Greetings from Mexico, Missouri, and Iowa. We realigned the start date of the bi-weekly format to accommodate the Easter holiday (and our 30th wedding anniversary) weekend. We will have a similar skip on Memorial Day weekend in May.

The opening picture is a familiar one to those of you who get Jim’s LinkedIn posts – eight years ago Friday, Lucid Drone Technologies won the Davidson College Nesbitt Award (grand prize of what eventually became $25,000 seemed like a lot at the time). A lot has happened since then, and, unlike 95+% of other companies that started eight years ago, Lucid Bots is cash flow positive and thriving. This is a tribute to a lot of grit shown by the early team, particularly their CEO, Andrew Ashur. We encourage you to follow them on their journey through their LinkedIn and YouTube pages.

A note of thanks – we have nearly doubled the size of our sundaybrief.com Wordpress distribution list over the past year. If you are interested in having a friend sign up for the Sunday Brief, please have them sign up on the website (subscribe button on the upper right). We are going to cap our traditional email list and transition all of those emails to the WordPress site by the end of 2025. We have never sold, and do not have any plans ever to sell our mailling list, so if you suspect that spam email is coming from your Sunday Brief subscription, please let us know at sundaybrief@gamil.com and we will address with WordPress and/or Google.

The fortnight that was

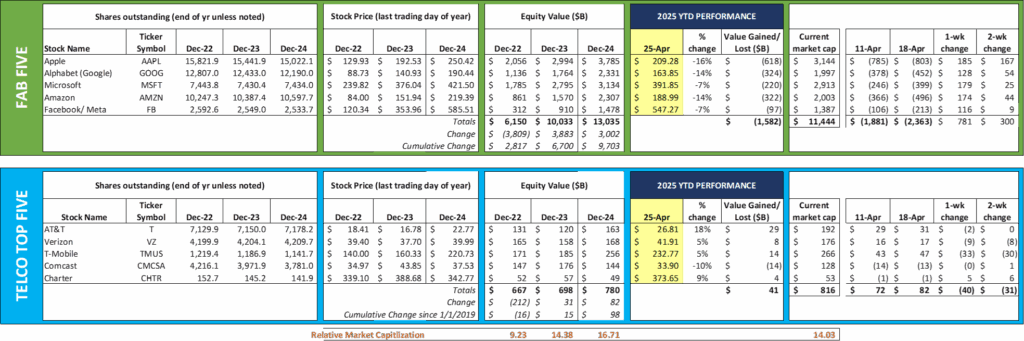

A modern paraphrase of Newton’s Law of Universal Gravitation is commonly expressed as “What goes up must come down.” After the collapse of Fab Five market capitalizations in the early part of April, many of us wondered when things would go back up. We got our answer this week as Google’s earnings assured investors that recent changes in government policy were not going to create permanent harm to its balance sheet or stock (we will discuss more in the next Brief, but there were only tiny movements in cash, marketable securities, and debt levels through March).

As a result, the Fab Five recovered $780 billion in equity losses this week, and slightly more than a trillion dollars since April 4. Interestingly, the financial news is quick to alert when the trillion dollars has been lost, but not when a subsequent recovery has taken place. The year-to-date Fab Five net losses as of March 28th (pre-Liberation Day) and today are a mere $50 million apart, and we still have earnings from Meta/ Facebook, Apple, Amazon, and Microsoft to come.

Meanwhile, as we will discuss below, each of the Telco Top Five reported earnings this past week. Only Charter had a materially positive reaction from investors (see analysis below). T-Mobile’s growth expectations are now being challenged by cable and Verizon, and the stock was punished this week ($33 billion in market cap losses over the last week). After the earnings dust has settled, there is now a 9% ($16 billion) gap between Verizon and AT&T as of Friday, and T-Mobile is now worth 2x more than Comcast.

We have completed Day 178 of the 180-day clock for the FCC to approve T-Mobile’s acquisition of US Cellular. The company offered few hints on their earnings call concerning changes to conditions or timelines (except for the acknowledgement that they will be updating profit guidance once the transactions close), and we expect good news for Magenta in May.

