolies by big hyperscaler cloud firms like AWS, perhaps most notably. Andrew Brown, practice lead for IoT at Omdia, says: “There remains a role for industry specific/pure-play AEPs despite the exponential growth of hyperscaler offerings and financial constraints for startups in the current economy.”

Either way, Omdia writes: “The cellular IoT ecosystem is poised for significant transformation over the next seven years, driven by the rise of 5G technologies… This paradigm shift underscores the evolving landscape and increasing prominence of advanced cellular connectivity solutions.”