December greetings from Cedar Rapids and Kansas City. The opening picture is of the Christmas tree perched atop the Quaker Oats plant in Cedar Rapids. Not only was this a pleasing sight this week, but they were manufacturing a version of Cap’n Crunch that made the downtown smell like cookies. This made our cooler than average December more palatable.

The last two weeks have been full of telecom and technology news. After our usual market commentary, we will succinctly share our insights from AT&T’s Investor Day and briefly analyze the projected drivers of bandwidth (and latency) infrastructure growth.

On the CellSite Solutions front, we have launched our new website (here) and have resumed regular posts on our LinkedIn page. Please follow all our developments by clicking here.

The fortnight that was

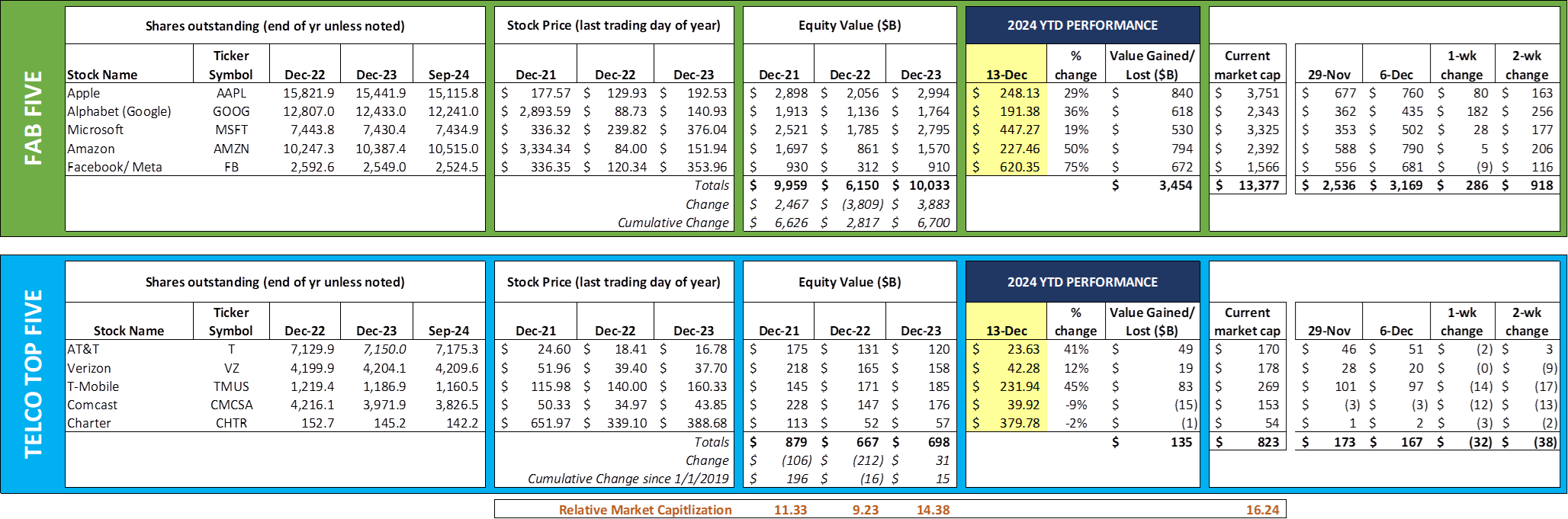

Despite global turmoil, a change of Presidential administrations and increasing signs of slowing growth and persistent inflation, the Fab Five managed to add $918 billion in value over the last two weeks. Each Fab Five stock gained at least two Charters over the period. Apple, who is not seeing a smartphone super-cycle but is getting decent reviews for Apple Intelligence, is quickly approaching $4 trillion in market capitalization. Meta, left for dead just two years ago, is up 5x. And the total value of these five equities is more than $13.7 trillion, more than 3x the total value of the entire London Stock Exchange.

Similarly, the Telco Top Five is poised to create more value in 2024 (excluding dividends) than any year since 2019. AT&T (+41%) and T-Mobile (+45%) account for nearly all of the market capitalization increase so far in 2024. In fact, AT&T, as we predicted in September, is poised to overtake Verizon as the second most valuable telco ($8 billion separating Ma Bell from Big Red). And, for the first time ever, T-Mobile is worth more than Comcast and Charter combined. What a difference a year makes.

