November greetings Cedar Rapids, Kansas City, and Iowa City. The opening picture was taken from Kinnick Stadium after the first quarter (note the “Hi Kids” sign on the scoreboard – more on the Hawkeye Wave tradition here), where the University of Iowa Hawkeyes thumped the University of Wisconsin Badgers 42-10. A terrific evening even with second half rain.

After a very brief market commentary, we will dive into third quarter earnings. While there were many developments in the quarter, our focus for the next two Briefs will be on momentum leadership. This week our attention will be on wireless with broadband to follow on November 17.

The fortnight that was

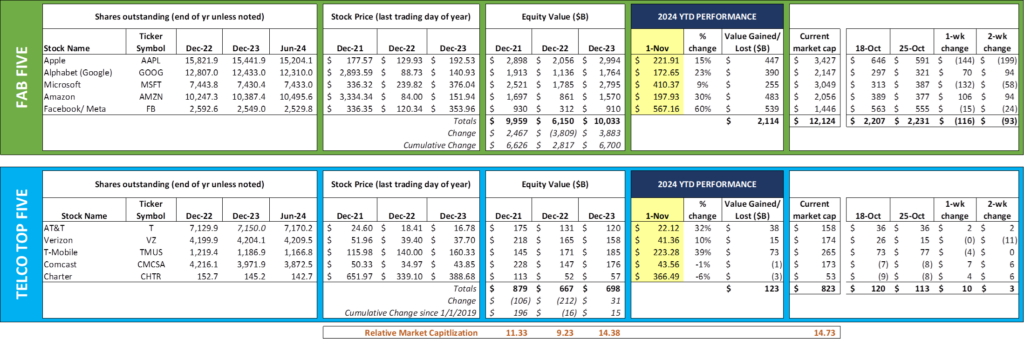

Note: Share counts in the table will be updated in next week’s interim Brief.

This was the week when investors decided that Comcast and Charter are going to be able to hold their own against increased fiber to the home deployments. We will discuss more below, but Charter had a nearly 12% pop on Friday after their earnings announcement and conference call. Over the last two weeks, the only Telco Top Five stock that is down is Verizon (-$11 billion).

Speaking of Verizon, their Frontier merger saga continued this week, with proxy advisory firm ISS recommending on Friday that shareholders vote “abstain” on the deal and to support the adjournment proposal instead. Per this article from Reuters, ISS stated “Given the possibility of substantially more value down the line, and the lack of urgency to approve a transaction … it seems reasonable for shareholders to exercise the optionality of abstaining for the time being.” Supporting the adjournment proposal is an interesting recommendation to say the least.

Additionally, Ares Capital, who holds 15.6% of Frontier shares, announced after the last Brief that they have retained investment bank Houlihan Lokey to evaluate the Verizon offer (Bloomberg Law News article here). With 50+% approval required, and somewhere between 15-20% of the existing shareholders already indicating that they will oppose the deal, this could come down to the wire (votes need to be cast by November 13).

The Fab Five did not move in lockstep prior to or after their third quarter earnings reports were published. For the week, Apple (-$144 billion) and Microsoft (-$132 billion) declined but were partially offset by gains in Google (+$70 billion) and Amazon (+$106 billion). Cloud revenue performance drove Microsoft’s capitalization down and Amazon’s up. Facebook/ Meta shares were relatively unchanged.

Apple announced solid results with iPhone quarterly revenue of $46.2 billion (+6% year-over-year). Services revenue growth was also up a robust 12% over the same period. Tim Cook, Apple’s CEO, fielded a question from Eric Woodring (Morgan Stanley) about the relationship between iPhone’s quarterly performance and whether some of the growth was attributable to better supply chain management. Tim’s response:

“In terms of exiting the December quarter with demand greater than supply, that’s not my recollection that, that happened for all 4 of the [COVID] years. We clearly had cases during COVID where there were disruptions, and that’s — some spilled over. But in a more regular environment where we’re not having something, a 100-year flood kind of thing, we would — our desire is to get into balance as quickly as possible. We don’t want customers having to wait for products.