No sooner did the T-Mobile call end than investment bankers and analysts begin to call for T-Mobile to get back on the fiber acquisition train. Light Reading is running an article this weekend suggesting that T-Mobile should buy Hotwire Communications (see markets from this broadbandnow.com profile of the company). Hotwire is a very well-run company who will do just fine without T-Mobile. Given their MDU focus, Verizon will not likely make a bid for the company, choosing instead to build a competitive offering using their millimeter-wave assets. AT&T is busy overbuilding. Citing 2-month old banker sessions at gossip central Metro Connect, certain analysis believe a deal is imminent. We aren’t so sure that’s the case, and think T-Mobile has several other candidates that would be more compatible than Hotwire.

There are many ways T-Mobile could use the Metronet and Lumos fiber assets to grow market share:

- Offer discounted speeds (e.g., 1 Gbps fiber speeds for the price of 300 Mbps) with higher-end wireless family plans. This is a no-brainer given the relatively low incremental costs for upgrades. This approach also renders the price locks announced by Comcast and Verizon obsolete (why pay for 300 Mbps when 1 Gbps is available for the same rate?).

- Significantly improve mobile coverage throughout the fiber coverage territory. We discussed the “edge out” effects of this activity in the last Brief. Tower/ radio upgrades will be needed anyway as they grow market share, but T-Mobile could significantly relax their wireless tower bandwidth oversubscription assumptions and be the undisputed speed test leader in Lumos and Metronet territories.

- Take several small but meaningful converged product steps. At last year’s Investor Day, AT&T announced they were including free wireless backup with each AT&T fiber connection. That’s easy to do and relatively low cost. T-Mobile should go one step further and offer not only wireless backup but also include a UPS for homes to reduce the impacts of power outages (this solution would be an affordable and reasonable place to start). We also think that any limitations placed on downloads (or uploads) to only occur only over Wi-Fi should be eliminated in all T-Fiber areas. This would enable greater use of mobile devices for downloaded programming.

We would rather be in T-Mobile’s shoes than have the copper boat anchor of both of their wireless peers. Magenta could still stumble, but we doubt that will occur. More on their earnings in the next section.

As the courts debate what Google should do with their Chrome product, we thought that Friday’s Bloomberg article outlining the arguments made to Judge Mehta were particularly insightful. We are not going to handicap the verdict today as there isn’t a clear and obvious remedy. The Bloomberg article delineates the intricacies of each proposal and is worth reading.

Finally, there is a very interesting synopsis of the Meta/ Facebook trial from The New York Times as past and present industry executives tried to remember their activities and thinking from decade-old emails. Rather than rehash the article, we include a link here for a quick read. There is little value to the company or society divesting the Instagram or WhatsApp assets – the only drawback would be the multi-year distraction to management that such a divestiture would involve.

Q1 telco top five earnings – five observations

First quarter earnings are out for each of the Telco Top Five, and there is plenty to discuss. We start the analysis with five observations:

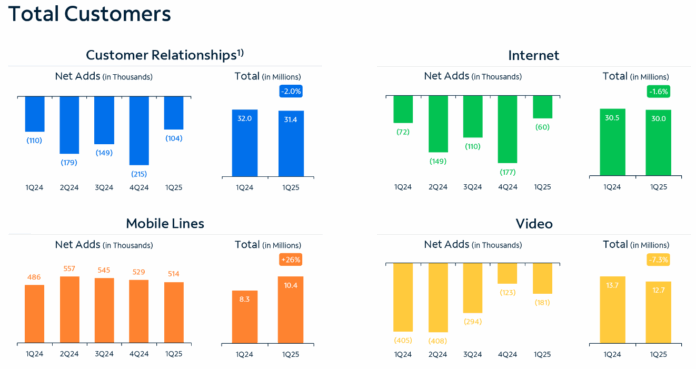

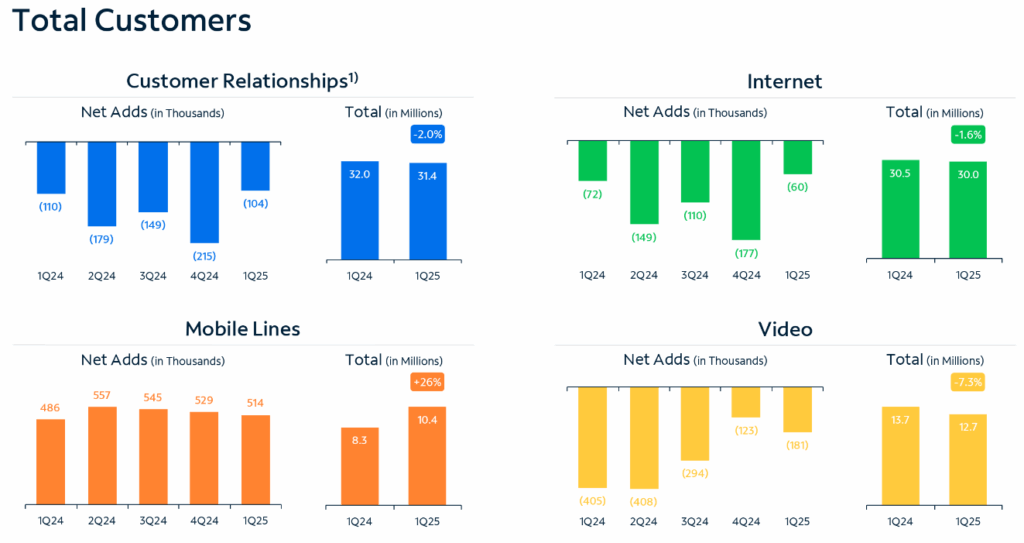

- Charter Communications is the best run and most innovative cable company in the world. Their results are neatly summarized in this schedule from their earnings presentation:

Charter now has slightly (4%) fewer domestic residential Internet customers than Comcast (1.2 million – two years ago that figure 200K higher). They have 610,000 (4%) more domestic video customers than Comcast. And they have substantially (28%) more mobile customers than Comcast. They have done this with less supporting assets (broadcasting, theme parks, etc.), with fewer acquisitions (namely Masergy, which boosted business subscriber and revenue figures) and a higher debt load than their Philadelphia-based peer. Using customer relationships as the basis, Comcast is now #2 (30.969 million domestic customer relationships for Comcast vs. 31.369 million for Charter).

- AT&T’s fiber progress is not comparable to any other past fiber-based broadband deployment despite commentary to the contrary. Any view of AT&T as just a larger version of previous fiber-to-the-home programs over the last decade is laughable. Here’s the exact quote from CFO Jason Armstrong on the Comcast earnings call:

“as we look at the competitive environment, fiber is what it is. It continues to creep into our footprint at 3% to 4% per year. That’s no change from what we’ve seen in the past several years. We expect that to continue. But we’ve competed against fiber for 20-plus years at this point. And it’s a very predictable pattern that we haven’t really seen changing. It’s sort of a pattern where the first three years, there’s significant market share gain, then it levels out and the patterns we see in those markets, whether it’s our own ARPU, churn rates, margins, et cetera, very much resemble our broader base. So it’s a segment we know how to compete well against. I would tell you that the newer competitor in the last few years has obviously been fixed wireless. They’re adding 1 million subscribers per quarter. So that’s sort of the competitive intensity that we’re seeing that’s sort of incremental.”

We would urge cable to reconsider the impact of AT&T and T-Fiber because 1) they have a lower cost structure than most if not all of the previous fiber providers; 2) they know how to market at the household, street, and town level; 3) they have wireless services to bundle with fiber that they want to protect, and 4) they have materially higher customer satisfaction scores than cable (see ACSI scores here).

