March greetings from Iowa and Missouri. Pictured is Jim with his colleague Marty Smith during a recent facility tour of Blue Star Power Systems manufacturng facilty in North Mankato, Minnesota (more on them here – a high durability product). As many of you are (painfully) aware, the increase in demand for generators from data centers has extended long lead times for the telecom industry. Good news for the manufacturers, but not so much for carriers and their suppliers (like CellSite Solutions).

This week’s Brief is full of commentary and analysis. We will look at comments made by telecom executives at last week’s Morgan Stanley Technology, Media & Telecom Conference. Our main focus, however, will be on capital spending, and we will use a wide variety of sources, including recently filed 10-Ks (annual reports) as the basis of our analysis.

The fortnight that wasy

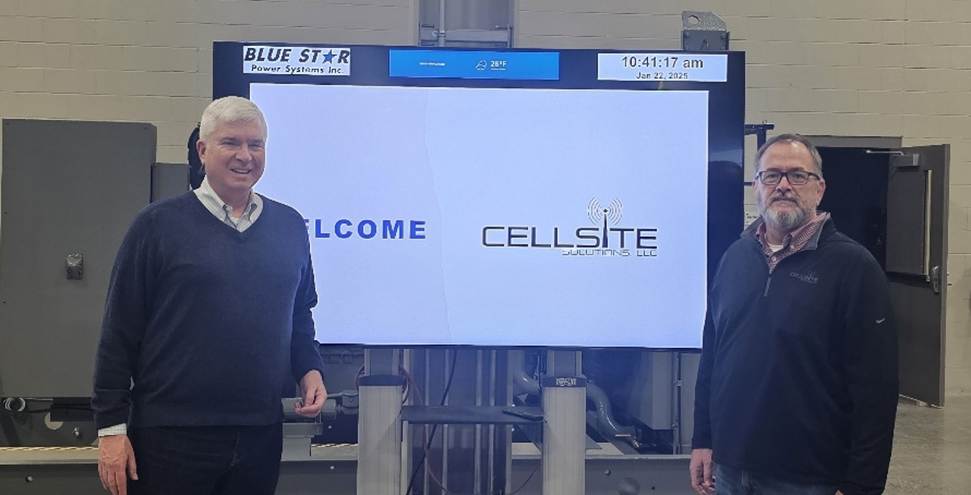

Another down week for the markets and the Fab Five (-$261 billion for the week, -$671 billion year-to-date). As mentioned to several Sunday Brief followers this week, if you had told us that 2025 would begin with a nearly $800 billion gap in market value creation between the Fab Five and the Telco Top Five, we would have questioned your sanity. But here we are. Every stock in the Telco Top Five is above water (even Comcast), and all but Meta/ Facebook are dragging down results for the Fab Five.

One of the rows not frequently cited from the above chart is the Relative Market Capitalization ratio (currently at 13.9, its lowest level since July 2023). It would be a stretch to describe the Telco Top Five as a “safe haven” for equites, but many investors who are cashing in on nearly $7 trillion in Fab Five gains from the end of 2022 to today are hedging their bets. AT&T pays a 4.09% dividend yield and has appreciated significantly since 2023; Verizon’s yield is 5.88% and their market capitalization is the highest in over two years. And T-Mobile is in the middle of a sizeable share buyback as they hold on to $300 billion capitalization and pay a 1.33% dividend. The thesis for these three stocks is growth and value.

