Has the slow rollout of 5G SA core networks hindered 5G RedCap adoption?

Release 17 of the 5G NR standard includes a provision for IoT sensors to connect to 5G with significantly reduced network — and therefore hardware, and therefore, cost — capabilities called Reduced Capability or RedCap. 3GPP Release 18 then introduced enhanced RedCap or eRedCap, designed to offer further reduced capabilities and lower data rate requirements.

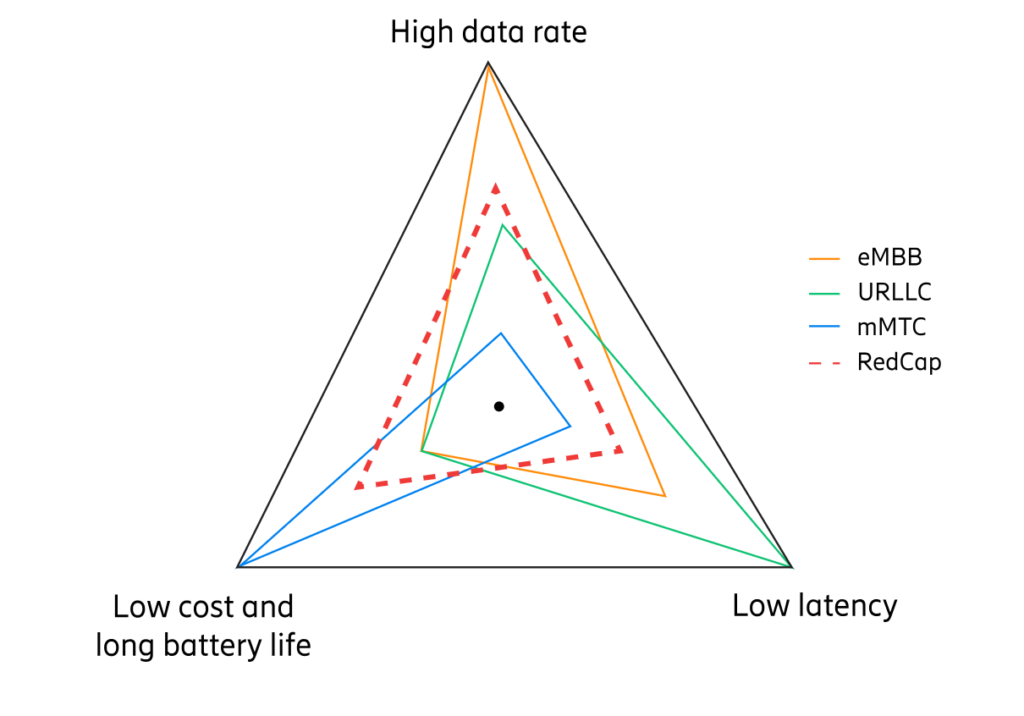

RedCap and eRedCap sit provisionally some number of latency rungs below ultra-reliable low-latency communications (URLLC). It is also not quite as fast as enhanced mobile broadband (eMBB) or as powerful as machine-type communications (mMTC). That is to say, if URLLC is for latency and reliability, enhanced mobile broadband (eMBB) for speed and efficiency and machine-type communications (mMTC) for coverage and power, RedCap is meant to plug a hole of sorts, addressing the use cases that, in Ericsson’s words, “are today not best served using eMBB, URLLC, or Low-Power Wide-Area [LPWA] (LTE-based mMTC) solutions.” These include things like wearables, surveillance cameras and certain sensors and monitors. They need lower device cost and longer battery life than can be provided by legacy 5G NR devices but also require higher data rates and lower latency than Narrowband Internet of Things (NB-IoT) and LTE-M can offer.

“RedCap is much more than lower complexity for IoT devices,” the Technology Manager of Rohde & Schwarz’s Wireless Unit Reiner Stuhlfauth told RCR Wireless News. “It is offering the industry completely new services for machine-type communications scenarios by bridging the gap between the low-end sensor networks [and] high-end devices.”

In October, Omdia, which similarly called RedCap the “big missing piece of the 5G IoT puzzle,” predicted the technology’s growth to be “explosive,” reporting a surge in connections that will reach 963.5 million by 2030 as global 5G IoT connections continue to climb. “5G RedCap was specifically designed for IoT applications, and in just a year since the first module launches, we’ve already seen small-scale deployments and trials begin to take shape,” commented Alexander Thompson, senior IoT analyst, adding that 5G eRedCap is expected to follow a similar deployment path.

