RCR Wireless does not normally pay so much attention to pay-walled market analysis reviews, but in the circumstances, and as a point of difference…

Another day, another analyst review of the private 5G market; this one, by UK-based Kaleido Intelligence, looks to have made a better fist of it than the last one (see: Blood on the tracks – weird Gartner review scrambles private 5G). But it still raises questions about the runners and riders, and the criteria for entry and scope of review. The headline from it, which fewer would argue with, is that a vendor and an integrator, Nokia and NTT DATA, are top of the pile – rather than a clutch of international SI-style business divisions within national mobile network operators.

This is partly, perhaps, because the review by Kaleido Intelligence is categorised as a ‘connectivity vendor hub’ – which presumably means it places more focus on the discipline of solution-making, rather than that just of solution-selling. (The gripe about Gartner is that it placed operators as the default ‘leaders’ in the market, ahead of vendors and integrators as ‘challengers’ and ‘niche players’, even though they are white-labelling these so-called challenged solutions and, often, their challenger/niche integration services as well.)

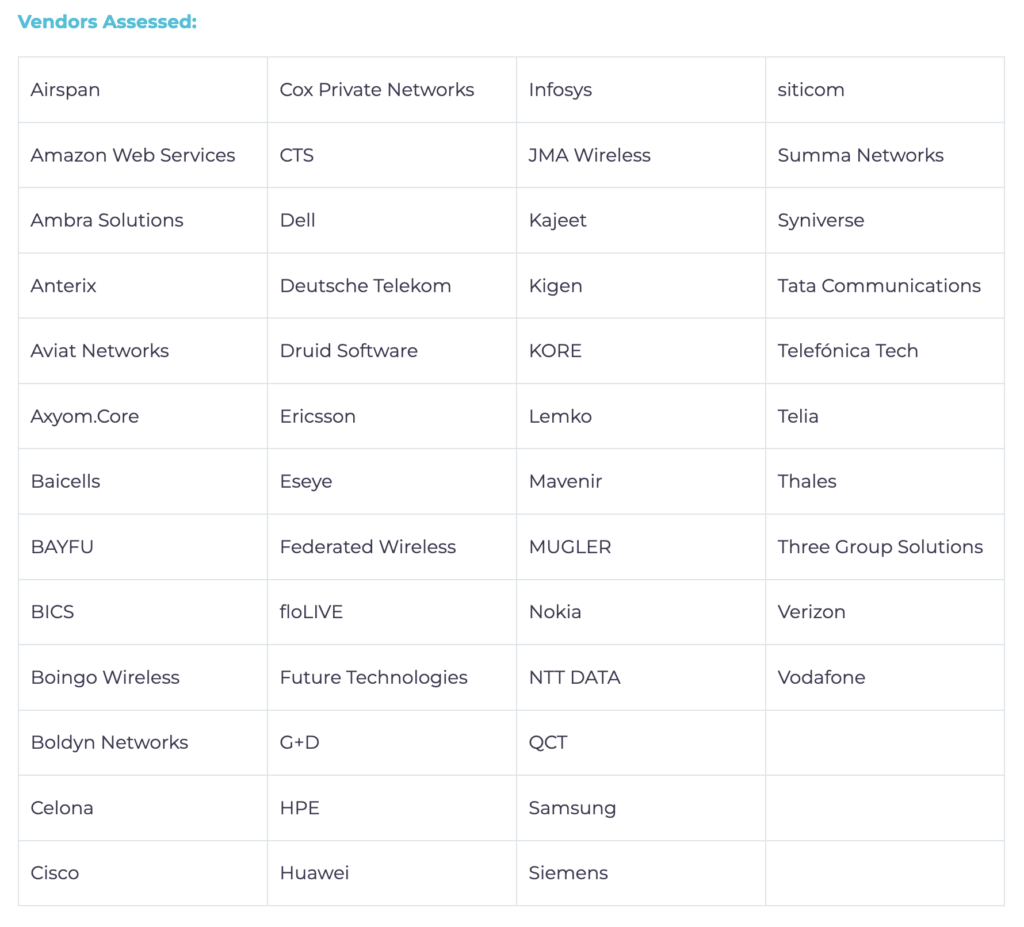

Kaleido Intelligence takes a different approach. It splits the private 5G vendor market into four categories: for network hardware (RAN), network software (core), network management, and connectivity (network) enablement. But it accepts a broader view of the ‘vendor’ market, too, running the rule over 49 “established private network players”. This definition, then, considers just about any business engaged in the sale of private 4G and 5G networks. Indeed, its list of contenders also covers mobile operators (see below), including most of Gartner’s adjudged ‘leaders’.

These are: Deutsche Telekom, Telefónica, Verizon, and Vodafone – most of which should probably be appended with ‘Business’ or the like (Telefónica Tech, Verizon Business, and so on) if just to distinguish their international sales identities from their national parent operations. But Orange Business is missing here, curiously; Swedish group Telia and Hucthison-owned Three Group Solutions are included in its place, effectively. So that’s a little weird, the absences on score cards. No matter; none of them appear anywhere near the top of the Kaleido card, anyway.

Very few do, in fact – which poses questions, too. But the review by Kaleido Intelligence demonstrates a better grasp of the broader private 5G ecosystem. It apparently considers network offerings from the likes of Airspan, Celona, Cisco, Druid Software, Huawei, Mavenir, Samsung, and Siemens, among others – most of which don’t get a mention by Gartner. Boldly, it also considers IoT carrier-services and virtual-network (MVNO) companies (BICS, Eseye, floLIVE, KORE, Syniverse, others) and SIM security and management firms (G+D, Kigen, Thales, others).

