5G has continued to expand its presence across markets and drive adoption. 5G adoption in the top 30 cellular markets is accelerating, from 1.52 billion to a forecast 4.20 billion by 2029. As 5G coverage and bandwidth have increased, we have also seen a shift in the applications and usage driving data traffic transmission. Historically, more than approximately 70% of traffic has been download-orientated but two-way interactive applications (mobile AI) and the growth in Internet of Things (IoT) deployment is starting to increase the importance of increased data throughput, as well as enhanced uplink channel throughput.

More applications, more upload traffic

Massive Multiple Input, Multiple Output (MIMO) technology enables superior 5G connectivity by using transceivers and receiver chains of 8 streams or more. By using multiple antennas, mobile operators can widen cellular coverage areas and increase data capacity and user throughput. In addition to TikTok and YouTube influencers conducting livestreams and/or uploading videos and photos of exotic locations and recreational activities, smart transportation, Unmanned Aerial Vehicles (UAVs), smart city applications and healthcare and city-wide Closed-Circuit Television (CCTV) monitoring system applications are prodding mobile operator Chief Technical Officers (CTOs) into upgrading the antenna equipment at the top of the cellular tower to support Multi-User (MU) MIMO and Massive MIMO:

- Transportation: In transportation contexts, massive MIMO provides high capacity for trains, buses, planes and other public transport systems. Massive MIMO is also key to supporting numerous users simultaneously per base station and facilitating a consistent user experience.

- Smart cities: Often, smart city applications involve significantly dense IoT device deployments, which require uplink data collection and video feeds for real-time monitoring/control.

- Retail: For retailers, massive MIMO can serve as the connectivity backbone for localized capacity for high density, in-store demand, low-latency analytics and digital overlays and Augmented Reality (AR)/Virtual Reality (VR) advertising applications.

- Healthcare: Hospital workers and other healthcare professionals will benefit from robust designs for safety-critical connections, stronger radio links to wearables and sensors and high-resolution, low-latency video streaming.

Mobile AI accelerates everything

Mobile Artificial Intelligence (AI) is transforming the lives of end users as well as the management of IoT devices and telco operations, but it is also increasing the amount of data being uploaded.

Generative AI (Gen AI) is the fastest growing AI framework with a 49.7% Compound Annual Growth Rate (CAGR); with foundation models, optimization software and model deployment tools being adopted. More traditional AI applications (such as AI sensing, predictive AI, Natural Language Processing (NLP)) are also stimulating traffic. All this AI activity is underscored by the amount of investment in AI functionality. ABI Research forecasts that investment in AI sensing, Gen AI, predictive AI and NLP will grow from US$100 billion in 2023 to US$390 billion by 2030.

CSPs will need to respond

Cellular operator CTOs are scrutinizing where their investment will maximize efficiency gains. For example, more than 120 mobile operators are accelerating their investment in 5G Standalone (SA) upgrades to more effectively route and prioritize data and applications. Furthermore, mobile telcos are also taking a good, hard look at the “on ramp” end of their networks, at the very top of their cell site towers.

In many markets, mobile operators have been allocated 5G Time Division Duplex (TDD) spectrum in the 3.5 – 3.7 GHz bands, but it is also true that the Frequency Division Duplex (FDD) bands are still very much “heavy lifters” of traffic, even if the spectrum may be fragmented between the 1.8 GHz, 2.1 GHz and 2.6 GHz bands. Until recently, many operators have been reliant on 4T4R antennas, but with the burgeoning growth in traffic —not just in the download link, but also in the uplink — operators will need to optimize those transmissions. Moving from an 4T4R antenna configuration to a massive MIMO configuration can provide a 4X to 7X improvement in capacity.