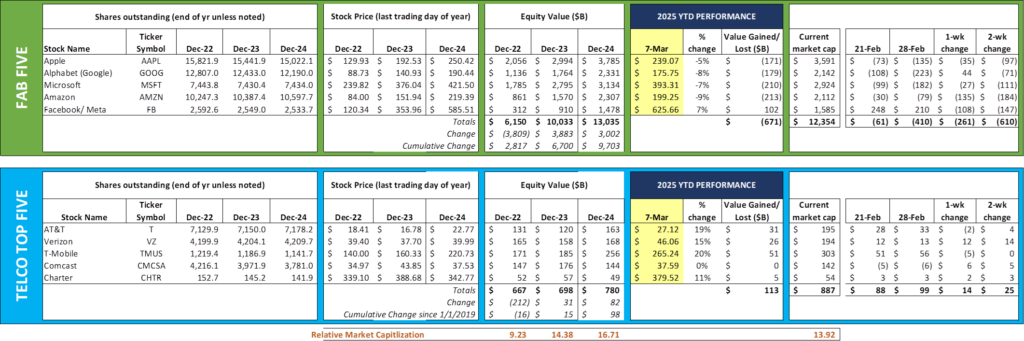

On the macro front, the Bureau of Economic Analysis (BEA) reported the largest trade deficit in recent memory last week (full article here and data in nearby chart). Driving this deficit was a substantial increase in purchases of steel and aluminum ahead of tariff implementation. This wild swing in imports drove a substantial change in the Atlanta Fed’s GDP projection for Q1 2025 (here). When we last looked at these figures, the GDP Now estimate ran ahead of most economist projections (3% for the Fed, and 2-2.4% for most economists). In the last few weeks, the GDP Now figure has plummeted, and, as of Friday, the projection was negative 2.4% growth for Q1. That’s a big swing considering consumer spending and business investment did not materially decrease (see the ISM report released last week here as well as the latest BEA data on consumer spending here). When times get turbulent, businesses postpone or freeze projects and spending. If business investment slows down (and, as we describe below, the telecom industry is not seeing a material slowdown), recession will follow.

If the import “bump” were not enough, Germany changed their decades-long fiscal policy last week, removing a “debt brake” implemented in 2009 and shifting toward meaningful deficit spending on defense and infrastructure. Per this Associated Press report:

“Leaders of the conservative Union bloc agreed with the center-left Social Democrats to exempt military spending over 1% of GDP from the debt limit, as well as a 500-billion-euro infrastructure fund for civil and disaster protection, transport infrastructure, hospitals, energy infrastructure, education, scientific research and digitization. Economists estimate that the measure, if passed, could enable a trillion euros in new borrowing and spending over a decade.”

Like the US in 2022, Europe is catching the infrastructure bug. Fortunately, they also have a 50% higher unemployment rate in Germany than in the US (6.2% vs. 4.1%) which should keep wage inflation in check. But competition for sovereign debt financing is going to increase, perhaps substantially. The extent to which this may reduce the supply of debt for corporations is unclear.

Finally, Mark Gurman at Bloomberg reported that Apple is experiencing issues with their next phase of Apple Intelligence implementation. Per this article:

“Apple had been planning to make Siri more ChatGPT-like and conversational next year. But now only the initial underpinnings for that upgrade are expected to be ready by 2026, during the iOS 19 release cycle. The actual interface that users experience likely won’t arrive until iOS 20 in 2027, the people said.”

Apple is wise to wait until the software experience matches the company’s high standards. But investors will continue to pressure the company to accelerate their timelines.

Last week’s Morgan Stanley conference – any new news?

We have listened to and read the transcripts of each of the Telco Top Five presentations at last week’s Morgan Stanley Technology, Media & Telecom Conference. Here are our takeaways:

- T-Mobile is clearly spending time evaluating how to turn their T-Fiber joint ventures into blockbusters. Peter Osvaldik, T-Mobile’s CFO, said that they are “very happy with the hand they have.” Said differently, the company is likely evaluating how to use Metronet and Lumos and their fiber expansion engines rather than adding several other companies to the fold at this time. Both transactions fit well into T-Mobile’s overall rural expansion efforts. As we said shortly after the Lumos transaction was announced (here), the opportunity for T-Mobile to deliver meaningful market share because of their owned/ controlled wireless and fiber assets is substantial. Where T-Mobile will be challenged is with content delivery. Fortunately, they have learned a lot through their fixed wireless efforts already and can remedy this in the Lumos and Metronet markets with minimal investments.

- AT&T is on a mission. Nothing is throwing AT&T Chairman and CEO John Stanley off his construction focus. That was the primary thrust of much of his presentation. When asked about competition from cable, Stankey replied with his trademark deadpan bluntness: “It’s tough to be the highest priced service in a market with a product that isn’t the best product in the market, and I believe that is the position they’re in when they compete against our fiber. And so as a result of that, I feel very, very comfortable that we can hold our own in those circumstances.” Based on his presentation, we expect beats on both households passed and overall penetration. We also expect AT&T to improve their market share by 2-3% (or more) in areas where they are completing their fiber builds (John goes into detail in his presentation about the challenges of a 10-20-30% fiber-deployment marketing plan vs. a 70-80-90% one.

