Father’s Day greetings from Atlanta, Kansas City, and, by the time you read this, Cedar Rapids. Pictured is a long-time colleague and friend Hunter Newby, along with Brent Legg of Connected Nation, discussing their joint venture which will bring up to 125 Internet Exchange Points (IXPs) to small towns across America. While the news is not new (it was announced at last year’s Metro Connect), the rollout of the first IXP in Wichita is underway (see this blog post from DE-CIX who will be operating the Wichita IXP). Hunter and Brent discussed their plans, architecture, and offerings at the Midwest Peering Summit (MWPS) held in Kansas City last week. It was terrific attending and catching up with many long-time friends.

We attended the MWPS in the new role (effective June 17th) as CEO of CellSite Solutions, a Cedar Rapids-headquartered company that leads the industry in remanufactured telecom and utility shelters. We transform decommissioned shelters, making them more energy efficient. A renewed shelter saves companies 30-40% purchase cost versus new and, in the process, consumes 70-80% less CO2 in the process. It’s a splendid example of common-sense asset reuse/ repurpose. It’s an honor to be able to lead a terrific team and we look forward to speaking with many of you about our product and civil engineering service offerings. Both the interim (online only) and Sunday Briefs will continue, so don’t be surprised to hear more about this great enterprise!

Speaking of the new role, the INDATEL Business Symposium kicks off in Nashville on June 25th. CellSite Solutions is the newest INDATEL supplier affiliate member. If you will be attending, please connect us at jim.patterson@cellsitesolutions.com.

This week was full of news, including the opening keynote at Apple’s Worldwide Developers Conference (WWDC) as well as AT&T CFO Pascal Desroches’ appearance at the Bank of America C-Suite TMT Conference. After a full market commentary, we will dive into the implications of both events for the telecom industry.

The fortnight that was

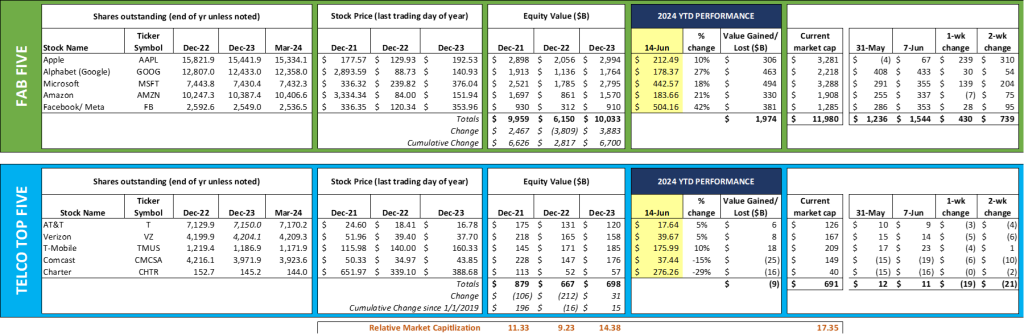

Hold a conference where AI is one third of content and gain $239 billion in market value in one week. That’s what happened with Apple. Overall, the Fab Five added $430 billion in value last week ($739 billion the last two) and are now collectively knocking on the door of $2 trillion in 2024 gains. Apple was weighing down the group’s performance until last week but now joins the double-digit percentage gain club. They are again contending with Microsoft for the “world’s most valuable company” title.

At the beginning of 2019, Apple was worth $733 billion. If today’s valuation is maintained through the end of this year, the capital appreciation compounded annual growth rate (excluding dividends) will be 28.4%, an outstanding long-term return that leads each of their Fab Five peers. They have accomplished this in large part due to their consistent (global) smartphone growth which extends from the consistently produced hardware to software and services. WWDC 2024 focused on how Apple will continue to this extension through coordinated applications. More on that topic below.

