Fixed wireless access (FWA) point adoption rates are continuing to climb in the U.S. and globally, as mobile carriers harness the combined power of 5G and advanced Wi-Fi to tap into a new revenue stream while improving the customer connectivity experience. However, the rise of FWA as an alternative to fixed broadband introduces a new set of design and test considerations that wireless service providers must take into account. LitePoint Product Marketing Manager, Khushboo Kalyani, provides her perspective on the rapidly evolving FWA segment in this Q&A.

Q: What is the take-up rate of fixed wireless access?

Khushboo: Fixed wireless access has been around since the days of 4G, but the adoption rate has skyrocketed in the 5G era, especially in the last four years. Globally, about 70 to 80 percent of operators have launched FWA services so far in 2024, with total network capacity across the big four U.S. providers – T-Mobile, Verizon, AT&T and Dish – positioned to support up to 16 million subscribers.

Q: What is driving that growth?

Khushboo: The adoption rate appears to be highest among users between the ages of 35 and 50. This demographic likes the relative ease of FWA deployment, and they’re open to newer technology, especially when there’s better speed and quality-of-service compared to fixed broadband. And the carriers have done a good job of making it simple for users to self-install the on-premise equipment using a simple installation guide or instructional video.

Q: How are LitePoint’s customers adapting to this changing market landscape?

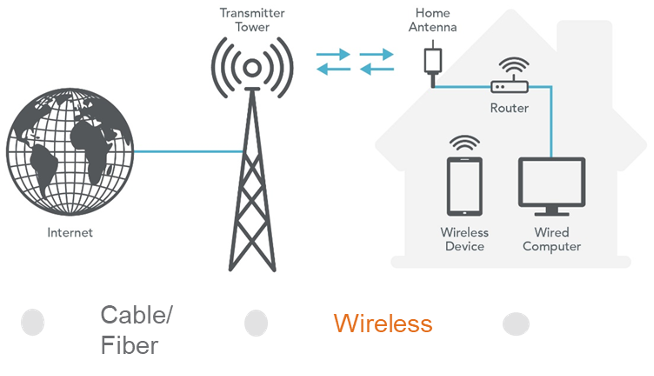

Khushboo: A lot of fixed wireless access is going to be deployed on the consumer side in the form of customer premises equipment (CPE) to provide Internet access to your PC, or TV or home IoT device. From a LitePoint perspective, we’re seeing network operators pursuing this new revenue stream by partnering with original design manufacturers and contract manufacturers in Asia to make CPE devices.

That requires device makers to ensure that they design CPE devices to prevailing standards, which in this case includes support for 5G as well as Wi-Fi 6/6E and potentially Wi-Fi 7.

This new breed of devices enhances throughput and quality-of-service, both of which require rigorous testing and validation to determine how well the device performs. In addition to providing robust connectivity, operators today also offer various tiered data-rate plans that rely heavily on the quality of the CPE device. Those dynamics are creating a whole ecosystem that is driving opportunity for LitePoint.

Q: A key benefit of FWA is its ability to reuse 5G spectrum while delivering a higher cost-per-bit return than fixed broadband. Is that progressing?

Khushboo: For operators, fixed wireless access is a huge win-win. First, their confidence that the services will get adopted comes from the fact that 5G delivers a quality-of-service and a data rate that’s comparable to what a consumer could get from fixed broadband.