Apple rolled out a new version of their iPhone operating system this week (18.2), and it contains several new Apple Intelligence features. Their strategy of rolling out features gradually is a welcome departure from their previous “big bang” launches. With this new release, for example, iPhone 15 and 16 Pro and Pro Max users can improve their Siri experience through the integration of Open AI’s Chat GPT (permission required per request). Those who tried earlier versions of the generative AI software will be surprised to see how much it has improved. Apple also has introduced a more intuitive and easier to access version of Google Lens. We have not seen much change in iPhone backlog, but their graduated campaign of periodic releases should improve spring and summer sales. More on the features in this CNBC article.

UBS held their annual Global Media and Communications Conference last week, and each of the Telco Top Five participated. Two comments generated the most activity. T-Mobile’s CEO, Mike Sievert, stated that, while they are confident in their recently revised guidance, “there’s a lot of risk” in the back half of the quarter because it’s “back-end loaded.” These statements, while true for the entire wireless industry, created a mini-panic in the stock (see nearby 5-day chart) and forced the company to release a clarification (8-K here) and to reiterate their plan to buyback up to $14 billion in stock (Reuters article here). As the opening chart shows, T-Mobile is still up 45% for the year and leads the group in value creation – but investors are on edge as many stocks, including Magenta, are trading at historically high multiples.

As we have stated in many previous Briefs, T-Mobile is the best positioned wireless service company for 2025. Their US Cellular retail operations acquisition, when approved, should be an easy lift for the Technology and Operations organizations. Lumos and Metronet will yield significantly more value to consumer postpaid phone net additions than most analysts currently anticipate without the copper hangover. Most importantly, T-Mobile has spectrum holdings and net debt levels that are industry leading. Our only hope is that they take advantage of the anticipated merger window presented by the incoming Trump administration by purchasing Comcast and/or Charter and/or Cox with appreciated stock.

While T-Mobile caught the brunt of investor nervousness, statements by Comcast’s Cable CEO, Dave Watson, weren’t well received either. Here’s the full exchange between Watson and UBS analyst John Hodulik:

John Hodulik: How would you characterize competition as in the fourth quarter versus what you’ve been seeing previously?

Dave Watson: “Competition remains competitively intense. That has not changed. It’s been pretty consistent throughout the year. In particular, in the more price conscious end of the marketplace that is where we’ve seen a little bit more swirl around that segment and it’s remained this way right through the fourth quarter, this competitive intensity.

Now, the most important thing though is that the churn in — on our really important traditional and premium segments, this is where we sell 500 megabits and above 1 gig services that we’ve had great success with. Those two segments, the churn has remained stable and near-record lows. So that’s very good news and it’s continued.

Yeah, when you replay the year though and if you look at the first half of the year, we lost just about 100,000 — just under 100,000 [per quarter] for the first half of the year. You go into the third quarter and on the shoulders of the Olympic marketing surge, the students returning, the seasonal dynamics trending fine, and then a competitor strike. Those three things saw improvements in performance in Q3.

Q4, to your question, resembles more of the first half of the year is what we’re seeing. And one other thing to add on top of Q4, we had the two hurricanes. So the two hurricanes, we’ve been assessing it, we’ve talked about this before as we did the Q3 unique positive elements. In Q4, the hurricanes, we think will impact to the tune of around 10,000 broadband losses and there will be a slight impact to ARPU.

When you add all these things together and you look at it going into Q4, we could be looking at a broadband subscriber loss in Q4 of just over 100,000 and there’ll be — while we’ll be in the range, the ARPU range that we’ve talked about 3% to 4%, we’ll at the lower end of that range. So that’s how things remain competitively intense but consistent with earlier parts of the year.”

This exchange resulted in 7.5% decline in Comcast’s equity value for the week. While the company did follow it up with an exciting announcement (Comcast Business will acquire managed service provider Nitel for an undisclosed sum), the damage was done. Comcast has not developed a sustainable defense for the cost-conscious segment of the market, and competition will inevitably turn their sights on higher value-adding segments in time.

We continue to be baffled by the lack of content promotion in the Comcast broadband offers and the deemphasis of Xumo as they experience intense competition. It appears that the company has an arsenal to counter AT&T and other fiber to the home providers in markets (potentially defining an end-to-end solution benchmark), but instead has decided to pay to an ARPU-accretive market share draw (which we see as a risky strategy — see the next segment on AT&T).