Meanwhile, the Telco Top Five lost $19 billion last week in value, with only one stock (T-Mobile) achieving a positive return over the fortnight (and it was only $1 billion). The group in total has lost $9 billion in value this year in equity market capitalization, with gains by the Big 3 wireless carriers outstripping their wired broadband peers. For those e-mail only subscribers who do not follow the interim Briefs, we did spend a little bit of time last week looking at the TMUS share repurchase/ TMUS share sale/ DT share repurchase cycle considering the German government’s announcement that they would be selling a small part of their 30% stake in Deutsche Telekom. That analysis is here.

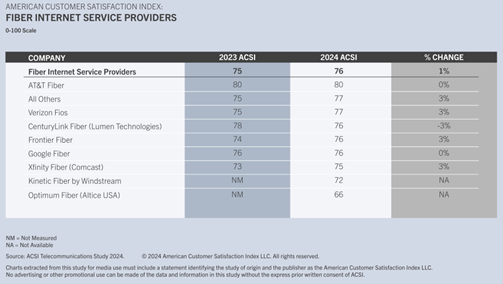

Since our last Brief, the American Customer Satisfaction index (ACSI) for Internet service providers was released (news release here). Here are the scores for fiber providers:

Here is the same index for non-fiber Internet service providers:

There are many interesting things to note between the two categories. Cox and Spectrum are really stepping up their game with 6% increases in their scores and lifting both companies close to the average. Even with those improvements, however, T-Mobile Home Internet has even higher satisfaction scores than either company. This is likely due to the “versus what” argument as T-Mobile (and, to a lesser extent, Verizon) are competing against legacy DSL and satellite. But a sizeable 8-point gap remains between T-Mobile and big cable.

Then there’s Google Fiber, who was long regarded as the technology leader. Now they are merely an average fiber provider with no improvement over 2023. And, like we saw with smaller MVNOs in the ACSI wireless results, “all other” fiber providers (think Allo, Clearwave, Greenlight, Metronet, Omni, Point, Fastwyre, and many others) generate high satisfaction rates. In fact, the only fiber provider to record lower customer satisfaction versus 2023 was Lumen, who is still attempting to sell their consumer fiber unit.

Finally, it’s interesting to note the difference between the ACSI MVNO/wireless customer service scores for the cable companies (Spectrum = 79 and Xfinity Mobile = 78; both materially above their peer averages) versus those of their Internet customer base (see above – at average). While the difference is less pronounced, Spectrum and Xfinity Mobile generate higher satisfaction than their retail counterparts. Mobile + broadband can significantly improve satisfaction scores. How that manifests into acceleration of wireless net additions remains to be seen.

Note: space does not permit a discussion this week on ACSI’s traditional video provider results, but it’s interesting to note how badly satellite has slipped in the overall rankings. More here.

AT&T’s comments at the Bank of America TMT Conference

AT&T CFO Pascal Desroches had a short but sweet discussion with David Barden (Bank of America analyst) last Tuesday (link to transcript here). Prior to his interview, the company released some financial information. Here’s how we summarize it:

- Postpaid upgrade rates are continuing a downward trend. Good for lower handset subsidies today, but, with the new iPhone coming, there could be additional dilution in 4Q 2024/ 1Q 2025. More on the magnitude of this cycle in the next section. For 2Q, however, fewer upgrades will help mobility profitability.

- The performance and penetration of AT&T Internet Air (see our discussion of the business product released nationwide this quarter here) continues to impress. We expect high ARPUs, but continued low volumes until the beginning of 2025 as there are additional product upgrades coming.

- Reducing net debt continues to be a priority, with the company reiterating a 2.5x ratio to adjusted EBITDA within the next 12 months (mid-2025).

- The company reiterated their $21-22 billion capital spending target for 2024, which puts them at ~$4 billion more than Verizon. This reflects C-Band deployments, and we expect $19 billion or less in capital spending for 2025.