- Verizon is very focused on the consumer marketplace. Verizon CFO Tony Skiadas spoke on a wide variety of topics and clearly has his sights (and budget expectations) set on improved consumer (postpaid and prepaid) performance in 2025. We found two comments most insightful: First, Verizon is not expecting meaningful improvements to the prepaid business until the second half of 2025 (which is really the fourth quarter based on demand cyclicality). We cannot determine whether Tony’s comment reflect the current budget assumptions or delays in operational/ market programs, but missing the Income Tax refund cycle is concerning.

Our second observation was a convergence statistic Tony cited that we do not recall having heard before: “We have owners’ economics both on wireless and broadband at scale. So we can serve across the portfolio… We’ll be ready when convergence comes, but only 16% of our mobility base has the converged bundle right now. And it hasn’t moved that much in the last year. So that gives you the impetus that it’s very much customer led. So we’ll see where it goes, but we’re well prepared when it does happen.” Seems like an opportunity for Verizon’s best-in-class marketing to come up with some messaging and promotions.

- Comcast is a giant conglomerate (yet is now the fourth largest of the Telco Top Five). Brian Roberts, Comcast’s Chairman and CEO, closed his comments with the following statement: “I think we’re going to have an exciting transformation that will give us growth. And that our businesses like theme parks and content give us other places to invest; business services, hopefully we talk a little bit about that; you put all that together, we have a fantastic company.” Comcast speaks like a trillion-dollar company yet, except for 2021 (when post-COVID theses were just beginning to take shape), the company has been in a $140-150 billion trough (see nearby 5-year stock price chart for details). Share buybacks have probably prevented further price deterioration. Debt levels are great, but growth, especially from wireless services, trails Spectrum. We think that there’s a lot on Comcast’s plate and that may be hindering their ability to focus.

- Charter is setting the stage for video to (hopefully) be a retention tool for Internet alongside mobility. Here is Charter CEO Chris Winfrey’s comment at the conference: “I’m not so sure I’d say we’d bet on it, but can video — in addition to mobile, can video really become a tool for acquisition of Internet and retention of Internet, the way that it once was.” Chris continued in a later response to detail the reasons behind their video focus. We applaud their efforts on wireless (their value proposition is clearly resonating with customers) and think that there are more ways they can integrate streaming, mobile, and broadband.

Where are they spending money? (2025 edition)

One of our most popular editions of the Sunday Brief follows our 10-K review. In the annual report, each of the Telco Top Five elaborate on their capital spending trends. We divide our analysis this year into three sections:

- C-Band densification and cell site construction. Several analysts have noticed a trend that wireless companies (particularly but not limited to AT&T and Verizon) are starting to add new cell sites to improve C-Band densification. Wells Fargo, in a recent note to investors, projected that new site (raw land) construction could result in 50,000 new sites over the next few years. T-Mobile is also on the move (including US Cellular) with additional cell sites (many of which will be co-location on existing sites and not new). Given low spectrum spending over the last several years, it’s all about densification – at least until the next spectrum auction.

- Local construction – line extensions, upgrades, etc. AT&T is going to be a big spender as they rebuild their existing footprint (total budget is $22 billion and we expect $10 billion to go to fiber buildouts with the vast majority being in their existing local exchange territories). Comcast and Spectrum are continuing to upgrade their plant to High-Split DOCSIS 3.1 and DOCSIS 4.0 and augmenting intra-city fiber networks. Verizon is expanding their current FiOS footprint by up to 650,000 premises prior to the Frontier acquisition and by close to a million passings annually post-acquisition.

- Support systems. We are going to hear a lot about the digitization of each of the Telco Top Five. T-Mobile spent a lot of time during their recent Capital Markets Day speaking about how better data and AI-enabled applications will drive out customer service costs. AT&T spoke at length about the seamless nature of their residential reconnect process for movers. Everyone is speaking about convergence. Product simplification efforts are underway (usually resulting in a price increase for subscribers), but data standardization efforts have a ways to go to be AI-ready. The systems to support restructured data need to be architected and implemented. While not as large as the first two areas, systems remain the Achille’s Heel of the telecom industry. And acquiring Frontier will not make it any easier for Verizon.

What’s also important is that telcos are not spending a lot of money on spectrum purchases this year. They have largely digested the costs of C-Band and are focused on improving productivity and efficiency. Hence their focus on improved data quality and more fiber miles.

That’s it for this week. In the next Brief (March 23rd), we will begin to look at first quarter earnings trends (hint – tariffs are not the primary concern). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website).

Finally – Go Royals, Sporting KC, and Davidson Basketball!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.