AT&T’s Analyst Day: Informative and few surprises (just how we like it)

December started with AT&T’s Analyst Day (materials here). To no one’s surprise, they are expanding their local exchange fiber expansion footprint by 15 million homes, and, once their 2.5x EBITDA/ Net Debt leverage ratio is met, they will repurchase shares. And the company indicated (and reiterated in the Q&A) that future dividend increases would likely not result in previously experienced high-digit yields (AT&T’s current dividend yield — 4.7% – now mirrors that of a short-term Treasury note).

Outside of one previously recorded interview, there were no guest speakers. Artificial Intelligence discussions were focused on how AT&T is using custom/ hybrid large language models to improve their operations and marketing. Rather than avoiding the topic, Susan Johnson detailed a logical and practical approach to eliminating their copper footprint. CEO John Stankey’s opening remarks described their methodical approach to increasing the value of their fiber-built territories.

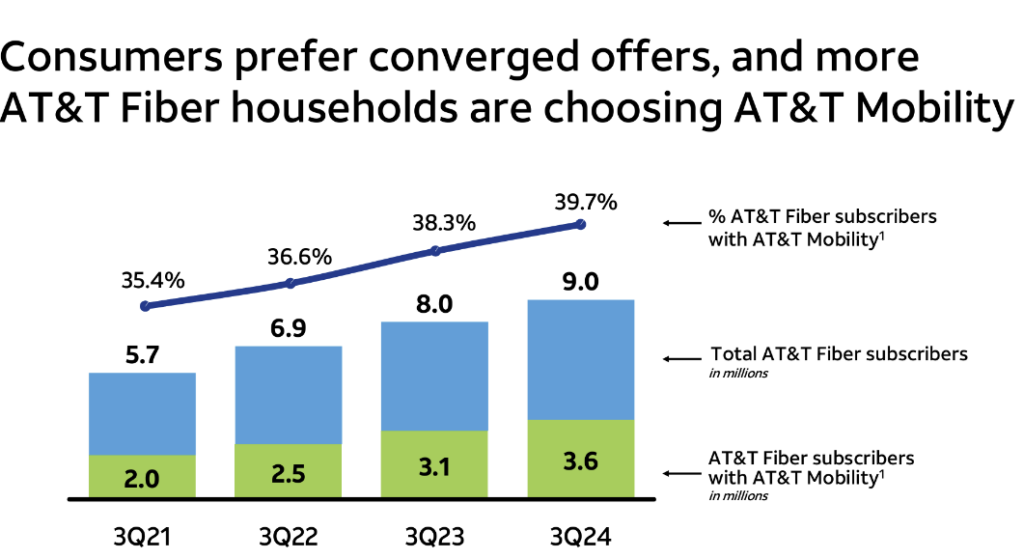

AT&T did disclose several noteworthy insights, however. The following chart was quickly picked up in the Q&A by Bank of America analyst David Barden:

As Dave correctly noted in his question, the AT&T Fiber subscriber base has accounted for a disproportionately high percentage of total postpaid phone growth (AT&T Mobility is defined as consumer postpaid phone) – 9 million homes accounted for roughly 30% of AT&T’s total postpaid phone growth.

Our take on this slide is that the half million growth over the last 12 months is in accounts (households) with AT&T Mobility, not the actual number of postpaid mobile subscribers (that would be the correct way to measure the 39.7% ratio). If that is true, then the percentage of AT&T’s phone growth coming from fiber subscribers is more like 60-70% (assuming 2-3 postpaid phones per family). As we have stated in many previous Briefs, we can only wonder how many fiber customers in high-growth Texas and Florida markets fell on the floor as AT&T scooped up market share.

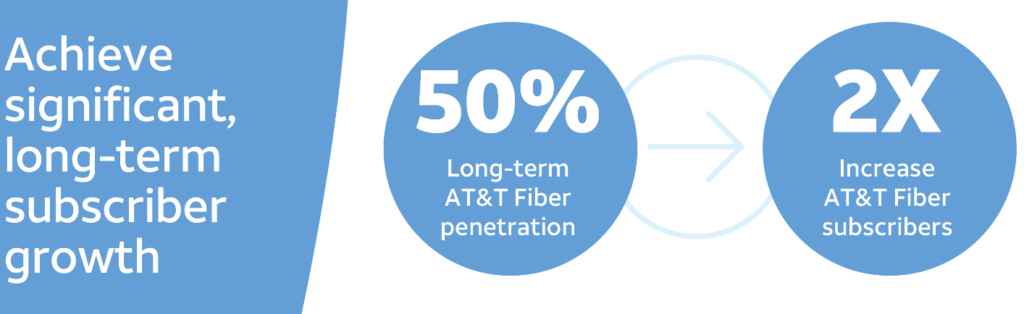

If this calculation is correct, then AT&T can’t go fast enough in their expansion from 30 million in-franchise homes to 45 million. It also makes the next insight (50% fiber penetration) more believable. This chart clearly explains the magnitude of the opportunity that exists within their current exchange footprint.