What was most intriguing, however, was Pascal’s comment about long-term profitability versus cable. Here is an extended excerpt:

“Our research would suggest that customers want one relationship, a simple straightforward relationship where they can get both services because it’s all about connectivity. We believe over time by having scaled networks in both fixed and wireless, we’re in a unique position. It allows us to deliver services to the customer in a way that is at the lowest possible price relative to our peers. Our cost per bit over time because we own both networks will be lower than our peers… Two, I would expect us over time to be in a position to provide added functionality and more seamless functionality between fixed and our mobile as a result of owning both networks. At a time where you have cable trying to replicate a bundle by using somebody else’s wireless network and our wireless peers pursuing broadband through fixed wireless at scale where the cost over time will become prohibitive. We are in a unique position to be able to deliver the best possible connectivity at the lowest cost to us.”

This argument works for the 30 million or so homes where AT&T serves as both the fiber and wireless provider. Perhaps there remains an addressable home broadband market to mine there with a converged offering (which we think would come disproportionately from Spectrum and Comcast). But what about the other 110 million homes where AT&T does not have a product advantage?

AT&T teases new (and we would presume, more advanced) seamless functionality between wired and wireless networks. But they are the company who has held those components (especially with their near monopoly over the connected vehicle market in the US which is rarely discussed) for nearly two decades with little functional improvements. In fact, the largest functional improvement for in-vehicle has bypassed AT&T car presence entirely (Apple CarPlay and Android Auto). Where would the improvements tie directly to network integration that Verizon would explicitly withhold from their cable partners (or that AT&T would exclusively gain as the 3rd largest US wireless provider)? We think that AT&T’s claim of uniquely competitive seamless converged connectivity is merely that – a claim with minimal historical precedent and few details. Until that claim is fulfilled, cable will continue to gain on AT&T.

What’s artificial about Apple Intelligence?

We close this week with some thoughts on Apple’s 2024 WWDC. About a third of the opening keynote was spent on Apple’s implementation of Artificial Intelligence which they call Apple Intelligence.

It’s a very good start, but it’s a start. Like Siri (which we were reminded was introduced thirteen years ago), Apple Intelligence will evolve as application functionality (adoption, use) increases. What we heard at WWDC was a platform announcement supported by some specific use cases. We think it’s important to focus on the former versus the latter.

Take writing aids for example. For those of us who have already used Microsoft’s CoPilot or received suggestions through Gmail, this is not new. But, when each English language response includes both a version in Spanish and Portuguese perfectly translated, and also integrates any action items into project management software or CRM, productivity possibilities emerge.

Our thoughts turned to enterprise and business productivity (nothing against custom emoji creation, but there’s a lot more here for businesses than Apple revealed). If cross-business information coordination can improve as a result of Apple Intelligence (sharing only updated information needed with the customer and assigning a notification priority), that would be needle moving. What would make it even better is if it was integrated with Android. More on how updates, communication, and acknowledgements could be transformed in a July Brief.

As we stated in the June 2nd Brief, we think that Apple’s creation of Private Cloud Compute is the biggest risk/ reward announcement Cupertino has made since the introduction of the iPhone. How applications connect to the cloud, use wireless (cellular/ Wi-Fi/ satellite) networks, while improving productivity and protecting privacy is the most interesting aspect of what was announced last Monday. Taken to its greatest extent, it could become the controller of all other cloud platforms (including the corporate/ enterprise cloud example described earlier).

Bottom line: Apple’s packed a lot into their Monday keynote. There were a lot of future tense verbs. And there will be a lot of angst with what’s really going on behind the scenes (especially in countries with fewer freedoms than the USA) should Apple’s Siri become the cloud conductor. We don’t think it has the same “super cycle” effect as the Apple 12 announcement (first device with 5G network capabilities), but we think it has the potential to revive Apple’s homegrown applications as well as position the company to control on-device computing (with private cloud communication).

That’s it for this week. Thanks again for all your support and referrals. Our next full Brief will focus on each of the Telco Top Five’s major capital projects. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Until then, a very Happy Birthday to my Mom, Mary Patterson, who turns 90 today. Also, Sporting KC and Kansas City Royals (who won at Dodger Stadium last night for the first time since 2003)!