“And so if you look at how we’ve done this year, we did that very quickly on the 16, on the 16 Pro family, the Pro and the Pro Max. We’ve been constrained in October, but we believe that soon we’ll be out of constraint. And so that’s a good sign from our point of view. Keep in mind that that’s a function of supply and demand, not one side or the other. And we’ve been preparing for the quarter for a while.”

All of this closely tracks to our weekly iPhone availability posts (latest one is here). Our prediction is that iPhone 16, iPhone 16 Pro, and iPhone 16 Pro Max volume growth over the holiday cycle will be muted, but that Apple Intelligence rollouts, including a major release in December, will result in steadier upgrade rates throughout 2025 (more on upgrades below). This will translate into lower handset subsidies in the fourth quarter for each of the wireless carriers but offset by steadily higher subsidies in 2025. For a very good review of last week’s Apple Intelligence rollout, check out Lisa Eadicacco’s (CNET) summary here.

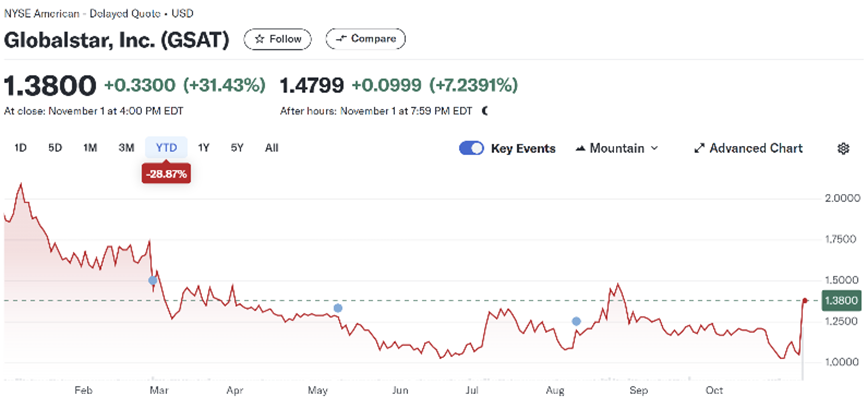

Finally, satellite provider Globalstar is receiving a $1.7 billion investment from their largest customer – Apple. Per this SEC filing, Apple will prepay $1.1 billion in expenses, pay for the early retirement of Globalstar’s 2029 debt ($232 million including make-whole fees), and invest $400 million to acquire a 20% stake in the company. Globalstar’s stock spiked 31% on Friday’s news but is still down 29% year-to-date (see nearby chart).

Who’s got momentum? (Part 1)

“Dynamic” is probably the best single word to summarize the state of the telecommunications industry after third quarter earnings. Verizon and AT&T are continuing C-Band rollouts. AT&T continues to deploy fiber (and it’s safe to assume that they will not be stopping at 30 million homes – more news on that in December). T-Mobile and Verizon are acquiring parts of US Cellular, and both companies have additional pending corporate development activities (T-Mobile with Lumos and Metronet, and Verizon with Frontier).

Meanwhile, data center builds continue unabated (creating potential power grid issues in 2025 and beyond) and AI-focused applications are just beginning to be launched. This will increase the adoption and use of new applications.

The move away from linear broadcasting is creating substantial disintermediation. Comcast’s announcement during the earnings call that they will be pursuing a “well capitalized spinoff” of their cable networks was a welcome surprise as they realign investment priorities, and, in the process, dismantle a part of the Philadelphia-based conglomerate. Peacock stays, sports programming stays, but USA/ CNBC/ MSNBC/ Bravo/ Syfy goes. (Note: the combination of part or all of these networks with those of Warner Bros. Discovery or even Fox makes for some strange bedfellows – Fox Business + CNBC? CNN + MSNBC? Bravo + TLC + Lifetime?).

