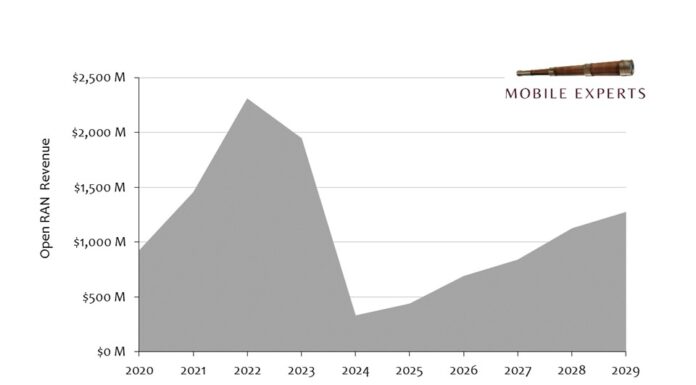

Open RAN revenue dropped by 83% in 2024 compared with 2023. Whoa. Let’s take a closer look at that. Why did revenue crater? And how will it bounce back?

During ’22 and the first half of ’23, DISH was spending heavily, deploying radios to satisfy their FCC obligations for coverage. After they met their milestone, DISH essentially shut down the deployment machine, and most of the Open RAN revenue evaporated.

Almost all Open RAN revenue has come from greenfield networks so far. Legacy network operators have done trials and tests, but the revenue has been trivial so far. That leaves 2024 at the bottom of the Grand Canyon in our chart.

There is hope. AT&T decided to move toward a different form of Open RAN, where the RAN software (DU, CU, SMO) comes from a single vendor, but the hardware involves several competitors. This is reasonable. After all, how many companies use Microsoft software across tens of thousands of employees, and buy PCs from multiple hardware manufacturers?

AT&T chose this path because it greatly simplifies their orchestration and management of the network, which will be crucial as network slicing and advanced automation come into the networks. Over time, we expect to see other mobile operators follow this model, as the cost of supporting multiple software/hardware combinations will become too onerous to continue.

Our revenue forecast anticipates growth in “Single Software Open RAN”, that will eventually grow to become a significant portion of network revenue. In the unknowable 6G cycle, we expect several nationwide deployments to follow this business model. The performance is good enough now for most cases. Operators will continue testing and small-scale trials through 2029, so that they can be ready for bigger deployments in 2030-2033.

There’s a hardware component with Open Fronthaul, and a software component with RIC and applications. Without getting deep into the details, I’ll say that the fronthaul market will move overwhelmingly toward the Lower Layer Split (aka ULPI), although the other format will hang around due to some legacy hardware issues. Chipset cost issues and economy of scale will limit the number of radio vendors to be countable on one hand.

On the software side, it’s a long road to reaching a more fluid market for applications. Don’t expect xApps (near-realtime) or dApps (real-time) anytime soon. But rApps will be used in both greenfield and brownfield networks for optimization. Eventually, we expect to see xApps and other optimizations for the Private Cellular market that drive meaningful customization.

Six years ago, the industry laid out a vision for Open RAN with healthy competition in every area. That’s not the Open RAN market we will get. Instead, we will get an Open RAN with a very short list of DU/CU software vendors and less than five open radio vendors.

One Christmas morning, my brother opened the wrapping paper to find a pink baseball glove. Thank you, Aunt Betty. My brother made the best of it; he caught a lot of fly balls with that glove.

It’s not the Open RAN you wanted. But it’s the one you got.