AT&T also raised their long-term fiber penetration from 40 to 50%.

While AT&T skeptics will view this as a “goal seek” number to justify 14 million previously uneconomic homes, we think the 50% is heavily informed by the previous chart. As customers receive superior value from fiber and wireless (e.g., bundling homes now receive free wireless backup), competitive offers (which likely feature either fixed wireless and/or MVNO economics) look less attractive. Multi-year churn reduction alone could account for more than half of the increase from 40 to 50%.

Bottom line: AT&T delivered an internally focused plan at their Analyst Day that was believable, achievable, and BEAD independent. It happens to also cost more than $65 billion over the next three years to achieve. While we believe the product roadmap was light on details, the plan lays a foundation to “win at home.”

Bandwidth infrastructure hype?

As we enter 2025, many analysts are predicting an additional step-up in bandwidth and server growth. Driven by continuously evolving and improving Artificial Intelligence (AI) large language models (LLMs), and the desire to deliver results quickly and accurately, server/ compute clusters are being implemented quickly.

Here’s our take on some of the dynamics impacting the broadband ecosystem today:

- The cost to add incremental fiber to the home (FTTH) capacity is far less than the perceived value produced. Five years ago, having 1 Gbps to the home was considered a niche – now, it’s quickly moving into the top choice for most homes.

- In-home Wi-Fi connectivity is quickly becoming a part of the bandwidth solution. Spectrum may get away with a $5/ monthly charge for premium bandwidth after the first year, but many providers (including AT&T) are simply including the Wi-Fi as part of an Optical Network Terminal (ONT) solution. End-to-end control is also critical to improving smartphone coverage in the home. Comcast and their cable brethren understand this requirement very well.

- Microsoft needs to be successful with their AI initiatives (specifically Chat GPT) to replace Google search as the “source of truth.” Google is not going to cede the title without a fight.

- Large language models need to be fed with updated data to improve, and most large carriers and corporations (see AT&T’s comments from their Analyst Day in the link above) will not make their customer information public. Private AI (e.g., the Mayo Clinic AI instance for complex computing and analysis) is going to proliferate. The Chat GPT operating “kernel” continues to scale, but derivative uses for specific corporate use also grows.

- The customization of AI will drive server requirements closer to the home and business. The dependency on reliability and resiliency will also grow as these systems move from answering random questions to suggesting personalized solutions that improve corporate and household efficiency.

- In less populated areas, some (minor) subsidies will be required. Wireless will bridge the low latency requirements until application (latency) requirements outgrow the network. We think that today’s wireless infrastructure will be a good solution for Internet access through this decade, but after that, more fiber-fed towers will be needed.

- We still lack a dominant hardware and software stack for residential and small business AI beyond today’s “write me a few paragraphs on” or “question and answer” formats. We think that the concept of a “teaching assistant” will be one of the critical applications developed in the next several years – it will change how and what our kids learn. We also think that the concept of “elder assistant” and “new employee assistant” also has a lot of promise. It only takes the development of a few of these applications to change the demand curve.

Nvidia and Broadcom are reinventing/redefining computer processing. Fiber networks enable consistent monitoring and feedback. The telecom winners are those who invest in critical infrastructure, particularly the economically feasible closest compute/ server stack. Power concerns aside (and they cannot be ignored), there’s steak with that sizzle, and future community and economic development will be highly dependent on critical infrastructure availability (as one of the long-time Sunday Brief readers said last week “Affordable housing, clean water, blue ribbon schools, reasonable traffic, and now ubiquitous broadband infrastructure are now the critical ingredients for community growth.”

Bottom line: If computing and power requirements can keep pace with the requirements of customized applications and large language models, the hype is real. We think there will be hiccups that will result in an uneven application of community AI over the next decade, but soon thereafter a consistent experience will be available to a large portion of the US. The impacts on quality of life and new addressable market creation will be significant.

That’s it for this week. We will have an interim (online) Brief next week and a Consumer Electronics Show (CES) preview on December 29 (Jim will unfortunately not be attending this year’s event). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – go Davidson College Basketball and Kansas City Chiefs!

The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.