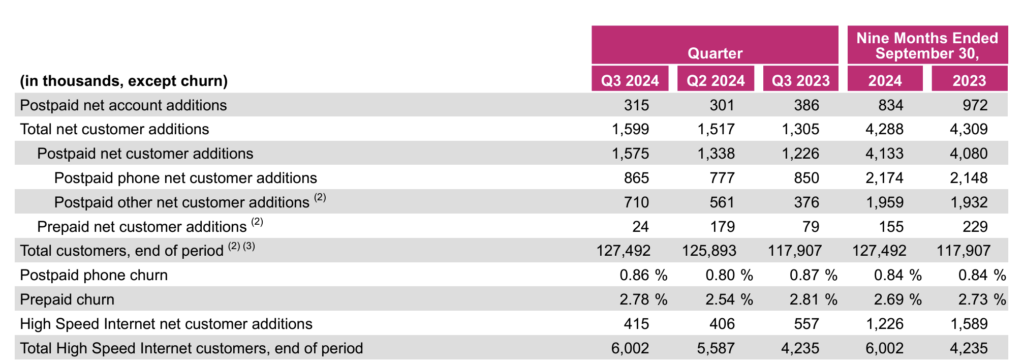

As mentioned above, the iPhone 16 launch is not a super-cycle event (at least yet). This weighed on upgrade rates (Verizon = 3.0% ; AT&T =3.5% , T-Mobile = 2.6%). Any iPhone launch is generally considered positive for challengers, and this one did not disappoint (T-Mobile +1.16 million excluding Internet, Charter +545K, Comcast +319K postpaid net additions).

Networks are being upgraded and expanded – Comcast to DOCSIS 4.0, Charter with high-split and then DOCSIS 4.0, AT&T from copper to fiber, Verizon and AT&T to 5G using C-Band (AT&T also deploying Open RAN), T-Mobile increasing rural coverage and density, and cable beginning to think about vigorous CBRS deployments. No new FCC spectrum auctions on the horizon, but T-Mobile has the (former Nextel) 800 MHz spectrum band available if a bidder can meet the reserve price.

That’s a lot of movement. Each carrier touts those areas where they are doing better, but which ones have real momentum? We will cover T-Mobile (wireless momentum leader) this week and AT&T (broadband momentum leader) in the next Brief.

T-Mobile is the momentum leader in wireless. The subscriber KPIs from their earnings release says it all:

Historically, there has always been a “but” when describing T-Mobile’s subscriber growth. A decade ago, the argument was that T-Mobile was acquiring lower-value customers and using their prepaid retail base migrations to inflate postpaid phone net additions. While the company acknowledges in their Fact Book that prepaid net customer additions were lower because of migrations, it’s clear that they were already cruising past expectations prior to those customers.

Then the argument was “but they will hit a hiccup while integrating Sprint.” No doubt there were hiccups, but they were quickly corrected. Also, Apple introduced the iPhone 12 (the first one with 5G) which created a super-cycle for T-Mobile and the rest of the industry. The timing was perfect to migrate Sprint devices to T-Mobile and upgrade when necessary. Postpaid phone churn has remained low and, with the help of lots of customer data, should head 10 basis points lower in 2025.

Today, four “but” arguments are surfacing from analysts:

- T-Mobile is great in urban areas, but statewide coverage is lacking

- Consumer business is strong, but they are still a distant third in business

- T-Mobile’s Internet growth is great (+415K, 6 million base) but not sustainable

- T-Mobile has growing EBITDA margins, but lacks backbone infrastructure to equal Verizon or AT&T

The company addressed each of these areas on their most recent earnings call (or their Capital Markets Day). Responding to Mike Rollins’ question, Jon Freier (T-Mobile’s Consumer Group President) gave some insight on their small market rural area (SMRA) expansion:

“Q2 was our highest win share quarter that we’ve ever delivered. And here in Q3, we beat Q2. And so we’ve got a great series of momentum happening in the marketplace where we’re driving switching, winning those switching decisions, number one in terms of win share in the marketplace in smaller markets and rural areas. And like I talked about at Capital Markets Day, too, the thing that built a lot of confidence for me is that our overall Net Promoter Score in smaller markets and rural areas is now number one, and it’s 20% higher than the next highest competitor. For me, that builds ongoing customer advocacy, customer loyalty, and continues to build that overall growth momentum that we have in that particular marketplace. And that’s while we’re continuing to build net new accounts in the top 100 markets as well.”