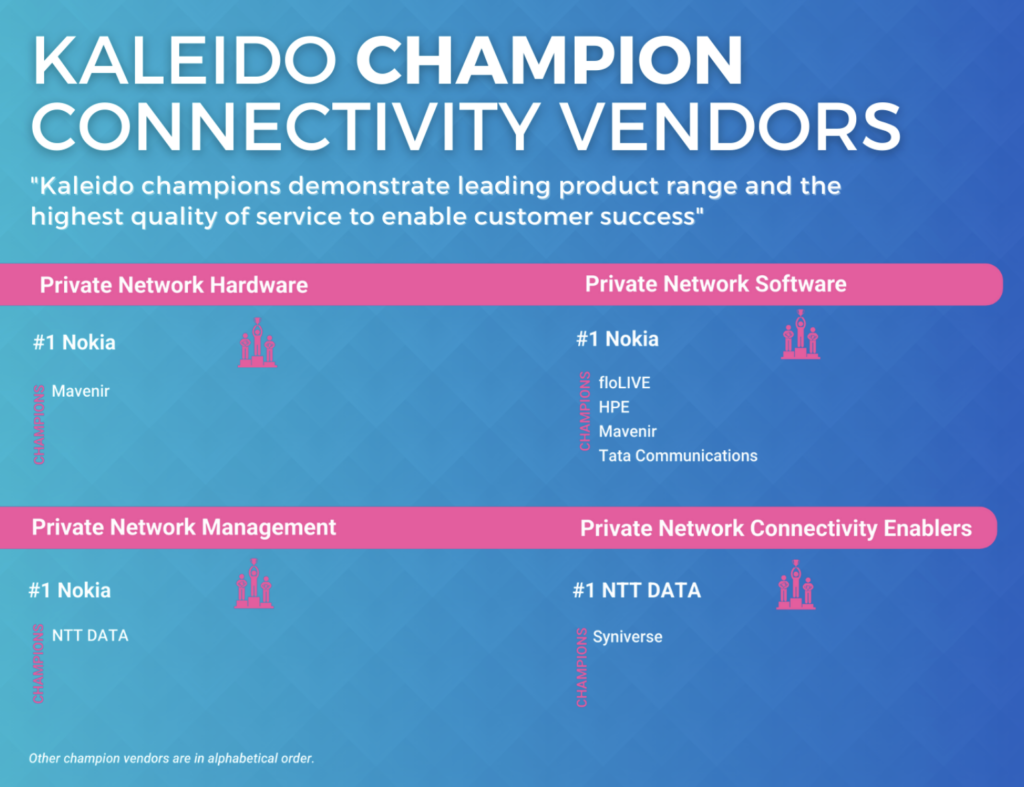

There is a better range of integrators, too, including genuinely-niche (written as a complement) local specialist integrators like Siticom and Future Technologies. The likes of AWS and Dell also get a mention. But among network suppliers, only Mavenir makes it on to the podium (for hardware and software; see below); and only a few of these others make it for ‘software’ (whatever that actually means, given the array of suppliers: floLIVE, HPE / Athonet, Mavenir, Tata Communications), and only one makes it for connectivity enablement (Syniverse).

Otherwise, Kaleido Intelligence fills the top spots in its ‘magic quadrant’ (apologies) with just two names: Nokia and NTT DATA – which were rated as the champion ‘challenger’ and champion ‘visionary’ by Gartner. Here, Nokia wins for just about everything; for network hardware, network software, and network management. NTT DATA – in part courtesy of its Transatel MVNO business, presumably – is named king of the heap for ‘connectivity enablement’, to dovetail private 4G/5G networks with public 4G/5G networks.

But as much as its broad focus, and its logical winners, the takeaway from the Kaleido review is probably also about its losers, which don’t register at all in the final analysis – probably, in part, because of the form-filling and access required for vendors to be considered seriously in the first place. And so: Ericsson and Huawei are not there; Celona and Druid Software are not there; DXC and Kyndryl are not there; BT Business and Orange Business are not there; Accenture and Deloitte are not there. You get the idea. It feels like a massive (!!!) improvement, versus Gartner; but also like there is a way to go to capture the complexity of the market.

The full review is available here – for £2,500.