Equipment vendors, such as Huawei, have taken steps to boost the capabilities of their FDD massive MIMO by incorporating a “M-Receiver,” or uplink multi-stream receiver, into the uplink antenna design. This reportedly improved the uplink budget by 10 Decibels (dB) and uplink speeds by 10X. The vendor states that with a 40 Megahertz (MHz) channel and all 8 uplink channels transmitting, uplink throughput can potentially reach 2 Gigabits per Second (Gbps). Improvements were made in a number of technical areas. For example, a 5% to 10% gain in uplink traffic management was achieved by applying Machine Learning (ML) to Channel Quality Indicator (CQI) processing, which improved the uplink MU-MIMO channel pairing probability and eliminated uplink MU interference by staggering Resource Block (RB) allocation. Communication Service Providers (CSPs) will need to validate these assessments, but with the continued ramp-up in traffic, operators will need to secure all the efficiencies they can get.

While the CTO may be impressed with the overall data throughput management of FDD massive MIMO over a 4T4R antenna, it is often the case that the Chief Financial Officer (CFO) is concerned about increased operating expenses that may be incurred from the tower management companies due to larger and heavier antennas. Antenna manufacturers have been striving to mitigate these financial burdens. The latest antenna materials have brought down the weight of FDD massive MIMO antennas by 20% to 25%, while wind load stresses have also been brought down by a similar percentage. The components that go into the latest antennas have become reliant on the latest innovations… from using ceramic, rather than metal filters, the use of integrated “Plus Etched Pattern” (PEP) dipoles, rather than metal dipoles, as well as the use of laser welding during the manufacturing process to prevent the unwanted generation of Passive Inter-Modulation (PIM). Lastly, the development of highly responsive electronics and the implementation of novel motherboard-level algorithms can reduce power consumption. When data traffic levels drop off during quiet periods, uplink low noise amplifiers within the antenna’s electronics can be powered down, resulting in power consumption dropping to 5% of legacy equipment.

Conclusion

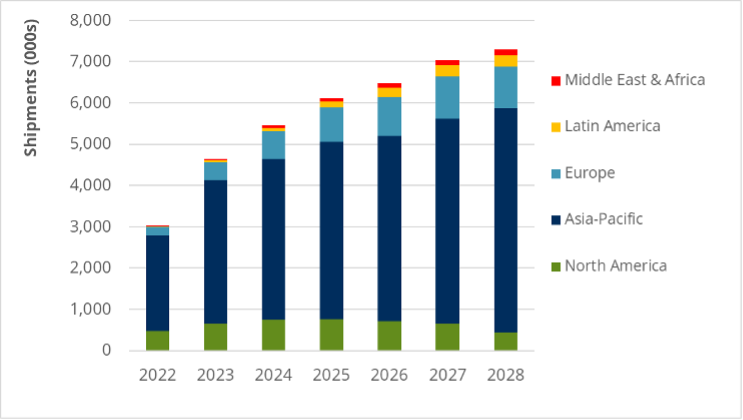

Worldwide, annual outdoor infrastructure spending is expected to grow by 6.2% in 2024, from US$93.34 billion to US$99 billion, but the outlook for the next 5 years is likely to demonstrate even lower Year-over-Year (YoY) growth. Despite this, the outlook for massive MIMO antennas is likely to remain robust over the next 5 years. ABI Research forecasts that massive MIMO shipments will grow from 4.65 million in 2023 to 7.29 million in 2028 (see Figure 1).

Mobile operator Chief Executive Officers (CEOs) are keen to pursue and support novel applications and services, but the telecoms equipment they purchase have to demonstrate a robust Return on Investment (ROI). The performance characteristics of cellular antennas, especially MU and massive MIMO antennas, can be directly connected to improvements in the end-user experience in terms of data throughput and reducing latency. As new cellular applications, such as smart transportation, UAVs, smart city applications and healthcare and city-wide CCTV monitoring systems, have come online, the ratio and the amount of traffic being uploaded has started to shift. Uplink multi-antenna solutions that address this challenge will need to be evaluated by telcos.

Figure 1. Worldwide 5G Massive MIMO shipments by type