Want more private 4G/5G market forecasts? Of course you do, and market research firm Kaleido Intelligence has come up with a humdinger: enterprises will spend over $7 billion per year on private 4G/5G networks by 2028, it says. Which sounds like a lot; but the key measure, which makes the figure impressive, is that total spending will grow by 36 percent per year, on average, from around $2 billion in 2024. It expects around 18,000 private 4G/5G networks by 2028.

There is no indication from a press statement of the start number for deployments in 2028. But the market will outgrow its experimentation phase in the period, it says, because of the value of the technology, which will be allowed to be proven by the flexibility of the technology. The manufacturing sector, covering assembly-based discrete and recipe-based process manufacturing, will outrun every other industrial sector in terms of spending and adoption of private 4G/5G technology.

Manufacturing will account for 5,000 private 4G/5G networks in 2028, it says; it accounts for closer to 1,000 now, meaning forecast growth in the sector is pegged at about 49.5 percent per annum in terms of total network deployments over the (four year) period. The sector will be responsible for more than one in four (27 percent of) deployments by 2028, it says; this implies the total private 4G/5G market will number around 18,500 networks in 2028.

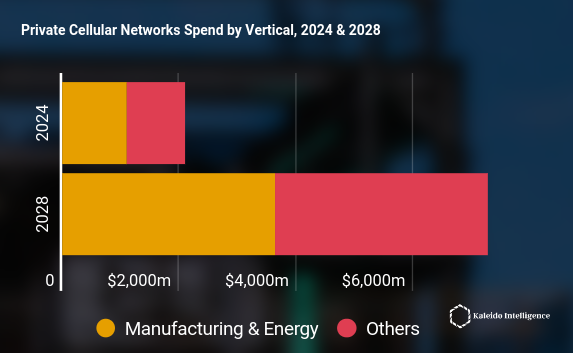

The energy and utilities sector is, and will remain, the second biggest for private 4G/5G networks in terms of deployments and spending. The energy market will have around 4,000 (“over 1,000 fewer”) deployments in 2028. Its growth will be slower (“relatively slow”) because of longer technology upgrade (“product”) cycles, says Kaleido Intelligence. Together, the manufacturing and energy sectors will account for half of the spend (about $3.5 billion) through the next four years.

They will also contribute “almost half” of private 4G/5G deployments in 2028. There is no reference for how Kaleido Intelligence is qualifying network deployments in its calculations – whether they include tests and trials (unlikely), or it starts counting at $50,000 or $100,000 (see GSA’s shifting criteria); whether it counts networks by-customer-by-region (also along GSA lines); and how it treats the China market, and whether it includes any semi-hybrid models (also unlikely).

Regardless, the message is that enterprise spending on private cellular networks will more than treble in the space of four years. Most interesting, perhaps, Kaleido Intelligence notes how the flexibility of both 5G component architecture and procurement / deployment models will encourage experimentation, and afford enterprises the chance to build the business case for their investments and applications to drive their digital-change programmes in the next few years.

It states: “The flexibility of 5G architecture will enable a variety of deployment types, as business models and collaborations between partners change over time. 5G’s modular architecture allows different components from different providers as needed… [The] sector has [also] seen a large amount of business model innovation, driven by MNOs looking to recoup [5G] investment… and [also] specialist private network vendors looking for innovative models that appeal to clients.”

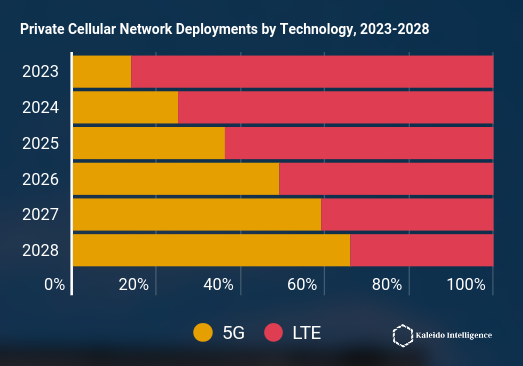

As a consequence, its finds the tipping point for 5G will come in 2027, when 5G usurps 4G-LTE to be in more than half of private network deployments; by 2028, 5G will be completely dominant, it says, existing in two thirds (66 percent) of deployments. The “business-model innovation” in the market will mean annual growth (CAGR) of 56 percent in operational spend (“accounted as op-ex”), compared to growth in capital spend (“cap-ex growth) of 33 percent.

James Moar, author of the report, commented: “Private Networks are still an experimental model for many businesses, for both vendors and customers. Our report shows that it is vital to have a model where the initial business case can be shown, and then expanded as needed, rather than encapsulating all possibilities within the initial deployment.” The report is available to buy here.