Kaleido Intelligence says it is the “culmination of more than five months’ worth of primary and secondary research, including product demos, questionnaires, and detailed interviews and briefings”. It is the firm’s “most detailed [study of the private 5G market] yet”, it said. It writes: “Seven vendors [ranked] as ‘champions’, with Nokia and NTT DATA achieving this rank across multiple categories, and each ranking as the #1 vendor in at least one category. In addition, another five vendors were acknowledged as ‘champions’ in at least one category.”

It supplied quotes from its champs.

Stephan Litjens, vice president of enterprise campus edge in Nokia’s cloud and network services division, said: “As private wireless and industrial edge drive industry digitalization, Nokia is proud to retain its ‘#1 champion vendor’ status in [this] report. The in-depth and quality study analyzing many factors such as industry presence, product features and capabilities, and innovation reaffirms Nokia’s bold vision to provide enterprise customers [with a] digitalisation platform that includes all of the enablers to accelerate their Industry 4.0 transformation.”

Parm Sandhu, vice president for enterprise 5G products and services at NTT DATA, said: “Kaleido’s recognition… underscores our commitment to market innovation. Our private 5G network and edge compute platform addresses the growing demand for greater connectivity to power edge AI and solves critical business challenges. This validation of our strategy, proven capabilities, and customer-centric approach validates NTT DATA’s role as a trusted partner in empowering organizations to achieve meaningful digital transformation across industries worldwide.”

James Moar, principal analyst at Kaleido Intelligence, commented: “The private network market is moving beyond the exploratory phase, with potential customers now needing to demonstrate concrete use cases to be successful. Our latest ‘vendor hub’ shows how the leading players are doing just that, combining a range of capabilities to deliver clear benefits to the enterprise.”