But another prevailing perspective is that the technology’s adoption has, thus far, been hindered by the slow rollout of 5G standalone (SA) core networks. And that’s because 5G SA is a requirement for RedCap. “RedCap is the first completely standalone IoT technology based on 5G,” confirmed Stuhlfauth. The implication, of course, is that telcos will need to make the necessary RAN and core upgrades in order to tap into the RedCap opportunity. Stuhlfauth added, though, that this means that an operator deploying RedCap will also be benefiting from other 5G core network features such as network slicing, service-based architecture and enhanced security mechanisms.

The Head of GSMA Intelligence Peter Jarich agreed on the importance of SA, telling RCR Wireless News that operators should not be looking to make some sort of investment “trade-off” between SA 5G and 5G-A. “it’s important for operators to make sure that ones not distracting from the other because there is a very real chance there where if they can do some things with SA and some without” — like increased uplink performance — “that operators will invest in 5G-Advanced and delay their SA investments,” he said. “And they need to be investing in SA. It’s a really important technology.”

So how is this dynamic between interest in RedCap and slow SA progress playing out? Well, the Head of IoT, Identity and Big Data at GSMA Richard Cockle told RCR Wireless News in September that as of the end of June, operators in 15 countries were already investing in RedCap technology. At the time, though, recent data from the Dell’Oro Group shows that only 61 operators have deployed 5G SA in 34 countries since 2020. According to Ericsson, this number amounts to less than 20% of all 5G worldwide commercial 5G deployments.

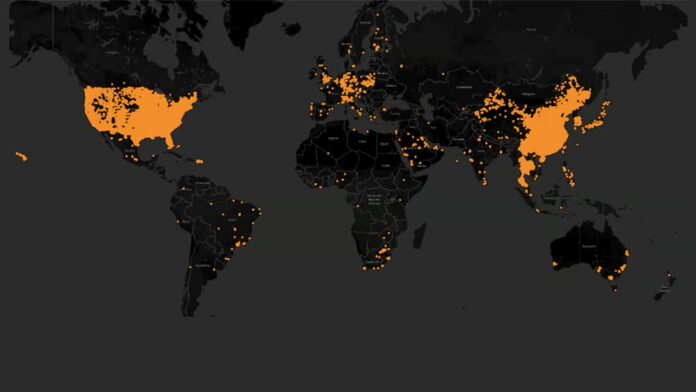

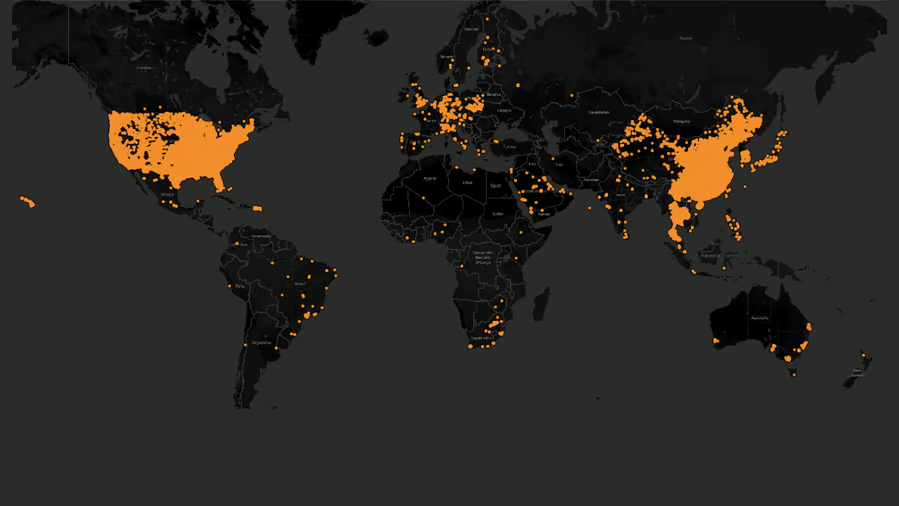

Further, the image below, from Ericsson’s 2022 Mobility Report, shows just how wildly uneven, regionally, these deployments have been, with Asia (China, more specifically, if we’re being honest) and the United States heavily coated in orange — the color Ericsson chose to indicate SA networks. The rest of the map? Pretty sparse, with some dots popping up here and there in Europe and even fewer in South America, South Africa and Australia.

Even more food for thought is this take, provided directly to RCR Wireless News, from Mobile Experts Founder and President Joe Madden: “Our forecast shows that RedCap will be used over time, simply because it’s the newest format. But in most applications, RedCap is not actually better than Cat-1.bis or Cat-M. In fact, today it appears that RedCap devices are more expensive than Cat-1.bis, so I see RedCap as a step in the wrong direction for most low-cost IoT applications. It’s not important that RedCap is cheaper than other 5G modems. It’s more important for each generation to be cheaper than the previous generation.”