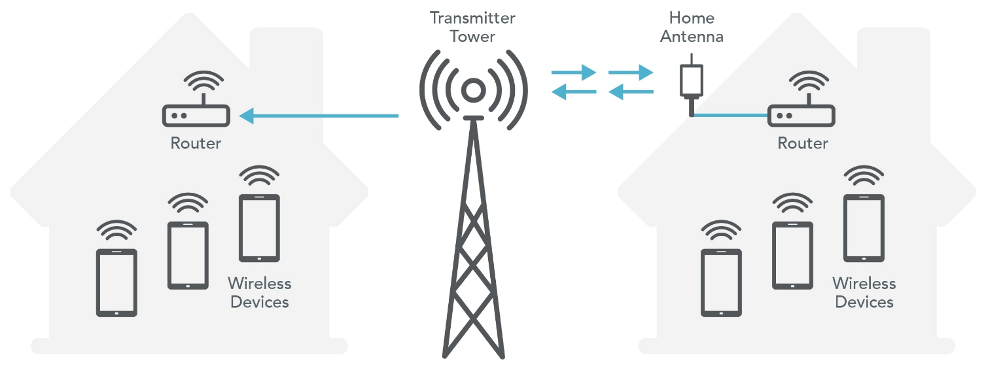

Secondly, the operators already have 5G mobile networks in place. They don’t have to create a separate infrastructure; they’re just reusing existing spectrum and network capacity. And third, the operators bought additional capacity in the midband and C-band spectrum so there is a lot more bandwidth and flexibility available to them and a higher return than they’d generate by offering this high speed broadband service. That’s not something they could have done with 4G, because it didn’t have the flexibility, bandwidth or physical layer capability of 5G cellular.

Q: Does FWA adoption look the same across the globe, or are there variations according to region or vendor?

Khushboo: It’s standard in that everybody is designing to the same end goal. That said, carriers with a little more vision are looking at CPE designs with Wi-Fi 6E/7 capability, while other operators may be only using Wi-Fi 6 depending on the geography they’re selling into. For example, if you’re selling CPE in a region that doesn’t support 6GHz-band Wi-Fi, then you don’t really need to design to the latest Wi-Fi standards.

Another consideration is mmWave spectrum, which was hyped when 5G first became available. Millimeter wave was auctioned globally in different geographic regions, and different operators bought it, but it didn’t really pick up much traction. Because of this, most of the 5G deployments you see are midband, which is where fixed wireless access service is being offered. Over next couple of years, CPE devices will probably include mmWave capability, and that will bring in a new set of design and test requirements.

Speaking of adoption, in a recent FWA global survey by GSA, it appears the CPE market will continue to see double digit growth, with countries in Middle east and Africa contributing to the upward trend. Specifically talking about 5G FWA, off the total CPE device shipments, 5G devices (from year to date) contributed over 50% of the total shipments driven largely by North America.

Q: Is 5G FWA scaling expected to evolve from mostly single-user to multi-user connectivity?

Khushboo: Certainly, FWA scalability is important in terms of serving more than one or a few end users. FWA has grown over the past several years by 700,000 to 900,000 subscribers per quarter, which is forcing the carriers to respond by implementing better network resource management to handle that increase in traffic. These resources are being managed at the sub-cell-site level and are taking advantage of 5G network slicing to ensure better load balancing, routing and management to scale their networks beyond single-user connectivity.

Q: Are LitePoint customers adopting FWA more for private or public networks?

Khushboo: 5G fixed wireless access can serve a number of users in an open environment, whether it’s urban or rural, and allows for more reliable connectivity in a smaller space. For now, fixed wireless access is being adopted more by end consumers for the home, but eventually you will see being it being adopted more for small-to-medium enterprises.

Large enterprises tend to have stable Wi-Fi mesh systems in place. Disrupting that by making a place for 5G FWA will be difficult, because large organizations require an added security layer and generally rely on LAN connections as a back-up in the event the Wi-Fi network fails.

Q: Does FWA introduce different test scenarios that operators need to consider?

Khushboo: Because FWA devices have both 5G and Wi-Fi, there’s an additional coexistence test step that’s required to measure end-to-end throughput. This ensures there is no internal interference between the 5G CPE device and Wi-Fi access point router, and that whatever throughput you’re taking from the 5G side is accurately disseminated to the Wi-Fi side.

Also, the carriers typically source their 5G and Wi-Fi components separately and from different vendors, and as a result they must guarantee that each individual module or chipset is well-tested. That’s only part of the test regimen, however. When they put the discrete devices together, they need to make sure the product is tested in its entirety, because they don’t just have the chipset, they also have the radio and the antenna. That’s where additional test requirements come into play.

Q: If you gaze into your crystal ball, where do you see FWA making the biggest impact in five years relative to traditional fixed broadband?

Khushboo: Over the next five years, fixed wireless access is expected to have its most significant impact in areas where conventional fixed broadband is lacking or insufficient. In terms of connection, GSMA intelligence predicts the number of 5G FWA connections across 70 countries will increase by 358% between Q4 2023 and Q4 2030, representing an increase from 17.3 million connections to 79.2 million.

This is especially true in regions across Africa, Southeast Asia and parts of Latin America, where the deployment of fixed broadband infrastructure like fiber-optic cables is often hindered by high costs and logistical challenges. In developed or urban regions, FWA will drive more competition, potentially leading to better service and pricing and offering more choices to the consumer.