When SMRA customers choose T-Mobile, they are happy and tend to stay. More customers fuel higher densification and additional coverage expansion. That fuels additional capacity to acquire even more customers. If T-Mobile sustains their reputation as the “new and fastest network that everyone wants to try,” then the acquisition of Metronet and Lumos (and others) makes a lot of sense. Even in non-Lumos/ non-Metronet areas, however, the company is gaining ground and appears to have found a winning formula.

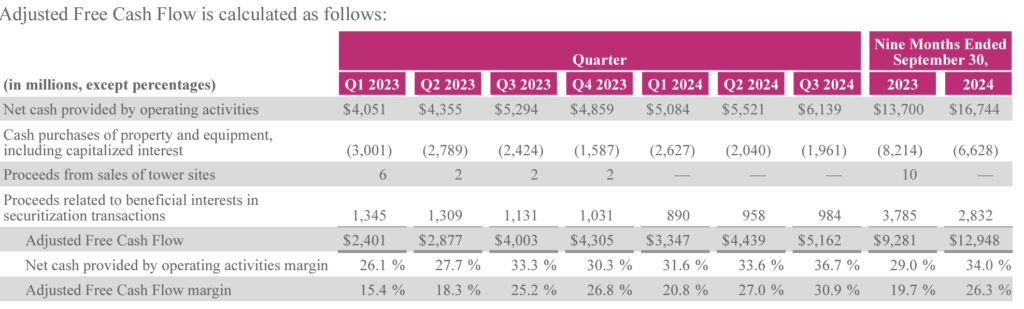

We will address the business and fixed wireless “buts” when we discuss the dynamics occurring in consumer and business broadband (the topic of the next Brief). However, T-Mobile is without a doubt the best capitalized telecommunications provider in the US. Here’s the cash conversion slide from the Fact Book:

Even with network expansion and densification (the company will have a capital spend figure of $2.2-2.3 billion in 4Q), T-Mobile is generating a lot of cash. In the third quarter, they slowed share repurchases (likely because the share price increased from $190 to $220 over the quarter making the share repurchase equation harder to justify) and now have nearly $10 billion in cash on their balance sheet (likely the most they have ever had without the corresponding debt).

We have mentioned over the years that T-Mobile could repay debt but refinanced heavily during the Sprint merger/ integration timeframe (2019-2022). It’s hard to justify paying down long-term debt that is less than 4%. So cash will continue to grow on their balance sheet earning 5% while interest will continue to accrue at 3-4%. And, when the next spectrum auction comes around, maybe T-Mobile will pay cash for their winnings.

To sustain their momentum, the company has initiated a material information technology upgrade which will drive personalized and actionable recommendations for each current customer based on their usage history and local community trends. This not only has the potential to materially reduce cost per gros addition but will likely open up opportunities for the company to strike partnerships beyond smartphones in both consumer and business segments. We would not be surprised to see, for example, a cross-town alliance with Amazon emerge across both segments (cf: Verizon chose to feature a Walmart+ myPlan offer over Amazon, and the retailing giant is still smarting from that).

Bottom line: T-Mobile’s value leadership is not a mirage. They have majority owners (Deutsche Telekom) who want to increase their ownership stake. They have excellent growth that outpaces their peers with minimal cross-subsidization. While they have gaps, they have plans to fix most of them already and will have cash to address the remaining items when the price is right.

That’s it for this week. Look for the sixth (and likely final) week of Apple iPhone 16 Pro and Pro Max availability charts tonight on the website, and in the next Brief, we will dive in to the puts and takes of the broadband marketplace. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Davidson College Basketball and Kansas City Chiefs!