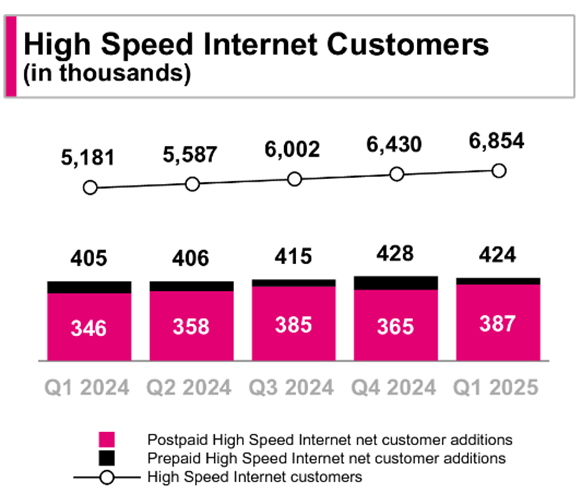

- Fixed wireless is not fading away. It’s hard to believe that its been over six years since T-Mobile launched their Home Internet Pilot (original announcement here). Regardless of what it’s called (the latest is “cellphone Internet”), it’s quickly becoming a core offering. As the nearby chart shows, it’s really becoming an important part of the growth equation for T-Mobile (it’s ~$4.6 billion in revenues annually for the company).

AT&T is marketing their Internet Air fixed wireless product after their cell site upgrades have been upgraded. For the quarter, they grew fixed 158,000 consumer fixed wireless connections (33% quarterly growth) even as they grew fiber connections by 307,000. Our guess is that their fixed wireless net additions rate will probably stabilize at 200-250K/ quarter after all of the wireless upgrades have been completed. This is smaller than T-Mobile but on par with Verizon wireless (note, however, that inclusive of fiber net additions, AT&T is the fastest growing provider – 465K fiber and fixed wireless net additions (excluding business customers) compared to 424K for T-Mobile (which includes business) and 240K for Verizon (which excludes business).

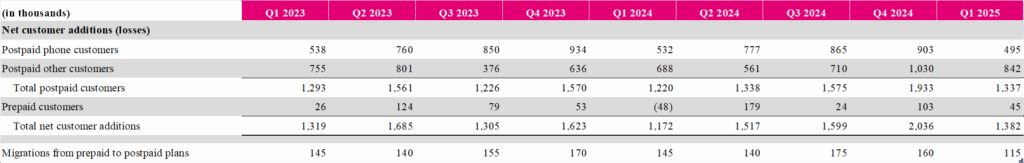

- Prepaid is attracting a lot of attention, but not a lot of growth. Verizon grew their retail prepaid base again (+134K subscribers), which was greater than AT&T (-177K) or T-Mobile (+45K). Revenue per user is decreasing for Verizon however, at 2-3% annually (AT&T’s growth was < 1% and T-Mobile was down 7%). The quality of the T-Mobile subscriber base (relative to their two largest peers) is the most concerning. This is borne out by the last line shown on the schedule below (from their earnings release):

If T-Mobile’s prepaid to postpaid migration rate had maintained that of Q1 2024, the postpaid phone net additions would have been essentially the same as last year (assuming that nearly all of those migrations carried phone subscriptions). Something is going on in the T-Mobile prepaid base – likely not critical, but Verizon is beginning to make prepaid a priority, and that increased competition might have caught T-Mobile off guard in the recent quarter.

- Debt reduction is a priority for Verizon. The company has reduced debt by an impressive $8 billion over the last four quarters. Combined with increasing EBITDA (+$1.29 billion), their coverage ratio (excluding secured debt) is down to a manageable 2.3x interest coverage ratio. They are doing all of this while maintaining a $17 billion capital plan. Their debt level will rise when the Frontier acquisition closes, but their fiscal discipline is notable.

We will parse more in the next Brief, but for now, we see the competition for value creation increasing between AT&T and T-Mobile with Magenta staying atop the value rankings through the end of the year. Verizon will regain their postpaid footing but will continue to languish in consumer wireline and business performance indicators. Cable will continue to make inroads with mobile (Comcast appears to be in full mirror mode with Spectrum) but we think fiber and fixed wireless will take incremental broadband share, particularly if mortgage rates fall and moving activity increases. Charter is our dark horse – their video strategy is working, and that’s helping their overall market proposition.

That’s it for this week. In the next Brief (May 10th), we will look at capital spending across all ten companies we cover. Until then, if you have friends who would like to be on the email distribution, please have them sign up directly through the website.

Finally – Go Royals, Sporting KC, and Davidson Baseball!

Important disclosure: The opinions expressed in The Sunday Brief are those of Jim Patterson and Patterson Advisory Group, LLC, and do not reflect those of CellSite Solutions, LLC, or Fort Point Capital.